The angst that characterized the first several weeks of the year continues to dissipate. Major equity markets are extending their two-week recovery into a third week. Immediate concerns about the US falling into a recession have eased. The market have withstood some downward pressure on the Chinese yuan. Late yesterday Moody's cut its outlook for China's credit …

Read More »

Monthly Archive: March 2016

Interest on Gold Is the New Tempest in a Teapot

Zero Hedge published an article on Canadian Bullion Services (CBS) last week. Other sites ran similar articles. The common thread through these articles, and in the user comments section, is that CBS is committing criminal fraud. Or, if not, then it’...

Read More »

Read More »

Great Graphic: Surplus Capacity is not the Same as Insufficient Aggregate Demand

Many economists argue that the key challenge is that of insufficient aggregate demand. That is why world growth is slow. Hobbled with debt, households have pulled back. Business investment is weak. Government dissavings has been offset by household and business savings. The solution offered by some economists is a large public investment program. The G20 …

Read More »

Read More »

Great Graphic: Gold Triangle–Continuation or Reversal Pattern?

During a period in which the zero bound no longer is the floor of interest rates, and many central banks continue to ease policy, we have been watching gold a bit closer. In early January, we noted that the technical pattern warned of breakout. Our first objective was $1110-$1135. In early February, we updated our …

Read More »

Read More »

FX Daily, 03/01: Markets Find Steadier Footing

It could have been a disaster. US faltered yesterday, with the S&P 500 again struggling in the 1945-1950 area, and China's PMIs were weaker than expected. However, after initial weakness Asian shares turned higher. The nearly 0.9% rise allowed the MSCI Asia Pacific Index to close at its best level in five sessions. European bourses …

Read More »

Read More »

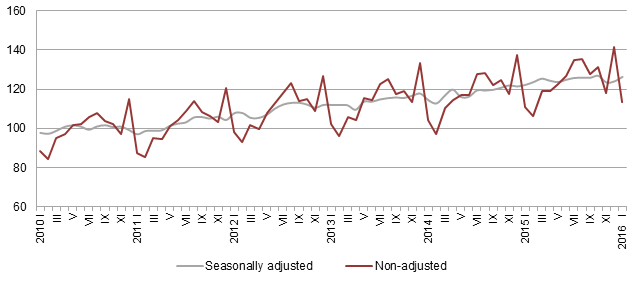

January Retail Sales: Real YoY +0.2 percent, Nominal -1.3 percent YoY

01.03.2016 09:15 - FSO, Economic Surveys (0353-1602-20) Retail trade turnover in January 2016 Neuchâtel, 01.03.2016 (FSO) – Turnover in the retail sector fell by 1.3% in nominal terms in January 2016 compared with the previous year. Seasonally adjus...

Read More »

Read More »