This is Part 2 of a two-part series. The series focuses on collusive discussions and meetings that took place between the world’s most powerful central bankers in late 1979 and 1980 in an attempt to launch a central bank Gold Pool cartel to manipulate and control the free market price of gold. The meetings centered around the Bank for International Settlements (BIS) in Basle, Switzerland.

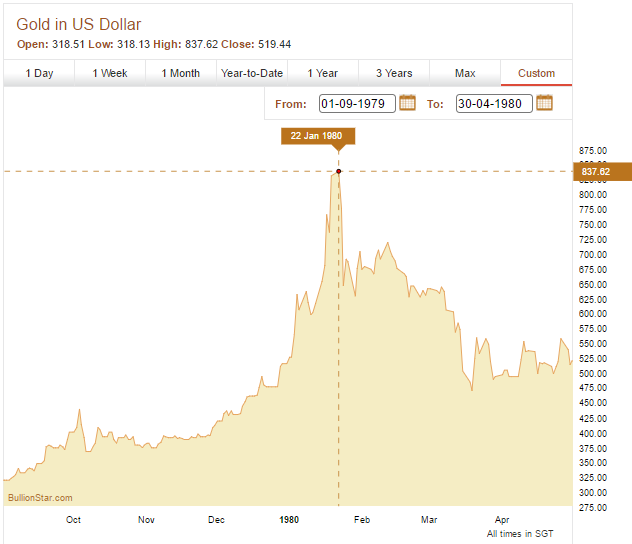

Part 2 takes up where Part 1 left off, and begins by looking at developments in the BIS Gold Pool discussions during January 1980, a month in which the US dollar gold price rocketed more than 60% during a three-week period to reach a then record of $850 per ounce. Part 2 then looks at how the discussions involving these central banks evolved over the remainder of 1980 and 1981 as key high level central bankers continued to call for intervention into the gold market.

Part 2 also looks at evidence that central bankers party to the discussions began advocating gold for oil exchanges between the West and the Saudis, exchanges which would provide real wealth (gold) to the Arabs in exchange for oil flowing to the West, while simultaneously keeping a lid on the gold price.

Summary of Part 1The first article in the series, published on 16 May and titled “New Gold Pool at the BIS Basle, Switzerland: Part 1”, concentrated on events and developments in late 1979 and revealed, among other things, that:

|

Gold Price, Spetember 1979 - April 1980(see more posts on gold price, ) |

As per Part 1, a number of internal documents from the Bank of England are cited below. These documents provide a unique road map on the evolution of the collusive discussions at the BIS and the thinking of the Bank of England executives involved in and supporting the discussions. Documents are rendered in blue text and italics, with bold, underlining, and a few cases of red text added where appropriate.

January 1980 BIS Gold Pool MeetingFollowing the Gold Pool meeting at Zjilstra’s office in the BIS headquarters on 10 December 1979, the central bank governors next met at the BIS in Basle on 7 January 1980 during their monthly scheduled ‘Basle Weekend’. The afternoon London Gold Fix was set at $431 on 10 December 1979, but by 4 January 1980 it was already 36% higher at $588. To recap from Part 1, Christopher McMahon, known as ‘Kit’ McMahon, became Deputy Governor of the Bank of England on 1 March 1980, taking over that position from Jasper Hollom. Prior to becoming Deputy Governor, McMahon was an executive director at the Bank of England from 1970 to 1980. McMahon signed his internal Bank of England memos and correspondence with the initials ‘CWM’, short for Christopher William McMahon. McMahon left the Bank of England in 1986 to take up the role of Chief Executive and Deputy Chairman of Midland Bank. Midland Bank was taken over by HSBC in 1992. See profiles of McMahon here and here.

|

|

Gordon Richardson was Governor of the Bank of England for 10 years from 1973 to 1983. Before that, he was a non-executive director of the Bank of England between 1967 and 1973. Richard was chairman of J. Henry Schroder Wagg from 1962 to 1972, and chairman of Schroders from 1966 to 1973. After leaving the Bank of England, Richardson went on to be a director of Saudi International Bank in London. He also headed the influential Group of Thirty (G30) central bank lobbyist group, and was chairman of Morgan Stanley International. John Sangster’s full name was John Laing Sangster, hence he signed his internal Bank of England memos and analysis with the initials ‘JLS’.

