- We name fourteen macro-economic reasons why Russia is currently the best place for contrarian investments.

- Russia has maybe the world’s best central banker that fights high pay rises with tight monetary policy and potentially with higher unemployment.

- Even if the current situation could trigger a somewhat harder landing; an end to the credit and housing boom is beneficiary for the country. Russian households are finally saving more.

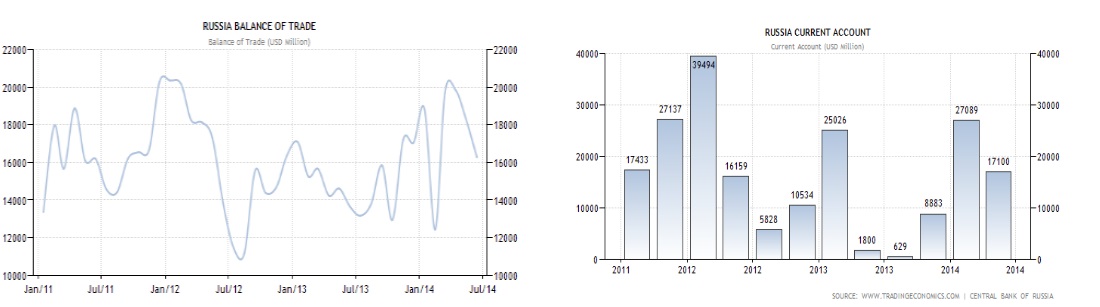

- Thanks to oil and gas sales and slower consumer spending, the Russian current account surplus will continue to be highly positive and prevent a stronger hard landing.

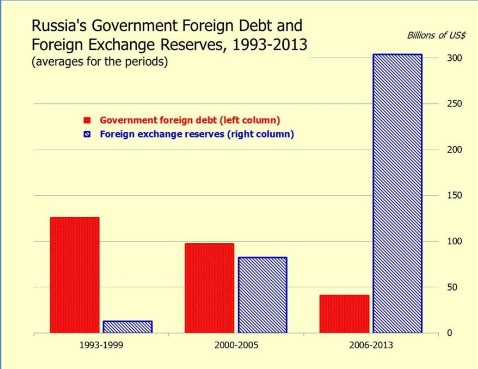

- Russia has low debt and a massive foreign currency reserves that permit to influence the ruble exchange rate.

Update November 2014:

Things got worse since I wrote this paper. Russia is driving into what we called the “somewhat harder landing”.

We recommended government bonds because that harder landing will strongly reduce wage and price inflation. The falling oil price combined with still rising wages, is not good for stocks either. However, obtaining 10% yield per year over a decade while inflation at 4% – as the central banks predicts – is a great deal. We have to see when exactly the 4% target will be achieved and will need to go first into a GDP recession. This is unfortunately not yet the case, Russia still sees GDC growth.

The risk for Russian bonds investments is solely the currency and the rapid depreciation of the ruble. Timing is key here. Strangely for many analysts (and for us), the oil price has fallen further and this had negative effects on the currency.

We expect a certain collapse of the Russian housing market. The first (and typical) reaction to inflation has been a continued strengthening of housing market (ex Moscow) in ruble terms (not in USD terms).

The central bank’s retreat from propping up the ruble highlights the fix the country is in. The authorities’ initial response was to use ample international reserves to counter the impact of sanctions imposed by the West after Russia’s actions in Ukraine. They backed this up by intervening in the foreign-exchange and repo markets, which readily exchange securities for cash, and by raising interest rates. This moderated what would have been more disorderly pressures on the ruble and an even faster loss of confidence. But the subsequent collapse in oil prices and the pickup in capital flight overwhelmed this strategy, forcing the central bank last week to retreat from its policy and fully float the currency. Something will have to give in the next few weeks. The country’s foreign-exchange situation could spin further out of control, at one extreme, or the Russian authorities might respond strongly with a range of fiscal and monetary measures, on the other, including higher interest rates and spending cuts. Either approach would risk depressing economic activity even more in the short run. …” (source)

The Best Contrarian Macro Investment: Russia?

