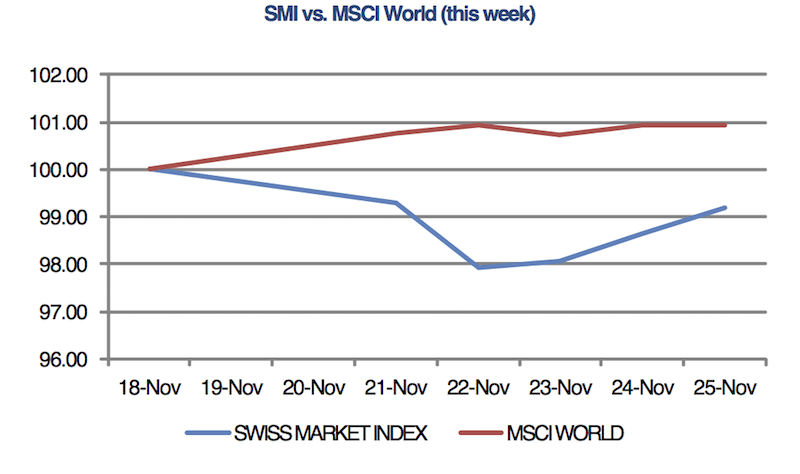

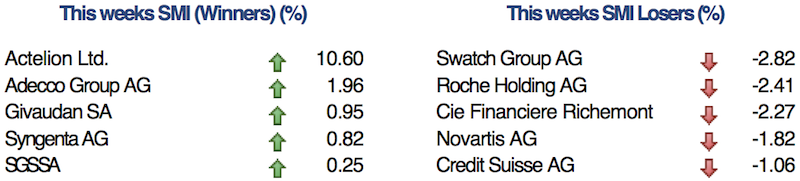

SMISwiss pharmaceutical and luxury goods giants pulled the Swiss Market Index (SMI) down again this week as investors dropped large cap firms. Global stocks however continued to rise, along with energy prices, on the promise of Trump’s reflationary administration. The US dollar headed further up, reaching decade highs. |

SMI Index, November 25 |

Economic DataBetter-than-expected economic reports from the US fueled speculation that the economy is strong enough to withstand an interest rate hike next month. The record of the last Federal Reserve Open Market Committee (FOMC) meeting showed that some Fed official’s support higher interest rates as the labour market tightens. |

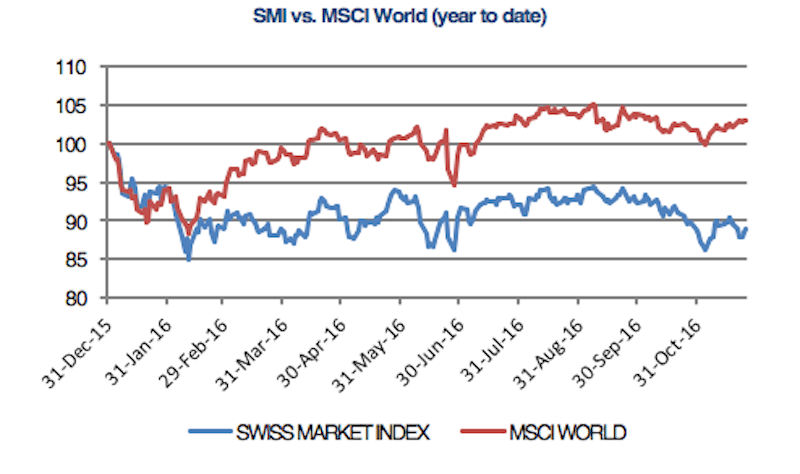

SMI vs. MSCI World(see more posts on MSCI World Index, SMI Swiss Market Index, ) |

| The odds of a December hike surged to almost 100% this week, with the probability of further moves in 2017 climbing to 66%. |

SMI vs. MSCI World Week November 25(see more posts on MSCI World Index, SMI Swiss Market Index, ) |

Swiss Economic DataIn economic news, Swiss watch exports saw their largest monthly drop in seven years in October, plunging 16% from last month as demand weakened in almost every major market for Rolex and Omega timepieces. October’s fall marks the 16th in a row and watch exports are now down 11% for the year. The longest slump in more than two decades is threatening employment in the sector. Richemont has recently announced plans to cut more than 200 positions at brands such as Vacheron Constantin. |

Swiss Bonds and FX |

Swiss CompaniesIn other company news, biotech company Actelion had a turbulent week. The share price fluctuated on rumours of a potential takeover by an Johnson & Johnson, the American pharmaceutical company. However, analysts believe that a sale is unlikely. |

Swiss Companies |

Full story here Are you the author? Previous post See more for Next post

Tags: MSCI World Index,newslettersent,SMI Swiss Market Index