Overview

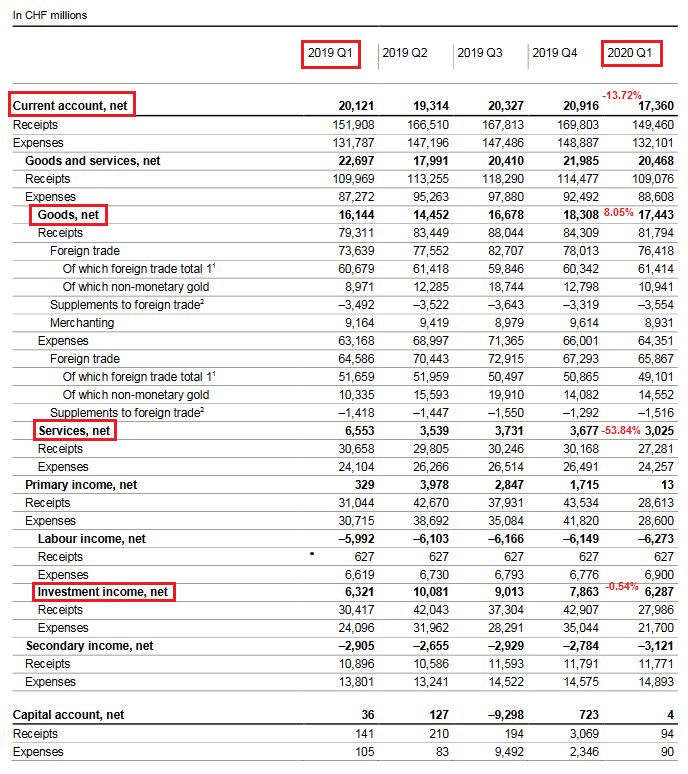

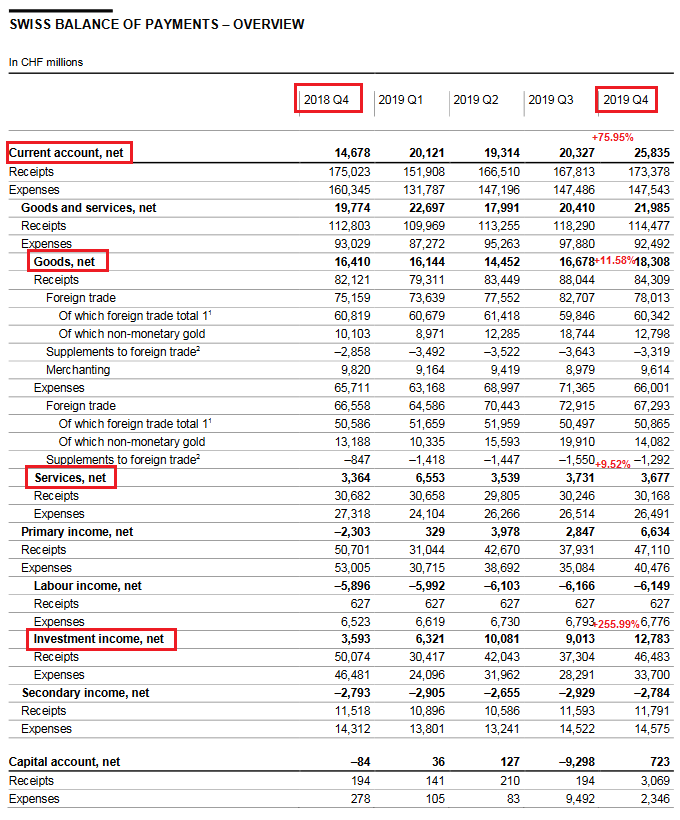

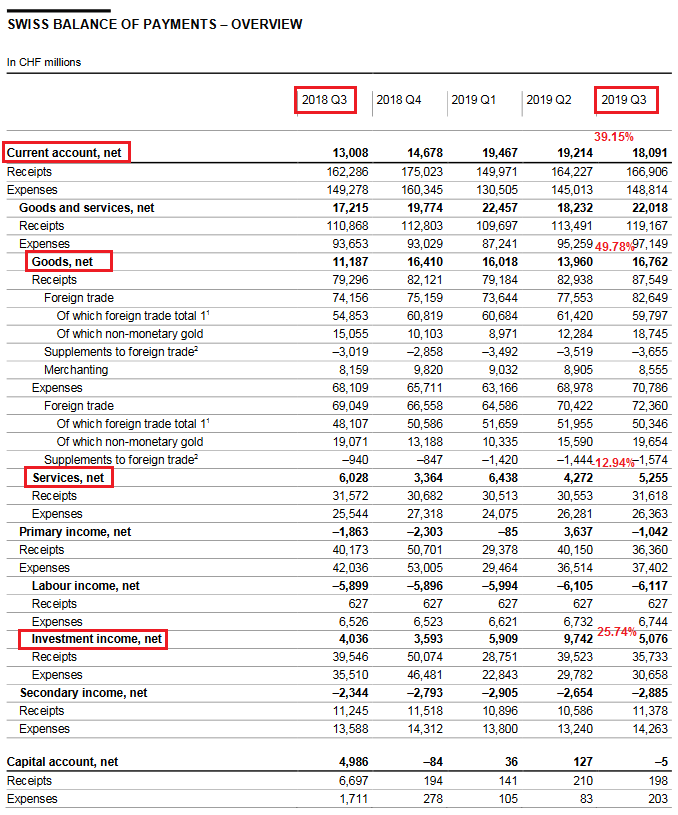