In a recent post we explained that in Western countries, GDP has become a slightly adjusted measurement of consumption but not of production any more. Contrarian macro investors buy bonds or stocks when that country sees low GDP growth caused by austerity and fiscal or monetary tightening. One example were peripheral bonds in 2011/20012.

We also said that austerity and unemployment help to contain wage hikes and therefore increase company margins over the longer term. In another article we explained that gross savings finally determines future wealth and that Chinese wealth will overtake that of the U.S. in the next twenty years.

Looking at Russia, also a country with high savings, we see the optimum conditions for such a contrarian investment.

Risks and reasons for being negative on Russia are:

- Due to low unemployment and the Emerging Markets and the Ukraine crisis, the ruble has fallen by 20% against the dollar compared to February 2013. This has caused high inflation, currently at 7.8%.

- With a high GDP deflator, real GDP will possibly contract this year, triggering some sort of “hard-landing”.

- Companies are not investing. Reasons are the weak ruble, capital outflows, high borrowing rates and rising wage costs.

- FX speculators and bond vigilantes are currently provoking a new round of ruble depreciation and higher Russian bond yields.

On the other side Russian authorities have reacted successfully:

- Russia possesses the maybe best central banker in the world:Elvira Nabiullina. She hiked rates recently to 8% and she will not hesitate to hike even further. She might even provoke the necessary higher unemployment. This measure is needed to stop positive real wages and the anticipating of higher pay checks by credit. Recently real disposable income rose by 5.8%, this is too high in comparison to a rather unchanged oil price.

- Thanks to higher rates, Russian consumers increased their savings and have stopped credit-based spending. The housing boom considerably cooled down.

- The Russian finance minister rejected calls for higher fiscal spending (WSJ).

- The incomes of Russian oil and gas companies (RSX) have strengthened thanks to the combination of financial reporting and most costs being in RUB but continuing incomes in USD. These incomes prevent a sharp hard-landing for the Russian economy.

MOSCOW, July 25 (Reuters) – Russia’s biggest oil producer Rosneft (RNFTF) said its second quarter net income surged by almost five times year-on-year to 172 billion rubles ($4.9 billion), beating analyst forecasts, due to a stronger rouble. (source)

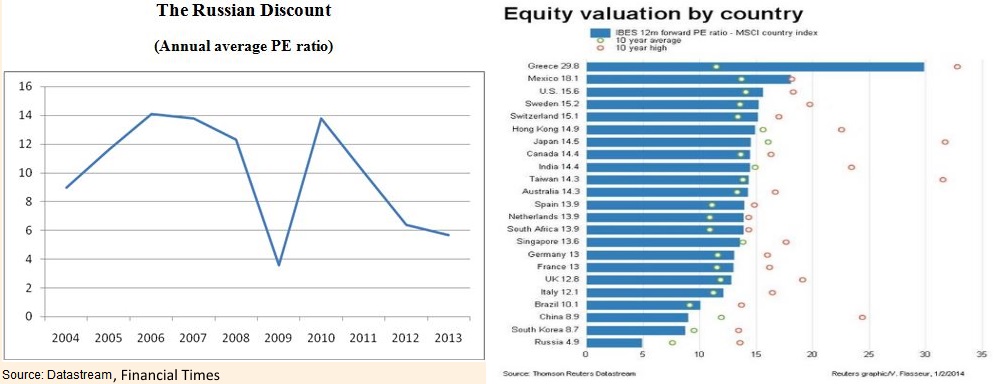

Despite that, price/earnings ratios of Russian companies remain one of the lowest in the world.

The Economist: “Bad governments cost investors a fortune“

5. We reckon that the magazine “The Economist” participates of the Anti-Russian economic war, they often tries to enforce the wishes of the U.S. government via misleading economic suggestions.

As example, it claimed that the reason for the weak price-earnings ratios of around 5.0 for Russian companies is solely mistrust in corporate governance, investor protection and corruption. Instead of showing China and South Korea, the countries that came close to Russia with P/E ratios of 8.7, the Economist presented Argentina, Iran and Zimbabwe, trying to suggest that those have better governments and protection than Russia.

We rather think that as for Russia, China and Korea, investors priced in tight monetary policy and low unemployment, hence future highwage hikes and therefore shrinking company margins.

