In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: the Japanese Central Bank’s interventions in the stock market are familiar to all by now, and for the most part the BOJ keeps its interventions local, mostly propping up Japanese stocks, whether the Nikkei 225 or the Topix.

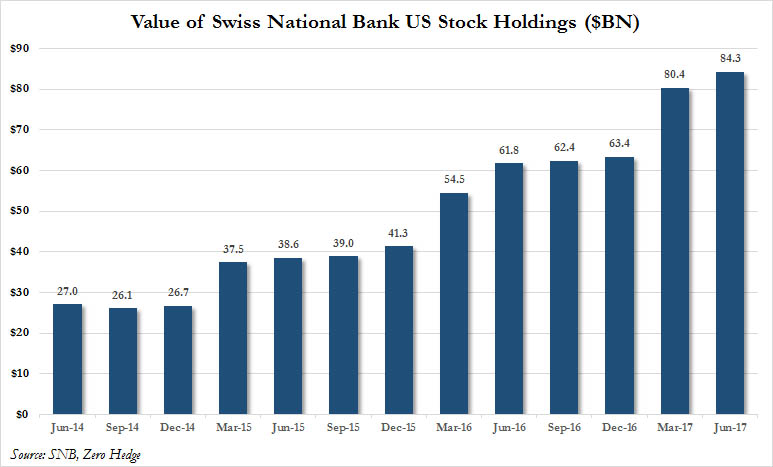

| The answer was revealed this morning when the hedge fund known as the “Swiss National Bank” posted its latest 13-F holdings. What it showed is that, as rumored, the Swiss National Bank had gone on another aggressive buying spree in the second quarter, and following its record purchases in the first quarter, the central bank boosted its total equity holdings to an all time high $84.3 billion, up 5% or $4.1 billion from the $80.4 billion at the end of the first quarter.

As reported last week, the Swiss central bank has accumulated foreign exchange worth 714.3 billion francs (over $740 billion) due to its ongoing interventions to depress the Swiss franc, and has “invested” those funds created out of thin air in stocks and bonds. At the end of the second quarter, it held 20% in equities, of which the bulk was in US stocks. |

Value of Swiss National Bank US Stock Holdings 2014-2017(see more posts on SNB US Stock Holdings, ) |

| While we are far beyond the point of debating central bank intervention in equity markets (we do want to remind readers that until several years ago, it was considered “fake news” to even mention it, and those who accused central bankers of manipulating stock markets were said to be paranoid tinfoil basement dwellers), we want to point out that unlike the BOJ, which at least keeps its capital markets distortion local, the SNB, which likewise creates money out of thin air (then sells it for dollars in an attempt to keep the Swiss franc depressed) is actively causing substantial price distortions in the US.