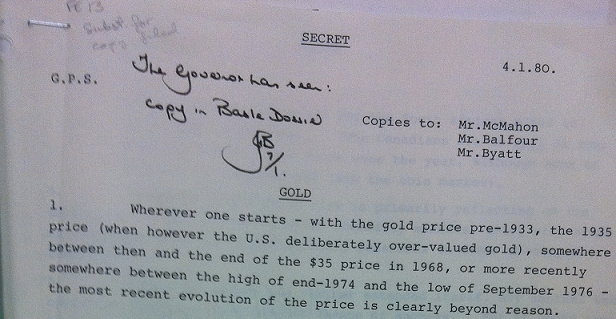

G10 plus SwitzerlandSangster’s secret memo to McMahon and Richardson was written on Friday 4 January 1980, a day on which the afternoon Gold Fix came in at $588 per ounce. The memo addressed developments in the gold price and discussed potential joint central bank intervention into the gold market. Hand written at the top are the words “The Governor has seen : copy in Basle Dossier JB 7/1“. JB is the Bank of England’s John Balfour who was also copied on the document, and who was a Bank of England alternate director at the BIS at that time. The memo has 6 numbered paragraphs, paragraphs 5 and 6 of which are most interesting: |

|

| The G10 that Sangster mentions refers to the Group of 10 highly industrialised nations which consisted of the USA, UK, France, West Germany, Netherlands, Belgium, Italy, Canada, Sweden, and Japan. The G10 as a grouping was formed in 1962 when these 10 countries participated in the IMF’s General Arrangements to Borrow (GAB) plan. Switzerland became associated with the GAB in 1964 but the name remained the G10. The G10 also participated in the Smithsonian Agreement in December 1971, with all other members agreeing to peg their currencies against the US dollar.

As readers will recall from Part 1, this list of 11 countries, as represented by their central banks, comprised the group of central banks that either advocated the gold market intervention meetings in late 1979 (the US), were present in the BIS Gold Pool meetings in November and December 1979 (Switzerland, West Germany, France, Netherlands, Belgium), or that were to be consulted after the December meeting. As per the December 1979 meeting: “The meeting ended with Leutwiler saying he would approach the Canadians and Japanese to see how they felt about the idea while Zijlstra would talk to the Italians. All would then think further about it and revert in January.“ No mention of the Swedes, but, based on Sangster’s comment above, the Swedes were considered to be “very low gold holders“. As per the 12 November 1979 Gold Pool meeting, there are no meeting minutes in the public domain for the 7 January 1980 Gold Pool meeting, with the BIS Archives office claiming it did not have such minutes. When asked about minutes from a 7 January 1980 meeting, the BIS Archives deflected the question and misdirected the answer, saying only that: “The Gold Pool came to an end in 1968, so I take it that you are referring to meetings of the Gold and Foreign Exchange Committee. We do have some minutes for this meeting, but unfortunately not for the period which interests you.” However, London Times correspondent Peter Norman, in Basle that day to cover the “Basle Weekend”, did write a report on the outcome of the BIS governors’ January meeting on gold. In his article titled “Bankers Rule Out Sale of Reserves to Hold Back Rush into Gold”, dated Monday 7 January 1980 (a day on which the gold price closed at $634), Norman wrote: “Western central bank governors today ruled out any concerted sales of gold from reserves to quell the speculative rush of funds into the metal on the world’s bullion markets. The idea, which has been suggested at various times in the past few months by Herr Fritz Leutwiler, the Swiss National Bank president, foundered when it became apparent that it would receive no support from the West German Federal Bank and the Bank of France. As these central banks have the second and third largest gold reserves in the Western world, their agreement was crucial to the launching of a concerted sale.” “It appears that the gyrations of the gold markets were discussed at some length yesterday at the regular monthly meetings of central bankers here.” “Behind the decision not to introduce a concerted programme of gold sales lies a hope that the speculative fever of the past few days will burn itself out and that the price will fall sharply of its own accord to administer a salutary shock to speculators. There is also the sober consideration that nobody knows how much gold would need to be dumped on the market to achieve the desired result.“ Norman only refers to ‘sales of gold’ and not a Gold ‘Pool’ since knowledge of the Gold Pool discussions was not in the public domain at that time. The reference in the London Times’ January 1980 report to the West German and French central bankers still being against the launch of a gold intervention operation gels with the view attributed to the Bundesbank and Banque de France during the December 1979 BIS meeting. The G5 Gold Meeting – WashingtonHowever, this did not stop further discussions on gold market intervention, since exactly one week later on Monday 14 January in Washington DC, the deputy finance ministers of the G5 convened a secret meeting to also discuss a plan for joint central bank gold sales. In the 1970s, the G5 (Group of 5) referred to the world’s then five largest economies i.e. US, UK, Japan, West Germany and France. This meeting was covered by a New York Times report, titled “Concerted Gold Sales Discussed” and filed in Washington DC on Wednesday 16 January 1980, a day on which the PM Gold Price closed at $760: “The possibility of concerted sales of gold by central banks from the leading industrial nations was discussed at a secret meeting in Washington last Monday by deputy finance ministers from the United States, West Germany, France, Britain and Japan. The United States Treasury, confirming reports of the meeting that have just leaked out, said discussions were not confined to gold, and that discussions covers a ‘ wide range’ of international monetary issues. European sources reported that there was as yet no consensus on the gold sales, with France and Germany opposed and the United States, Britain and Japan in favour, but with varying degrees of enthusiasm.” As per the London Times report on 7 January, the New York Times report of 16 January referred to sales of gold but not to the secretive Gold Pool discussions. The New York Times also recorded the West Germans and French as being non-cooperative about joint gold market intervention. On Thursday 17 January 1980, the London Times, in an article titled “Gold at $755 after biggest jump ever” also commented on the secret Washington DC meeting, which it said was “chaired by Anthony Solomon, Under-Secretary of the United States Treasury for Monetary Affairs“, and that “apparently there was general agreement at the meeting that political factors were totally dominating the gold markets and that there was little point in any central bank selling gold.” |

