| – Gold coins and bars saw demand rise 17% to 222t in Q3, driven largely by China – Chinese investors bought price dips, notching up fourth consecutive quarter of growth – Jewellery, ETF demand fell while gold coins and bars saw increased demand – Central banks bought a robust 111t of gold bullion bars (+25% y-o-y) – Russia, Turkey & Kazakhstan account for 90% of 111t of central bank demand – Turkey increased gold purchases and saw broad based physical gold demand – Gold demand in Q3 at eight-year low as ETF inflows slowed sharply – Gold demand saw 9% year-on-year (y-o-y) drop in to 915 tonnes (t) – Total global gold supply fell 2% in Q3Editor: Mark O’Byrne |

|

| By first impressions the latest World Gold Council report could make for pretty dismal reading if one were to consider the headlines that followed its release.

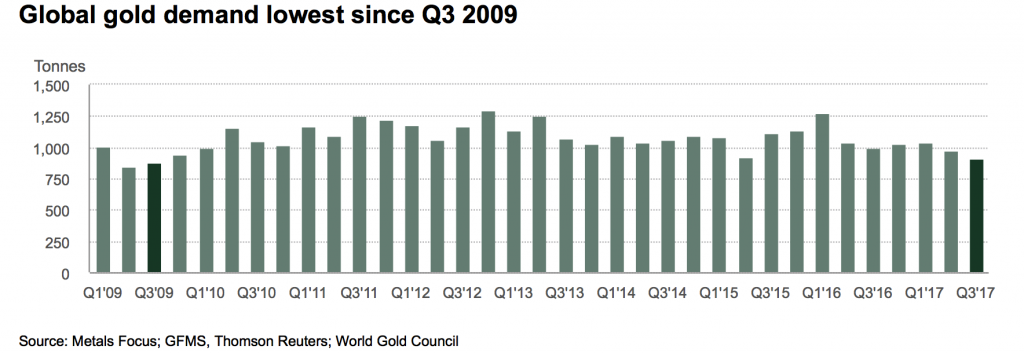

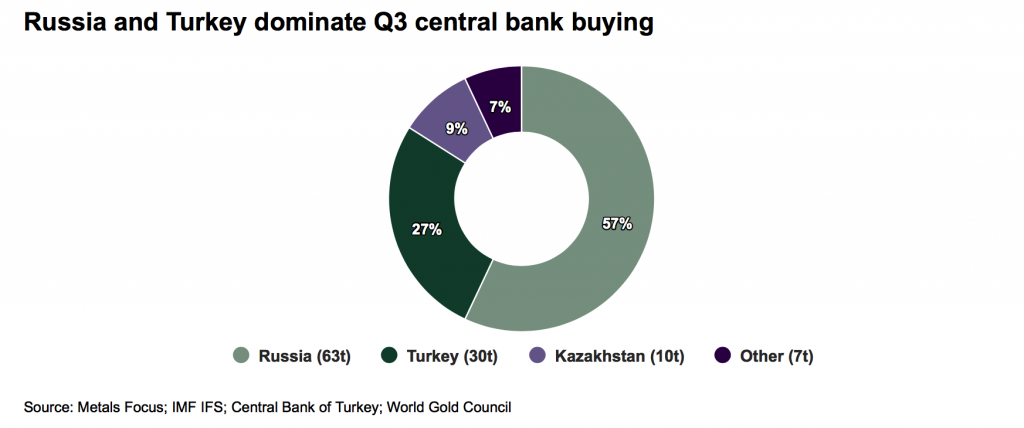

Much of the focus was on the fact that record and reported gold demand was at its lowest last quarter since Q3 2009 and down 9% year-on-year. This was predominantly down to ETF demand which fell from the very high levels seen last year. ETF gold holdings climb by just 18.9t and jewellery demand which fell by 3%. When one looks at the real gold investment demand which was strong in both areas – demand for gold coins and bars and central bank demand – then they might have cause to start feeling more positive again. Chinese demand is firmly back with a bang. Chinese investors bought on price dips, bringing a fourth consecutive quarter of growth. This contributed to a 17% rise in Q3 in gold coins and bar demand. Physical gold investors weren’t the only ones picking up the pace. 111t of central bank demand marked Q3 bringing total reserve demand to nearly 290t for the year to date. 90% of this demand was thanks to Russia, Turkey and Kazakhstan. These figures don’t really say much at face value. For example, ETF and jewellery numbers contributing to the 8 year low in gold demand suggest those avenues of investment have fallen out of favour. However, as with the increase in physical gold investment demand and central bank demand, there is a lot more to the figures than the headlines might initially suggest. |

Global Gold Demand, Q1 2009 - Q3 2017 |

| ETF demand to blame?

