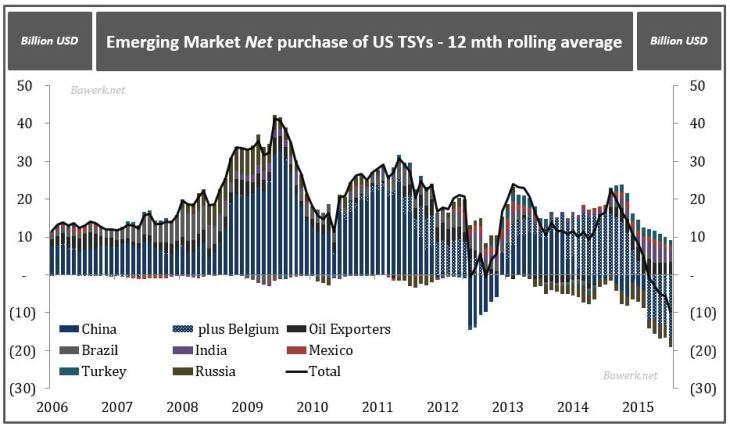

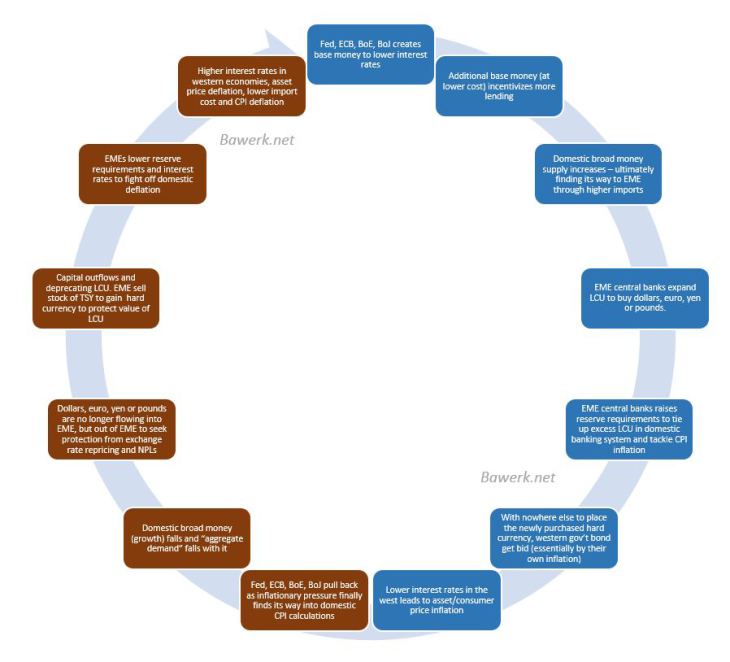

Over the decade long commodity boom made in China we have all been accustomed to the large and growing current account surpluses being recycled back into western financial security markets. Case in point, from 2000 to its peak in the fall of 2013 the Chinese added more than 2,000 per cent to their TSY holdings. China (plus Belgium), the Middle Eastern oil exporters, Brazil, India, Mexico, Turkey and Russia now hold a combined $2 trillion worth of TSYs.

This has been nothing short of a massive Ponzi scheme whereby the “west” inflate their currencies and create claims to those very same currency units (id est the ‘dollar’ as explained here) which invariably find their way into commodity producers, either directly or indirectly through China’s manufacturing hub. Recipients of these ‘dollars’ are reluctant to let them do their bidding; which left unattended would lead to an alteration in the exchange value and thereby create unfavourable terms of trade.

To stem the flows of incoming ‘dollars’ they are removed from the marketplace through issuance of domestic currency used to buy up hard currency – western inflation thus begets emerging market inflation which begets even more western inflation. This process obviously leaves recipient countries with a surplus of ‘dollars’ which only the US TSY market are large enough to fully absorb.

As this process of vendor financing represses interest rates in western economies, and by extension also in emerging markets, it leads to ever more credit expansion as debt servicing cost falls, enabling more household, corporate and government leverage. At some point reality strikes and consumer price inflation pick up and the virtuous process of leverage turns ugly forcing central banks to reign in further leverage.

This ‘dollar’ cycle has been going on for so long now that whole system is teetering on the brink of a complete meltdown. It is so fragile that even the mere expectation of 25 basis point hike by the Federal Reserve almost pushed it over the cliff in August, forcing the Federal Reserve to an abrupt about-turn on the much anticipated September lift-off.

