|

What if bitcoin is a reflection of trust in the future value of fiat currencies?

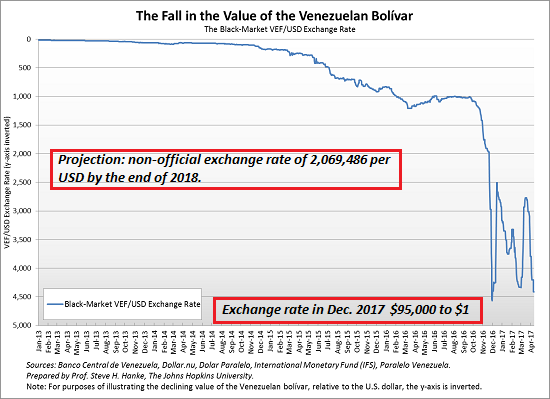

I am struck by the mainstream confidence that bitcoin is a fraud/fad that will soon collapse, while central bank fiat currencies are presumed to be rock-solid and without risk. Those with supreme confidence in fiat currencies might want to look at a chart of Venezuela’s fiat currency, which has declined from 10 to the US dollar in 2012 to 5,000 to the USD earlier this year to a current value in December 2017 of between 90,000 and 100,000 to $1:

|

Venezuelan Bolivar, Jan 2013 - Apr 2017 |

|

On 1 December, the bolivar traded in the parallel market at 103,024 VED per USD, a stunning 59.9% depreciation from the same day last month.

Analysts participating in the LatinFocus Consensus Forecast expect the parallel dollar to remain under severe pressure next year. They project a non-official exchange rate of 2,069,486 VEF per USD by the end of 2018. In 2019, the panel sees the non-official exchange rate trading at 2,725,000 VEF per USD.

If this is your idea of rock solid, I’ll take my chances with bitcoin, which currently buys more than 1 billion bolivars. Of course “it can’t happen here,” which is precisely what the good people of Venezuela thought a decade ago.

Gordon Long and I discuss Fiat Currency Failure (The Results of Financialization – Part IV) in a new 31-minute video. The bottom line is that fiat currencies are debt-based claims on future profits, energy production and wages, claims that are expanding far faster than the real economy and the productivity of the real economy.

In effect, fiat currencies and debt are like inverted pyramids resting on a small base of actual collateral.

If you look at the foundations of fiat currencies, you find loose sand, not bedrock. Massive mountains of phantom wealth have been created by central-bank inflated bubbles, bubbles based not on actual expansion of net income earned from producing goods and services, but on financialization, the pyramiding of debt and leverage on a small base of real assets.

“Free money” that accrues interest isn’t free. Eventually the interest eats debtors alive, regardless of the debtor’s size or supposed wealth.

Creating “free money” in unlimited quantities impoverishes everyone who holds the currency. In the initial boost phase, the issuance of “nearly free money” to borrowers, qualified or not, generates the illusion of prosperity. But once the boost phase ends, reality sets in and marginal borrowers default, inflation moves from assets (good inflation) to real-world essentials (bad inflation), and creating more “free money” ceases to be the solution and becomes the problem

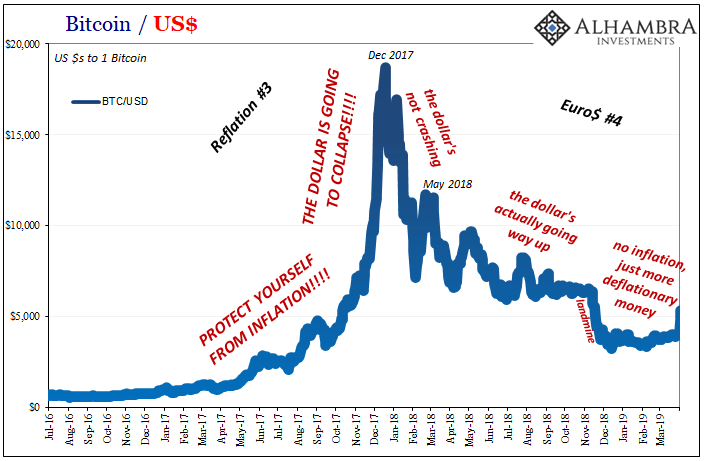

Yes, cryptocurrencies are risky–but so are fiat currencies. Illusory “wealth” evaporates, and expanding credit-based “risk-free money” at rates that exceed the rate of expansion of the real economy reduces the purchasing power of all those holding the currency. Eventually trust in the currency, and in the authorities who control its issuance, erodes, and a self-reinforcing feedback loop turns the rock-solid currency into sand.

What if bitcoin is a reflection of trust in the future value of fiat currencies? Those dismissing bitcoin as a fad might be missing the point: trust in the authorities who control the expansion of fiat currencies might be eroding fast in a certain segment of the populace.

And more importantly, they might be right, and everyone who placed their trust in the authorities who control the expansion of fiat currencies ends up holding a handful of sand.

|

Tags: Bitcoin,newslettersent