A Simple Solution for a Difficult Problem

Since the start of the abominable Obama Administration in 2009, the adjusted monetary base of the U.S. rose from $1.772 trillion to $3.966 trillion as of March 16, 2016.***

Of course, even these unfathomable figures as well as all other information supplied by the dominant media and government cannot be trusted. It, therefore, can be safely assumed that the real money supply is more than officially reported.

Money, like every other good, is subjected to the immutable law of supply and demand. Every increase in the money supply reduces the purchasing power of the monetary units which are already in circulation.

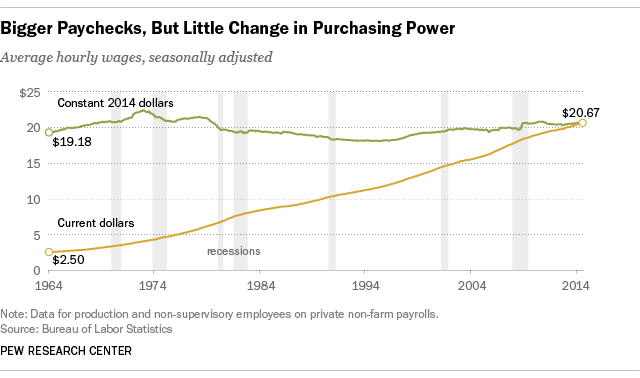

Naturally, since wages are paid in dollars, increases in the supply of them will decrease their purchasing power. Thus, while nominal wages have gone up as the Pew Study shows, real wages (what wages can purchase) have stagnated.

Lower standard of living

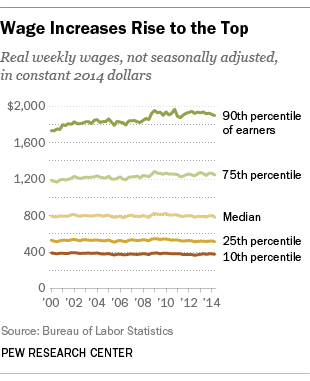

The decline in real wages over the decades from profligate money printing has resulted in lower standard of living for wage earners and those living on fixed incomes.

The rise in two income families is, in part, a consequence of a paper money economy and the fact that the financial survival of families now requires two incomes. Two-income families have also profound cultural implications which are now manifesting themselves.

There has been much talk throughout the current presidential campaign about the financial decline of the middle class. Candidates on the Left naturally talk of subsidies and more redistribution of wealth while those on the Right have called for tax cuts.

While tax reduction of any kind is always welcomed and leads to economic growth, a sound monetary policy is just as important for a revitalization of the middle class. Moreover, a return to honest money does not require any expansion of government spending or debt. |