Gold Price, November 1979 - October 1980(see more posts on gold price, ) |

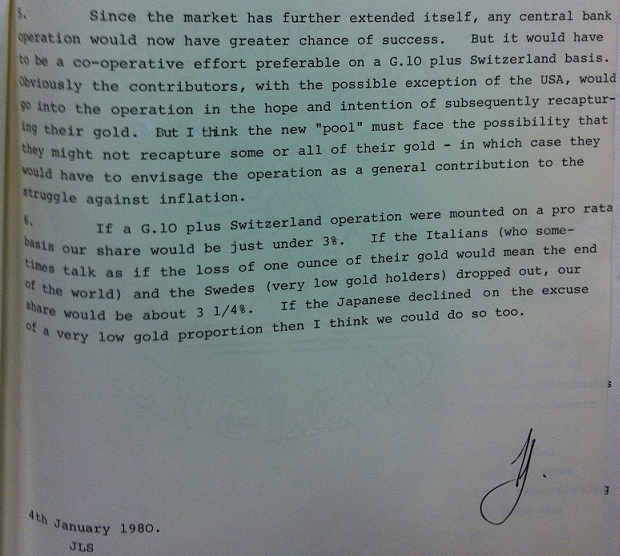

Sangster’s G5 Gold BriefsThe day after this Times report, on Friday 18 January, when the gold price closed in London at $835 per ounce, John Sangster at the Bank of England sent a confidential memorandum to Kit McMahon and to the attention of the Governor Gordon Richardson, commenting on the “G5 gold briefs“, i.e. the G5 gold discussions in Washington DC between the US, UK, France, West Germany and Japan. Sangster’s memo was as follows: The ‘international tension’ referred to in Sangster’s note above most likely refers to the Soviet invasion of Afghanistan in December 1979 and the Iranian hostage crisis that began in November 1979. While John Sangster’s ‘glosses on the G5 gold briefs‘ memo from 18 January 1980 may have given the impression that gold market intervention was off the cards for the time being, no one told this to Fritz Leutwiler, chairman of the Swiss National Bank, because less than 2 weeks later, Leutwiler was again stirring for “central bank intervention in the gold market”. SNB’s LeutwilerAccording to Peter Norman in an article for the Times titled “Swiss call for banks to dampen gold price”, dated 31 January 1980 , a day on which the US dollar gold price closed at $653: “Dr Fritz Leutwiler, president of the Swiss National Bank, has once again advocated central bank intervention in the gold market to curb wild price movements. In today’s issue of Handelsblatt, the West German business daily, Dr Leutwiler was quoted as saying that central banks should exercise control over the gold price to dampen down inflationary expectations and prevent speculation on the gold market from spreading on to foreign exchange markets.” “What has provoked Dr Leutwiler to raise the issue of central bank intervention in gold at this time remains a mystery. Neither he nor his spokesman were available for comment in Zurich today.“ “He has suggested central bank intervention in the gold market before, at the meeting of the International Monetary Fund in Belgrade last autumn and again to foreign journalists in Geneva last December. However, at the meeting of central bank governors in Basle last month [December 1979], the issue was quickly disposed of once it became apparent that neither the French nor West German central banks would support the idea.” Note that after working for the London Times, Peter Norman subsequently moved to the Financial Times in 1988 and was the FT’s economic editor from 1992 to 1995, as well as later becoming the FT’s chief EU correspondent. Norman’s profile can be read here. After gold in US dollars hit a peak of $850 in January 1980, the price came off but still ended January 1980 at over $700 per ounce. By the end of February 1980, the US dollar gold price was trading in the $640 range, and by March and April 1980 it was trading in the $500 range, as the Paul Volcker led US Fed’s interest rate hikes began to take effect. But by the end of June 1980, the gold price was again above $600 per ounce, and in late September 1980 gold was trading above $700 per ounce. |

