Stock MarketsEM ended last week on a somewhat firmer note, though we note divergences remain in place. For the week, ZAR and KRW performed the best while TRY and BRL were the worst. US jobs data Friday will draw some attention, though a December Fed rate hike is pretty much fully priced in. China reports November PMI readings this week, and should show continued stabilization of the world’s second largest economy. Brazil is likely to continue feeling the negative impact of rising political risk, making the COPOM decision Wednesday a bit trickier. Turkey is finding that the rate hike last week is having little effect. |

Stock Markets Emerging Markets November 28 . Source: economist.com - Click to enlarge |

ThailandThailand reports October trade and manufacturing production Monday. Exports are expected to rise 1.4% y/y and imports 2.0% y/y. Manufacturing is expected to contract -0.4% y/y. Thailand then reports November CPI Thursday, which is expected to rise 0.6% y/y vs. 0.3% in October. IsraelIsrael’s central bank meets Monday and is expected to keep rates steady at 0.10%. Recent shekel weakness will be welcomed, as policymakers are reluctant to ease monetary policy further even though CPI is running at -0.3% y/y, well below the 1-3% target range. BrazilBrazil reports October consolidated budget data Monday. The central government primary surplus was better than expected, suggesting a similar reading for the consolidated data. It also reports November IGP-M wholesale inflation and October PPI Tuesday. Brazil reports Q3 GDP Wednesday, which is expected to contract -3.2% y/y vs. -3.8% in Q2. COPOM then meets later Wednesday and is expected to cut rates 25 bp to 13.75%. However, a minority of analysts see a 50 bp cut to 13.5%. Brazil reports November trade Thursday and October IP Friday. ChileChile reports October manufacturing production and retail sales Tuesday. The former is expected to rise 1.1% y/y and the latter by 4.8% y/y. For the most part, the economy remains sluggish but falling inflation should allow the central bank to start the easing cycle next year. The next policy meeting is December 13, and rates are likely to remain on hold at 3.5%. KoreaKorea reports October IP Wednesday, which is expected at -1.5% y/y vs. -2% in September. Korea then reports November CPI Thursday, which is expected to rise 1.5% y/y vs. 1.3% in October. It also reports November trade and October current account data Thursday. The external accounts remain in very good shape, which should be won-supportive. TurkeyTurkey reports October trade Wednesday, with the deficit expected at -$4.1 bln vs. -$4.4 bln in September. Tensions with the EU, its largest trading partner, have ratcheted up as accession talks have stalled. The European Parliament voted to suspend talks with Turkey, while President Erdogan threatened to reopen its borders to allow refugees into Europe. South AfricaSouth Africa reports October trade and budget data Wednesday. Last week, SARB kept rates steady at 7.0%. S&P is expected to issue a ratings statement Friday. The agency currently rates South Africa at BBB- with negative outlook. Last Friday, Fitch moved the outlook on its BBB- rating from stable to negative. IndiaIndia reports Q3 GDP Wednesday. Growth is expected at 7.5% y/y vs. 7.1% in Q2. The economy remains robust, but the rupee has come under pressure nonetheless. While there may be some FX intervention to help limit the moves, we do not think the RBI will hike rates to support the currency. PolandPoland reports November CPI Wednesday, which is expected to be flat y/y vs. -0.2% y/y in October. If so, this would be the “highest” reading since June 2014. Since then, Poland has been experiencing deflation. ChinaChina reports official and Caixin manufacturing PMI for November Thursday. The official reading is expected to fall to 51.0 from 51.2 in October, while the Caixin PMI is expected to fall to 50.8 from 51.2 in October. The economy appears to be stabilizing in Q4. MexicoBanco de Mexico releases its minutes Thursday. At that meeting, it hiked rates 50 bp to 5.25% and left the door open to further tightening. Minutes will be scoured for clues, but we believe the major determinants going forward will be external. The next policy meeting is December 15, and the decision will largely depend on 1) the Fed and 2) the peso. If the Fed hikes December 14 and the peso remains under pressure, another 50 bp hike next month seems likely. |

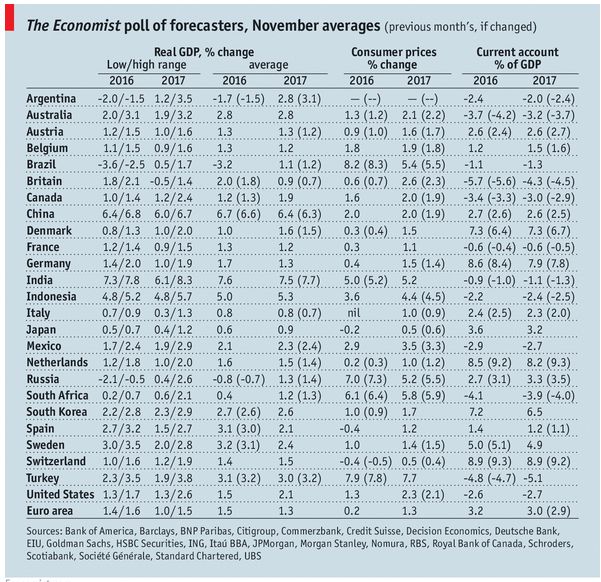

GDP, Consumer Inflation and Current Accounts The economist poll of forecasters November 2016 Source: Economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Emerging Markets,newslettersent