At the ZLB/NIRP there is not much that can be done to save an overleveraged system. Time has come to face up to the consequences of an irrational exuberant multi-decade boom based on credit expansion, capital consumption and resource misallocation.

| We have started to see this process go awry already. According to U.S. Treasury data the aforementioned emerging markets have become net sellers of U.S. TSYs on a 12-month rolling average basis. To get a feel for how unprecedented this is, note that during the worst of the Great Financial Crisis, emerging market did not become net sellers measured on a trailing 12-month average. Today they are.

And if it wasn’t for the heavy use of dollar SWAP markets to borrow forward dollar and selling them spot, the sell-off in TSYs would have been much worse by now. Since such short-term financially wizardry is nothing more than a band-aid solution to a structural problem, it will only help postpone the problem as it cannot support EME currencies indefinitely. When capital flight continues and escalates, as it inevitably will, the problem will come back two-fold. |

|

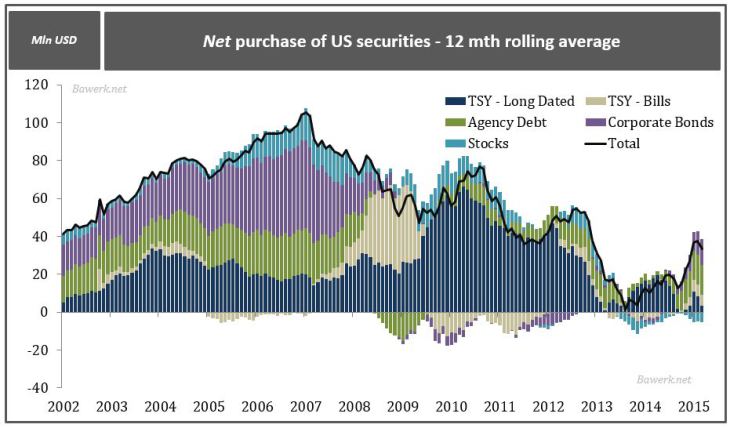

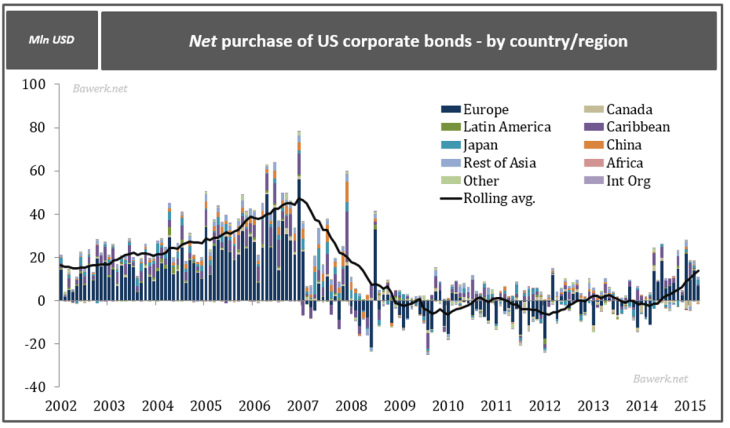

| As EMEs have been forced to sell TSYs to prop up their currencies, others have started to buy US securities on a scale not seen since 2012. Agency debt and corporate bonds have become hot again, after a long slog lasting from 2008 up until very recently. There are two main reasons for this. First of all, a stronger dollar prompted by the expected yield differential, especially over the Atlantic, led more investors into U.S. securities. Secondly, U.S. corporates seeing lower funding cost in euros due to ECB’s NIRP and open-ended QE are eagerly selling bonds to yield starved Europeans. European net purchases of U.S. corporate bonds are now running at around $11bn a month, as opposed to average net monthly selling of $4bn between 2009 and mid-2014. | |

| Now, the real worry in terms of elevated U.S. financial asset valuation going forward can be found in the next chart, where we show net flow into U.S. TSYs from the major buyers. With China, Japan and the Federal Reserve all ending TSY inflow simultaneously, a liquidity starved market could easily be overwhelmed. Now, this does not necessarily mean higher yields in the U.S., but it will mean rotation out of stocks and into bonds as the classical risk-off trade takes hold. |

As we outlined in Why NIRP my Trump QE4 one way out of this doldrums may be to activate the massive pile, of mostly unwanted, deposits held in the commercial U.S. banking system. If these could be forced into longer dated TSYs, the great risk-off rotation could be staved off for yet another couple of months.

Tags: commodities,Economics,Emerging Markets,Europe