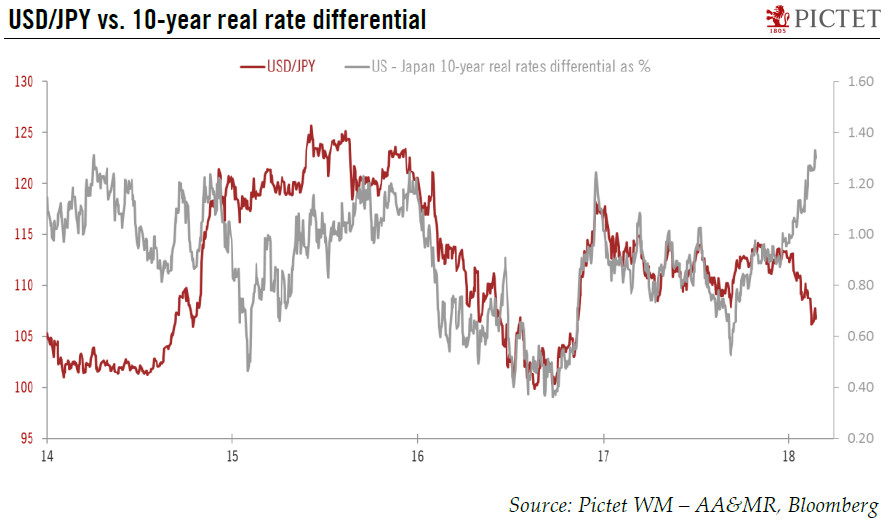

The most extreme speculative positioning, judging from the futures market is the long yen position. The bulls added another 3.4k contracts, lifting the gross long position to 82.8k contracts. The record was set in 2008 at 94.7k contracts.

The gross short position was trimmed by 4.5k contracts, leaving 29.5k. It is the smallest gross short position since before Abe was elected in Prime Minister in 2012. The net long yen speculative position rose to 53.3k contracts. The record was also set in 2008 at 65.9k contracts.

There were three significant speculative position adjustments in the CFTC reporting week ending March 22. The largest was the unwinding of the previous week's record jump in gross long sterling positions. After adding 33.5k contracts, speculators liquidated 24.4k contracts, leaving 38.5k.

Speculators continued to reduce the gross short euro position as they have done throughout the first quarter. The gross short position peaked near 262k contracts in early-December. With the 10.5k decline in the latest reporting period, the gross long position stands at 157.4k contracts.

Speculators reduced Canadian dollar exposure. The bulls took profits, and the bottom pickers were punished. The gross short position fell 11.6k contracts to 36.8k. The gross long position fell by a third or 9.8k contracts to 21.8k.

If there was an overall pattern, it was that speculators tended to reduce short currency future positions. They did so for six of the eight currency futures we follow. The exception were the top pickers in the Australian dollar, who added 1.1k to their gross short position, lifting it to almost 50k contracts. Speculators also added to the gross short Mexican peso position. The 6.7k contract increase boosted the gross short position to 74.2k contracts.

Speculators liquidated 15.2k contracts of 10-year Treasury note futures position. The gross long position now stands at 486.0k contracts. The bears stood pat, with a two hundred contract decline in the gross short position, leaving 435.9k. These adjustments the net long position fall to 50.1k contracts.

The net long speculative light sweet crude future position was boosted by 38.1k contracts to 308k. However, the speculative longs took profits, trimming the gross long position by 16.6k contracts to 527.8k. The shorts were simply covered faster. The bears bought back 54.7k contracts, leaving the gross short position of 219.9k contracts.

| 22-Mar | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change | Gross Short | Change | |

| Euro | -66.1 | -77.6 | 91.3 | 1.0 | 157.4 | -10.5 |

| Yen | 53.3 | 45.5 | 82.8 | 3.4 | 29.5 | -4.5 |

| Sterling | -37.7 | -13.6 | 38.5 | -24.4 | 76.2 | -0.2 |

| Swiss Franc | 4.2 | 5.3 | 19.4 | -3.2 | 15.2 | -2.2 |

| C$ | -15.0 | -16.8 | 21.8 | -9.8 | 36.8 | -11.6 |

| A$ | 18.0 | 12.8 | 67.9 | 6.4 | 49.9 | 1.1 |

| NZ$ | 1.0 | 1.3 | 19.4 | -1.1 | 18.4 | -0.9 |

| Mexican Peso | -45.7 | -45.0 | 28.6 | 5.5 | 74.2 | 6.7 |

| (CFTC, Bloomberg) Speculative positions in 000's of contracts | ||||||

Tags: Commitments of Traders,Japanese yen,Speculative Positions