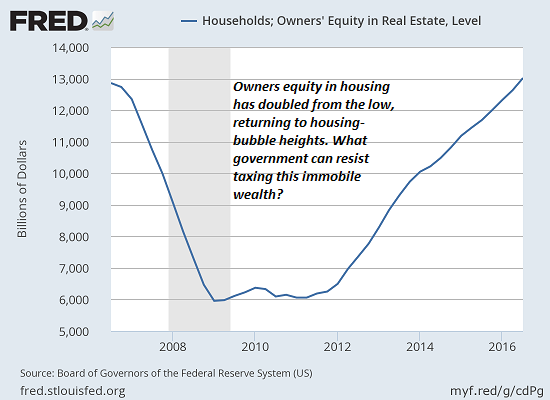

It will be the middle class that accepted the notion that “real estate is the foundation of family wealth” that will be stripmined by higher taxes on immobile assets such as real estate.

Correspondent Joel M. submitted an article that struck me as a harbinger of the future: In Greece, Property Is Debt:

“At law courts throughout Greece, people are lining up to file papers renouncing their inheritance. Not necessarily because some feckless uncle left them with a pile of debt at the end of his revels; they are turning their backs on what used to be a pillar of Greece’s economy and society: real estate.

Growing personal debt, declining incomes and ever higher taxes as Greece’s depression grinds on have turned property and the dream of easy money into dread of a catastrophic burden.

After many years in which only very valuable properties were taxed, many Greeks went from paying almost no taxes on real estate to not having enough money to pay.

In 2010, property taxes accounted for 0.26 percent of gross domestic product, while this year they are around 2 percent, according to state budget figures. ‘Suddenly, the state treated the Greeks as if they were rich, at the precise moment that they ceased to be rich.’

Among the many disruptions of the past few years, this one shows how traditional conceptions — and a sense of security — can be shattered. With a history full of wars, bankruptcies and rampant inflation, Greeks had always seen land as a haven.

But it is private debt — at 222 billion euros last year — that may prove an even greater danger. This shows in government revenues. With the unified tax, ownership of every kind of property is now subject to taxation.

It will be very difficult for the Greeks to get out from under this mountain of debt. Delinquent loans, which at the end of June made up 31.7 percent of all housing loans, were a mere 5.3 percent of the total in 2008.”

The self-reinforcing dynamics in this narrative profoundly reverse time-honored concepts of value: assets that once held or gained value now carry high costs of ownership and lose value.

1. Governments desperate for tax revenues raise property taxes, which add costs that eventually depress sales and future price appreciation.

2. High debt levels and high property taxes trigger foreclosures and forced sales that further depress the market with high inventories of unsold/unrented homes.

3. As sales decline, appreciation can no longer be counted on to enrich owners. Instead, owners fear declines in value and higher taxes. This further depresses sales.

4. High debt levels become even more burdensome as property values fall.

5. Rather than offer a means of building and protecting wealth, real estate becomes a liability that destroys wealth via payment of taxes and declines in value.

|

While it can be argued that Greece is a unique situation–a cumbersome, costly bureaucracy of land transfer coupled with soaring taxes–perhaps Greece is simply early to the party.

Governments everywhere are facing fast-rising pension and healthcare costs, and the need for more tax revenues will skyrocket once the global recession trims income, payroll, business and sales taxes.

|

Additional taxes on assets that can’t flee the country–i.e. real estate–become extremely attractive.

Once an asset class shifts from being a means of wealth preservation and appreciation to a financial risk and burden, a self-reinforcing feedback loop reduces demand and increases supply, pushing prices lower–a decline that then causes more people to sell before prices drop further.

The nightmare scenario for recent buyers is a sharp tax increase that crushes the market value of their home, putting them underwater, i.e. their mortgage is greater than the value of their home. Faced with ever-increasing property taxes and further erosion of value, what’s the advantage of holding onto the property?

Anecdotally, stories of owners destroying buildings to lower their property tax appraisal emerged in America’s Great Depression, as owners desperate to lower their property taxes destroyed their assets (buildings on the land) as the only available means of keeping their property.

Which asset class attracts new taxes will be different from nation to nation, but we can anticipate that governments will go after assets that are currently considered safe and that can’t flee to low-tax havens.

Mobile capital can flee to safer, lower tax climes, and the super-wealthy can buy legislative tax breaks on their wealth. It will be the middle class that accepted the notion that “real estate is the foundation of family wealth” that will be stripmined by higher taxes on immobile assets such as real estate.

This essay was drawn from Musings Report 45. The Musings Reports are sent exclusively to major patrons and contributors ($5/month or $50 annually) every weekend.

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the book's website.

Full story here

Are you the author?

Previous post

See more for

Next post

Tags: newslettersent