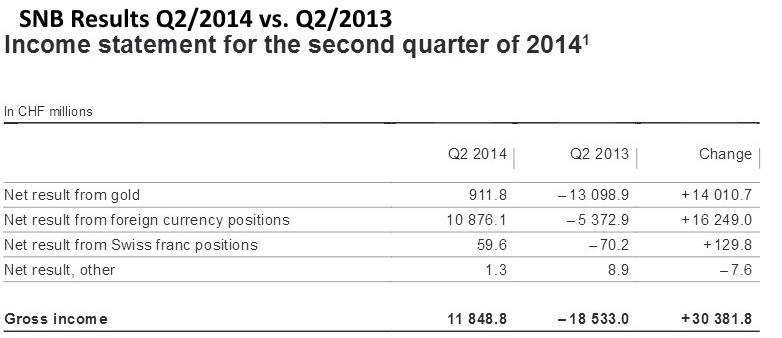

The ECB commitment to a weak euro and the maintenance of ultra-low interest rates, was a nice (temporary) gift for the Swiss National Bank (SNB). The bank earned nearly 12 billion francs in Q2/2014.

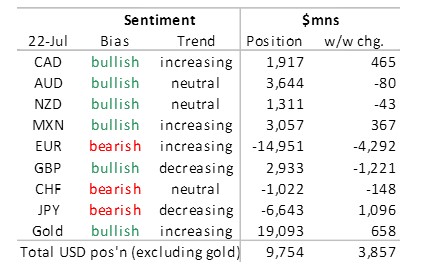

Sight deposits and total SNB debt, however, have been rising again since June. But FX speculators are still driving both EUR and the pegged Swiss franc to new lows against the dollar.

At the same time, low interest rates and falling inflation expectations in the United States have boosted both bond and equity prices upwards. Thanks to slow global growth, even the gold price recovered.

Hence all main four investment categories for the SNB improved in price: currencies, bonds, equities and gold.

We realize that this status is not sustainable over the long term, in particular looking at the rising wage costs (e.g. +3.7% annualized) in Q1/2014 of U.S. companies compared to Swiss ones (+0.8%). Just after we were writing this post, the U.S. employment cost index for Q2 was published at 0.7% for one single quarter.

This makes Swiss stocks a more interesting investment and may explain why sight deposits at the SNB increase.

Sight deposits mirror the movements of the Swiss balance of payments (BOP) and if the capital account is able to neutralize the strong Swiss current account surplus. The most important piece of the capital account are stocks purchases of global investors. Hence rising sight deposits may reflect a higher preference of global investors for Swiss equities compared to foreign stocks based on parameters like profit margins.

We reckon that one day high U.S. inflation without corresponding rate hikes will lead to strong inflows into CHF. But thanks to slow global growth due to monetary tightening in Emerging Markets we are not there yet.

Q2/2013 reflected the fear of inflation and a reduction of cheap money. Q2/2014 was the complete opposite. Investors have understood that in developed economies, money will remain cheap for many years. This changed thinking is visible in the SNB results, in particular in equity and bond positions.

As opposed to 2011/2012, the SNB is not in a hurry to get rid of the currency reserves. Inflation is low and the real estate bubble has calmed thanks to European disinflation.

The full results are available at the SNB.

Here our: SNB Q2/2014 Composition of Reserves and Balance Sheet

Are you the author? Previous post See more for Next postTags: results,Swiss National Bank