1. The continued build of short currency futures positions characterizes the changes in the speculative positioning. All the currency futures we track saw an increase in gross short positions. This is what drove the large net short positions. One thing this means is that late shorts are in weak hands, and as we have seen in the Australian dollar, vulnerable to a squeeze.

2. There were five significant (10k+ contracts) gross currency adjustments in the CFTC reporting week ending November 17. The gross short euro position jumped 21.1k contracts to 243.1k contracts. The record high set in March was near 271k contracts. The bears added another 11.1k short yen contracts to their gross short position, lifting it to 113.1k contracts.

3. The gross short Canadian dollar and Australian dollar futures positions grew by 10.2k (to 73.9k contracts) and 12.7k (to 111.4k contracts) respectively. As of November 17, the gross short speculative Aussie position was nearly as large as the gross short yen position. Short-covering likely helps explain part of the Australian dollar's strength in the days since the reporting period ended.

4. The bears added 17k Mexican peso contracts to their gross short position, lifting it to 79.7k. It was the largest increase since mid-year. The peso was little changed over the reporting period, but has strengthened in the sessions since . Here too, the late shorts were in vulnerable hands.

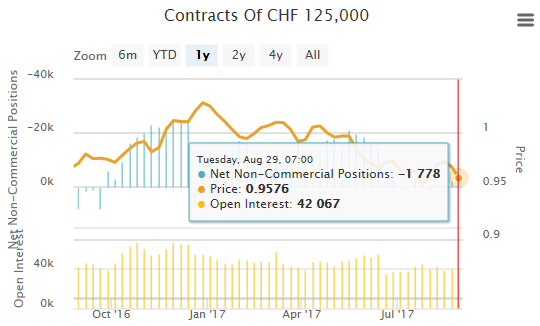

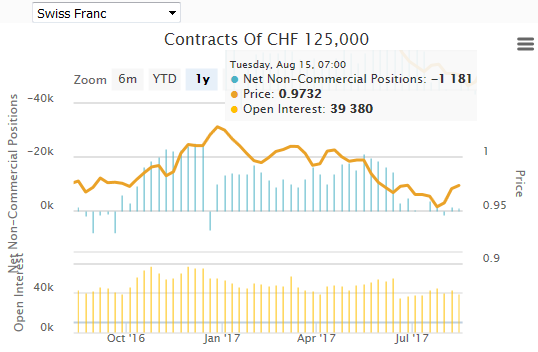

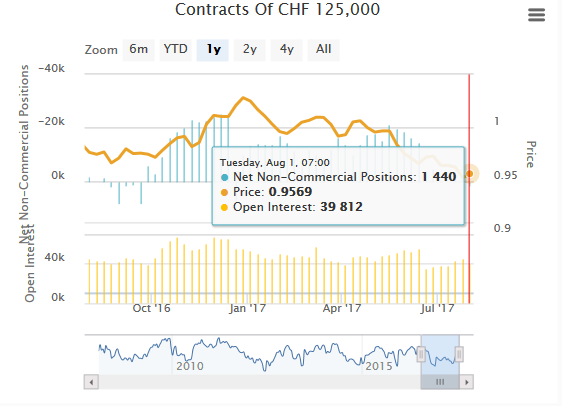

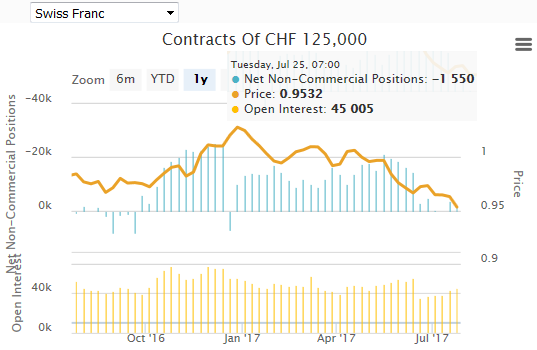

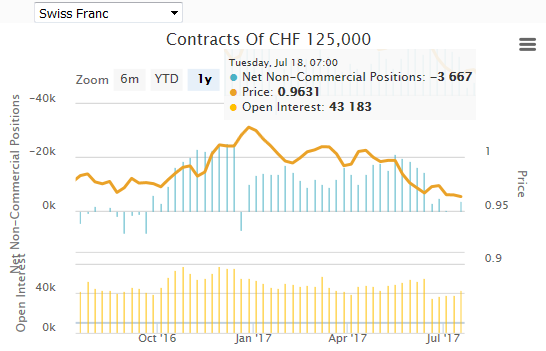

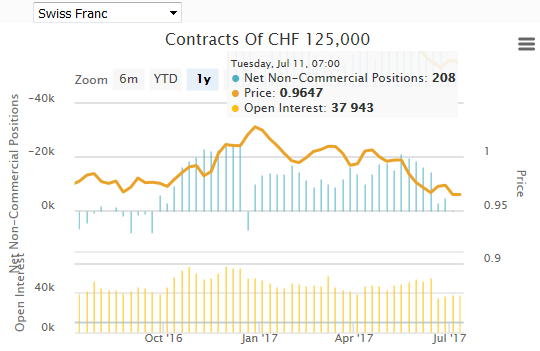

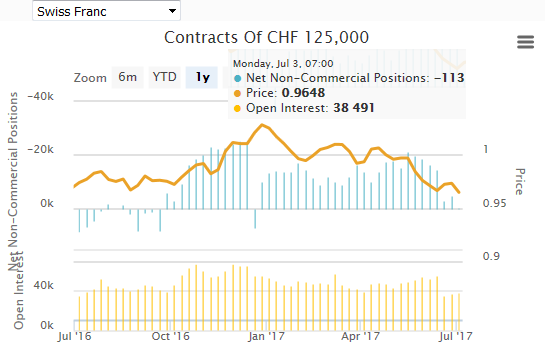

