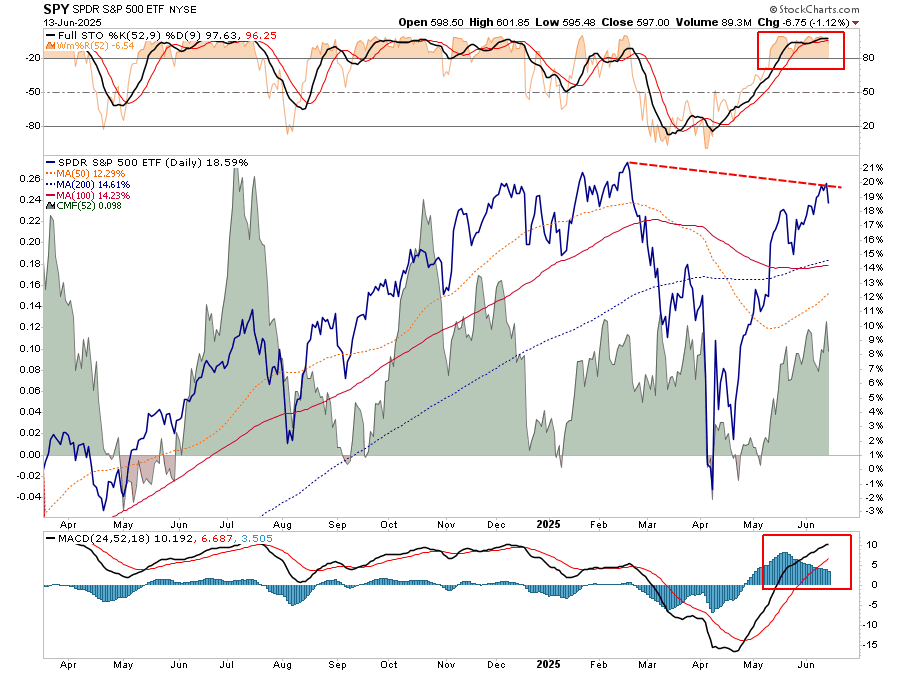

| Gold futures had their heaviest day of trading during April 2013 when a mysterious flash crash sent the precious metal collapsing with no clear fundamental/news catalyst. In June, Brexit sparked massive volume buying in the barbarous relic, but overnight, as a Trump victory became more and more of a reality, gold futures are approaching their busiest day ever. As Bloomberg notes, that’s triple the full-day average this year and U.S. trading is just getting underway. |

Gold Flash Crash |

BullionVault, an online trading service, said client activity in the three hours to 6 a.m. London time exceeded the amount traded on Tuesday. Buying outweighed selling by three-to-one, according to an e-mail from Adrian Ash, the head of research.

In a result that stunned political pundits, polling companies and financial markets, Trump was elected on pledges that included reneging on global trade deals that he says have cost American jobs. A Trump presidency could send bullion to $1,395 an ounce, according to more than 20 analysts and traders surveyed by Bloomberg before the vote. Futures were up 2.2 percent to $1,303.51 on Wednesday. |

Gold Continuous Contract |

Full story here Are you the author? Previous post See more for Next post

Tags: Business,economy,Finance,flash,Futures contract,investment,money,newslettersent,Precious Metals,Reality,Switzerland