Monthly Archive: November 2017

Big Swiss names surface in ‘Paradise Papers’

Politicians, business directors and companies in Switzerland are among those connected to the so-called Paradise Papers, a massive trove of leaked offshore investment documents. There is currently no evidence of any legal wrongdoing.

Read More »

Read More »

German Investors Now World’s Largest Gold Buyers

Today, gold is increasingly viewed by German investors as a regular form of saving: 25% of those surveyed in 2016 said their gold purchase had been part of a regular review of their investments, while 23% said it was part of their retirement planning.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week under pressure. News of the Venezuela debt restructuring was digested well, but sentiment went south as the day wore on. Weakness was concentrated in the weakest links TRY, BRL, RUB, and ZAR, while MXN and COP were dragged along for the ride. We see EM selling pressures persisting into 2018.

Read More »

Read More »

Cool Video: Bloomberg TV on Powell–Heir Apparent

In London on business and had the opportunity to go to Bloomberg. In this clip, Francine Lacqua discuss the likely nomination of Fed Governor Powell to succeed Yellen at the helm of the Federal Reserve. I make three points. First, that, like others, I recognize a strong element of continuity between Bernanke, who was first appointed by a Republican, Yellen, and now, presumably Powell.

Read More »

Read More »

Gold Price Reacts as Central Banks Start Major Change

Bank of England raised interest rates for the first time in ten years. President Trump announces Jerome Powell as his choice to lead the U.S. Federal Reserve. Most investors outside the US Dollar and Euro see gold prices climb after busy week of central bank news. Inflation now at five-year high of 3%. Inflation, low-interest rate, debt crises and bail-ins still threaten savers and pensioners.

Read More »

Read More »

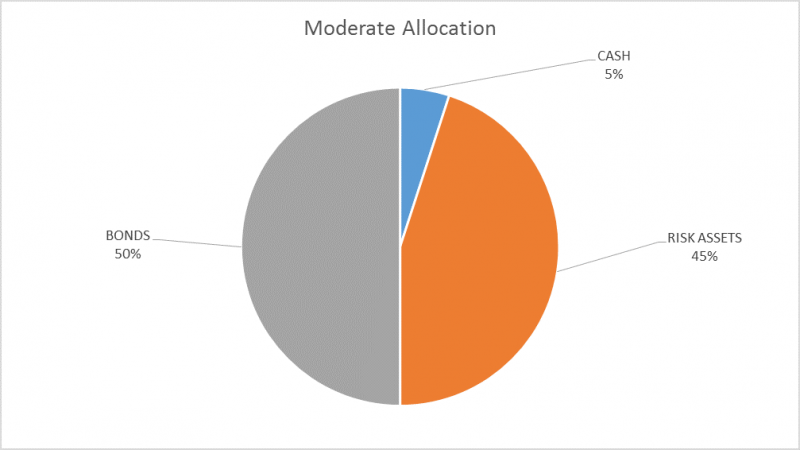

Global Asset Allocation Update

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise.

Read More »

Read More »

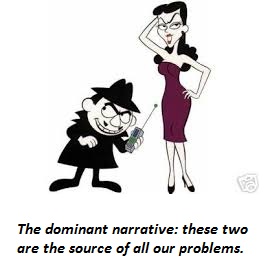

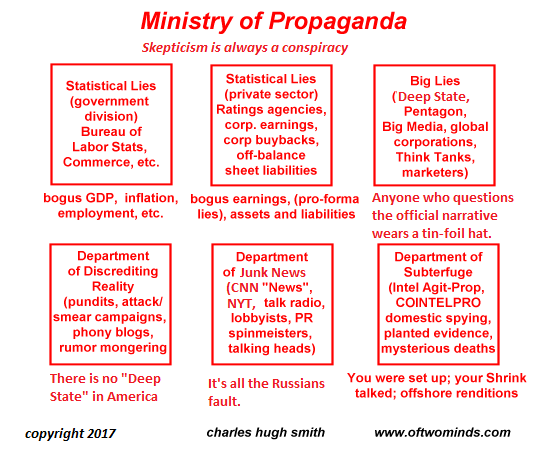

What’s Driving Social Discord: Russian Social Media Meddling or Soaring Wealth/Power Inequality?

The nation's elites are desperate to misdirect us from the financial and power dividethat has enriched and empowered them at the expense of the unprotected many. There are two competing explanatory narratives battling for mind-share in the U.S.: 1. The nation's social discord is the direct result of Russian social media meddling-- what I call the Boris and Natasha Narrative of evil Russian masterminds controlling a vast conspiracy of social media...

Read More »

Read More »

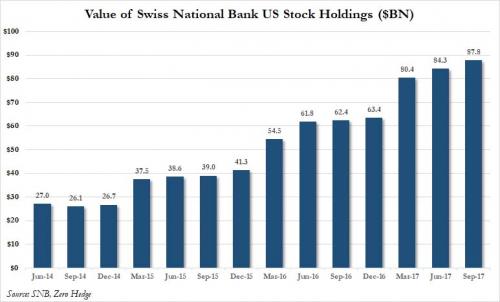

The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented "coordinated growth spurt", and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" freshly printed out of thin...

