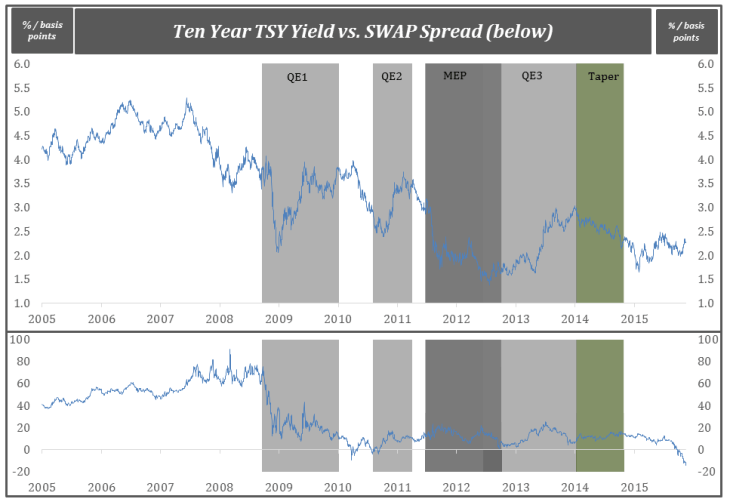

SWAP spreadsSWAP spreads recently took a nosedive and are once again trading at negative levels, even for shorter maturities. As can be seen from the chart below, treasury yields, here represented by the 10 year maturity, rose during QE policies programs contradicting the very raison d’être spouted by the central bankers. Interestingly enough we also see the same pattern in SWAP spreads. As QE programs were enacted SWAP spreads started to move upwards, just to rollover as the central bank program was getting close to a conclusion. Also, note that the exact same pattern in yields occurred during the taper period with the all too familiar plunge in the immediate aftermath as the program ended. In addition, SWAP spreads also drifted downward as one would expect. However, something changed in 2015. Yields started to move upward, while SWAP spreads collapsed and even became negative. This market perversion suggest that Wall Street is a safer counterpart than the very institution that underwrites the whole fractional reserve fraud in the first place. To price in a higher risk premium on the US government than on US banks is a contradiction in terms so there need to be another explanation behind this puzzling market phenomenon. |

|

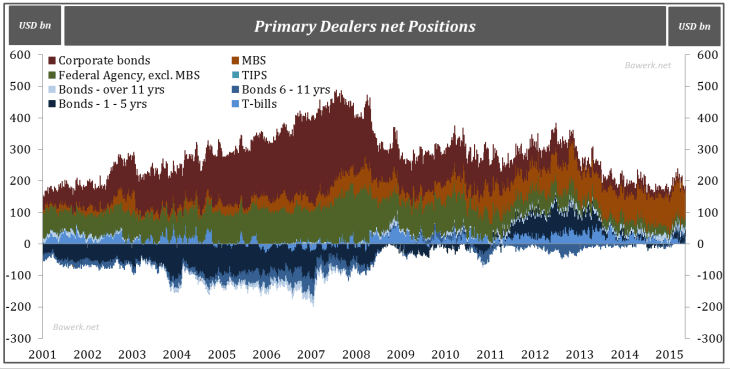

Primary Dealers net PositionsOne reason, which seem very popular among the mainstream pundits, relates to new banking regulations post-GFC. It has become more expensive for banks to make markets compared to what it used to as higher capital requirements means holding “inventory” of bonds are costlier. In addition, banks are now required to maintain a total loss absorbing capacity (TLAC) which equate ˈsafeˈ government bonds with other more risky paper. Overall, globally systemically important banks, here represented by US Primary Dealers have reduced their bond inventories dramatically since 2008 to reduce their cost of capital. Initially, before the TLAC proposal, they also changed the composition. Corporate bonds fell precipitously from 2008 while a net short positon in TSYs became a net long position (front -running QE). In times of stress, corporates may want to hedge large positions while the main conduit, the global banks, are nowadays unable to respond accordingly. Pricing in the SWAP market then reflect the demand / supply mismatch driving the TSY spread negative. |

|

| By isolating the holdings of corporates, we see how dramatic the change has been in the post-GFC period (note that there is a break in the time series from 2013, which exaggerates the effect, but the shift is remarkable nonetheless). | |

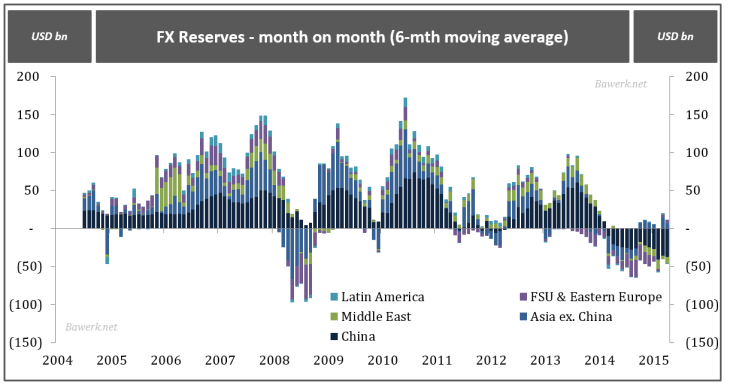

FX ReservesIn addition, we know that foreign exchange (FX) reserve managers have been net sellers for quite some time now. It is safe to assume these are mostly US treasury securities being sold to prop up various Emerging Market currencies, of which China is the most notable. The next chart depict a moving average of monthly change in FX reserves of those countries that as recently as last year used to be large accumulators. From this it is clear that there have been significant selling pressure in the TSY market, and with the Fed now being a neutral bystander this has led to lower prices (higher yields) which have helped intensify the SWAP spread perversion. |

