The main feature in the foreign exchange market continues to be the surge of the Japanese yen. A convincing explanation of the yen's strength seems elusive. Until last week, which means through the fiscal year-end last month, Japanese fund managers have been buying foreign bonds at a near-record pace. Foreign investors, for their part, have been dumping Japanese shares. The main buyers of the yen appeared to be speculators, wherein the futures markets, they have amassed a near-record net and gross long yen position.

Our Tokyo contacts point to an another source of flows that have been yen positive, however, concrete figures are not yet to be found. Japanese exporter is suspected repatriating overseas earnings at the start of the new fiscal year. The yen has strengthened against the dollar four of the five past Aprils. Month-to-date, the yen has soared nearly 4%. Its closest rival is the Swiss franc, which has gained about 0.6% against the greenback.

Japanese officials have stepped up their verbal warnings to the market but with little effect as it is widely understood that officials have limited room to maneuver. The bar to intervention is high. The G7 and G20 recently have reiterated their pledge (what we have cast as a type of arms control agreement) not to seek competitive advantage from the currency market. Prime Minister Abe himself reiterated this in an interview with Dow Jones this week.

It has been five years since there was intervention on dollar-yen, and that was in coordinated action following the tsunami and earthquake in Japan. Although the pace of the move is strong, and the move has been one-way, the market is not disorderly. We note that the current five days advancing streak of the yen follows a seven-session run to the downside between March 17 and March 28.

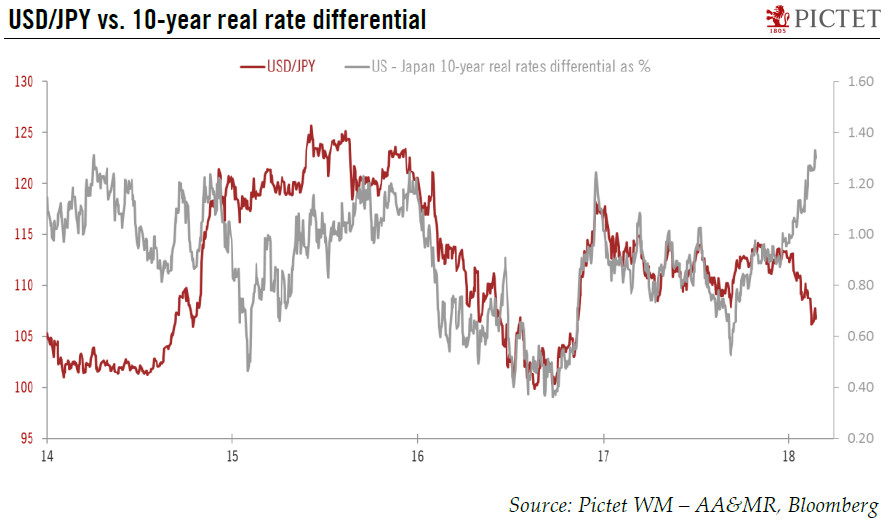

The yen's rise has coincided with a sharp fall in the US 10-year premium over Japan. The premium peaked on March 22 near 204 bp. Today, it is below 180 bp. We have suggested a technical objective for the dollar in the JPY106.80-JPY107.00 area. Despite the talk of a secret agreement struck in Shanghai to weaken the dollar, Japanese and American officials are likely as surprised by the yen's strength as are a market participant. This is most likely not an engineered move.

A secondary feature of the foreign exchange market is sterling's weakness. The pound is off 2% against the dollar this month and a little more against the euro. Brexit fears seem to offer a better explanation that trying to link sterling's weakness with yen strength. The Dutch handily rejected the associational agreement with Ukraine yesterday, and euroskeptics throughout Europe are celebrating. There does not appear to be negative fallout for the Dutch market in response, but rather the implications are seen adding to the EU governance challenge.

There are two economic reports today of note. First, defying expectations, China's reserves rose for the first time since last October. However, we caution against exaggerating the significance. Many observers still seem not to recognize the importance of valuation swings in accounting for the changes in the dollar value of China's reserve holdings.

Just as the dollar's past strength contributed to the decline in the value of China's reserves, the fall in the dollar in March bolstered their value. In March, the euro appreciated 4.65% against the dollar. The Australian dollar soared 7.2%. The Canadian dollar rose 4%. Sterling rose 3.2%. Incidentally, the yen rose a minor 0.1%.

The other data point of note was disappointing Spanish industrial output figures. Rather than rise 0.4% as the consensus expected in February, Spanish industrial production fell 0.2%. It is the second consecutive decline and brings the year-over-year rate to 2.2%, its slowest pace since last April, and half the pace from last November. The times series tends to be volatile, but it does play on fears that the Spanish economy is losing momentum.

One way we now know Spain was able to achieve its growth was the near abandonment of austerity. Last year's budget deficit was near 5.2%, well above the agreed upon target. The December election has failed to provide for a new government, and this means that little progress is likely in the first half of the year. A do-over election in June is looking increasingly likely.

Investors continue to try to make sense of the FOMC minutes that were released yesterday. What stands out to us is the increased importance of global variables in the Fed's policy-making equation. According to one news wires, "global" was cited at least 22 times on March, 14 in January and 4 in December. We are not as disturbed by the cacophony of voices picked up in the minutes. Our approach as a long placed emphasis on the Fed's leadership, Yellen, Fischer, and Dudley, where we argue the clearest signals emanate.

US economic data today--weekly jobless claims, and consumer credit are not typically market movers. Canada reports building permits. They are expected to have risen 4% in February after a sharp 9.8% drop in January. The Canadian dollar will likely take its cues from the general US dollar tone, and oil prices. Oil prices are steady, holding on to most of the past two days rise, buoyed by the unexpected drawdown of US stockpiles.

Tags: Japanese yen,newsletterNotSent,Spain Industrial Production