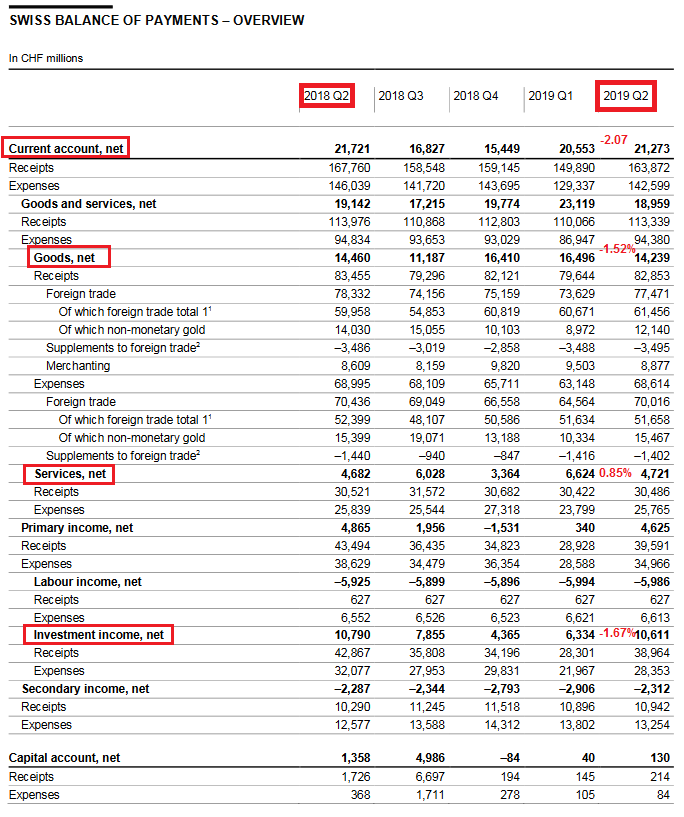

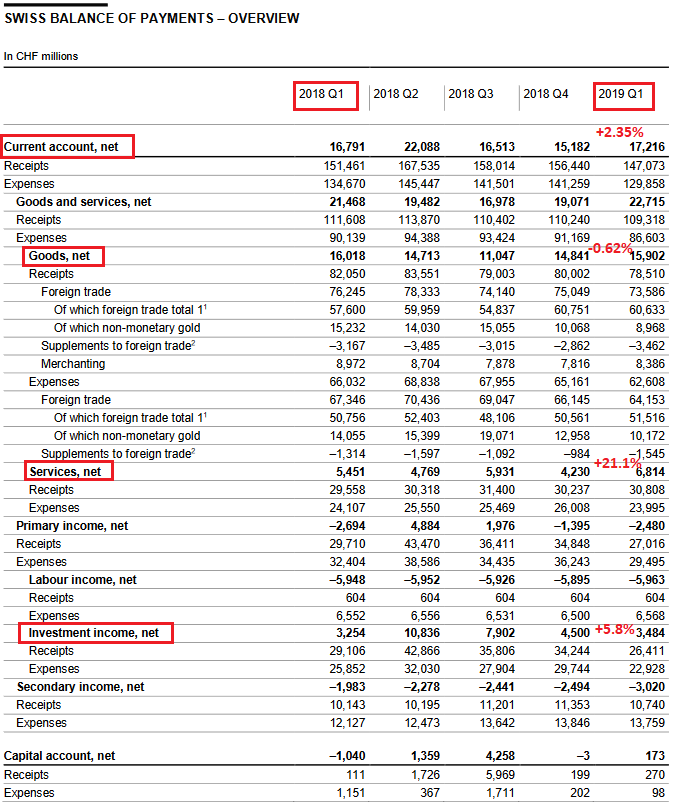

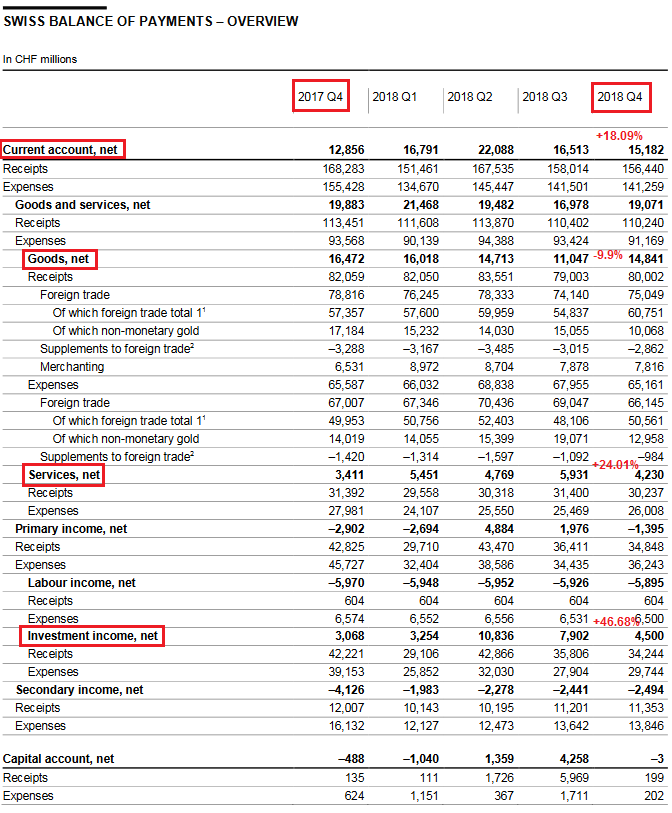

