Monthly Archive: November 2017

Emerging Markets: Week Ahead Preview

EM FX closed the week on a soft note. For the week as a whole, best performers were MYR, PLN, and COP, while the worst were BRL, ZAR, and INR. US inflation and retail sales data will likely set the tone for EM. Also, the US fiscal debate is set to continue this week, so expect lots of choppy trading across many markets.

Read More »

Read More »

Stories making the Swiss Sunday papers

The following stories were reported in Switzerland’s Sunday press on November 12, 2017. A major South American rail deal. The SonntagsBlick newspaper reports that Bolivian President Evo Morales will head to Switzerland on December 14 to sign a memorandum of understanding with Swiss Transport Minister Doris Leuthard over a massive South American rail transport project.

Read More »

Read More »

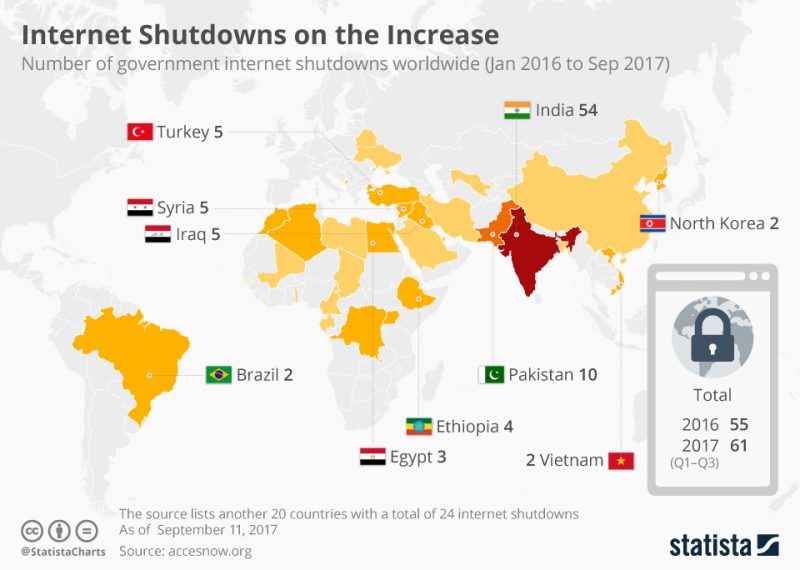

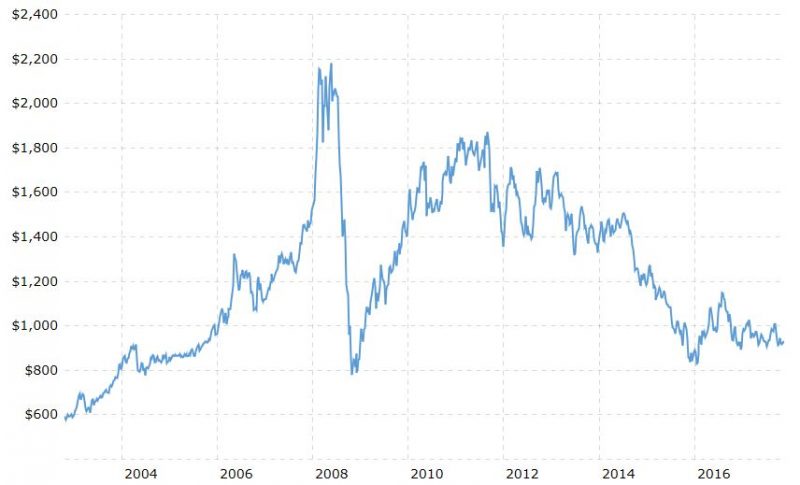

Internet Shutdowns Show Physical Gold Is Ultimate Protection

Internet shutdowns (116 in two years) show physical gold is ultimate protection. Number of internet shutdowns increased in 2017 as 30 countries hit by shutdowns. Democratic India experienced 54 internet shutdowns in last two years; Brazil 2. EU country Estonia, a technologically advanced nation, experienced a shutdown. Gallup poll shows Americans more worried about cybercrime than violent crime. Governments use terrorist threat as reason for...

Read More »

Read More »

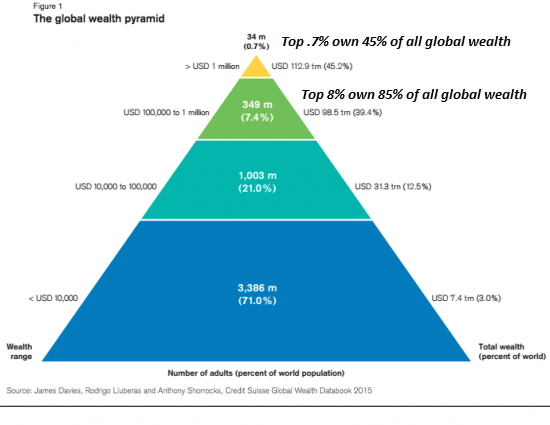

Our Culture of Rape

These are the poisoned fruits of a neofeudal system in which power, wealth and political influence are concentrated in the apex of the wealth-power pyramid. Stripped of pretense, ours is a culture of rape. Apologists for the system that spawned this culture of rape claim that this violence is the work of a few scattered sociopaths. The apologists are wrong: The system generates a culture of rape.