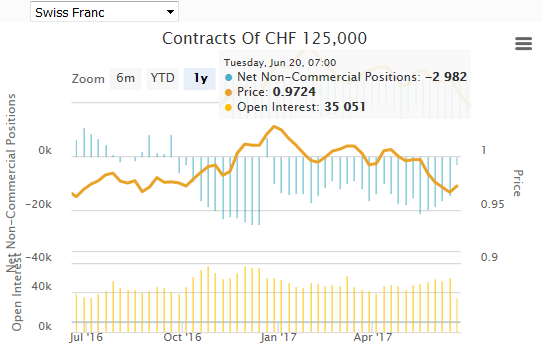

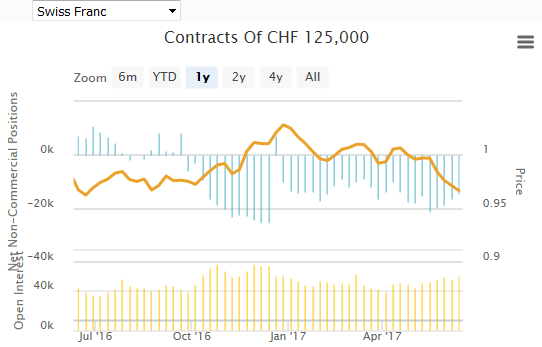

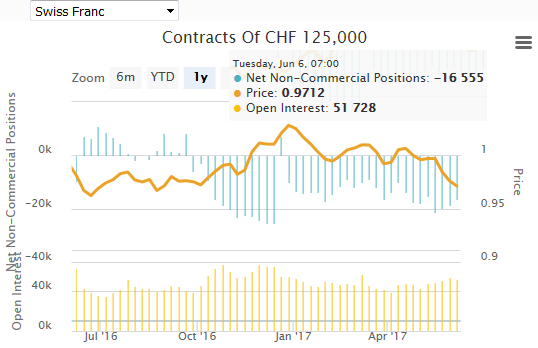

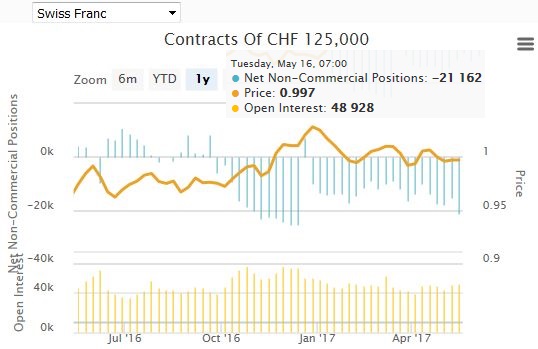

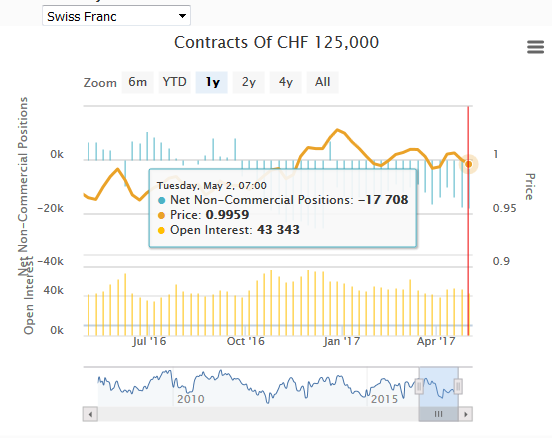

5. The gross long positions were little changed. One changed by 4.5k contracts, but of the remaining seven, four changed by less than 1k contracts. The gross longs were trimmed except for the Swiss franc and New Zealand dollar which rose by 100 and 1000 contracts respectively.

6. The speculative net short 10-year Treasury futures position rose by 11.2k contracts to 48.1k. This was a result of a 20.4k contract increase in the gross short position (to 469.1k contracts) partially offset by the 9.3k contract increase in gross long positions (to 421k contracts).

7. The speculative net long light sweet crude oil position was trimmed by 9.8k contracts, leaving 228.6k. The bulls liquidated 4.8k contracts to 494.1k. The bears added 4.9k contracts to their gross short position, bringing it up to 265k contracts.

| 17-Nov | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change | Gross Short | Change | |

| Euro | -164.2 | -142.9 | 78.9 | -0.1 | 243.1 | 21.1 |

| Yen | -78.6 | -66.9 | 34.5 | -0.6 | 113.1 | 11.1 |

| Sterling | -25.3 | -15.8 | 35.1 | -4.3 | 60.4 | 5.2 |

| Swiss Franc | -15.3 | -9.3 | 19.0 | 0.1 | 34.3 | 6.1 |

| C$ | -28.4 | -17.9 | 45.6 | -0.2 | 73.9 | 10.2 |

| A$ | -66.5 | -52.8 | 44.9 | -1.0 | 111.4 | 12.7 |

| NZ$ | 5.2 | 5.6 | 22.2 | 1.0 | 17.0 | 1.3 |

| Mexican Peso | -38.3 | -18.7 | 41.4 | -2.4 | 79.7 | 17.0 |

| (CFTC, Bloomberg) Speculative positions in 000's of contracts | ||||||

Tags: Commitments of Traders,Speculative Positions