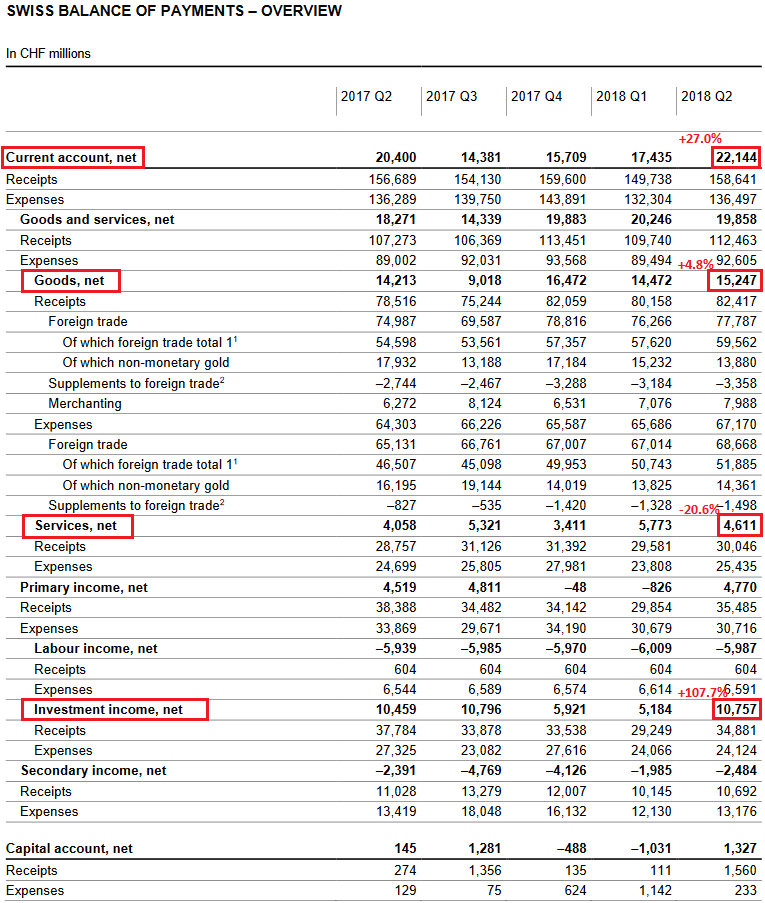

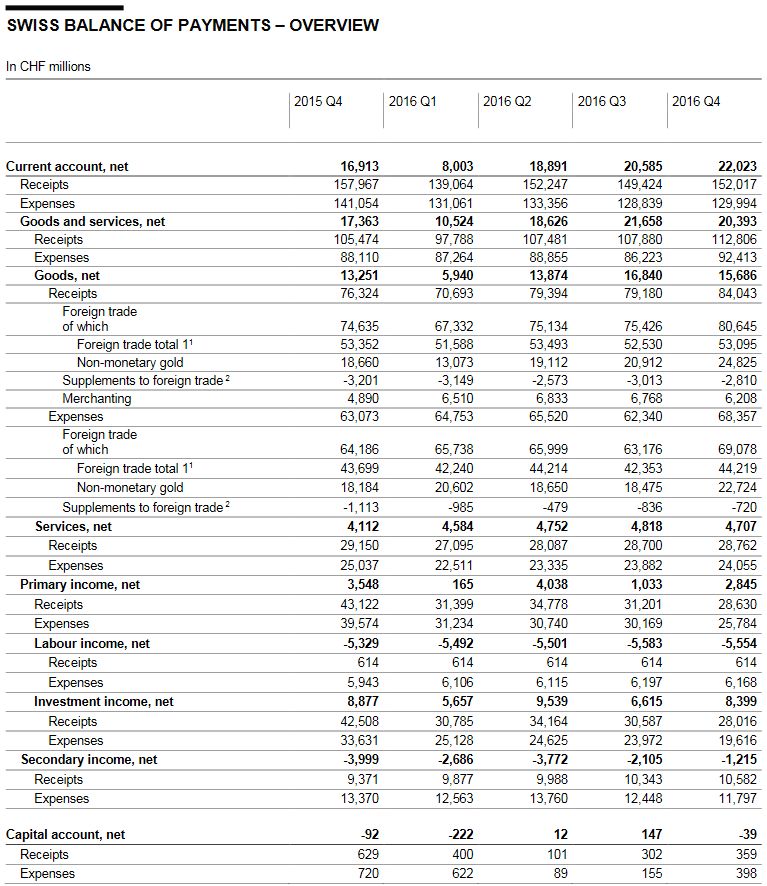

Switzerland extended its current account and trade surplus in Q4/2016 by 22%, helped by strong interventions by the Swiss National Bank.

