Summary

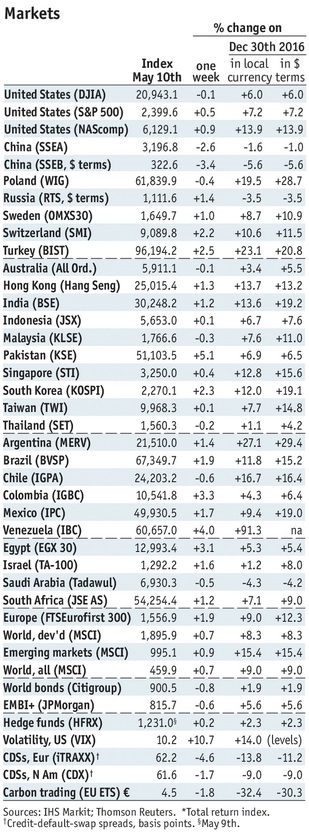

Stock MarketsIn the EM equity space as measured by MSCI, Brazil (+5.5%), Hungary (+4.3%), and Colombia (+4.3%) have outperformed this week, while Thailand (-0.9%), Poland (-0.7%), and the Philippines (-0.6%) have underperformed. To put this in better context, MSCI EM rose 2.5% this week while MSCI DM fell -0.2%. In the EM local currency bond space, Poland (10-year yield -14 bp), Brazil (-12 bp), and Hungary (-10 bp) have outperformed this week, while Czech Republic (10-year yield +25 bp), Argentina (+21 bp), and Turkey (+17 bp) have underperformed. To put this in better context, the 10-year UST yield fell 1 bp to 2.34%. In the EM FX space, RUB (+1.5% vs. USD), BRL (+1.4% vs. USD), and MXN (+1.2% vs. USD) have outperformed this week, while TRY (-0.7% vs. USD), PEN (-0.5% vs. USD), and ARS (-0.3% vs. USD) have underperformed. |

Stock Markets Emerging Markets, May 10 Source: economist.com - Click to enlarge |

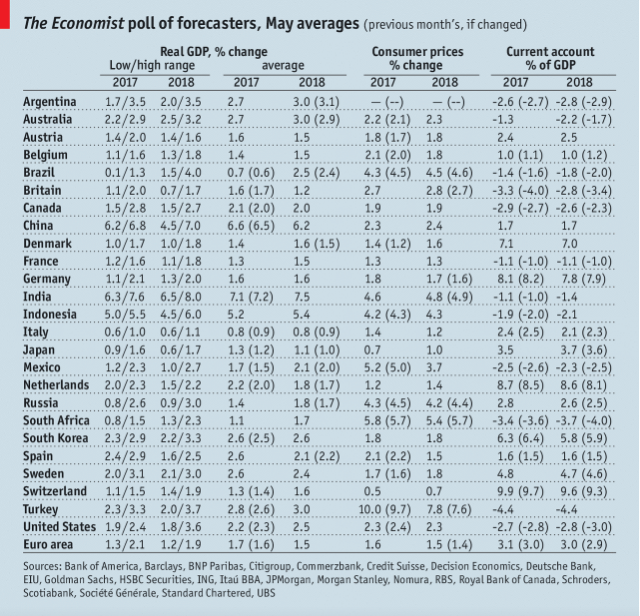

South KoreaMoon Jae-in was elected president of South Korea. We think the biggest potential change coming from the election is in North-South (and as a result, US-South Korea and China-South Korea) relations. President-elect Moon has said he will resume the “sunshine policy” of engagement with Pyongyang after 9 years of the hardline conservative approach, and will review the controversial THAAD missile shield. PhilippinesPhilippine President Duterte named Nestor Espenilla as central bank governor. He succeeds Amando Tetangco, who retires in July after completing two six-year terms. Espenilla has worked at the central bank for over three decades, and has been Deputy Governor and head of bank supervision since 2005. NigeriaNigerian President Buhari traveled to London for a follow-up to the initial medical visit earlier this year. Spokesperson said that “The President wishes to assure all Nigerians that there is no cause for worry.” Before this trip, Buhari had not been seen in public lately and so observers are left wondering if the situation is more than just a follow-up. BrazilMarket expectations for 2018 inflation in Brazil rose for the first time in more than a year. According to the central bank’s weekly survey, analysts raised their 2018 forecast for IPCA consumer inflation to 4.39% from 4.30% previously, marking the first increase since March 2016. PeruPeru’s central bank unexpectedly started the easing cycle with a 25 bp cut to 4.0%. We thought it would wait until H2 given inflation is still above target, but the sluggish economy was the likely trigger. Peru joins Chile, Colombia, and Brazil in easing. Mexico stands out as the exception in the region, as it is still in tightening mode. |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, May 2017 Source: economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Emerging Markets,newslettersent