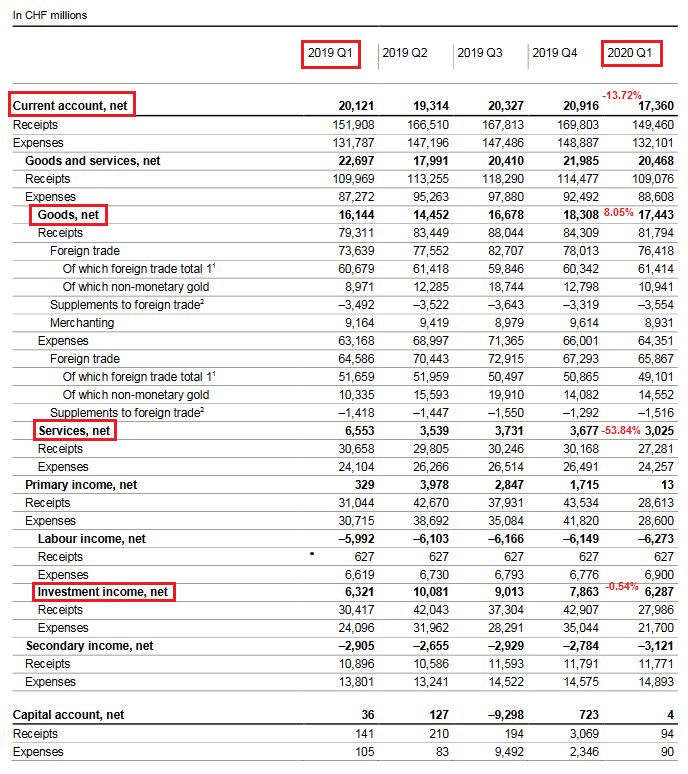

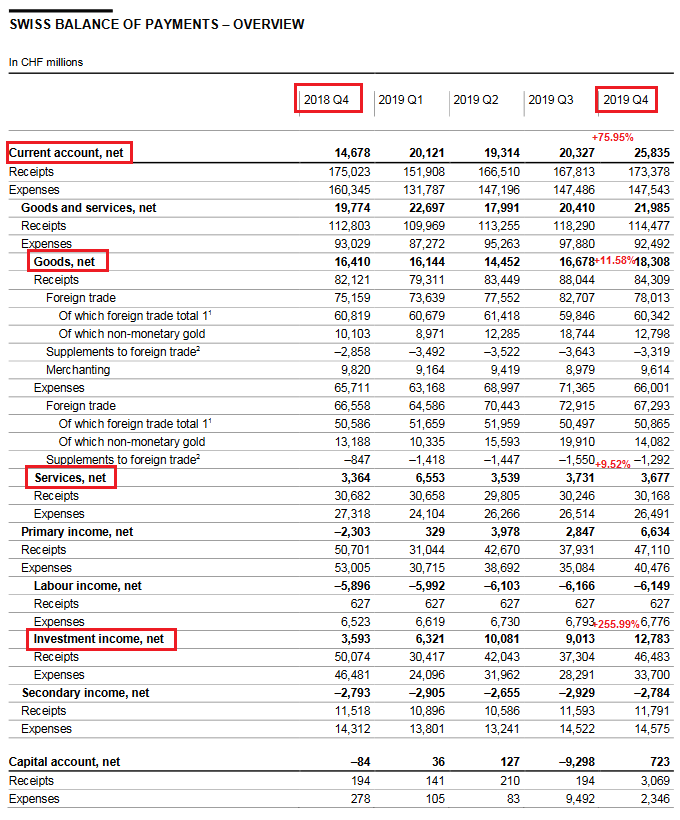

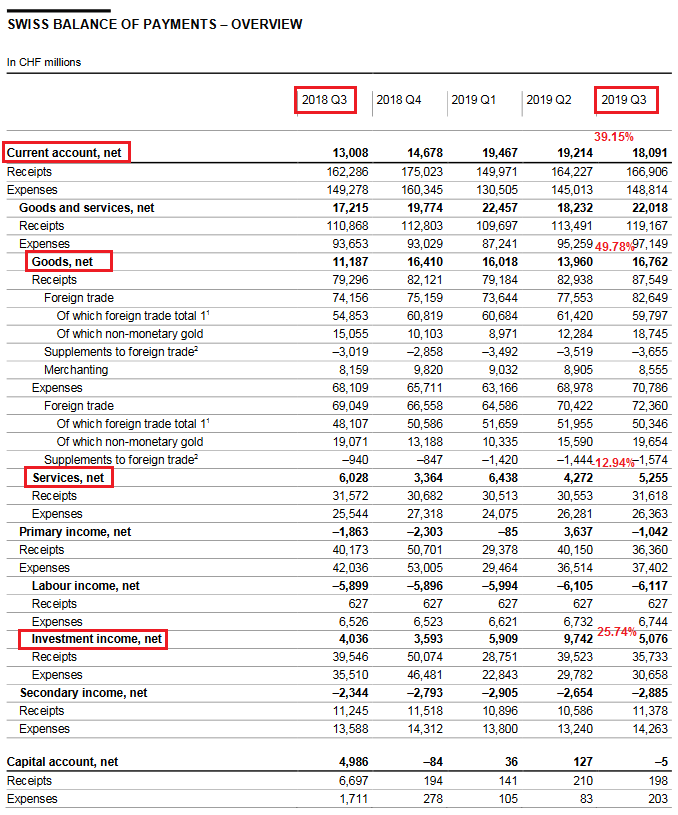

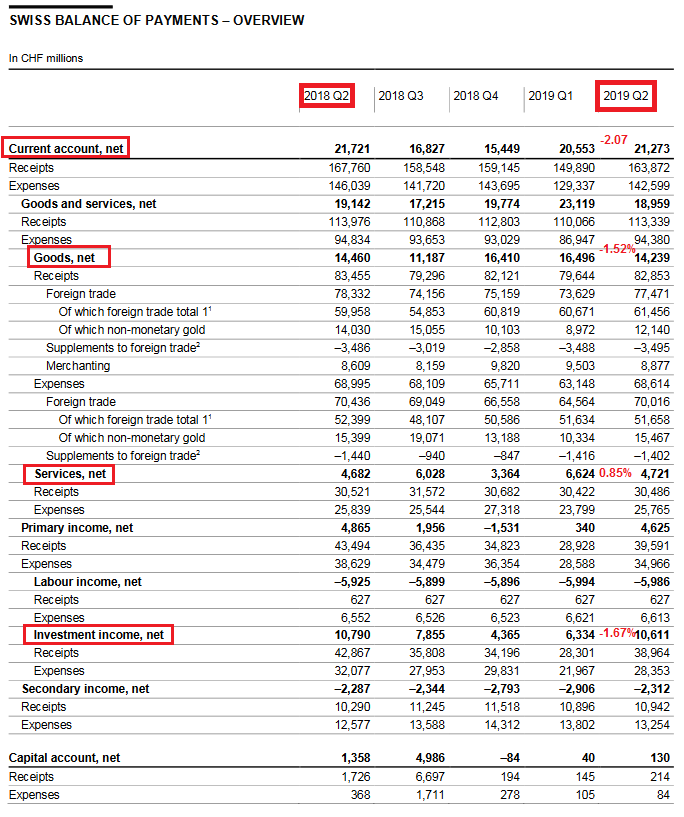

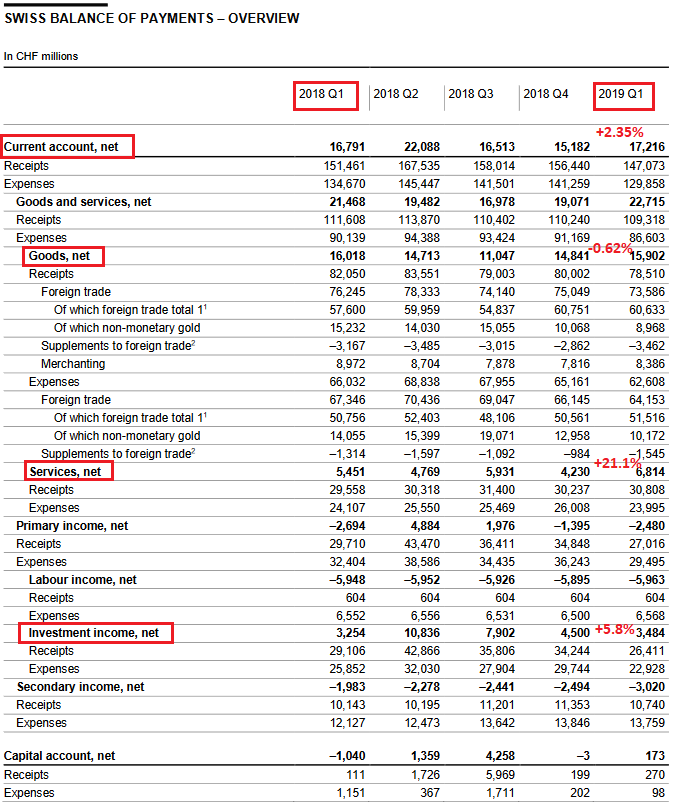

Current AccountThe current account was down 9.6% against the same quarter in 2016. Key figures:Current Account: -9.6% against Q4/2016 to 19,679 bn. CHF

Higher Trade Surplus in Goods: +24.4%

|

Swiss Balance of Payments Q4 2017(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

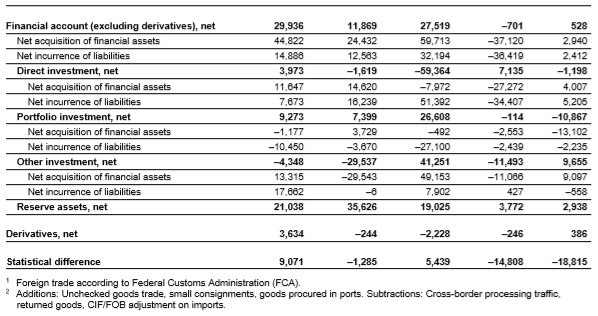

Financial accountKey Figures:

The following is from the official press release and gives more details on the other parts of the financial account.

|

Switzerland Financial Account(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Extract from the Balance of Payments Q4 2017 Source: snb.ch - Click to enlarge

|

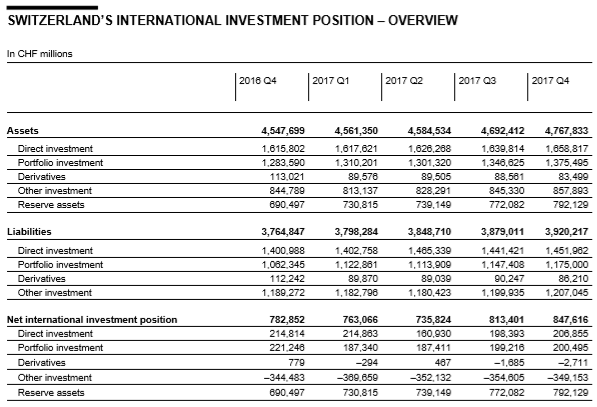

Switzerland’s International investment positionAssetsStocks of foreign financial assets were up CHF 75 billion on the previous quarter to CHF 4,768 billion. Valuation changes, in particular, were responsible for the increase. Since the major part of assets is held in foreign currencies, it was the strengthening of the euro against the Swiss franc, above all, which led to currency gains. In addition, capital gains arising from higher prices on foreign stock markets contributed to the increase. Stocks of portfolio investment rose by CHF 29 billion to CHF 1,375 billion. Reserve assets grew by CHF 20 billion to CHF 792 billion. Stocks of direct investment were up by CHF 19 billion to CHF 1,659 billion, while those of the other investment item also advanced, by CHF 13 billion to CHF 858 billion. By contrast, stocks of derivatives declined by CHF 5 billion to CHF 83 billion. LiabilitiesStocks of foreign liabilities were up by CHF 41 billion to CHF 3,920 billion, mainly due to valuation changes resulting from domestic stock market advances. Stocks of portfolio investment rose by CHF 28 billion to CHF 1,175 billion, while those of direct investment increased by CHF 11 billion to CHF 1,452 billion. Stocks of the other investment item advanced by CHF 7 billion to CHF 1,207 billion. By contrast, stocks of derivatives declined by CHF 4 billion to CHF 86 billion. Net international investment positionSince foreign financial assets climbed more markedly (CHF +75 billion) than foreign liabilities (CHF +41 billion), the net international investment position advanced by CHF 34 billion to CHF 848 billion. |

Switzerland International Investment Position(see more posts on Switzerland International Investment Position, ) Switzerland International Investment Position - Q4 2017 Source: snb.ch - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account,Switzerland International Investment Position