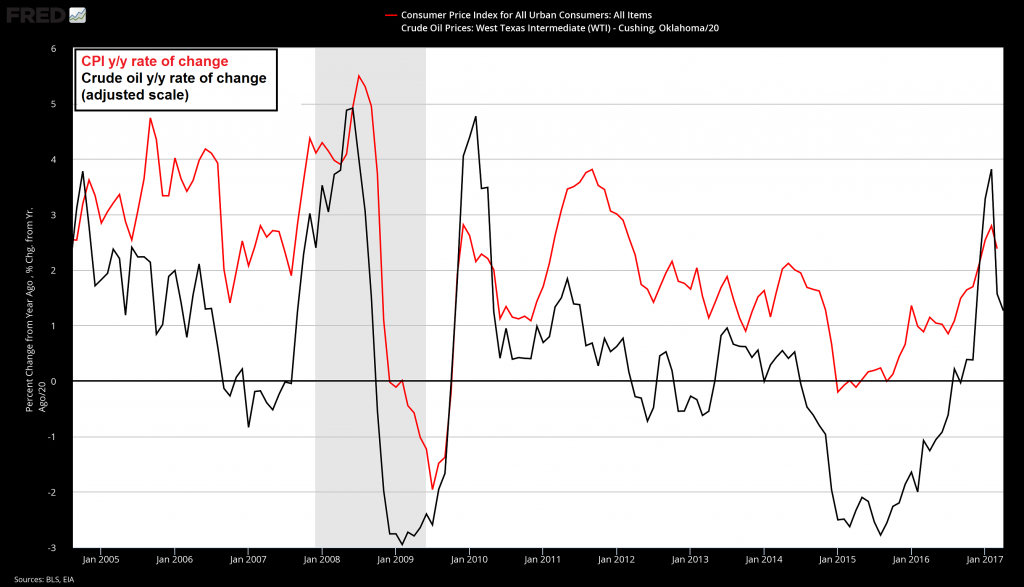

Correlation vs. CausationA very good visual correlation between the yearly percentage change in the consumer price index (CPI) and the yearly percentage change in the price of oil seems to provide support to the popular thinking that future changes in price inflation in the US are likely to be set by the yearly growth rate in the price of oil (see first chart below). |

|

| But is it valid to suggest that a price of an important input such as oil is a key determinant of the prices of goods and services? It is true that producers of goods and services set asking prices. It is also true that producers, while setting prices, take into account various production costs including the cost of energy.

Whether the asking price set by producers is going to be realized in the market place, however, hinges on whether or not consumers will accept those prices. Consumers dictate whether the price set by producers is “right.” On this Mises wrote:

If consumers don’t have the money to support the prices asked by producers then the prices asked cannot be realized. What is a price? It is the rate of exchange between goods established in a transaction. The price, or the rate of exchange of one good in terms of another, is the amount of the other good divided by the amount of the first good. In a money economy, price will be the amount of money divided by the first good. A price is the sum of money paid for a unit of a good. If the stock of money rises whilst all other things remain intact obviously this must lead to more money being spent on the unchanged stock of goods — an increase in the average price of goods (the term average is used here in conceptual form since such an average cannot be computed.) If the price of oil goes up and if people continue to use the same amount of oil as before, this means that people are now forced to allocate more money to oil. If people’s money stock remains unchanged then this means that less money is available for other goods and services, all other things being equal. This of course implies that the average price of other goods and services must come off. Note that the overall money spent on goods does not change. Only the composition of spending has altered here, with more on oil and less on other goods. Hence, the average price of goods or money per unit of good remains unchanged. |