Read More »

Read More »

Emerging Markets: What has Changed

Russia’s Finance Ministry announced plans to increase its dollar. purchases in November. Bahrain has reportedly asked its Gulf allies for financial assistance. S&P upgraded Argentina a notch to B+ with stable outlook. Brazil raised BRL6.15 bln ($1.9 bln) by auctioning off the rights to explore 6 of the 8 deep-water oil blocks. Venezuela bowed to the inevitable, announcing that it would have to restructure its debt.

Read More »

Read More »

What the Kennedy Assassination Records Reveal: Uncontrollable Incompetence

One way to interpret the intelligence community's reluctance to let all the Kennedy assassination archives become public is that the archives contain evidence of a "smoking gun": that is, evidence that the intelligence agencies of the United States of America were complicit in the assassination of the President.

Read More »

Read More »

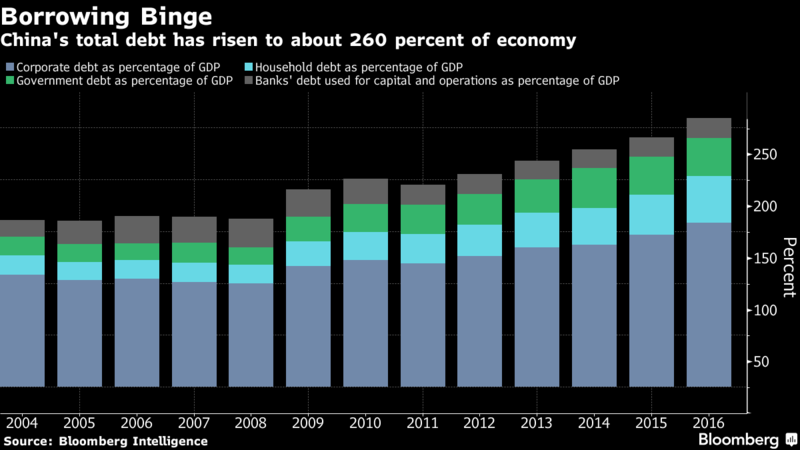

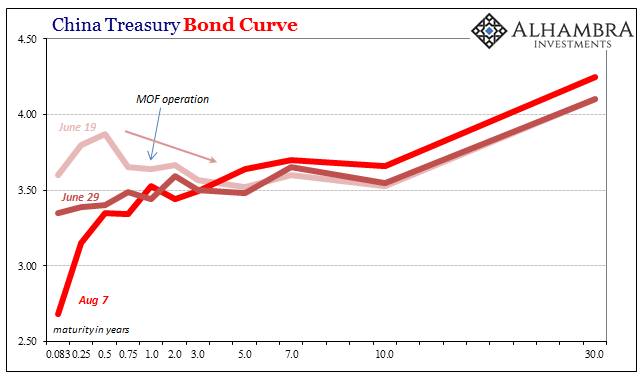

Bonds And Soft Chinese Data

Back in June, China’s federal bond yield curve inverted. Ahead of mid-year bank checks, short-term govvies sold off as longer bonds continued to be bought. It was for some a rotation, for others a reflection of money rates threatening to spiral out of control. On June 19, for example, the 6-month federal security yielded 3.87% compared to a yield of 3.525% for the 10-year.

Read More »

Read More »

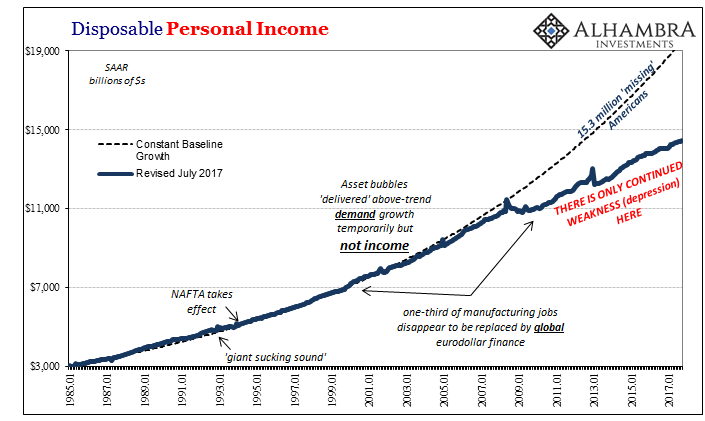

The (Economic) Difference Between Stocks and Bonds

Real Personal Consumption Expenditures (PCE) rose 0.6% in September 2017 above August. That was the largest monthly increase (SAAR) in almost three years. Given that Real PCE declined month-over-month in August, it is reasonable to assume hurricane effects for both. Across the two months, Real PCE rose by a far more modest 0.5% total, or an annual rate of just 3.4%, only slightly greater the prevailing average.

Read More »

Read More »

Agriculture suisse: trop, c’est trop.

