Rising income and wealth inequality is causally linked to globalization and the expansion of Darwinian trade and capital flows.

Stripped of lofty-sounding abstractions such as comparative advantage, trade boils down to four Darwinian goals:

1. Find foreign markets to absorb excess production, i.e. where excess production can be dumped.

2. Extract foreign resources at low prices.

3. Deny geopolitical rivals access to these resources.

4. Open foreign markets to domestic capital and credit so domestic capital can buy up all the productive assets and resources, a dynamic I explained last week in Forget “Free Trade”–It’s All About Capital Flows.

All the blather about “free trade” is window dressing and propaganda. Nobody believes in risking completely free trade; to do so would be to open the doors to foreign domination of key resources, assets and markets.

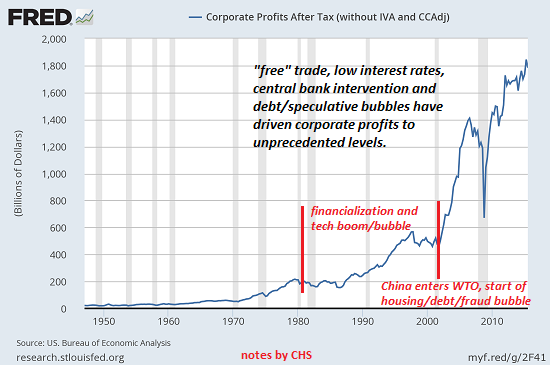

Trade is all about securing advantages in a Darwinian struggle to achieve or maintain dominance. As I pointed out back in 2005, the savings accrued by consumers due to opening trade with China were estimated at $100 billion over 27 years (1978 to 2005), while corporate profits expanded by trillions of dollars.

China Trade Surplus: Gusher Profits for U.S. Corporations (August 13, 2005)

In other words, consumers got a nickel of savings while corporations banked a dollar of pure profit as sticker prices barely budged while input costs plummeted. Corporations pocketed the difference, not consumers.

As longtime correspondent Chad D. noted in response to my essay on capital flows, restricting trade may be one of the few ways smaller nations have to avoid their resources and assets being swallowed up by mobile capital flowing out of nations with virtually unlimited credit (the US, the EU, China and Japan).

Protecting fragile domestic industries with tariffs has a long history, including in the US, but the real action isn’t in tariffs: it’s in the bureaucratic tools to limit trade and the soft and hard power plays that secure cheap resources while denying access to those resources to geopolitical rivals.

The bureaucratic means of restricting imports have been raised to an art in Japan and other export-dependent nations: there may not be any visible tariffs, just bureaucratic sinkholes that tie up imports in red tape.

Then there’s currency manipulation, for example, China’s peg to the US dollar.What’s the “free market” price of Chinese goods in the US? Nobody knows because the peg protects China from its own currency being too strong or too weak to benefit its export-dependent economy.

Those bleating about “free trade” are simply pushing a Darwinian strategy that benefits them above everyone else. US corporate profits have quadrupled since China entered the WTO; is this mere coincidence? No: global corporations arbitraged labor, credit, taxes, environmental/regulatory and currency inputs to dramatically lower their costs (and the quality of the goods they sold credit-dependent consumers) and thus boost profits four-fold in a mere 15 years while tossing the hapless consumers a few nickels of “lower prices always” (and lower quality always, too).

The Neoliberal Agenda trumpets “free trade” because “free trade” is a cover for “free capital flows.” Once capital is free to flow from central-bank fueled global corporations, no domestic bidder can outbid foreign mobile capital, as those closest to the central bank credit spigots can borrow essentially unlimited sums at near-zero rates–an unmatched advantage when it comes to snapping up resources and assets.

|

If we ask cui bono, to whose benefit?, we find the consumer has received shoddy goods and paltry discounts from “free trade,” while corporations, banks and financiers have benefited enormously.

Rising income and wealth inequality is causally linked to globalization and the expansion of Darwinian trade and capital flows: the winners are few and the losers are many. Tariffs will not solve the larger problems of reduced employment, stagnant wages and rising income inequality. To make a dent in those issues, we’ll need to tackle central bank and central-state policies that have pushed financial speculation to supremacy over the productive economy.

|

Corporate Profits After Tax, 1950 - 2018 |

Tags: newslettersent