As we noted last night, in what was the second clear example of sheer desperation by the Bank of Japan, the central banker formerly known as Peter Pan for his on the record belief that "he should fly", and as of this morning better known as Peter Panic, desperately tried to pull of his best "Draghi", up to and even stealing the ECB's trademark catch phrase, to wit:

- KURODA: POSSIBLE TO CUT NEGATIVE RATE FURTHER IF NEEDED

- KURODA: NO LIMIT TO MONETARY EASING MEASURES

- KURODA: WILL EXPAND EASING IF NEEDED FOR PRICE TARGET

- KURODA: BOJ TO KEEP LOOKING FOR INNOVATION IN MEASURES

- KURODA: BOJ NEEDS TO DEVISE NEW TOOLS IF MEASURES INSUFFICIENT

- KURODA: BOJ WILL DO WHATEVER IT CAN TO REACH PRICE TARGET

Which is probably why since Peter Panic's statement last night, the Yen has soared (the USDJPY has plunged) by over 250 pips, with the market's message to the BOJ quite clear: if there is no limit to the BOJ's policy, then prove it.

But a question emerges: how far can the market push Kuroda, and just how negative can the BOJ (which ironically was just trying to talk back its NIRP via the latest 3am article in the Nikkei) go with negative rates.

For the answer we go to Nomura, which is likewise unsure, so instead it punts to a familiar "barbarous relic": gold. This is what it said:

NIRP's lower bound

If conditions remain inimical to attainment of the BOJ's 2% inflation target, the BOJ may cut its IOER rate further below zero. In such an event, how low could the rate go?

Among European central banks that have already adopted NIRPs, the Swedish Riksbank, Swiss National Bank, National Bank of Denmark and ECB have cut their policy rates to -1.1%, -0.75%, -0.65% and -0.3%, respectively (we used mid-point rates for the central banks targeting an interest rate range). The ECB may ease again in March. Some expect it to cut its policy rate further. Based on European central banks' negative policy rates, the BOJ seems to have the latitude to cut its IOER rate to -0.5% or thereabouts.

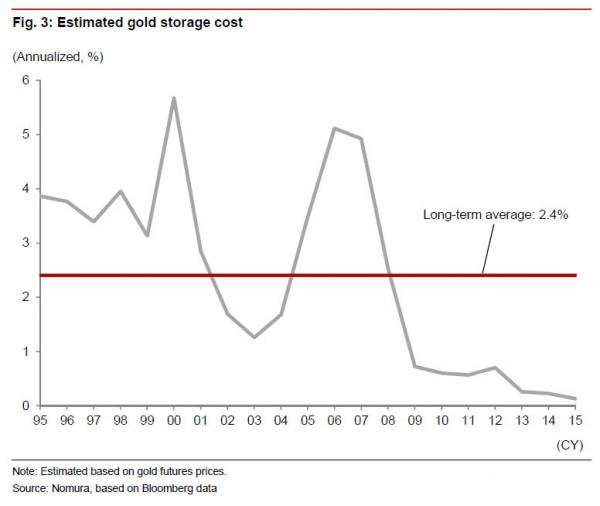

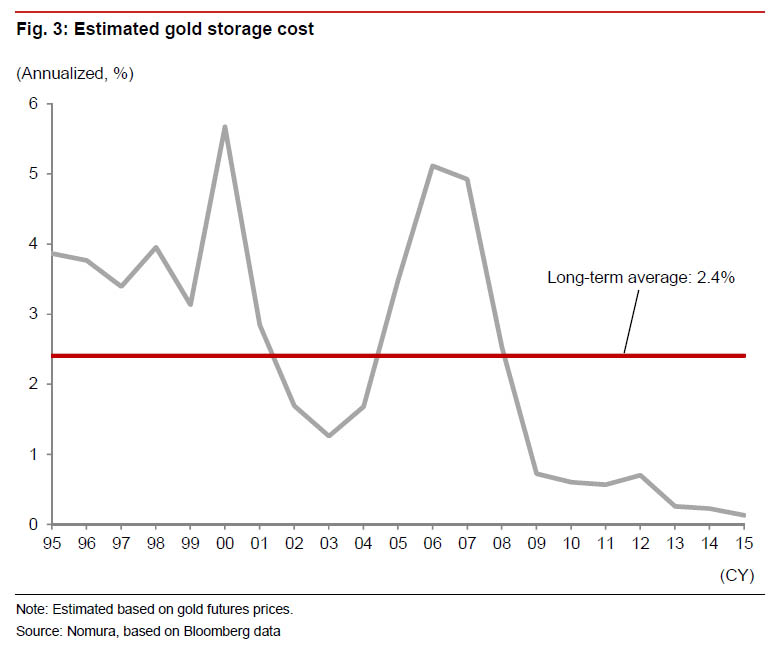

Theoretically, negative interest rates' lower bound depends partly on the cost of holding cash in the form of physical currency. When people hold cash out of aversion to negative interest rates, they risk losses due to theft and the like. The cost of avoiding this risk could be a key determinant of negative interest rates' lower bound, but it is hard to directly quantify. As a proxy for the cost of holding physical currency, we estimated the cost of storing gold based on gold futures prices. This cost has averaged an annualized 2.4% over the past 20 years, though it has varied widely over this timeframe.

While somewhat comical, coming from the most prominent Japanese bank (one whose stock got clobbered last night on a huge earnings miss sending its share price crashing the most in years) Kuroda is likely listening.

Which means that as the BOJ lowers ever lower, and it will, it will proceed to do so until it the only economic thing to do is to hold gold, which incidentally despite yielding 0%, will - relatively speaking - have a higher yield than both cash and most Japanese bonds: after all the 10Y is about to go negative.

So please bring it on central bankers: as you unleash more and more failed policies, all you are doing is confirming what we have said all along - as the "central planning committee to save the world" fails in its task, the only safe asset will be the one that has survived 5000 years of human, politician and central banker idiocy, with its value unscathed.

It will survive this period of particularly acute idiocy, as well.

Full story here Are you the author? Previous post See more for Next postTags: Bank of Japan,central banks,Japan,Japanese yen,Nikkei,Nomura,Swiss National Bank