|

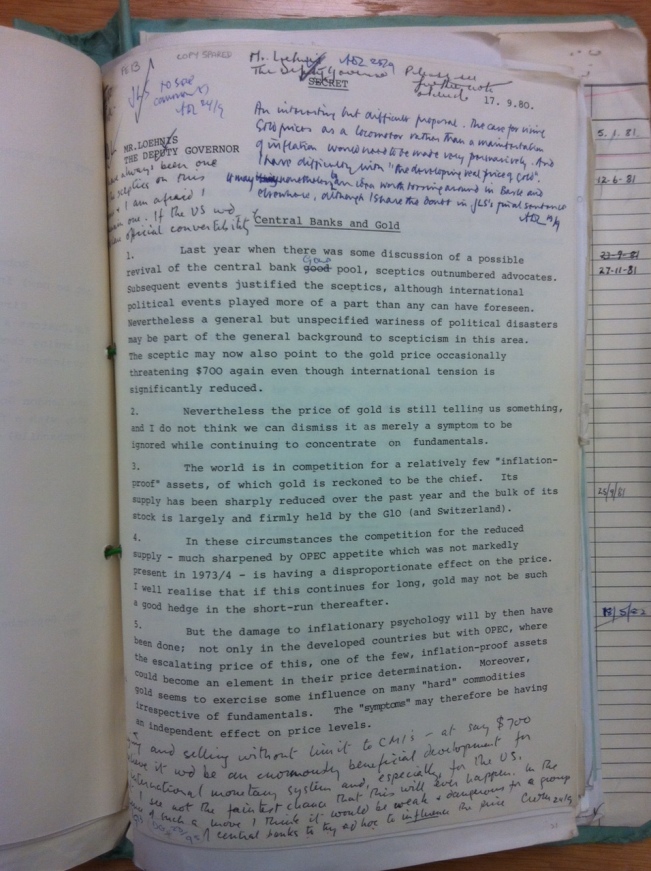

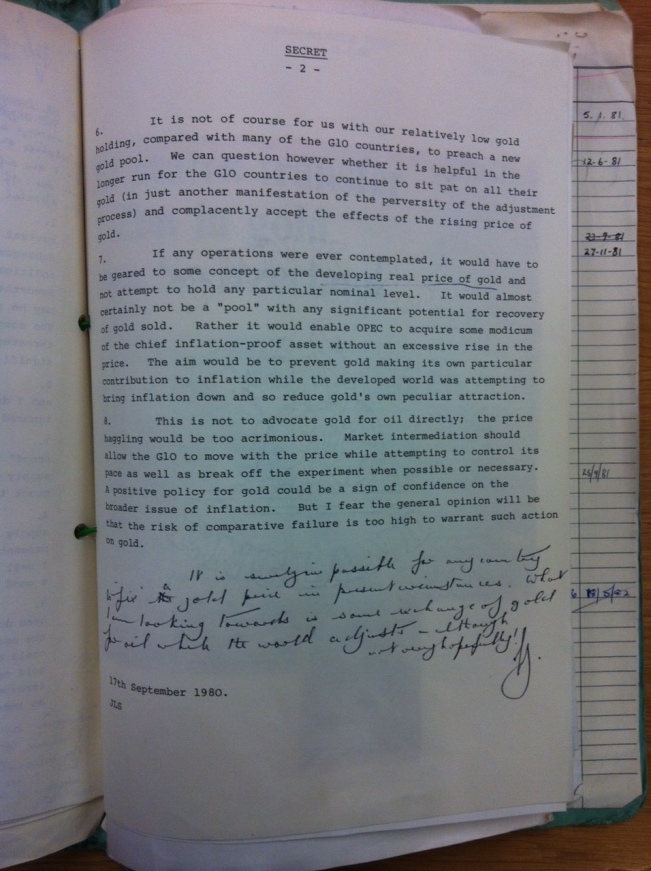

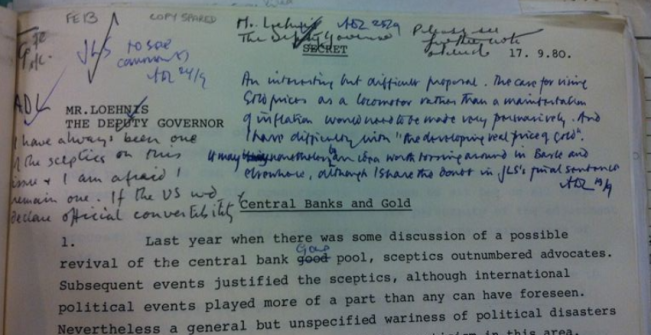

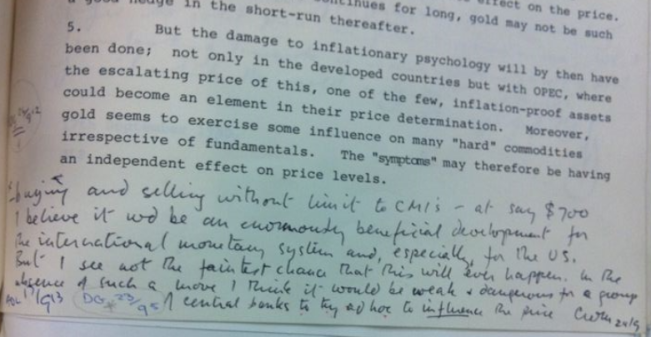

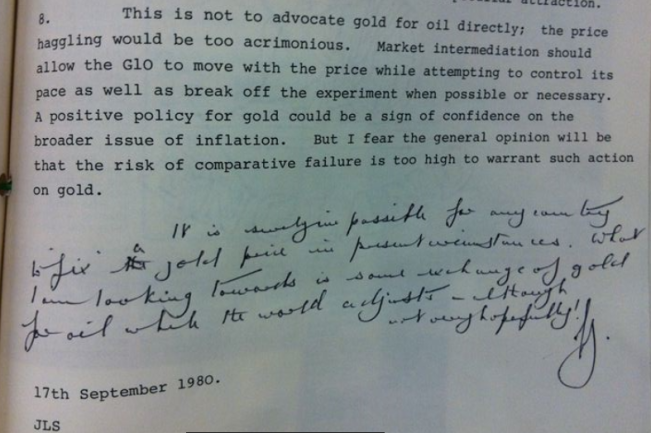

Exchange of Gold for Oil while the World AdjustsIn September 1980, the Bank of England Governors (the Governor and Deputy Governor) and senior executives again went on record addressing the gold price and possible coordinated central bank interventions into the gold market. The following detailed commentary document was written by the Bank of England’s John Sangster (JLS) on Wednesday 17th September 1980, a day on which the US dollar gold price closed at $673. Although JLS addressed the September 1980 memorandum to “The Deputy Governor” and to “Anthony Loehnis”, it was also sent to the Governor, Gordon Richardson, because Richardson, along with McMahon and Loehnis, all replied to the memorandum by writing signed notes in pen on the actual circulated document, as was the convention at the time. In the document, “Mr Loehnis” refers to Anthony Loehnis. At that time in 1980, Loehnis was an Associate Director of the Bank of England. In 1981, he became an executive director of the Bank responsible for overseas affairs. Loehnis had previous worked for the Bank of England Governor Richardson from 1977 to 1979, and Richardson had actually brought Loehnis into the Bank of England from J henry Schroder Wagg & Co, where Richardson had been chairman. Loehnis moved to SG Warburg in 1989. Loehnis’ full name was Anthony David Loehnis and hence he signed his internal Bank of England memos and correspondence with the initials ‘ADL’. See profile of Loehnis here. The actual memorandum from John Sangster (JLS) to McMahon and Loehnis (and Richardson) can be seen here: Page 1 and Page 2. The links may take a little while to load first time. Since this is an extremely important document, it can also be viewed below: |

|

There are a number of intriguing aspects to Sangster’s Bank of England document, namely that:

There are 3 hand-written notes on the document. The first note at the top of page 1 in blue pen was written by Anthony Loehnis. The second note which starts at the top left of page 1 and continues at the bottom of page 1 in black pen was written by the Deputy Governor Kit McMahon. The 3rd note at the bottom of page 2 in black pen was written by the Governor Gordon Richardson. |

|

Again, there were some intriguing comments in the these hand-written notes.