Read More »

Read More »

One in five Swiss avoids visiting doctor due to costs

Just over 20% of Swiss residents decided not to see a doctor last year for medical treatment due to the high costs, according to a new report. This is one of the findings of the Health at a Glance 2017 reportexternal link published by the Organisation for Economic Co-operation and Development (OECD) on Friday. The share of the population foregoing a doctor’s consultation due to cost in 2016 was highest in Poland (33% of the population) followed by...

Read More »

Read More »

Gold Coins and Bars Saw Demand Rise 17percent to 222T in Q3

Gold coins and bars saw demand rise 17% to 222t in Q3, driven largely by China. Chinese investors bought price dips, notching up fourth consecutive quarter of growth. Jewellery, ETF demand fell while gold coins and bars saw increased demand. Central banks bought a robust 111t of gold bullion bars (+25% y-o-y). Russia, Turkey & Kazakhstan account for 90% of 111t of central bank demand. Turkey increased gold purchases and saw broad based physical...

Read More »

Read More »

Swiss tax spy avoids jail time as Frankfurt trial ends

A Swiss man on trial in Frankfurt has been found guilty of spying on the tax authorities of the German state of North Rhine-Westphalia (NRW). ‘Daniel M.’ was handed a suspended sentence of 22 months and a fine of €40,000 (CHF46,600). The verdict brings to a premature end the twists and turns of a case that brought scrutiny on Swiss-German diplomatic relations since the arrest of the 54-year-old in April this year.

Read More »

Read More »

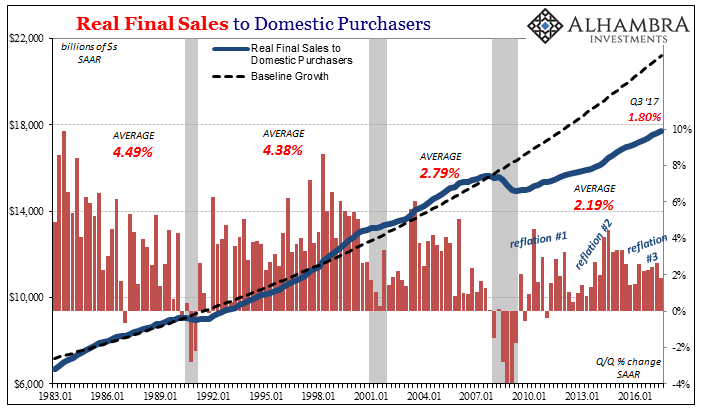

Heat Death of the Economic Universe

Physicists say that the universe is expanding. However, they hotly debate (OK, pun intended as a foreshadowing device) if the rate of expansion is sufficient to overcome gravity—called escape velocity. It may seem like an arcane topic, but the consequences are dire either way.

Read More »

Read More »

Aligning Politics To economics

There is no argument that the New Deal of the 1930’s completely changed the political situation in America, including the fundamental relationship of the government to its people. The way it came about was entirely familiar, a sense from among a large (enough) portion of the general population that the paradigm of the time no longer worked. It was only for whichever political party that spoke honestly to that predicament to obtain long-term...

Read More »

Read More »

Emerging Markets: What has Changed

China announced that it will remove foreign ownership limits on banks and other measures to open up the financial sector. Central Bank of Turkey lowered commercial bank FX reserve requirements in an effort to support the lira. US-Turkey relations appear to be thawing slightly. Middle East tensions are rising on a variety of fronts. Argentina central bank unexpectedly hiked rates again.

Read More »

Read More »

BMW must pay multimillion-franc fine, Swiss court rules

Switzerland's highest court has confirmed a CHF157 million ($158 million) fine against German luxury carmaker BMW for blocking car shipments to Switzerland. The fine was originally levied on BMWexternal link by Switzerland’s Competition Commissionexternal link (COMCO) in May 2012 for preventing Swiss residents from buying BMW cars from the European Economic Area (EEA) and importing them to Switzerland, after the strong francexternal link made...

