The Rationale for Interventionism

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.”

The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative Easing (QE) packages injecting money into the economy.

The rationale for this government intervention was that it would boost spending, restore confidence in the market and reignite economic growth to everyone’s benefit – but has it succeeded in doing so? |

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative Easing (QE) packages injecting money into the economy. - Click to enlarge September 2008: a solemn-faced “rescue party” of bureaucrats and politicians (from left to right: Ben Bernanke, GW Bush, Hank Paulson and Donald Cox) announces that the village needs to be destroyed in order to save it (“normally, we’re all for free market capitalism, just not this time”).

Photo credit: Credit Larry Downing / Reuters

|

QE: Faith-Based Monetary Policy

With QE still ongoing (albeit tapered down to reinvestment of maturing debt), it is no longer part of a “rescue” package – it has now become the new normal – despite the utter lack of positive results.

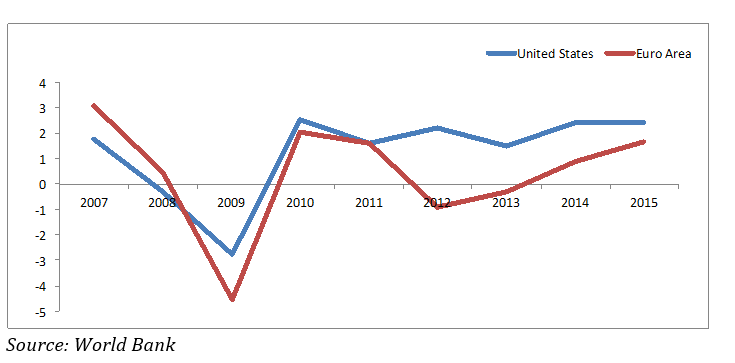

Since end-2007, the Federal Reserve’s balance sheet has expanded from about USD 890 billion to more than USD 4.5 trillion. And yet, U.S. growth rates have remained in the vicinity of just 2% since 2010 (see chart below).

It is no different in Europe. The European Central Bank (ECB), which first embarked on QE in March 2015, has raised the monthly amount for asset purchases from EUR 60 billion to EUR 80 billion, and expanded the range of assets to include corporate bonds.

Despite that, the growth outlook remains dim, with consensus expectations of 1.4% in 2016, and 1.7% in 2017 (source: Bloomberg). So why do governments continue to cling to an approach that simply doesn’t deliver? |

GDP Growth in the US and Eurozone

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative Easing (QE) packages injecting money into the economy. - Click to enlarge |

US real interest rates and GDP growth

“All present-day governments are fanatically committed to an easy money policy”, Ludwig von Mises observed in Human Action in 1949, and to this day, nothing about that seems to have changed.

Ever since governments, represented by their central banks, have monopolized the production of money, while backstopping fractionally reserved banks, the markets haven’t been free from intervention.

Monetary expansion happens all the time, not just in crises. In fact, the world has grown accustomed to this monetary policy, the new normal – and here is why:

To justify increasing liquidity, they say, “unemployment is high” or “economic growth rates are lower than expected”, and “inflation is too low”. But as we see in the chart below, the economy hasn’t really improved now, has it? |

US real interest rates and GDP growth

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative Easing (QE) packages injecting money into the economy. - Click to enlarge |

The False Promises of QE – There Are Only Few Winners

Even though Keynesians and other opponents of free market economics say there is no such thing as a “trickle-down effect”, QE is based on the very assumption that it will trickle down and spur economic growth by boosting spending.

But with low growth rates, weak currencies, and zero-to-negative interest rates, one has to wonder: who really stands to gain from this monetary policy stance?

Developed economies have been increasingly dominated by the financial sector in recent decades. Compared to the 1960s, the share of the financial sector has more than doubled from 4% to about 10% today, according to Forbes.

This can be attributed to the closing of the gold window back in 1971, when the American administration looked for an easy way to finance the welfare- warfare state.

The American citizenry was deluded into thinking that higher spending and more money printing were intended to improve the economy’s performance. In reality the government was trying to use an unbacked currency to print its way out of its debt burden.

Inflation does not affect everyone equally. Those who are wealthy and well-connected to the banking system are benefiting from inflation, because they are usually among the earliest receivers of newly-created money.

The lower one goes down the socio-economic pyramid, the more adverse the effects will be, as by the time new money gets into the hands of those less well off, it will already have lost a lot of purchasing power.

The fiat money system protects and serves only certain strata of society: the financial sector (and those connected to it), the government, various government cronies and the rich. Everyone else is impoverished by the system, and what is even worse, becomes dependent on it.

Those familiar with the system often know what to do to hedge against the risks of deterioration in the economy and the currency. But many others, such as middle class professionals and the working class, as a rule have less opportunity to diversify what wealth they have, and usually don’t have the time and opportunity to properly inform themselves about the system’s workings.

They are more likely to simply hold savings in the form of bank deposits. This fully exposes them to monetary debasement, zero or even negative interest rates, as well as bank insolvency risk. |

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative Easing (QE) packages injecting money into the economy. - Click to enlarge The fact that monetary inflation inter alia causes a kind of “reverse wealth redistribution” because newly created money doesn’t reach everyone in the economy at the same time and gradually distorts prices as it spreads from earlier to later receivers has been known since Richard Cantillon published his treatise on economics and monetary theory in the early 18th century. Of course modern-day central bankers deny that this is the case, or simply pretend that this knowledge doesn’t exist. Unfortunately that means they are either lying or ignorant – and yet, they get to make decisions that affect us all.