The headline of the WGC report reads: ‘Gold demand in Q3 at eight-year low as ETF inflows slowed sharply’. Most readers would take from this the first part – gold demand down. However, ETF demand was merely down not negative. Outflows did not exceed inflows, growth merely slowed as holdings only increased by 18.9t. This is not a new phenomenon or one that was last seen only back when gold demand levels were so low. In fact we would be wise to consider the levels of outflows 2011 when the gold price was low and gold numbers were only supported by Chinese buying. Since then ETF demand has recovered. It might also be worth noting if the lack of interest in ETFs this quarter is a statement about concerns regarding the inherent risk in both the economy and the structure of ETFs. As both the political and financial systems appear to be inherently weaker than say a year ago investors will be starting to question to safety of their chosen asset allocations. Given that ETF demand has fallen in contrast to physical gold demand investors may be starting to realise the dangers of holding the financial instruments that do not offer allocated and segregated physical gold bullion. The level of counterparty risk when investing in ETFs is unprecedented when compared to likes of gold sovereigns and bars. They are also wholly prohibitive and inaccessible should the owner wish to take delivery. For example, when one would like to physically posses the gold underlying the ETF they must first own 100,000 GLD shares. Most investors do not own over $1 million dollars of shares. At a time when we are questioning who we can trust and the tales we here from bankers and politicians it would not be surprising to me if this is an ongoing trend in the gold space. As more investors are likely to start projecting their concerns from the wider world onto their portfolios they may choose to invest in the real hard stuff of gold bars and coins. |

Modest ETF Growth, Q3 2016 - 2017 |

| Or was jewellery demand to blame?

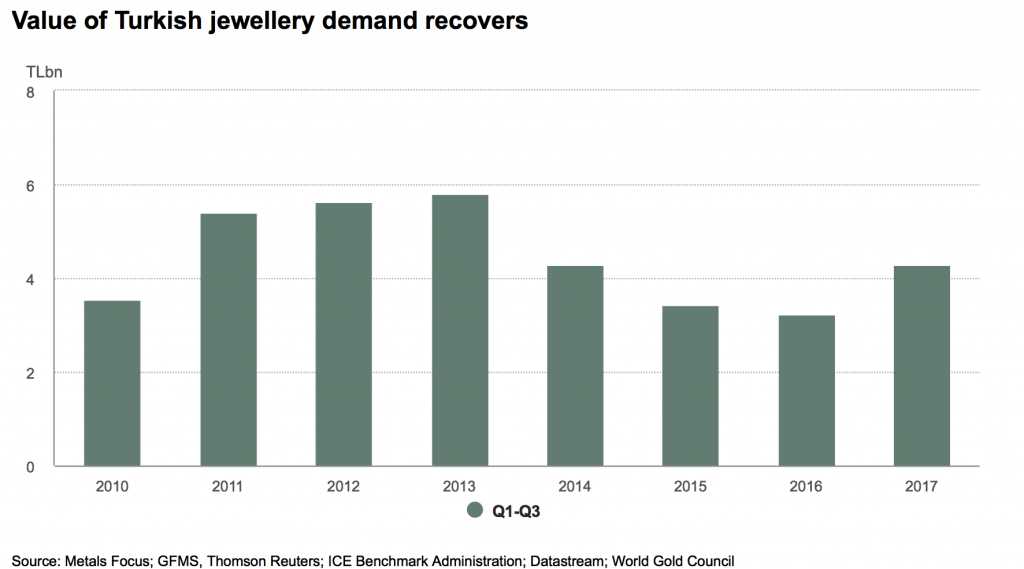

Jewellery demand was certainly down more than ETF demand this last quarter, by 3% to 479t. This was the lowest Q3 demand on record. Jewellery investment has had a tough time of it of late. This is largely thanks to the Indian government who have spent much of the last five years or so working hard to make changes in the areas of gold, tax and even cash. With each new rule comes a negative impact in demand. Q3 this year was the first quarter following the imposition of new tax and regulatory changes which deterred customers from buying more gold. The quarter is traditionally quiet anyway for gold jewellery purchases as it follows Diwali and is prior to the busy wedding season. As far as we can tell, Indian gold demand overall is still looking strong. In the first half of the year imports exceeded those for all of 2016. Meanwhile in Turkey, the value of year-to-date demand was up 25% in the third quarter as demand grew by 11% much of it supported by inflows from the UAE. The country was also partly responsible for the increase in central bank demand suggesting something akin to China – where both the central bank and citizens are diversifying their portfolios into gold, in a unified manner. |

|

| Physical gold investment: demand for gold coins and bars

Purchase of gold bars and coins climbed by 17% to 64.3t this last quarter. Much of this was thanks to China where the year-to-date has seen the second highest volume of bar and coin demand on record.

Interestingly, it was also in China where mining figures began to slow down. This might suggest further gold supply shortages will be noted later in the year, should demand remain strong. We would be remiss if we failed to mention Turkey once again. Coin and bar demand hit 15t, almost three times higher than the same period last year.

