Brought to you by Investec Switzerland.

For more stories like this on Switzerland follow us on Facebook and Twitter.

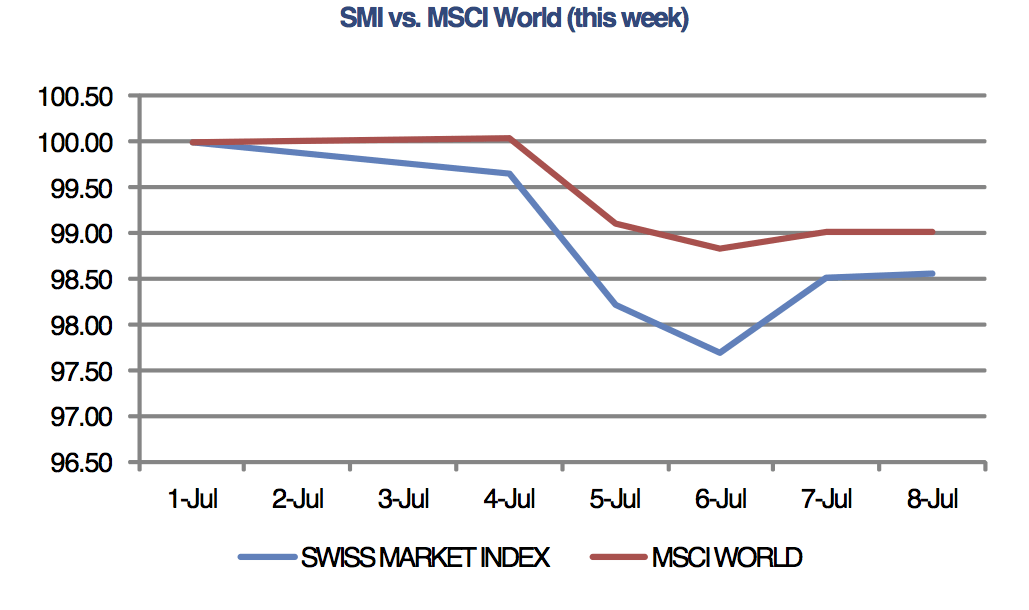

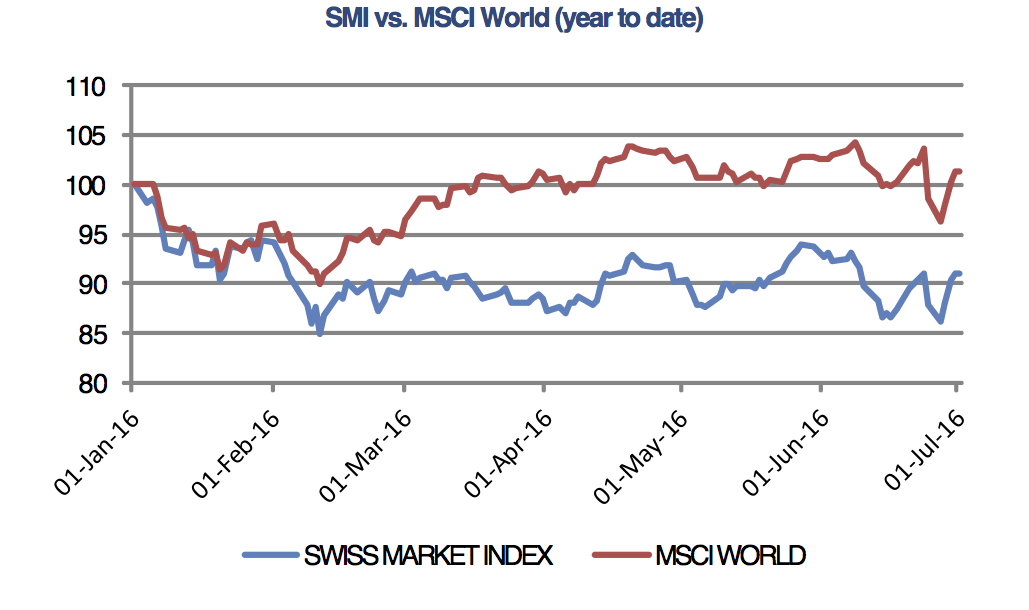

Full story here Are you the author? Previous post See more for Next postTags: Business & Economy,Editor's Choice,newslettersent,SMI Swiss Market Index