| Q4/2016 | Change vs. Q4/2015 |

Change in % |

|

| Current Account | +22 bn | +5 bn. | +22.7% |

| of which Goods Trade net | +16 bn. | +2 bn. | +12.5% |

| of which Services Trade net | +4.7 bn. | +4.1 bn | +12.7% |

| of which Investment Income net | +8.3 bn. | +8.9 bn. | -7.2% |

| Financial Account | +18 bn. | +10.3 bn. | +43% |

| of which Direct Investments net | +9.9 bn. | +28 bn. | +282% |

| of which Portfolio Investments net | +10.1 bn | +5.2 bn | +104% |

| of which Reserve Assets (SNB interventions) |

+21 | +11.4 bn. | +54% |

On the assets side, the financial account recorded a net acquisition of CHF 18 billion (Q4 2015: net acquisition of CHF 60 billion). The increase was mainly attributable to reserve assets. On the liabilities side, there was a net incurrence totalling CHF 1 billion (Q4 2015: net incurrence of CHF 49 billion). Other investment posted a net incurrence, while direct investment and portfolio investment recorded a net reduction. With the inclusion of derivatives, the financial account balance was positive at CHF 20 billion.In the international investment position, stocks of assets increased by CHF 83 billion to CHF 4,482 billion in the fourth quarter of 2016. This increase was attributable both to transactions reported in the financial account and, in particular, to exchange rate gains on assets denominated in US dollars. Stocks of foreign liabilities were up CHF 49 billion to CHF 3,628 billion as a result of exchange rate effects and statistical changes. The net international investment position advanced by CHF 34 billion to CHF 854 billion.Review of the Year

In 2016, the current account surplus amounted to CHF 70 billion, which was CHF 5 billion less than in 2015. The decline was largely attributable to primary income, where the receipts surplus was down by CHF 10 billion to CHF 8 billion. This was counteracted by a decrease in the expenses surplus for secondary income (current transfers), which fell by CHF 3 billion to CHF 10 billion. The receipts surplus for trade in goods rose by CHF 1 billion to CHF 52 billion, that for trade in services by CHF 1 billion to CHF 19 billion.In the financial account, the net acquisition of financial assets amounted to CHF 95 billion (2015: net acquisition of CHF 235 billion). Switzerland acquired assets especially in the form of reserve assets and direct investment. Liabilities recorded a net incurrence of CHF 18 billion (2015: net incurrence of CHF 139 billion). The net incurrence for other investment exceeded the net reduction for direct investment and portfolio investment. The financial account, including derivatives, reported a positive balance of CHF 83 billion.In the international investment position, stocks of assets increased by CHF 205 billion to CHF 4,482 billion at the end of 2016. In addition to the net acquisition of assets, capital gains resulting from exchange rate movements were decisive for the increase. Stocks of liabilities fell by CHF 35 billion to CHF 3,628 billion. This was mainly attributable to valuation losses as a result of lower share prices. Overall, the net international investment position advanced by CHF 240 billion to CHF 854 billion. A detailed presentation of the annual data will be provided in the Swiss Balance of Payments and International Investment Position 2016, to be published on 31 May 2017.

Current accountReceiptsReceipts At CHF 84 billion, receipts from total goods trade exceeded the figure for the year-back quarter by CHF 8 billion. Goods exports according to the foreign trade statistics (total 1) remained unchanged year-on-year (CHF 53 billion). Exports in the chemical and pharmaceutical industry, and of metal products, were up, while exports in the watch industry and in jewellery receded. Receipts from non-monetary gold trading increased from CHF 19 billion in the year-back quarter to CHF 25 billion. Net merchanting receipts amounted to CHF 6 billion, a CHF 1 billion increase year-on-year.

At CHF 29 billion, receipts from trade in services remained unchanged from the year-back figure. An increase was registered in transport and insurance services. By contrast, receipts from telecommunications, computer, information and business services were down.