Moreover, we reckon that buying stocks is rather unpopular among Chinese or Russian wealthy people; those prefer more direct investments like real estate or their own businesses. Stocks are still something for foreigners, but this should change with more wealth distributed to the common population.

Last but not least, the typical contrarian arguments: Cyclicality and fear, Russian P/E ratios have fallen from 14 in 2005 to 4 in 2014, prices have strongly fallen, a similar movement as in China. (see similar mainstream talk about investor protection in the FT).

We wonder if in 2005 or in 2010, at P/E ratios of 14, the Russian government was so much nicer and investors were better protected than they are today.

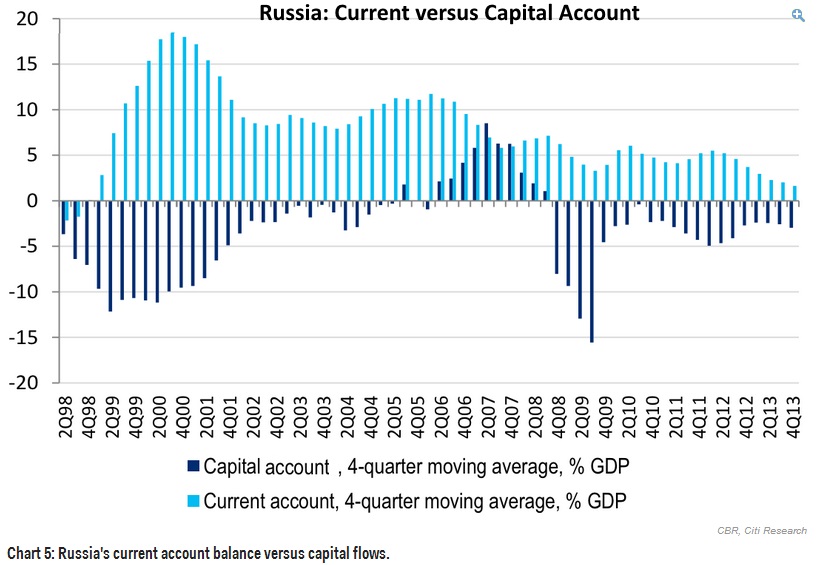

6. The following graph shows the down-trend of the Russian current account to GDP ratio until Q4/2013. This tendency is visible also in the falling CA/GDP ratio in China. Reasons are rising GDP and spending in Russia or China as opposed to austerity, stagnating GDP and higher trade surpluses of their main trading partners, in particular in Europe.

7. But the downturn seems to be stopped. High rates, weaker lending growth and slower spending combined with continued production and sales of commodities in USD has stabilized the Russian trade balance

8. Putin has bound nearly all oligarchs to investments in Russia. A massive capital flight like in the 1990s is not possible any more. Putin managed to neutralize oligarchs like Khodorkovsky (Yukos) or Berezovsky that were trying to expropriate the Russian people from their natural resources. We judge that Russia will not obey the recent decision from The Hague for a renewed expropriation of Russian wealth in favor of former Yukos owners.

9. The Bank of Russia is happy with limited capital outflows, because they weaken the ruble and Russian labor costs in global comparison. But the central bank has massively increased its foreign currency reserves.

10. Due to bond vigilantes and the falling ruble, Russian government bonds are currently cheap at ten year yields near 10%. Another reason is that the Russian insurance industry is still in its infancy. But this should also change in the next decades. Moreover, there is the chance that – similarly as in March/April – the Bank of Russia intervenes and sells dollars in favor of the ruble.

11.  The major risk is that a full-blown trade war could limit oil and gas exports. As opposed to Iran, this is not possible because there is no spare capacity that could replace Russian production. More detailshere.

The major risk is that a full-blown trade war could limit oil and gas exports. As opposed to Iran, this is not possible because there is no spare capacity that could replace Russian production. More detailshere.