CPI VS Crude Oil, January 2005 - May 2017 |

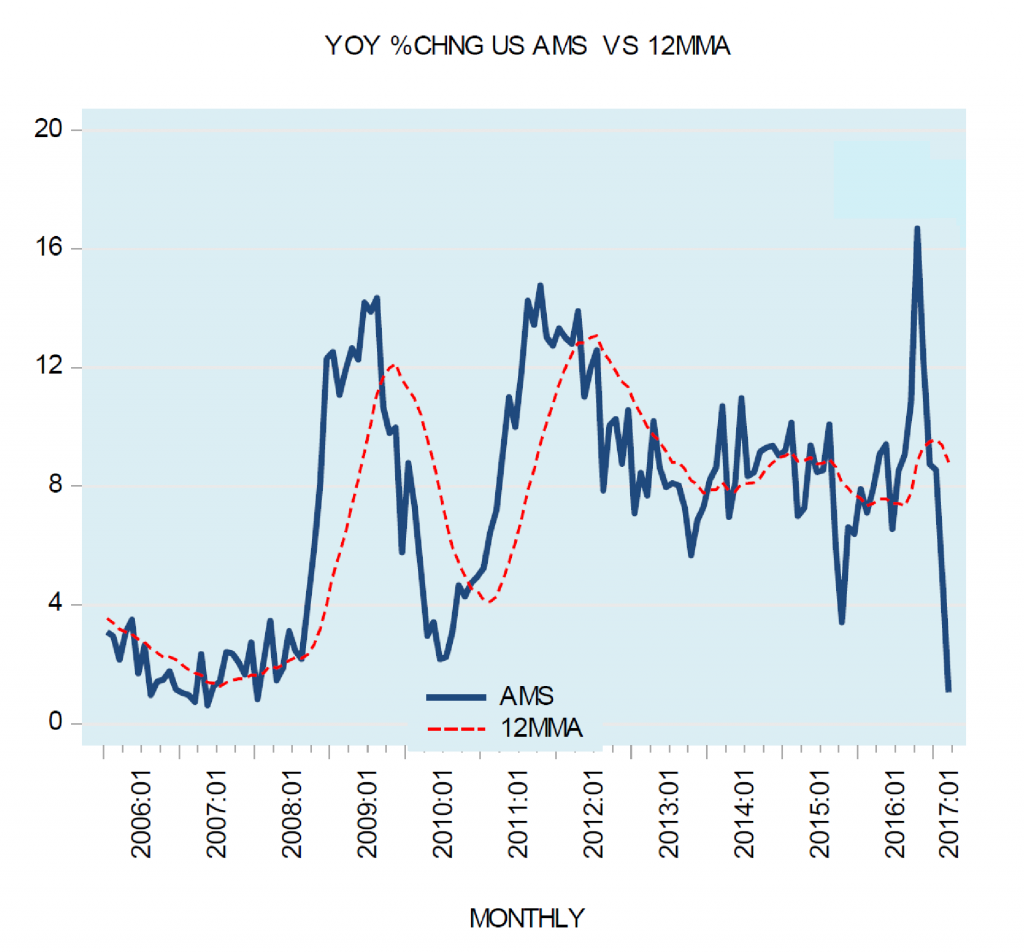

Money Supply Growth as a ConstraintFrom this we can infer that the rate of increase in the prices of goods and services in general is going to be constrained by the rate of growth of the money supply, all other things being equal, and not by the rate of growth of the price of oil. It is not possible for rises in the price of oil to set in motion a general increase in the prices of goods and services without corresponding support from the money supply. One could, however, argue that a rise in the price of oil may result in an increase in the growth rate of the money supply. (That is, the increase in the price of oil will be monetized.) This in turn should provide support for a general rise in prices on account of the increase in the price of oil. Even if this were to be the case, because of a lengthy time lag from changes in money to price inflation in the short run this would have almost no effect on the growth momentum of the CPI. For example, after peaking at 13.1% in July 2012 the 12-month moving average of the yearly growth rate of our monetary measure AMS has been in a visible downtrend for the US, closing at 8.9% by March this year. Based on this, the growth momentum of prices of goods and services is likely to follow a downtrend in the months ahead. Given how market prices are set, it doesn’t follow that rising oil prices lead to general increases in prices. It is more likely that the core driver of general increases in prices of goods and services is money supply (AMS) growth that in turn is driven by central and commercial bank money creation, not the price of oil. |

United States AMS VS 12MMA, January 2006 - May 2017 |

Tags: Chart Update,commodities,newslettersent