Après la place financière, la production d’électricité, le secteur de la santé, des assurances-maladie, voici arrivé le tour de la destruction du secteur agricole. Remarquez la chose est déjà bien emmanchée avec des suicides et des faillites d’agriculteurs harcelés par un Etat qui poursuit l’agenda d’un « marché » financier et non celui des électeurs, quand bien même ceux-ci financent leur salaire …

Read More »

Read More »

FX Daily, November 03: Dollar Firms Ahead of What is Expected to Be Strong US Jobs Data

The US dollar is firm but is not going anywhere quickly. The lack of fresh interest rate support and uncertainty over the US tax proposals, which the Brady, the Chair of the House Ways and Means Committee hopes to have a revised version out after the weekend so the committee work can begin on Monday.

Read More »

Read More »

If American Federalism Were Like Swiss Federalism, There Would Be 1,300 States

In a recent interview with Mises Weekends, Claudio Grass examined some of the advantages of the Swiss political system, and how highly decentralized politics can bring with it great economic prosperity, more political stability, and a greater respect for property rights. Since the Swiss political system of federalism is itself partially inspired by 19th-century American federalism, the average American can usually imagine in broad terms what the...

Read More »

Read More »

Why Switzerland Could Save the World and Protect Your Gold

Precious metals advisor Claudio Grass believes Switzerland can serve as an example to rest of world. Switzerland popular for gold storage due to understanding of the risks inherent in fiat money and gold’s value as a store of wealth. International investors opt to store gold in Swiss allocated accounts due to tradition of respecting private property.

Read More »

Read More »

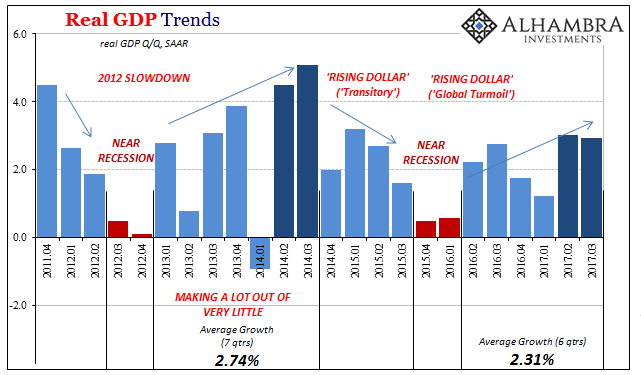

Strong Growth? Q3 GDP Only Shows How Weak 2017 Has Been

Baseball Hall of Famer Frank Robinson also had a long career as a manager after his playing days were done. He once said in that latter capacity that you have to have a short memory as a closer. Simple wisdom where it’s true, all that matters for that style of pitching is the very next out. You can forget about what just happened so as to give your full energy and concentration to the batter at the plate.

Read More »

Read More »

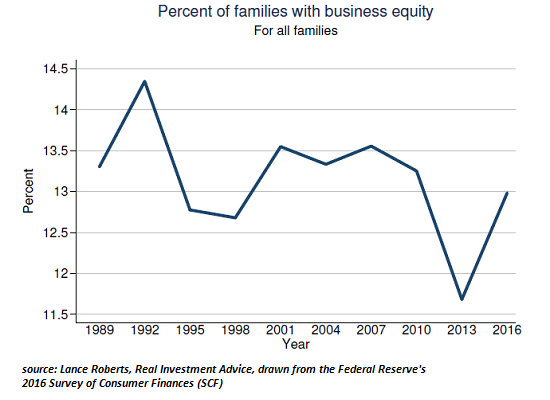

Observations on Wealth-Income Inequality (from Federal Reserve Reports)

There's a profound difference between assets that produce no income and those that produce net income. To those of us nutty enough to pore over dozens of pages of data on wealth and income in the U.S., the Federal Reserve's quarterly Z.1 reports and annual Survey of Consumer Finances (SCF) are treasure troves, as are I.R.S. tax and income reports.

Read More »

Read More »

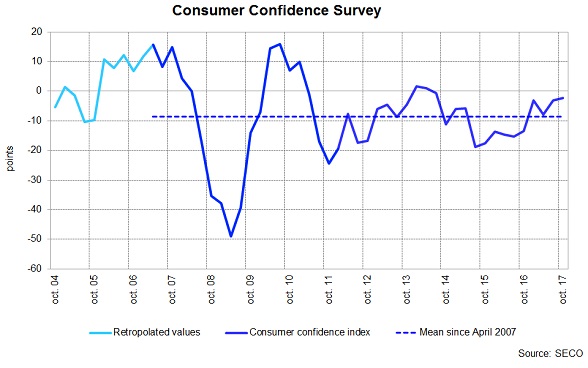

Swiss Consumers continue to expect a positive economic development

Consumer sentiment in Switzerland remains above average. At -2 points, the overall index is virtually unchanged in October compared to the previous quarter (-3 points). Continued optimism regarding economic development and unemployment are supporting the positive outlook in particular, while expectations regarding the financial situation of households remain below average.

Read More »

Read More »