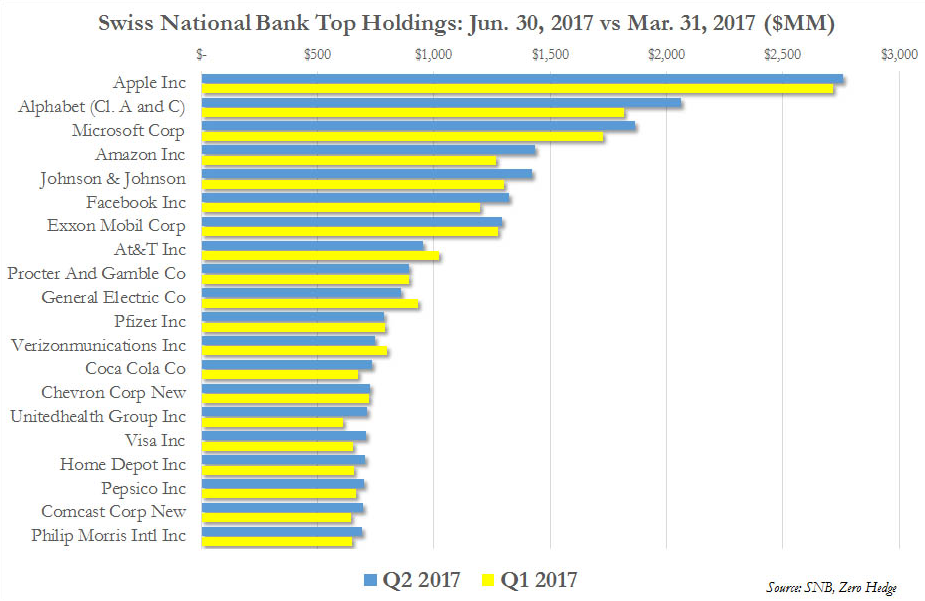

While we doubt this will be investigated with stocks are at all time highs, we look forward to the Congressional hearings after the crash when the scapegoating and fingerpointing begins, and everyone is “stunned” to learn that central banks were responsible for blowing the biggest asset bubble the world has ever seen by directly buying stocks. What else did the SNB reveal in its 13F? Two main things. First, its top 20 holdings are as shown in the following chart. The central bank was clearly not shy in adding to its top positions, especially the top position, which increased as a result of both appreciation and new purchases. |

Swiss National Bank Top Holdings Q1 vs Q2 2017(see more posts on SNB Holdings, ) |

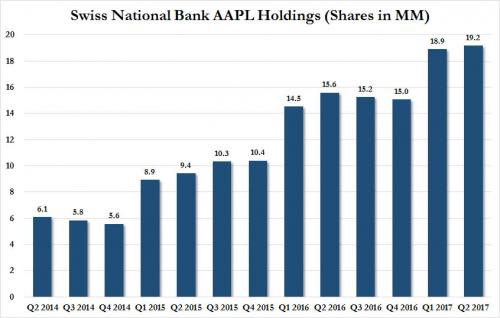

| And while we have yet to learn if Warren Buffett was actively frontrunning the SNB once again during the quarter, similarly to his activity in Q1 when he more than doubled his AAPL stake making him a top 5 holder of the tech giant, a look at the SNB’s holdings of AAPL stock which again increased from 18.9 to 19.2 million shares, making it a larger holder of AAPL stock than Schwab and Franklin Resources (with 18.3 and 17.8 million shares respectively), and just behind AllianceBernstein, shows why the Nasdaq has until recently been hitting new all time highs on a daily basis.

The chart above may also explain why Goldman, despite warning of rising worries about record low volatility remains bullish on the Nasdaq 100: after all, when a central bank can and does create money out of thin air, then splurges on the handful of tech companies that have the biggest impact on the broader market, pushing both the Nasdaq and all indices higher, what is the point of even talking about “risk”? |

Swiss National Bank AAPL Holdings 2014 - Q2 2017(see more posts on SNB Apple Holdings, ) |

Source: SNB 13-F

Full story here Are you the author? Previous post See more for Next postTags: Bank of Japan,Business,Capital Markets,central banks,economy,Equity Markets,Finance,money,NASDAQ,Nasdaq 100,newslettersent,Nikkei,Nikkei 225,Philipp Hildebrand,SNB Apple Holdings,SNB Holdings,SNB US Stock Holdings,stock market,Swiss Franc,Swiss National Bank,Swiss National Bank Stock,UBS,Volatility,Warren Buffett

1 comments

Ole C G Olesen

2017-08-12 at 10:18 (UTC 2) Link to this comment

I WONDER .

Isnt this the Ultimate Exploitation and Exposure of the ” Central Banking ” Scheme ?

Creating Money out of thin Air .

Buying real productive Value ..for nothing

Does it matter what the Price is ?

Hardly !

The Swiss Central bank is a private bank

but Majority owned by the Swiss Cantons .. as far as I know.

Besides being an intelligent Hedge against fake Money creation … for free

Additionally .. keeping the Swiss Currency at export promoting Levels.

NOT SO STUPID

it could also be viewed as an Insurance against overly aggressive USA behaviour

of which Switzerland has suffered quite some

Think of it !

What would dumping massive chunks of US Shares ( which cost nothing )

mean to the US financial Stability ?

Excellent !