In the Bank of England Archives, there do not seem to be any relevant files relating to Gold Pool discussions or gold market intervention after the year 1980. Likewise, BIS Archives claim not to have any material whatsoever about the 1979-1980 BIS Gold Pool discussions, despite the fact that there are numerous files in the Bank of England archives proving that these discussions took place. We therefore need to look at relevant material from other sources covering the period after 1980. |

|

Zjilstra’s Per Jacobsson lecture – September 1981Just over 1 year after John Sangster had written his document dated 17 September 1980 to Kit McMahon, Anthony Loehnis, and Gordon Richardson, in which he envisioned a scheme that would “enable OPEC to acquire some modicum” of gold “without an excessive rise in the price”, the BIS President Jelle Zijlstra was again proposing joint action to control the gold price. On Sunday, 27 September 1981 in Washington DC, Zjilstra gave the main speech at the IMF’s annual “Per Jacobsson Lecture”. Zijlstra was chosen to give this speech to mark the fact that he was scheduled to retire at the end of 1981 from his role as President and Chairman of the BIS and as President of the Dutch central bank, De Nederlandsche Bank (DNB). Note that Fritz Leutwiler of the Swiss National Bank (SNB) became BIS President and Chairman from January 1982 onwards, while Wim Duisenberg became President of the Dutch central bank in January 1982. In his “Per Jacobsson Lecture” which was titled “Central Banking with the Benefit of Hindsight”, and which was given while the gold price had last traded that week at $450 per ounce, Zijlstra candidly told his Washington DC audience of fellow central bankers that: “I feel that it is necessary for us, within the Group of Ten and Switzerland, to consider ways to regulate the price of gold, admittedly within fairly broad limits, so as to create conditions permitting gold sales and purchases between central banks as an instrument for a more rational management and deployment of their reserves. On the occasion of the annual meeting of the IMF in 1979 this was brought up, but regrettably, insufficient agreement could be reached to make even a modest start with regulating the gold price in the free market. It is my firm conviction that relatively small-scale interventions, though not forestalling the subsequent explosion of the gold price, would at least have reduced it to more manageable proportions. Now that the turbulent emotions seem to have quietened down, we would be wise to reflect anew and without prejudice on these subjects.” |