|

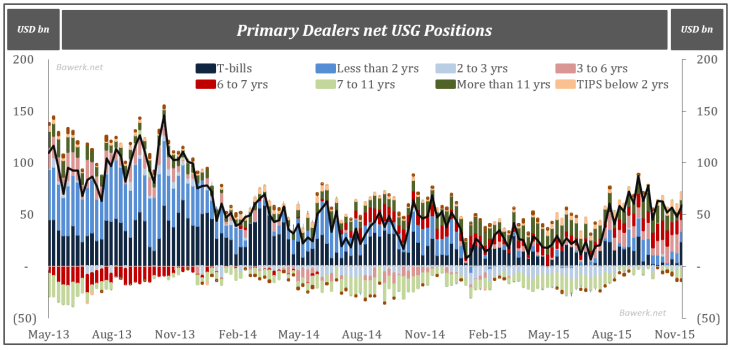

Primary Dealers net USG PositionsTo substantiate this argument we look at Primary Dealers holdings of TSYs, and it is clear that they have had to be more active in the market when FX managers started to sell in earnest in July. Funding this position must have had an impact on repo market, as witnessed in the rising GC collateral rate, which in turn have propagated into TSY markets, id est helped raise rates relative to SWAP markets. |

|

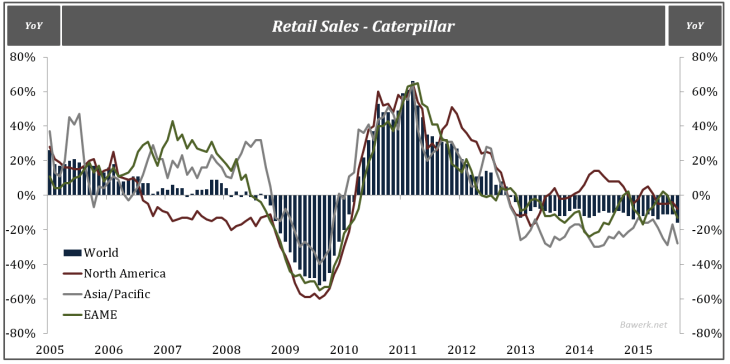

Retail Sales – CaterpillarAs a side note, it is interesting to witness Caterpillar’s retail sales and how it tracks the ebb and flow in FX reserves. See how, in particular, Asia/Pacific retail sales track their changing FX reserves. As a supplier to the construction- and its consequent commodity boom Caterpillar has been highly dependent on global ˈdollarˈ funding; a system which paradoxically fed on itself. As ˈdollarˈ, funding became ever more available, first through fractional reserve expansion (pre-Lehman) and subsequently by QE (post-Lehman) final sales demand for manufactured goods rose almost uninterrupted, leading to an unprecedented expansion in Chinese fixed asset investments, which in turn incentivized commodity producers to expand their output. These surpluses where promptly recycled back into the very same pockets of those expressing demand for their products in the first place. This virtuous cycle of higher demand feeding the global ˈdollarˈ-funding scheme obviously benefited the likes of Caterpillar. |

|

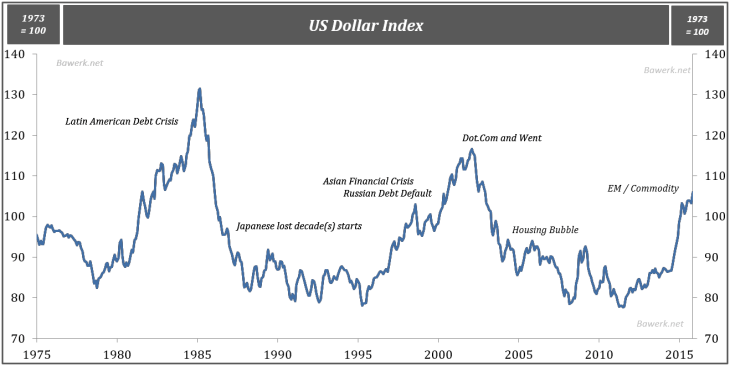

U.S. Dollar IndexThe other side of this structure was debt accumulation, both private and public. ˈDollarˈ recycling means the producing nation accumulate claim on the consuming nation’s capital stock and future output. In addition, as Emerging Markets took over what used to be highly paid jobs from the spoiled western worker, wages would eventually start to converge, meaning stagnate and ultimately falling in the west. Lower incomes could thus not keep pace with the relentless surge in leverage so the demand was clearly unsustainable. QE unfortunately prolonged the process for almost a decade even though the market tried to correct the capital consuming process several times. Now, that demand is clearly falling we find ourselves with massive overcapacity of manufacturing capacity and commodity output. Inventories, both in manufactured goods and commodities are breaking record levels every day now. We are “swimming in oil” in North America, Europe and China while desperate producers keep churning out a product no one wants. The story is no different in coal, gas, iron ore, steel, cement, cars, glass, trucks, heavy-duty equipment etc. A massive inventory liquidation is underway which will lead to a new global recession in 2016. This is the real reason why SWAP spreads are negative. The complete unwind, or even reversal, of global wholesale ˈdollarˈ funding put extreme pressure on corporations (which overwhelm the market for hedging) as they realize they can no longer roll over debt to maintain their overcapacity. With a scramble for real dollars (note, a ˈdollarˈ is a claim on dollars for which no dollars actually exists) the dollar exchange rate is surging; both compounding and reflecting the problem at hand. Historically, large and sudden shift in the value of the global reserve currency is synonymously with global turmoil. We guarantee you that this time is not different. We are heading straight into a massive deflationary inventory liquidation with mass defaults across the globe. This is what a negative SWAP spread is really telling us. |

Tags: China,commodities,Dollar Index,Economics,Regulation