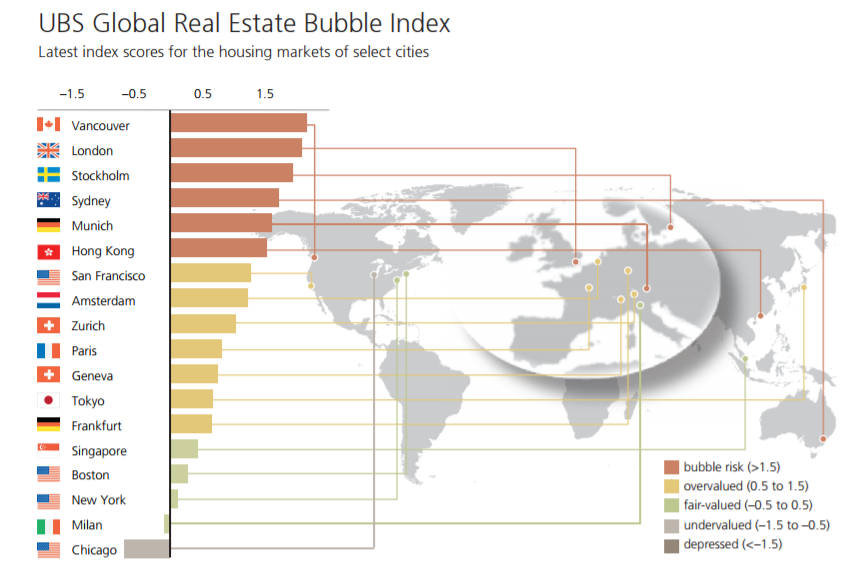

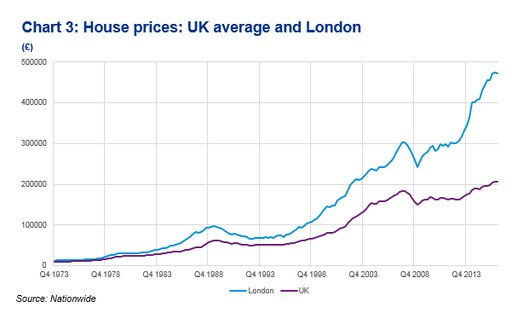

| – London property bubble bursting? UK in unchartered territory on Brexit and election mess – Evidence of downturn in London housing market – Over 75% of London homes now selling below asking price – Prime north London property down 6 per cent annually – House prices have not fallen for three consecutive months since the 2009 crisis – Bank of England report expresses worry over UK property market – ‘Adverse shock’ to UK economy may amplify negative feedback loop – Increased political and economic uncertainty has weakened fragile London buyer sentiment – Bank of England Financial Stability Report: “Mortgages are the largest loan exposure for UK lenders” – BOE FSR refers to a “self-reinforcing feedback loop” that, if triggered, would cause another 2008-style crisis in the UK Is the London property market heading for tough times? The most recent housing figures and a new Bank of England report suggest it may well be. Recent figures show that 77% of London houses sold in May went at below asking price, up from 72% in April. London as the capital of UK reflects international market but international investors have major concerns over uncertainties namely Brexit and the current state of the government. As a result London house prices are rising at their weakest rate in five years (if they are rising at all). In prime estate London things are particularly bad, with prices in prime north and north west London falling by 6% in the last year. Across the country, price drops in May signalled the third consecutive monthly drop, something which has not been seen since the 2009 crisis. Banks are well aware of what this could mean for them and as a result are now offering mortgages that scream ‘bubble bursting!’ Rates for 90% loans have tumbled to as low as 1.9% for two-year deals and just 2.55% for five-year fixes. Yet, cheap mortgages are not enough. Buyers are getting worried whilst homeowners increase their desire to sell their properties, CityAM reports: ‘prospective buyers registering with estate agents fell from 381 people per branch in April to 350 in May, although that was up from 304 at the same time last year. The number of homes available rose 11 per cent to 40 per branch, up from 37 per branch in May last year.’ |