As the World Gold Council explains:

|

Value of Turkish Jewellery Demand Recovers, 2010 - 2017 |

But it is interesting to note that in regions that are particularly feeling the pressure both politically and economy there have been upticks in demand. One of course is Turkey, as previously mentioned but there is also the small market of South Korea where:

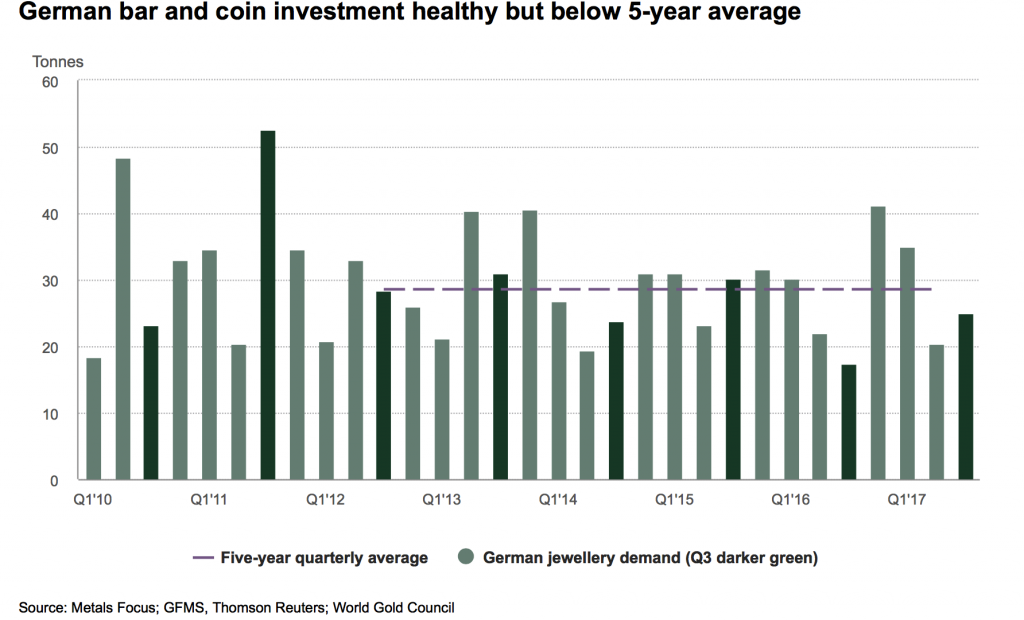

And finally Europe which is looking increasingly fractured also saw gold demand rise by 12t to 45.5t, a 36% improvement on Q3 last year:

|

Germany Bar and Coin investment, Q1 2010 - 2017 |

| Central bank demand grows as US dollar avoidance takes centre-stage

Central bank demand in recent years has been fascinating. The presence of gold in a central banks reserves has always been the ultimate statement in a country’s war chest. Previously when we think about going to war we consider the likes of North Korea and the US. For a our major central bank buyers it is not just about harmful weapons but also about financial ones – such as avoiding and abandoning the US dollar. As we mentioned a fortnight ago, Russia added 1.1 million ounces to reserves in September taking their total holdings to nearly 1,800t. The purchases are all part of their ongoing diversification from the US Dollar. Something they, nor the likes of China and Turkey have been particularly covert about. Turkey yet again deserves a mention here. In the last quarter it added 30.4t. to its gold reserves taking holdings to 167.4t. This is more than 50t higher than at the end of April this year. None of the countries that are reported to have increased their holdings are in the West or in the doldrums of issues such as Trump politics or Brexit unhappiness. They are all countries which have long been under the heavy boot sole of the US Dollar. The likes of Russia, Turkey and Kazhakstan have been quietly accumulating gold as they prepare for a new stage in the global economy when the US is no longer as powerful and they balance of financial influence has changed. |

|

|

And in other news… Rarely do we focus on the industrial uses of gold but they are important to keep half an eye on. The WGC’s report shows that gold used technology was 2% higher yoy in its fourth quarter of consecutive growth. The use of gold in the likes of 3D sensors and memory chips is likely to increase as humans begin to rely more on technology and its advances. This may begin to impact gold supply, something which is already falling year on year. One of the interesting areas where there has been an increase in gold use is in wireless applications which has seen around 8% yoy growth. Gold plays an important role in areas of wireless charging and 3D sensors. The latter having wide reaching applications in the likes of gaming, healthcare and vehicle development. Whilst half the world sabre-rattles the other half buys gold Looking at the gold investment figures one can almost imagine a dividing line being drawn between those who are blindly wandering into economic and political disputes and those who are quietly stocking up on gold. This is certainly the case at a central bank level. At an investor level we are also seeing some moves into gold that are clearly an expression of concern regarding the current environment. This is a very good sign for the gold market. People invest in gold in order to diversify their portfolios and to add some insurance to their wealth. It is even more encouraging to see an uptick in the counter-party free from of investment into allocated, segregated gold and away from the likes of ETFs. Those buying physical gold should be additionally encouraged upon reading that peak gold is on the horizon thanks to global gold supply falling by 2% yoy. When we last wrote about Russia’s one million ounce purchase we encouraged readers to take a similar approach to portfolio diversification. The advice still stands:

|

UK Measure of House Prices in London, 2012 - 2017 |

Tags: newslettersent,Weekly Market Update