|

FOREIGN skiers were bound to suffer. So was the Swiss economy, most assumed, after the Swiss National Bank (SNB) suddenly abandoned the Swiss franc’s peg to the euro in January. The franc rose by 30% against the euro in a matter of minutes, and remains about 15% higher than it was. This made Swiss exports more expensive for foreigners, and foreign goods cheaper for the Swiss. That would dent exports and deter tourists, the assumption ran—a particular worry in a country where net exports (ie, exports less imports) make up 12% of GDP. In addition, shopkeepers seemed likely to suffer for another reason, as more Swiss headed across the border into the euro zone to load up on cheap goods. At a vinothèque in Ferney-Voltaire, a French town a short walk from the border, the manager says that the franc’s appreciation has been good for business. Swiss families flocked to Ferney-Voltaire in January to exchange their francs for euros and go on a shopping spree. “Cars were queuing down the road,” he says. Yet the loss of business to the euro zone cannot be all that bad, since consumer spending within Switzerland has continued to grow. And the impact on the country’s trade balance has not been as great as feared: although the Swiss bought more things from abroad, cheaper prices meant overall spending on imports stayed flat. Meanwhile, exports to the euro zone, Switzerland’s biggest trade partner, have not fallen as much as one might expect given the franc’s rise. That is because Switzerland has considerable “pricing power” in much of what it exports, including fancy watches, banking and pharmaceuticals. (There aren’t that many good substitutes for its powdery pistes either.) In any case the euro zone matters less than it once did. In 2005 it took 55% of Switzerland’s exports of goods; these days it takes 44%. And outside the euro zone things are looking better. Exports to Britain and America, against whose currencies the franc has appreciated much less, rose in the first quarter of this year compared with the same period last year. Sales to other markets, including the Middle East, India and South Korea, have also grown. A few industries, such as hotels, are suffering, but overall Swiss exports will increase by 1.5% this year, estimates the KOF Swiss Economic Institute. All this means that in the first quarter of the year net exports fell by just 4% in real terms, year on year. The trade surplus remains near record levels. |

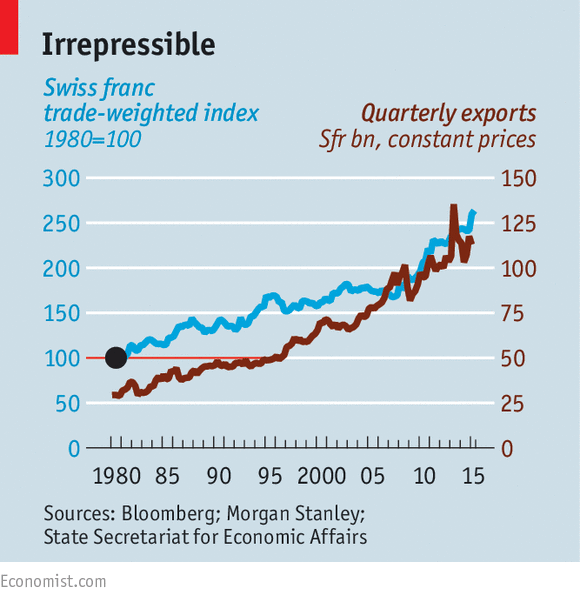

Irrepressible |

Not all is well: the Swiss economy still needs negative interest rates to prevent a further appreciation of the franc. At its last monetary-policy meeting on June 18th the SNB kept them at -0.75%. Yet even though firms can now borrow money without charge, investment remains subdued. The failure to build new factories and hotels must eventually take a toll on exports.

In Switzerland, however, eventually can be a long time coming. Over the past 30 years the franc’s trade-weighted exchange rate has risen by 130%, but exports have grown by 200% in inflation-adjusted terms (see chart). “The Swiss just learn to get better,” as an expat in Geneva puts it.

Full story here Are you the author? Previous post See more for Next postTags: