Monthly Archive: March 2018

Maker of the Sniper’s Choice, makes the news – but what is the Swiss company RUAG?

The Swiss company RUAG made the news last week when investigators were called in to look at information relating to the sale of ammunition. But what is this company? According to RTS, the investigation revealed contracts for the sale of ammunition to Russia that had not been properly declared, RUAG triggered the investigation itself when a whistle blower reported irregularities and has filed a criminal complaint.

Read More »

Read More »

Swiss electricity getting cleaner, says energy report

The electricity consumed in Switzerland is ever greener, according to government statistics: some 62% comes from renewable sources, while nuclear has fallen to 17%. The figures (in French/German)external link were released on Monday by the Federal Office of Energy, which gathers each year the sources used by electricity providers in Switzerland. The latest report refers to 2016.

Read More »

Read More »

London House Prices Falling Sharply – UK’s Much Needed Wake-Up Call

London house prices falling at fastest pace since 2009. Values fell by 2.6% in year through January. London house prices likely to be weakest in UK over next five years. Inflated prices make London property more exposed to economic and political shocks. Worries over house prices are having a knock-on effect in wider economy. Physical gold to act as much needed hedge against falling property prices.

Read More »

Read More »

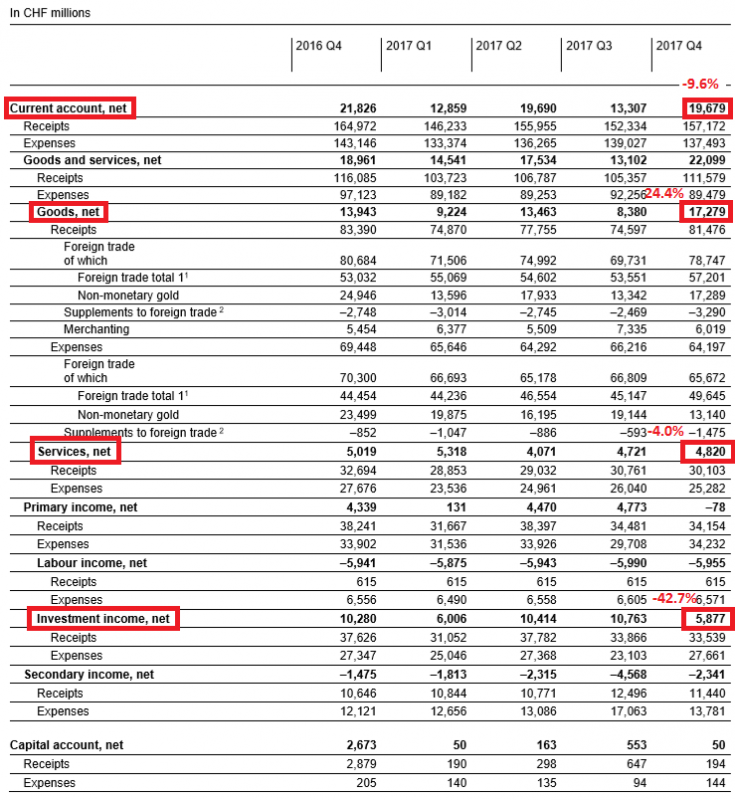

Swiss Balance of Payments and International Investment Position: Q4 2017 and review of the year 2017

Key figures: Current Account: -9.6% against Q4/2016 to 19,679 bn. CHF, Record High Trade Surplus in Goods: +24.4% to 17,279 bn., Services Surplus : -4.0% to 4,820 bn., but Investment Income: down 42.7% to 5,877 bn.

Read More »

Read More »

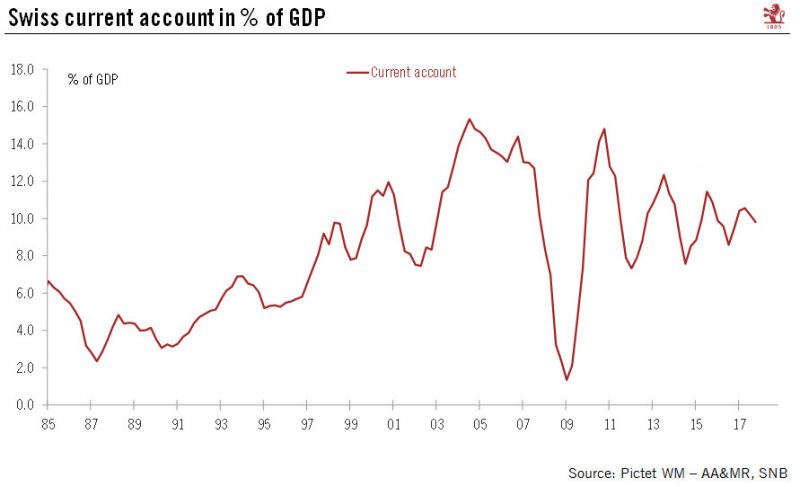

Disentangling the Swiss current account

Following the Swiss National Bank’s (SNB) publication of Switzerland’s balance of payments data for Q4 2017, in this note we look deeper into the Swiss current account to try to find out why Switzerland persistently runs a surplus and whether or not the current account balance can be used to assess the fair value of the Swiss franc.

Read More »

Read More »

FX Daily, March 27: Global Equities Follow US Lead, Dollar Steadies

We argued that the talk of trade war was exaggerated. The confrontation, strong demands and a climb down is the Art of the Deal, and is part of the way the Trump Administration negotiates. We see striking parallels between the policymakers and tactics with the Reagan Administration's attempt to pry open Japanese markets.

Read More »

Read More »

Weekly Technical Analysis: 26/03/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/JPY, GBP/JPY, USD/CHF

The USDCHF pair provided negative trades after 0.9488 proved its strength against the recent positive attempts, to keep the bearish trend scenario valid efficiently in the upcoming period, supported by the EMA50 that pushes negatively on the price, waiting to test 0.9373 initially.

Read More »

Read More »

Fintech lending platform Loanboox eyes French expansion

Award-winning Swiss fintech firm Loanboox is planning further expansion into Europe having obtained a foothold in Germany. The digital portal for matching institutions with investors plans a move into France and is also looking at other European markets.

Read More »

Read More »

FX Daily, March 26: Equity Meltdown Aborted, Dollar Eases

After a poor start in Asia, equities recovered. The MSCI Asia Pacific initially extended last week's losses and fell to its lowest level since February 12 before recovering to finish near its highs, 0.4% above last week's close. European markets followed suit. They did not have to take out last week's lows. The Dow Jones Stoxx 600 is up about 0.4% in late morning turnover.

Read More »

Read More »

FX Weekly Preview: The Investment Climate

The investment meme of a synchronized global upturn has been undermined by the recent string of US and European economic data. The flash March eurozone composite reading fell to 55.3, the lowest reading since January 2017. Although Q4 17 US GDP may be revised higher (toward 2.8% from 2.5%) mostly due to greater inventory accumulation, the curse of weak Q1 GDP appears to be showing its hand again, with forecasts now coming in below 2%.

Read More »

Read More »

Swiss gold refiners accused of sourcing illegal and conflict gold

A report by the NGO Society for Threatened Peoples (STP) has accused Swiss gold refiner Metalor of procuring gold from controversial suppliers in Peru. Metalor denies the charge. The reportexternal link, released on Thursday to time with the opening of the Baselworld Watch and Jewellery Fair, says that in all likelihood, Metalor continues to procure illegally mined and sold Peruvian gold, which is linked to tax evasion and environmental destruction.

Read More »

Read More »

Swiss government set to remove ‘mariage tax penalty’

In Switzerland, married couples file one combined tax return. Because tax rates rise in line with income it means that second incomes of married couples are taxed at a higher rate than those of single cohabitating ones. Those campaigning to have this changed argue that it is unfair and acts as a disincentive for second income earners.

Read More »

Read More »

Decrypting the Appointment of John Bolton

So perhaps the dominant wing of the Deep State is finally willing to cut a deal with Trump. To many observers, the appointment of John Bolton as national security advisor is the functional equivalent of appointing the Anti-Christ--or maybe worse. Indeed, these observers would, when comparing the two, find grudging favor with the Anti-Christ.

Read More »

Read More »

What Fed Chair Powell Forgot to Mention

What are the chances of Federal Reserve Chairman Jerome Powell being wrong? The chances he’ll be wrong on the economy’s growth prospects, the direction of the federal funds rate, and inflation itself? Our guess is his chances of being wrong are quite high.

Read More »

Read More »

Imports curdle mood of Swiss cheese producers

Switzerland may be living up to its cliché as a cheese loving nation, but a growing appetite for foreign brands has alarmed local farmers. On average the Swiss consumed 21 kilograms of cheese per person last year, compared to 18 kilograms across Europe, according to figures published by the Swiss Farmers’ Associationexternal link on Wednesday.

Read More »

Read More »

Swiss authorities say Uber drivers should be treated as ‘employees’

For the first time, the Swiss State Secretariat for Economic Affairs (SECO) has clearly indicated that Uber taxi drivers should be classed as employees rather than self-employed. In an internal statement seen by the 10vor10 programme on Swiss public television, SECO gave the legal opinion that according to the conditions that bind drivers to Uber, they should be regarded as employees rather than independent contractors.

Read More »

Read More »

Global Trade War Fears See Precious Metals Gain And Stocks Fall

– Market turmoil as trade war concerns deepen and Trump appoints war hawk Bolton

– Oil, gold and silver jump as ‘Russia China Hawk’ Bolton appointed

– Oil up 4%, gold up 2.2% and silver up 1.6% this week (see table)

– Stocks down sharply – Nikkei down 4.5%, S&P 4.3% & Nasdaq 5.5%

– Bolton scares jittery markets already shell-shocked by US’ tariffs against China

– Currency wars and trade wars tend to proceed actual wars

– Gold now...

Read More »

Read More »

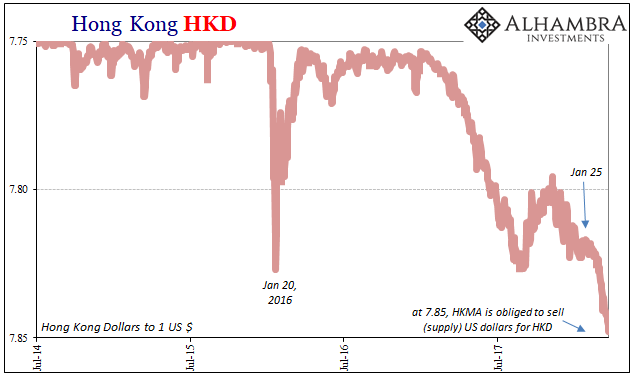

Just A Few More Pips

On Page 1, Chapter 1 of the Central Banker Crisis Handbook it states very clearly, “do not make it worse.” It’s something like the Hippocratic oath where monetary authorities must first assess what their actions might do to an already fragile system. It’s why they take great pains to try and maintain composure, appearing calm and orderly while conflagration rages all around. The last thing you want to do is confirm the run.

Read More »

Read More »

US Stock Market – How Bad Can It Get?

In view of the fact that the stock market action has gotten a bit out of hand again this week, we are providing a brief update of charts we have discussed in these pages over the past few weeks (see e.g. “The Flight to Fantasy”). We are doing this mainly because the probability that a low probability event will actually happen has increased somewhat in recent days.

Read More »

Read More »