What will it take to radically reduce the cost basis of our economy?

If we had to choose one “big picture” reason why the vast majority of households are losing ground, it would either be the stagnation of income or the spiraling out of control cost basis of our economy, that is, the essential foundational expenses of households, government and enterprise.

Clearly, both rising costs and stagnating income cause households to lose ground, i.e. their income buys fewer goods and services every year.

I’ve often covered the dynamics of stagnating income for the bottom 95%, and real-world inflation, i.e. a decline in purchasing power.

But neither of these dynamics fully describes the relentless upward spiral of the cost basis of our economy, that is, the cost of essentials and the foundations of the economy: education, healthcare, energy and labor.

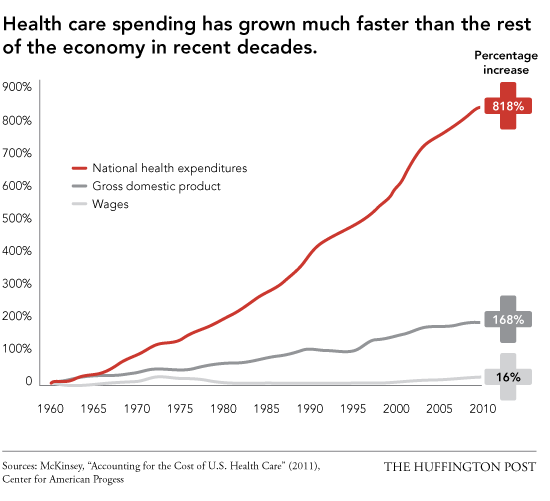

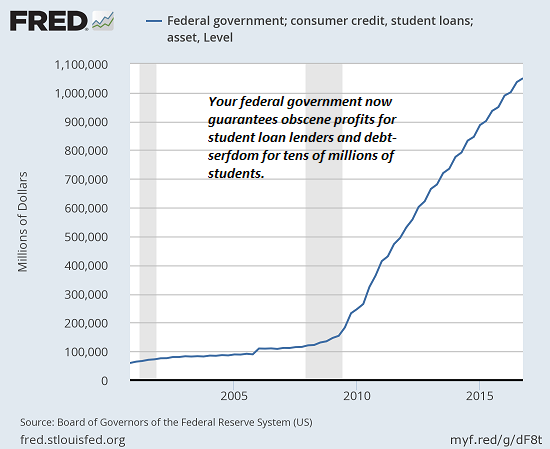

These expenses are pushing the costs of virtually every good and service, public and private, higher in a self-reinforcing spiral. The costs of education are spiraling out of control, stripping households of income as an entire generation is transformed into debt-serfs by student loan debt. The soaring costs of healthcare are a core driver of higher costs in the education complex (and government in general), and to cover these higher costs, counties raise property taxes, which add additional cost burdens to households and enterprises as rents rise.

Rising rents push the cost structure of almost every enterprise and agency higher.

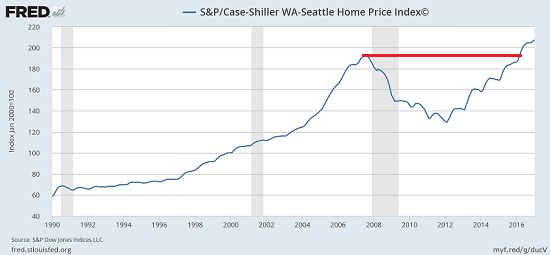

Then there’s the asset inflation created by central bank ZIRP (zero interest rate policy) which has inflated a second echo-bubble in housing that has pushed home ownership out of reach of many, adding demand for rental housing that has pushed rents into the stratosphere in Left and Right Coast cities.

Let’s look at a few charts that illustrate the relentless rise in the cost basis of our economy:

| Do you reckon these two charts are connected–soaring costs and ballooning administrative payrolls? |

US Healthcare Spending, 1960 - 2010 |

| Student loan debt is soaring above $1 trillion, guaranteeing profits to lenders and debt-serfdom to the students exiting with degrees that are in over-supply, i.e. possessing little scarcity value in an over-credentialed economy: |

Growth of Physicians and Administrators, 1970 - 2009 |

|

The echo housing bubbles in many locales exceed the nosebleed valuations of the previous bubble:

|

Federal Government, 2005 - 2017 |

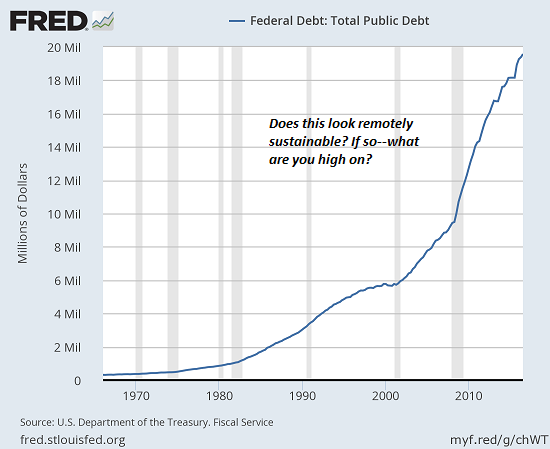

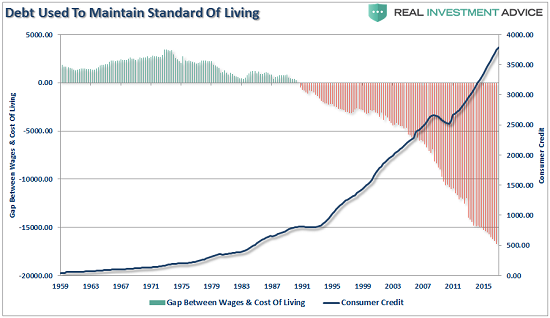

| And how do we pay for these spiraling out of control costs? By borrowing more, of course: |

S&P/Case-Shiller WA-Seattle Home Price Index, 1990 - 2017 |

| Courtesy of Lance Roberts, here’s a chart depicting how households are filling the widening gap between income and expenses with debt. This is another self-reinforcing spiral of rising costs, as debt accrues interest, adding costs at every turn of the spiral. |

Federal Debt: Total Public Debt, 1970 - 2017 |

| What will it take to radically reduce the cost basis of our economy? A fundamental re-ordering that breaks up all the cartels and quasi-monopolies that push prices higher even as they deliver lower quality goods and services would be a good start. |

Debt Used to Maintain Standard of Living, 1959 - 2017 |

Tags: newslettersent