|

These quite extraordinary statements from Zjilstra while still BIS President illustrate that the desire of the BIS head to intervene in the gold market had not dwindled between early 1980 and the end of 1981. In fact, Zjilstra seemed to be indicating that the lower volatility in the gold price towards the end of 1981 provided a perfect opportunity to revisit the discussions with more chance of success in controlling the gold price.

This view of Zjilstra’s resonates with John Sangster’s comment in his 18 January 1980 report about the G5 Gold Briefs in which Sangster said: “If tension eased substantially, however, central bank action need not then be unnecessary. With greater chance of success, it could be helpful in further cooling the inflationary environment.” Given that Fritz Leutwiler of the Swiss national Bank took over the reigns as BIS President in January 1982, and given that Leutwiler was arguably the most prominent of all the BIS governors as an advocate of a new BIS Gold Pool (see above and Part 1), then it would not be surprising if, under Leutwiler’s stewardship, the BIS inner club of Governor’s recommenced discussions of a BIS Gold Pool during the 1982 – 1983 timeframe. First, there is the Meeting on the Gold Pool – 1983During that time, Gordon Richardson was still Bank of England Governor, Karl Otto Pohl was still Bundesbank President, Fritz Leutwiler was still Swiss National Bank Chairman, and Paul Volcker was still Chairman of the US Federal Reserve. So, is there any evidence of a Gold Pool mentioned during this timeframe? Fascinatingly, there is: “Over A bratwurst-and-beer lunch on the top floor of the Bundesbank, Karl Otto Pohl, its president and a ranking governor of the BIS, complained to me in 1983 about the repetitiousness of the meetings during the “Basel weekend.” “First, there is the meeting on the Gold Pool, then, after lunch, the same faces show up at the G-10, and the next day there is the board which excludes the U.S., Japan, and Canada, and the European Community meeting which excludes Sweden and Switzerland.” Edward Jay Epstein, “The Money Club” – An Essay, HARPER’S November 1983 In 1983, investigative journalist Edward Jay Epstein was given privileged access to the Bank for International Settlements and some of its inner sanctum central bank governors while he was writing an article on the BIS (“The Money Club”) for US magazine Harper’s. In his Money Club article, Epstein writes: |

|

|

“Artfully concealed within the shell of an international bank, like a series of Chinese boxes one inside another, are the real groups and services the central bankers need-and pay to support. The first box inside the bank is the board of directors, drawn from the eight European central banks (England, Switzerland, Germany, Italy, France, Belgium, Sweden, and the Netherlands), which meets on the Tuesday morning of each “Basel weekend.“ To deal with the world at large, there is another Chinese box called the Group of Ten, or simply the “G-10.” It actually has eleven full-time members, representing the eight European central banks, the U.S. Fed, the Bank of Canada, and the Bank of Japan. It also has one unofficial member: the governor of the Saudi Arabian Monetary Authority. “This powerful group, which controls most of the transferable money in the world, meets for long sessions on the Monday afternoon of the “Basel weekend.” [Karl Otto Pohl] concluded: “They are long and strenuous-and they are not where the real business gets done.” This occurs, as Pohl explained over our leisurely lunch, at still another level of the BIS: “a sort of inner club.“ Bundesbank President Karl Otto Pohl is clearly on record in 1983 as stating that “First, there is the meeting on the Gold Pool“ during the “Basle weekend“. But the only publically known gold pool was the London Gold Pool which operated from November 1961 to March 1968. Epstein interviewed the Bundesbank’s President Karl Otto Pohl in 1983, more than 15 years after the London Gold Pool had collapsed. Pohl only joined the Bundesbank in 1977, and he would not, in 1983, have used the term ‘Gold Pool’ for a meeting that had not discussed a gold pool since 1968, i.e. 15 years earlier. So what does this term ‘Gold Pool’ refer to? Often Outnumbered, never OutgunnedIn 2012, German investigative journalist Lars Schall asked this very question to the Bank for International Settlements. Schall asked: “What is the ‘gold pool’ cited by BIS board member and Bundesbank President Karl Otto Pohl in his interview with the financial journalist Edward Jay Epstein published in the November 1983 edition of Harper’s magazine?” The BIS initially responded to Schall with a classic ‘deflection and avoid answering the question’ response. The BIS wrote: “Many thanks for your phone call and e-mail enquiry… A detailed history of the Gold Pool, which operated between 1961 and 1968, can be found in Toniolo, Gianni (2005), ‚Central Bank Cooperation at the Bank for International Settlements,‘ Cambridge: Cambridge University Press, pp. 375-81 and 410-23. This book should be available from most academic libraries covering finance and economics.” Schall responded: “Thank you for your response. However, it seems that you have not answered my question as to the ‘gold pool‘ that Mr. Pohl cited in his interview with Edward Jay Epstein. That interview took place many years after the London Gold Pool disbanded and it must have been the BIS‘ own gold pool. Therefore, once again: what is the ‘gold pool‘ that Mr. Pohl was talking about in 1983?” |