|

| Danger for mortgage holders

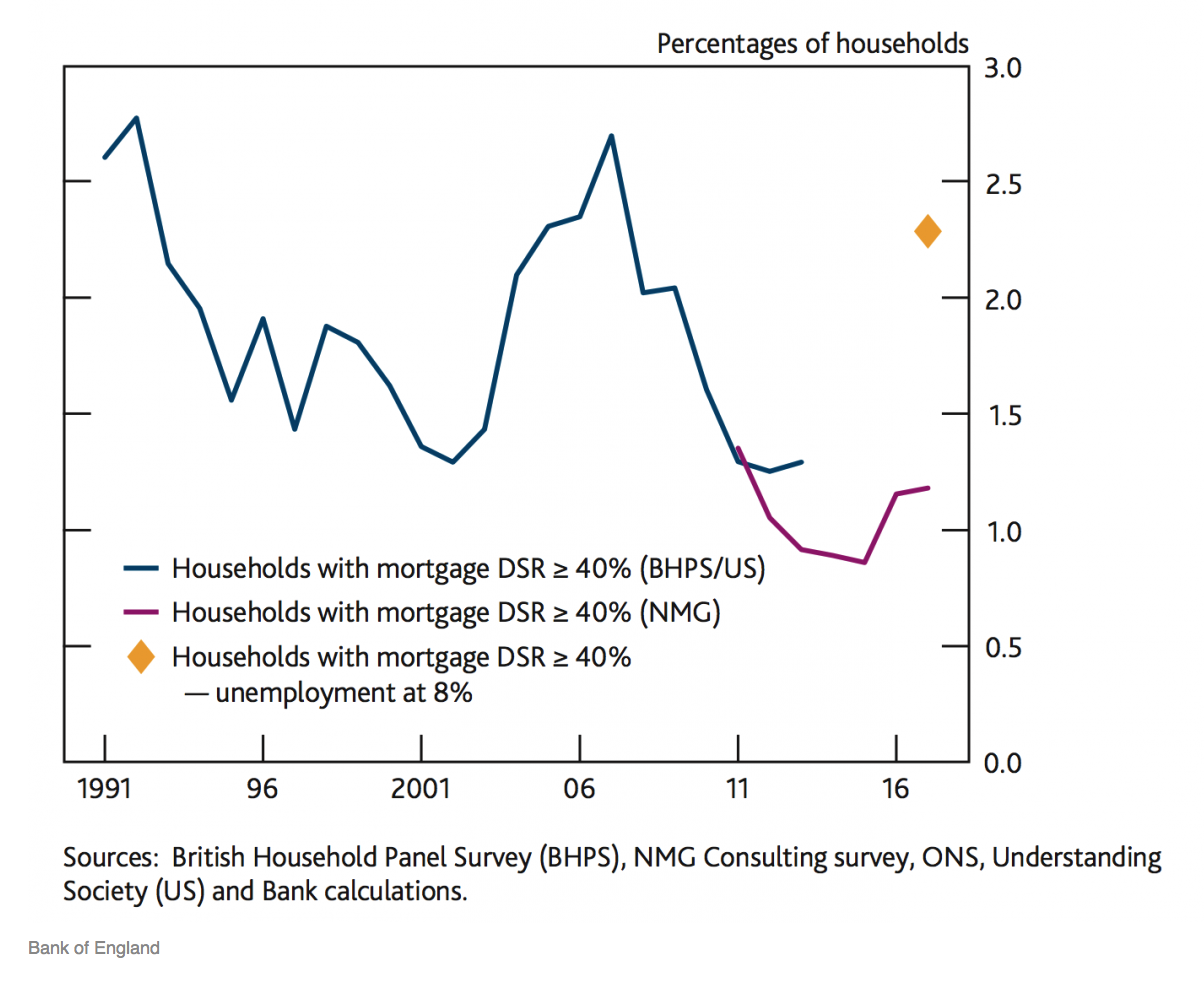

Of course one of the major threats to the property market is not only the affordability of housing but the cost of borrowing. The BoE’s Financial Stability Report draws attention to just how sensitive the country is to interest rate rises. Not only was ‘80% of new mortgage lending in 2016 either on a fixed rate for a period of less than five years or on a floating rate’ but ‘”mortgages are the largest loan exposure for UK lenders.’ This means that the next rate decision by the MPC in August will not only be taking into account concerns over the growing rates of real inflation but also the impact of a potential rate rise on millions of UK homeowners. Should a rate rise occur then we will likely see a downward spiral which will leak into the rest of the economy. As homeowners struggle to keep up their unaffordable mortgage payments they will delay defaulting on their homes and instead avoid paying other debts such as credit cards and car loans. Of course, a rate rise is not the only concern right now. Just the simple matter of having an economy with jobs so homeowners can actually pay their mortgages is a pretty key thing to try and manage. One of the more concerning charts in the BoE’s report is the representation of what would happen if UK unemployment increased from just below 5% as it is currently, to 8%. |

Percantage of Households, 1991 - 2017 |

| This small move in unemployment would result in twice the number of households who have high debt service ratios — the most fragile mortgages out there. The estimate is represented by the yellow diamond in the chart above. |