As a result of lower income from investment abroad, particularly from direct investment, primary income (labour and investment income) decreased by CHF 14 billion to CHF 29 billion compared with their fourth quarter 2015 levels. Secondary income (current transfers) advanced by CHF 1 billion to CHF 11 billion compared with the year-earlier quarter.

ExpensesExpenses for total goods trade amounted to CHF 68 billion, a CHF 5 billion increase over the year-back quarter. According to the foreign trade statistics (total 1), goods imports increased by CHF 1 billion to CHF 44 billion year-on-year. The largest rise was recorded in chemical and pharmaceutical products and in vehicles. Expenses from non-monetary gold trading came to CHF 23 billion, compared to CHF 18 billion in the fourth quarter of 2015.

At CHF 24 billion, expenses in services imports were down by CHF 1 billion compared to the year-earlier quarter. This was primarily attributable to lower expenses for licence fees and business services. However, transport registered an increase. The other components did not change significantly from their fourth quarter 2015 levels.

As regards primary income (labour and investment income), expenses declined by CHF 14 billion to CHF 26 billion. This was primarily due to lower earnings recorded by investors abroad on their direct investment in Switzerland. Expenses on secondary income (current transfers) totalled CHF 12 billion, down by CHF 2 billion compared to the year-back quarter.

NetThe current account surplus amounted to CHF 22 billion, exceeding the year-earlier level by CHF 5 billion. This was the result of all receipts (CHF 152 billion) minus all expenses (CHF130 billion).

|

Swiss balance of payments Q4 2016(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

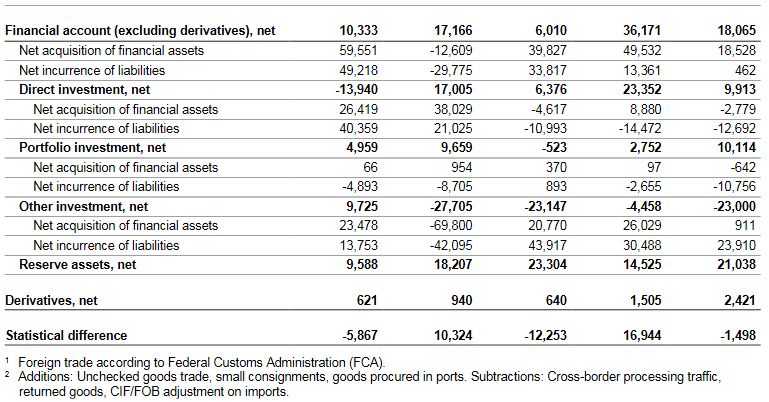

Financial accountNet acquisition of financial assetsNet acquisition of financial assets amounted to CHF 18 billion (Q4 2015: net acquisition of CHF 60 billion). The decisive factor was the net acquisition in reserve assets of CHF 21 billion (Q4 2015: net acquisition of CHF 10 billion). In the case of other investment, the net acquisition of CHF 1 billion (Q4 2015: net acquisition of CHF 24 billion) was due to the fact that the SNB increased its financial assets that do not form part of reserve assets, while commercial banks reduced their claims in interbank business. Direct investment registered a net reduction of CHF 3 billion, mainly as a result of foreign-controlled finance and holding companies domiciled in Switzerland selling participations abroad (Q4 2015: net acquisition of CHF 26 billion). Portfolio investment recorded a net reduction of CHF 1 billion, as domestic investors sold equity securities of foreign issuers. In the year-back quarter, purchases and sales under portfolio investment had been on a par.