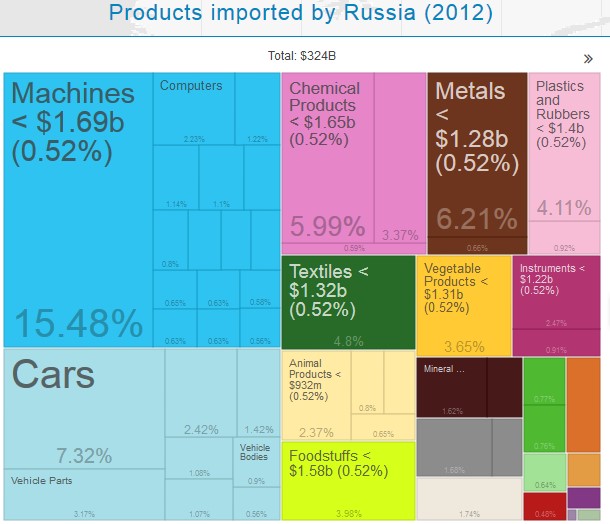

12. The recent embargo on food imports are said to increase inflation. However food stuff is only 0.52% of total Russian imports. Machines, cars, computers and similar goods make up 25% of Russian imports. But a full export stop of these goods to Russia would severely damage Germany and partially the U.S. Hence the whole trade embargo story is for us rather a symbolic act, but in the short term it influences (in particular German) company valuations due to lower capital goods sales into Russia.

13. It is not in the Russian interest to isolate itself economically from the West or to fail on debt payments like Argentina regularly does.

Strangely foreign investors fear totalitarian regimes but they should be more anxious about democracies like India, Brazil or Argentina that allow wages to rise too quickly and company margins to shrink.

Coming back to the introduction:

Russian real GDP might even contract in 2014. However, this implies that thanks to higher savings, it will grow more strongly in the future.

As opposed to Argentina (net saving -21.4%), Greece (-11.4%), Zimbabwe and – I dare to name – the United States (net adjusted saving +2.3%, data World Bank), the Russian net savings rate is currently +24.6%.

Thanks to high savings, Russian foreign debt is low and central bank reserves are high.

Strongly connected with savings are investments. The increase of fixed capital in the U.S. was weak, but strong in Russia for many years. But already two years of weak investments entrained a massive sell-off of Russian stocks.

With high saving rates, Russian wealth has quickly increased in the last 15 years. Even if currently there is some capital flight, and the strong Russian current account surplus exits via the capital account: the owners of this capital are Russian (oligarchs). Most will invest in Russia again, because their skills and knowledge perfectly fits to Russia. Moreover the country offers higher possibilities than our secular stagnation.

Hence, we are not preoccupied that incomes of Russian commodity-centric companies and of the state will contract. In the Maslov hierarchy, transportation is one of the first needs that must be satisfied. China and India have 2.5 billion inhabitants and far too many still do not have a car. Similarly as the Modern Monetary Theory argues in the case of continuing demand for US dollars as reserve currency: long-term rising demand for oil and other commodities paid in US dollar will always support the Russian finances and additionally prevent a strong ruble collapse.

The yield on Russian government bonds is therefore mostly a function of inflation and short-term rates established by the central bank. If the Bank of Russia decides to lower the rate, then bond prices will rise again. With high Russian wealth and saving and at least moderately rising oil prices, there is – as opposed to 1998, no default risk on Russian government bonds.

With rising wealth, slower spending and GDP growth and lower inflation, we see Russian ten-year bond yields fall from 10% to levels of 4% or 5% in the next decade, similarly values as other countries with strong trade surpluses like China, South Korea or Malaysia. This decline of bond yields mirrors the one that Western countries saw in the 1980/1990s with the re-adjustments of purchasing baskets from food/energy/rent towards durable goods and services. That Russian bond yields for 25 years are currently lower than the ones for 10 years, is an early indicator of this great investment opportunity.

Bear in mind the base principle for contrarian investments: Do not expect quick gains, Buy and Hold is the strategy. Until a contrarian investment gets into the money, you might have forgotten this article.

Reference:

See also The Economist Capital-Freeze Index

Tags: Bank of Russia,Bond yield,inflation,investment,wages

1 comments

tobymcguire

2015-02-02 at 06:05 (UTC 2) Link to this comment

I have tried debt management services, and unfortunately these services are very helpful, some people don’t understand but they do have to try.

http://www.debtmanagementplan.us