Gold Chart, July 1979 - December 1985 |

The BIS then replied again as follows: “After further in-house research the following can be said about references to the’‚Gold Pool’: The ‘Gold Pool‘ Mr Pohl referred to in the 1983 interview is clearly a bit of a misnomer. The (London) ‘Gold Pool‘ as such – i.e. as a mechanism to intervene actively in the gold market by buying and selling gold on behalf of the central banks – operated only between 1961 and 1968. Out of the regular meetings of central bank gold and foreign exchange experts organized at the BIS between 1961 and 1968 to discuss the operations of the London Gold Pool grew the so-called G10 Group of Gold and Foreign Exchange Experts, which continued their regular meetings at the BIS after the London Gold Pool had been abandoned. But for quite some time after 1968 this group was still being referred to by some as the ‘Gold Pool’, although it didn’t have the operational role the London Gold Pool had. This forum still exists today — it was re-named the Markets Committee in 1999. Thus, it should be clear that after 1968 the mandate of this Gold and Foreign Exchange Committee was no longer to discuss and agree on direct interventions on the gold market, but simply to monitor and discuss developments on the financial markets generally. This is the ‘Gold Pool‘ Mr Pohl refers to in his 1983 interview. Frankly, this BIS response is risible and fabricated since Karl Otto Pohl only joined the Bundesbank in 1977 and had no dealings whatsoever with the 1960s gold pool so would never have referred to a meeting which had nothing to do with a gold pool as “the meeting on the Gold Pool“. Many Modicums of Gold for the SaudisTherefore, what sort of Gold Pool would the early 1980s gold Pool have been? Bank of England Governor, Gordon Richardson, a member of the BIS inner club of governors, was calling for “some exchange of gold for oil while the world adjusts”. Bank of England gold and foreign exchange specialist John Sangster recommended a pool that would not have significant potential for recovery of gold sold, but that “would enable OPEC to acquire some modicum” of gold “without an excessive rise in the price.” It would involve “market intermediation” which would “allow the G10 to move with the price while attempting to control its pace.” OPEC was “increasingly concerned that gold is outpacing oil”, and while Al Quraishi, Governor of the Saudi Arabian Monetary Authority (SAMA) said that the Saudi’s “would not rock the boat” and buy gold on the open market if a new gold pool was selling, the Saudi’s still wanted to“diversify” into gold. Incoming BIS President, Fritz Leutwiler “advocated central bank intervention in the gold market“. Outgoing BIS President Jelle Zjilstra wanted the G10 and Switzerland to “consider ways to regulate the price of gold, so as to create conditions permitting gold sales and purchases between central banks.“ |

|

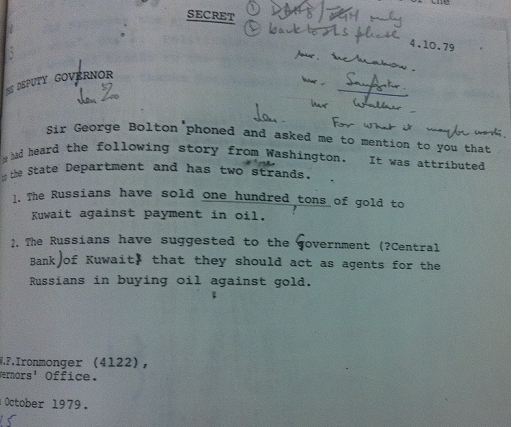

Soviet – Kuwait Gold for Oil DealsGold for Oil sales were not just in the realm of theory even in 1979. They were fact. On 4 October 1979, the Governor’s office at the Bank of England wrote the following Secret briefing to the Bank of England Deputy Governor about Russian gold being exchange for Kuwaiti oil:

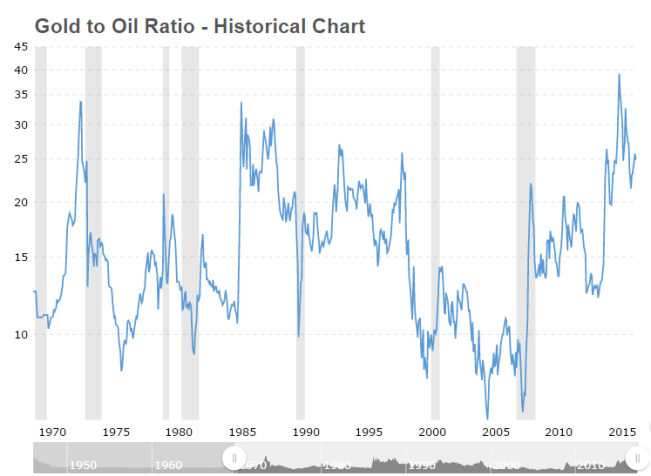

Handwritten 1 DAHB / JGH only. 2 back to JLS please. Handwritten “Mr McMahon, Mr Sangster, Mr Walker” “for what it may be worth”. The day before this Secret memo was written, the New York Times reported from the IMF conference in Belgrade on 3 October 1979 in an article titled “Saudis Hint Oil Output May Drop – Dollar’s Eroding Value Cited at IMF Meeting” that: “Saudi Arabia’s finance minister told a forum of international monetary officials and private bankers today that his country was considering new cutbacks in oil production because of the eroding value of the dollar.” “It would be naive to pretend that a continuous erosion of our financial resources, through inflation and exchange depreciation, could not evoke reactions,” Sheik Abalkhail said. “We have done this to maintain more orderly conditions in the oil market and to promote a higher level of sustained growth of the world economy. We are finding it increasingly difficult to continue our policies under prevailing instabilities in exchange markets, coupled with high levels of inflation in industrial countries.” On 4 October 1979, the New York Times again reported from the IMF conference in Belgrade in an article titled “Historical Linkage Cited For Gold and Oil Values” that: “South Africa’s finance minister suggested today that there was a rough historical relationship between oil and gold prices.” “Of the relationship between gold and oil, [Oren] Horwood declined to provide any explanation, saying ‘I simply note the fact’. The reaction of bankers here was that the relationship showed a constancy of real values against the background of gyrations in currencies.” “Mr Horwood said that, as tracked over the last half-century, the price of gold per ounce was generally 15 times greater than the price of oil per barrel.” Prior to the 1970s, the gold oil ratio was more static than the gold oil ratio since the 1970s for the simply fact that the gold price was fixed for a large period of time prior to the 1970s. However, the Gold to Oil ratio since 1970 has moved in a range of about 10 to 35, with a lengthy period during the 2000s when the ratio dipped below 10. Conclusion – The BIS, Where Noone Can SeeTo me, the evidence suggests that a Gold Pool did evolve at the BIS in the early 1980s but that it has been extremely well hidden. If it did evolve, was its intent to control the gold price so that Saudi & Co could acquire gold on the open market without driving up the gold price, or was it a dual purpose operation of Western central banks to quell inflationary signals, while in the background transferring a portion of their substantial gold holdings to Saudi & Co in secretive BIS administered transactions? And did it fix the gold / oil ratio or attempt to target a range, while allowing the dollar price of gold and oil to seemingly fluctuate randomly? And where was the gold that was being provided to Saudi & Co coming from, central bank sales from the large western central bank gold holders? The Bank of England’s Sangster said he did not want to“advocate gold for oil directly” but was advocating that OPEC “acquire some modicum” of gold “without an excessive rise in the price.” And Bank of England Governor Gordon Richardson was “looking towards some exchange of gold for oil while the world adjusts“. Remembering that given that the Governor of the Saudi Arabian Monetary Authority (SAMA) was an unofficial member of the G10 at the BIS, then it is not implausible that the Saudis got what they wanted i.e. a chance to acquire real money in the form of gold in return for continuing to supply oil to the advanced Western economies. Anyone familiar with the writings of “Another” on the USAGold website which appeared starting in October 1997 will recognise that this is exactly what “Another” said happened at the BIS, i.e. that the BIS fixed the gold/oil ratio so as to allow the Saudis to acquire gold even as they were receiving US dollars in payment for their oil exports. In other words, that one leg of the BIS transactions took the form of behind the scenes gold transfers that flowed to Saudi & Co as subsidised payments for oil, thereby allowing the Saudis to receive payment in the ultimate money of gold in addition to fiat US dollars, while the other leg of the transactions allowed oil to continue to flow to the West. And lastly, that these arrangements, by also targeting the gold price, kept gold at an artificially low level which prevented gold fulfilling its traditional role of inflationary baramoter. Anyone who reads ‘Another’ will see intriguing sentences such as follows, which just so happen to resonate with what BIS discussions and Bank of England documents were alluding to:

|

Gold To Oil Ratio, 1970 - 2015 |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank for International Settlements,Bank of England,Bank of international Settlements,gold market,gold price,gold price manipulation,International Monetary Fund,newslettersent,Paul Volcker,Uncategorized