The vise will tighten until something breaks. It could be the currency, it could be the political status quo, it could be the credit/debt system–or all three.

The problem with an economy dominated by state-enforced cartels and quasi-monopolies is that prices rise (since cartels can push higher costs onto the consumer) but wages don’t (since cartels can either dominate local labor markets or engage in global wage arbitrage: offshore jobs, move to lower-wage states, etc.)

Think about the major expenses of the typical household: Internet, telephony, cable and other digital services: cartels. Airlines: cartel. Healthcare insurance, providers and Big Pharma: cartels. Defense weaponry: cartel. Higher education and student loans: cartels. Mortgages: cartel. And so on.

The economy is now dominated by two consequences of state-enforced cartels:

1. High profits / high incomes for the owners and managers at the top who reap most of the gains of the cartel: high-income individuals pay most of the income taxes and fund most of the political class’s campaign contributions. No wonder the political class insures that the state protects cartels from competition: it’s called self-interest.

2. Debt. i.e. credit for consumers, so they can continue to borrow more to pay the ever-higher costs of living.

But debt has a cost, too, and even at low rates of interest, eventually the interest on ever-larger mountains of debt crimps households’ spending and their ability to borrow more.

When consumers aren’t earning more and can no longer borrow more to support additional consumption, consumption and the rate of new debt expansion both decline, guaranteeing recession.

Cartels don’t really have competition, and so there is no pressure to lower costs; cartels have no incentives to innovate in ways that radically reduce costs and improve their services. Consumers see this most dramatically in healthcare and higher education, where costs just keep rising year after year.

If consumers can’t borrow more to pay higher costs, then cartels lobby for the government to pay their rising costs via deficit spending, i.e. the government borrows more to fund the cartels.

Now that students are over-indebted, the higher education/lending cartels are demanding that the government pay the students’ debts, so neither cartel suffers any decline in income/profits.

Since competition would threaten profits and higher prices, cartels buy political influence to protect their rackets. Politicos, always desperate to raise millions for their permanent campaigns for re-election, are happy to comply.

The only output of this system is higher public and private debt taken on to pay the rising prices imposed by cartels, and stagnation as wages no longer enable the bottom 80% of consumers to keep up with ever-higher prices.

|

The vise will tighten until something breaks. It could be the currency, it could be the political status quo, it could be the credit/debt system–or all three.

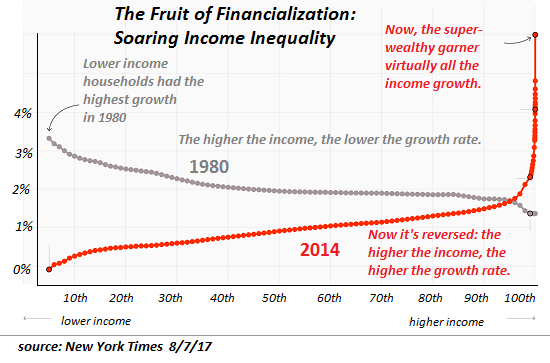

Here’s a chart of the net result of a financialized state-cartel economy: the politicos skimming fortunes in campaign contributions love it, and the protected cartel insiders skimming the nation’s wealth love it, too. Well let’s see, that’s all the important people, so what’s not to like?

|

The Fruit of Financialization, 1980 - 2014 |

Tags: newslettersent