1) Korea’s Financial Services Commission will introduce a so-called “omnibus account” for foreigners investing in local stocks

2) Malaysian Attorney General Apandi Ali closed the investigation into transfers of foreign money into Prime Minister Najib Razak’s personal bank accounts

3) The South African Reserve Bank increased the pace of its tightening

4) The Egyptian central bank eased restrictions on dollar cash deposits

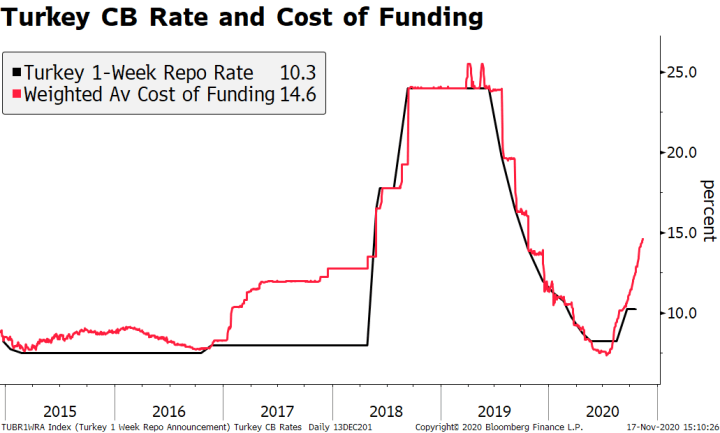

5) The Turkish central bank raised its 2016 and 2107 inflation forecasts after the minimum wage was hiked 30%

6) Brazil’s COPOM minutes confirmed a dovish shift

7) Banco de Mexico extended its dollar auction program through March 31

In the EM equity space, UAE (+7.8%), the Philippines (+7.7%), and Turkey (+4.4%) have outperformed this week, while China (-5.4%), Korea (+1.7%), and India (+1.8%) have underperformed. To put this in better context, MSCI EM rose 3.9% this week while MSCI DM rose 0.8%.

In the EM local currency bond space, Brazil (10-year yield -58 bp), South Africa (-37 bp), and Turkey (-23 bp) have outperformed this week, while Hungary (10-year yield +18 bp), Poland (+7 bp), and Ukraine (+6 bp) have underperformed. To put this in better context, the 10-year UST yield fell -10 bp this week.

In the EM FX space, RUB (+3.7% vs. USD), MYR (+3.5% vs. USD), and ZAR (+3.3% vs. USD) have outperformed this week, while ARS (-1.3% vs. USD), PEN (-0.6% vs. USD), and INR (-0.2% vs. USD) have underperformed.

1) Korea’s Financial Services Commission will introduce a so-called “omnibus account” for foreigners investing in local stocks. This would end the current (unpopular) rule that requires foreign investors maintain a separate account for each of their funds. The move is reportedly being made to help Korea get included in MSCI’s Developed Market indices.

2) Malaysian Attorney General Apandi Ali closed the investigation into transfers of foreign money into Prime Minister Najib Razak’s personal bank accounts. Ali said no laws had been broken. Apandi Ali was appointed by Najib last year, after the previous Attorney General resigned. Elsewhere, the government trimmed its 2016 growth forecast to 4-4.5% from 5% previously but stuck to its budget deficit forecast of -3.1% of GDP. It also cut the mandatory employee contribution rates to the national pension fund by 3 percentage points, which should boost consumption.

3) The South African Reserve Bank increased the pace of its tightening. The 50 bp hike was not unanimous; 1 voted for steady rates, 2 voted for a 25 bp hike, and 3 voted for the 50 bp hike. A worsening backdrop pushed the SARB to be a bit more hawkish, as it said risks to the inflation outlook were materializing and that inflation was likely to remain above target in both 2016 and 2017. Governor Kganyago said the bank is still on a tightening cycle, so markets should expect another hike at the next meeting on March 17.

4) The Egyptian central bank eased restrictions on dollar cash deposits. The bank raised the monthly limit to $250,000 from $50,000 for importers of food, machinery, spare parts, capital goods and medicine. It also removed a daily ceiling for the same group of importers as long as they don’t exceed the new monthly limit. The $50,000 monthly limit was kept in place for individuals and companies that fell outside the types specified above.

5) The Turkish central bank raised its 2016 and 2107 inflation forecasts after the minimum wage was hiked 30%. Governor Basci said that the increase for about 5 mln workers earning the minimum wage was the biggest single factor that pushed up the bank’s 2016 inflation forecast by a percentage point to 7.5%. The 2017 forecast was raised to 6% from 5.5% previously. The bank’s inflation target is 5%, and Basci added that price stability will now only be achieved in 2018. Basci also estimated that higher prices for tobacco, alcohol and other items due to tax hikes will add another 0.4 percentage point to inflation. Lastly, he urged the government to take actions to curb price pressures.

6) Brazil’s COPOM minutes confirmed a dovish shift. The language in the minutes suggests that rate hikes are now off the table, totally reversing the hawkish stance from late 2015. COPOM now says “It’s necessary to monitor the impact of recent changes in the domestic and external balance of risks for inflation, which combined with monetary policy adjustments already implemented, may strengthen the scenario of convergence toward the 4.5 percent target in 2017.” Elsewhere, Finance Minister Barbosa unveiled a BRL83 bln loan program to help the economy. Barbosa said it wouldn’t conflict with monetary policy and won’t have additional fiscal costs since the loans won’t be subsidized.

7) Banco de Mexico extended its dollar auction program through March 31. However, it did not change any operational aspects and instead maintained the triggers (-1.0% and -1.5% moves in the peso) and the amounts ($200 mln). In light of recent peso weakness, some were hoping that the FX Commission would boost the amounts. However, this current EM bounce could have bought it some time. Elsewhere, the government said it could inject capital in Pemex if the company can present a plan for long-term sustainability and profitability.

(from my colleague Dr. Win Thin)

Tags: Emerging Markets