Image via Wikimedia Commons

|

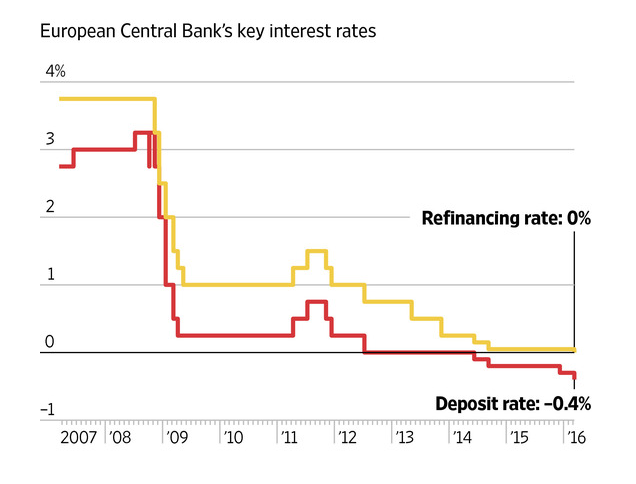

An Idea Boomerangs

Negative interest rates imposed by central banks are supposed to encourage lending and stimulate spending. But because commercial banks are now required to pay for keeping reserves at the central bank’s deposit facility, they are charging customers for current accounts, are lowering the interest they pay on savings to next to nothing, and often even refuse to open accounts for lower income clients these days.

Ultimately this will discourage depositors with limited means from keeping money at banks altogether and increase the number of the so-called “unbanked” – people who have no banking facilities whatsoever at their disposal. In the U.S. this currently applies to about 7% of all households (approximately 25 million people).

And what if banks actually don’t pass on negative rates on the deposit side? Ironically, they will then end up charging more on loans, by introducing higher fees (even on credit cards), or interest rate floors on variable rate loans, as has already happened at German banks.

The idea that imposing this policy would make loans cheaper has completely boomeranged and actually created the opposite effect. |

European Central Bank

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative Easing (QE) packages injecting money into the economy. - Click to enlarge The ECB’s main refinancing rate and deposit facility rate: stuck at 0% and -0.4% since March of 2016. The treatment seems to be killing the patient.

|

Penalizing Saving and Encouraging Reckless Spending

This flawed system penalizes saving and encourages reckless spending. Although we are all stuck in the same environment of negative interest rates and monetary debasement, it is particularly the lower strata of society that are destined to lose from this state of affairs.

Discouraged from saving by zero or negative rates, they tend to end up spending more than they would have otherwise and often even begin to accumulate debt in order to keep up with increasing prices.

And then there is the handful of winners, who know how to take advantage of the system and are actually thriving in it. All of this is ultimately made possible by a government monopoly on money production.

Should one assume that social equality would be ensured in a free market environment without government intervention? There is no such guarantee, and such a utopian promise has never been made by supporters of a free society.

However, as my friend Philipp Bagus pointed out in a recent interview, there is a difference between inequality in a free society and inequality imposed by bureaucratic activism and there is certainly a moral dimension to consider:

“We should distinguish between morally justified and unjustified inequality. When someone gets rich because he is productive and satisfies the wishes of people in a cheaper and better way than his competitors, we should applaud him. The resulting income inequality is justified.

The problem starts if someone earns an income due to government intervention such as licenses, other regulations, or simply tax transfers. The resulting income inequality is unjustified. Getting richer at the expense of others through the use of the fiat monetary system, which represents a government monopoly and banking privileges, is unjust.”

|

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative Easing (QE) packages injecting money into the economy. - Click to enlarge |

Conclusion: Delaying the Inevitable Only Makes it Worse

The truth is that government officials have failed to solve the economy’s problems. They have merely delayed the downfall and have poisoned the investment environment in the process.

Had they really wished to address the root causes, they would have allowed the bubble to deflate and the bust to proceed. Yes, it would have been a harsh experience.

Possibly Bush and other officials at the time wanted to spare the citizenry from having to endure a great deal of short term misery, but obviously, the economy has not exactly flourished since then.

In fact, loose monetary policy has essentially kept the economy in a miserable state of suspended animation since 2008. It has transitioned from one bubble to another, merely postponing the inevitable.

It could be argued that the poorer members of society would have been most vulnerable to the effects of a bust as well. But this ignores that every time a needed economic correction is artificially postponed, the subsequent bust will be even worse.

The denouement cannot be avoided, it is solely a question of whether it should be faced sooner or later. Since the current system has succeeded in stripping away many people’s savings, they are ultimately exposed to far greater risks than ever before.

Charts by World Bank, Forbes, PGM Capital

Chart and image captions by PT

Claudio Grass is the managing director of Global Gold, a Swiss bullion depository. Acting Man is an affiliate of Global Gold (here is our landing page at Global Gold, where you can obtain additional information about the service).

Full story here

Are you the author?

Claudio Grass is a passionate advocate of free-market thinking and libertarian philosophy. Following the teachings of the Austrian School of Economics he is convinced that sound money and human freedom are inextricably linked to each other. He is one of the founders of GoldAndLiberty.com.

He is also founder of GlobalGold Switzerland

.................

Keeping assets outside of the country you live is key. Switzerland remains the best jurisdiction for private property rights. Why? Because of its federalist structure in combination with direct democracy. It assures that the power of politicians is limited and that the people and not the politicians are the sovereign.

Previous post

See more for 6a.) Gold & Switzerland

Next post

Tags:

Ben Bernanke,

ECB,

newslettersent,

On Economy,

On Politics,

U.S. Gross Domestic Product