Net incurrence of liabilitiesThe liabilities side of the financial account registered a net incurrence of almost CHF 1 billion (Q4 2015: net incurrence of CHF 49 billion). Other investment posted a net incurrence of CHF 24 billion (Q4 2015: net incurrence of CHF 14 billion), mainly because the SNB increased its liabilities abroad. By contrast, direct investment recorded a net reduction of CHF 13 billion (Q4 2015: net incurrence of CHF 40 billion). This was mainly attributable to foreign-controlled finance and holding companies, from which investors abroad withdrew equity capital associated with group reorganisations. In addition, investors abroad sold more equity securities of Swiss issuers than they purchased, resulting in a net reduction of CHF 11 billion in portfolio investment (Q4 2015: net reduction of CHF 5 billion).

NetThe net figure for the financial account was CHF 20 billion (Q4 2015: CHF 11 billion). This is calculated as the sum of all net acquisitions of assets minus the sum of all net incurrences of liabilities plus the balance from derivatives transactions. This positive financial account balance corresponds to the increase in the net international investment position resulting from cross-border transactions.

|

Switzerland Financial Account(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Extract from the Balance of Payments Q4 2016 Source: snb.ch - Click to enlarge

|

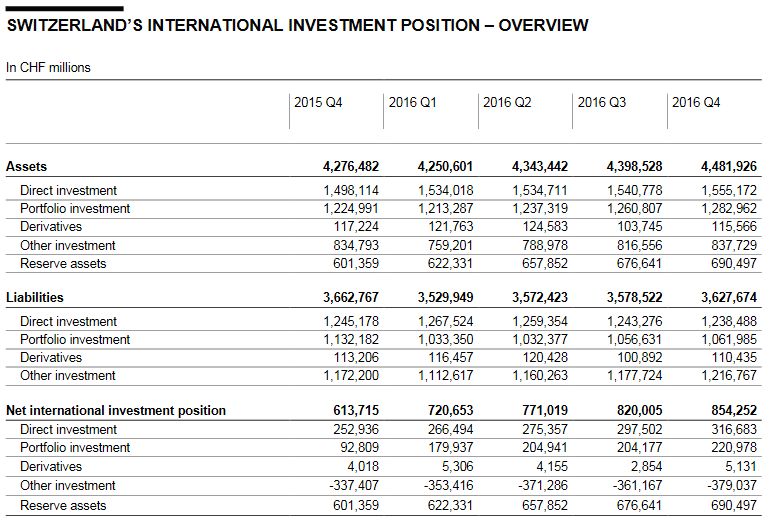

Switzerland’s international investment positionForeign assetsStocks of foreign assets climbed by CHF 83 billion to CHF 4,482 billion compared to the third quarter of 2016. This increase, which occurred in all components, was attributable both to transactions reported in the financial account and to capital gains resulting from exchange rate movements. Stocks of direct investment were up CHF 14 billion to CHF 1,555 billion. Portfolio investment grew by CHF 22 billion to CHF 1,283 billion, in particular due to exchange rate gains on securities denominated in US dollars. Other investment also increased by CHF 21 billion to CHF 838 billion. Reserve assets climbed by CHF 14 billion to CHF 690 billion, with transactions being partly offset by valuation losses on gold holdings and securities. Stocks of derivatives grew by CHF 12 billion to CHF 116 billion.

Foreign liabilitiesStocks of foreign liabilities rose by CHF 49 billion to CHF 3,628 billion compared to the previous quarter. Other investment recorded the largest increase, partly as a result of the SNB’s cross-border transactions, growing by CHF 39 billion to CHF 1,217 billion. Stocks of derivatives and portfolio investment were up as well, advancing by CHF 10 billion to CHF 110 billion and by CHF 5 billion CHF 1,062 billion respectively. By contrast, stocks of direct investment decreased by CHF 5 billion to CHF 1,239 billion.

Net international investment positionSince foreign assets expanded more markedly (CHF +83 billion) than foreign liabilities (CHF +49 billion), the net international investment position advanced by CHF 34 billion to CHF 854 billion compared to the previous quarter.

|

Switzerland International Investment Position(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Switzerland International Investment Position - Q4 2016 Source: snb.ch - Click to enlarge |

Remarks

Tags: newslettersent,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account