(from my colleague Dr. Win Thin)

Today’s Fitch downgrade is a stark reminder that Brazil continues to suffer from a toxic mix of high inflation, recession, low commodity prices, and heightened political uncertainty. Because we see no end in sight for these negative factors, we believe Brazil assets will continue to underperform.

POLITICAL OUTLOOK

POLITICAL OUTLOOK

The impeachment process has begun, but it is not yet clear whether it can gain enough traction to actually topple President Rousseff. We have always felt that the opposition PMDB was in no hurry to replace Rousseff, since it would simply inherit a very messy economy. Rather, it made more sense to us for the PMDB to obstruct and generally make things miserable for Rousseff in order to be well-positioned to win the October 2018 elections. Municipal elections in October 2016 will be closely watched.

Meanwhile, the “Car Wash” corruption scandal continues to widen. More and more senior politicians and business leaders have been arrested in recent weeks. Police have also raided the residence and office of lower house President Cunha, as well as other PMDB lawmakers. The situation remains murky, as Cunha and his PMDB are supporting impeachment. Are these raids on the PMDB simply political pushback from Rousseff? Stay tuned.

Brazil press is reporting that President Rousseff has agreed to Finance Minister Levy’s exit. While this is a familiar report in recent months, it never fails to move markets. The report added that Levy has agreed to stay on for a short while until a replacement is found, and that Rousseff plans easier fiscal policy (which Levy opposes). We continue to see more downgrades to sub-investment grade as only a matter of time (see below), but a Levy exit would move up the timetable.

ECONOMIC OUTLOOK

The economy remains in recession. GDP growth is forecast to contract -3% in 2015 and -1% in 2016, with growth not seen until 2017. For 2014, GDP was basically flat. With commodity prices still falling and more policy tightening ahead (see below), we think the risks are to the downside with regards to these growth forecasts.

Yet price pressures are still rising, with IPCA inflation of 10.48% y/y in November. This is the highest rate since November 2003, and well above the 2.5-6.5% target range. Wholesale and PPI measures are still rising, so pipeline pressures are likely to keep consumer inflation high.

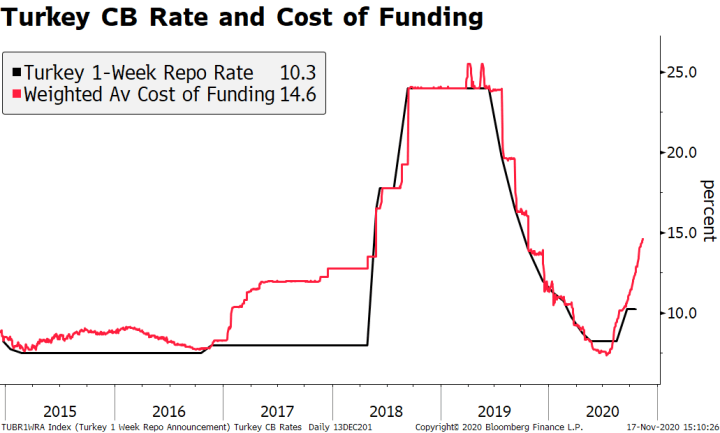

There is a growing debate in the market over whether Brazil will resume its tightening cycle. The central bank has been on hold since July, when it hiked the policy rate by 50 bp to 14.25% and signaled an end to the cycle. Since then, price pressures have continued to rise. We believe COPOM will resume tightening with a 50 bp hike at the next meeting on January 20.

Fiscal policy remains a key concern. The primary deficit was -0.7% of GDP in November, while the nominal deficit was a whopping -9.5% of GDP. This is the highest since at least 1998. Revenues have been hurt by the slowdown, while congress has been slow to pass spending cuts proposed by Rousseff. To make things worse, reports suggest that the government will submit to congress a lower primary surplus target for next year (0.5% of GDP vs. 0.7% previously).

The external accounts are stabilizing. Lower commodity prices have hurt exports, but the ongoing recession has helped reduce imports even more. The current account gap is seen falling to slightly under-4% of GDP both this year, with further modest improvement seen next year. Foreign reserves have fallen from the 2014 but remain fairly high at $357 bln in November. FDI continues to cover much of the current account gap.

INVESTMENT OUTLOOK

Fitch just joined S&P in cutting Brazil to sub-investment grade BB+ with a negative outlook. Many investors can only invest in countries that have at least 2 out of 3 agencies at investment grade. Now that only one agency has Brazil at investment grade, there will likely be some forced selling. Moody's still has Brazil at Baa3, but it's only a matter of time before they cut too. Our own ratings model has Brazil at BB-/Ba3/BB- so there are still downgrades in the pipeline ahead.

BRL had held up fairly well recently, but we think this downgrade will keep a lot of selling pressure on it. It is still the worst performing currency in EM overall at -33% vs. USD. The next worse is COP at -28%. Retracement objectives for the September-November drop in USD/BRL come in near 3.97 (50%) and 4.0360 (62%). Break above 4.0360 needed to signal a test of the all-time high near 4.25 from September 24. We see a move above 4.5 to as high as 5.0 over the course of next year. Our EM FX model views BRL as having WEAK fundamental backing.

Brazilian equities have underperformed within Emerging Markets. MSCI Brazil is down -41.4% YTD, and compares to -17.6% YTD for MSCI EM. This underperformance should continue, as our EM Equity model has Brazil at VERY UNDERWEIGHT position for this quarter.

Brazilian bonds have also underperformed this year. The yield on 10-year local currency government bonds is up +387 bp, the worst in EM. The next worst are Turkey (+265 bp), Peru (+181 bp), and Colombia (+173 bp). With inflation likely to remain high and the central bank likely to resume hiking, we think Brazilian bonds will continue to underperform.

Tags: Emerging Markets