UK House Prices: Average and London |

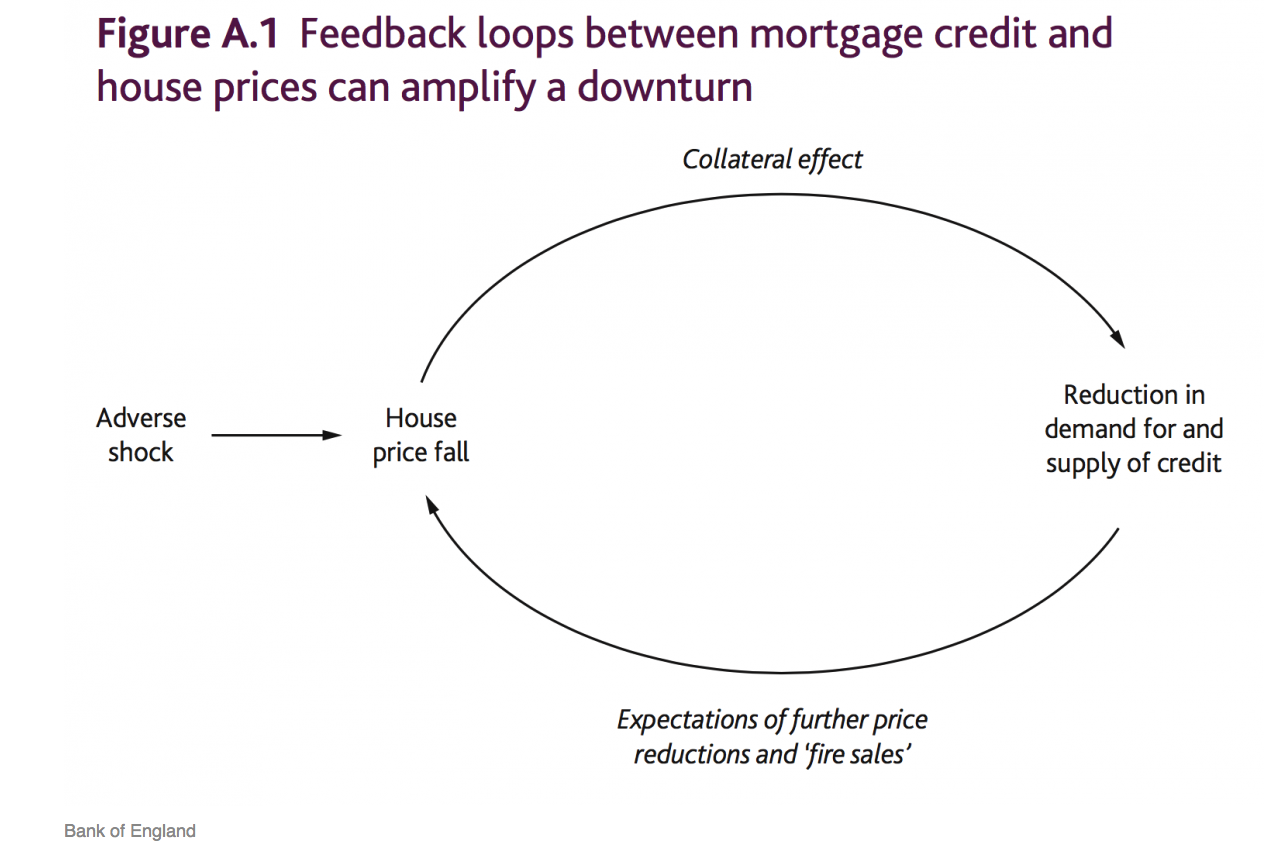

| Adverse Shock? Which one to pick?

In the FSR from the BoE, an ‘adverse shock’ is referred to. It is this which will impact jobs, push up rates and ultimate lead to a negative feedback loop that will ‘amplify a downturn’. The bank states, a ‘feedback loop between house prices and credit also arises in a downturn. An economic slowdown can reduce house prices. Due to the role of housing as collateral, lower house prices reduce the demand for, and supply of, credit. Expectations of further price reductions, which can result in sales of houses at heavily discounted prices (‘fire sales’), can further amplify house price falls, reinforcing the adverse feedback loop. The resulting deterioration in borrowers’ and lenders’ resilience will intensify a downturn.’ Brexit is the most obvious adverse shock for the UK economy at present but this does not mean that homeowners should take comfort from Mrs May’s positive negotiations. The truth is, we have no idea what the final Brexit package will look like or (more importantly) how it will really affect the UK economy. The UK and its homeowners are at a real risk of being blinkered by Brexit. The FSR is clearly trying to present the divorce from the EU as an ‘adverse shock’ (they have a special section on Brexit) but readers must remember this is not the only threat to the bubble. As we explained in yesterday’s comment on shrinkflation in relation to price inflation, the issues in the housing market have been there for many years. Brexit is the latest scapegoat for the struggling housing market. One headline in a local London rag reads, ‘Brexit to blame: prime north London property down 6 per cent annually.’ Yes, Brexit may well be the final trigger, but the pieces were all lined up for the gun to fire. |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of England,Business,central banks,economy,European central bank,European Union,fixed,flash,Foreign exchange market,Hedge,Housing market,Jim Rogers,Loans,newslettersent,Real estate bubble,Reuters,Sovereigns,Switzerland,Unemployment