Read More »

Read More »

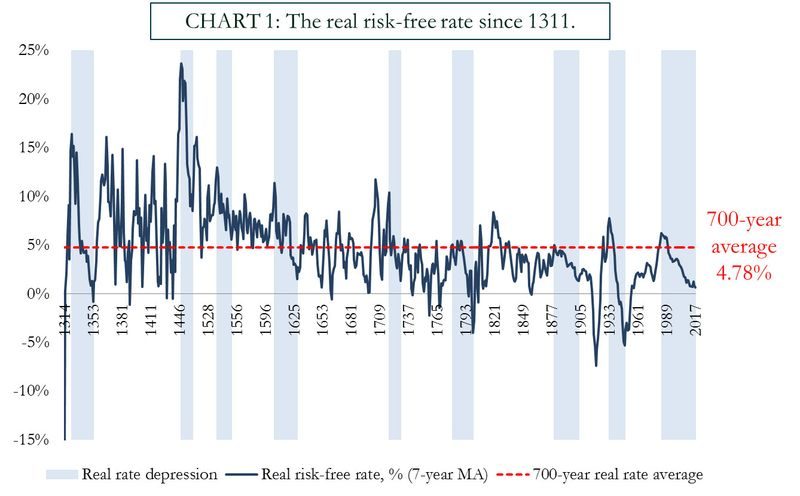

Prepare For Interest Rate Rises And Global Debt Bubble Collapse

Diversify, rebalance investments and prepare for interest rate rises. UK launches inquiry into household finances as £200bn debt pile looms. Centuries of data forewarn of rapid reversal from ultra low interest rates. 700-year average real interest rate is 4.78% (must see chart). Massive global debt bubble – over $217 trillion (see table). Global debt levels are building up to a gigantic tidal wave.

Read More »

Read More »

The Downright Sinister Rearrangement of Riches

Simple Classifications. Let’s begin with facts. Cold hard unadorned facts. Water boils at 212 degrees Fahrenheit at standard atmospheric pressure. Squaring the circle using a compass and straightedge is impossible. The sun is a star.

Read More »

Read More »

Maybe Hong Kong Matters To Someone In Particular

Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods.

Read More »

Read More »

La politique monétaire de la BNS rejaillit sur le système bancaire suisse. Le cas de la BCV.

Les « opérations de refinancement » de la BNS peuvent-elles exposer l’ensemble du système bancaire suisse aux aléas de la finance spéculative européenne ? Les too-big-to-fail sont-elles les seules concernées ? Eh bien non. Certaines déclarations du directeur de la Banque cantonale vaudoise (BCV*) nous ont incité à nous pencher sur les comptes de cet établissement de taille moyenne.

Read More »

Read More »

Switzerland moves closer to female board quotas

This week, Switzerland moved closer to requiring minimum percentages of women on company boards and management teams. A parliamentary commission came out in support of the Federal Council’s plan to require greater gender balance in the boardrooms of Switzerland’s large listed companies.

Read More »

Read More »

OECD Country Report 2017 on Swiss economic policy

On Tuesday, November 14, 2017, the OECD presents the OECD Country Report 2017 on Swiss economic policy at a media conference. This takes place at 15.00 clock in the media center Bundeshaus, Bundesgasse 8-12, 3003 Bern.

Read More »

Read More »

Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’

Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’Platinum “may be one of the cheap assets out there” and “is cheap when compared with stocks or bonds” according to Dominic Frisby writing in the UK’s best selling financial publication Money Week.

Read More »

Read More »

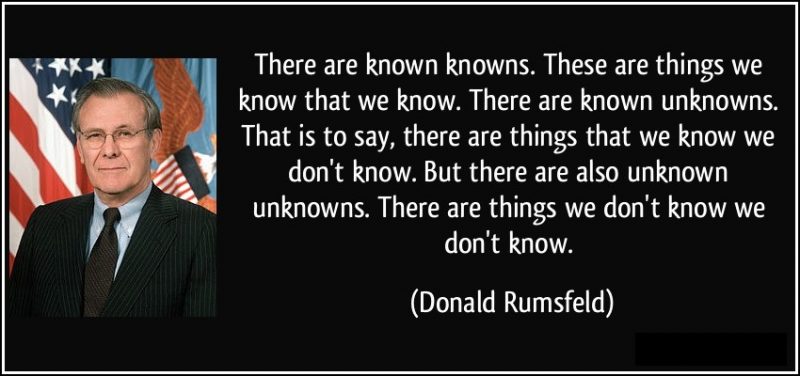

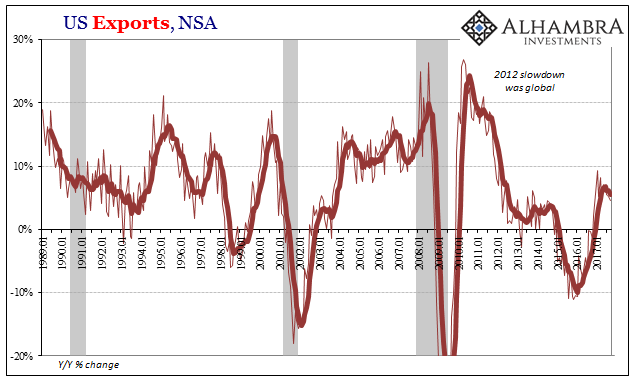

Synchronized Global Not Quite Growth

Going back to 2014, it was common for whenever whatever economic data point disappointed that whomever optimistic economist or policymaker would overrule it by pointing to “global growth.” It was the equivalent of shutting down an uncomfortable debate with ad hominem attacks. You can’t falsify “global growth” because you can’t really define what it is.

Read More »

Read More »