We name the main drivers of disinflation and the downwards manipulators of the CPI: Markets, central banks, investors, governments, statisticians, ageing, entrepreneurs, global competition, technology and last but least the euro.But manipulation is only temporary. Inflation is already there just not where you, Americans or Europeans, might live !

Even some Fed researchers agree with the monetarist and Austrian idea that over the long-term inflation correlates with narrow money supply. The research confirms that since 1929 the yearly U.S. GDP deflator was 2.8% and the average growth in excess money at the Fed 2.9%. But the economic reality seems to be different: The ECB could even go for negative deposit rates if inflation remains low. We ask why all this money printing doesn’t create inflation?

The answer is simple: in developed nations only central banks try to create inflation, they want to push inflation upwards, while there are many factors that move it downwards, factors that create disinflation. Inspired by the Argentine CPI manipulation, we call some or all of those movements “manipulation”. Central banks’ money printing does not have a chance against these drivers, against this downwards CPI manipulation.

Currently the “CPI manipulators” create disinflation

There is essentially one component of the CPI (consumer price inflation) that is difficult to manipulate. This is food. The other components of the CPI can be altered easily:

Cheap interest rates from central banks manipulated people to take on high debt. Now those are trying to pay down their debt and reduced consumption. Some debt has been paid back, but there are still years to go.

Cheap interest rates from central banks manipulated people to take on high debt. Now those are trying to pay down their debt and reduced consumption. Some debt has been paid back, but there are still years to go.- Central banks’ intervention often helps to devalue the local currency. The country that prints the most, recently Japan, has the weakest currency and the highest inflation. Countries with central banks that do not manipulate like the euro zone and China obtain disinflation.

The interesting thing in our days is that not the printing creates inflation, but the currency devaluation and higher import prices. This is essentially due to markets strong trust in the central bank. - Markets manipulate equity, oil and commodity prices. In 2011 and 2012 they created inflation, in 2013 and early 2014 disinflation. Oil prices mostly fell due to the market perception of a slowing in Emerging Markets (EM) and global growth. The reason for the EM slowing, however, was excessive inflation.

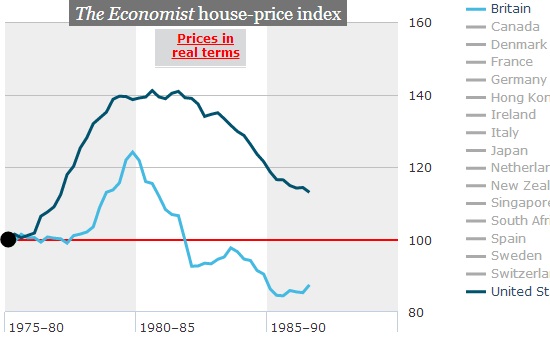

- Investors manipulate home prices. Aided by central banks, e.g. QE3, investors distort home prices. A pity that they want to make profits and that they will sell the homes again in a couple of years, when inflation and higher rates come back.

- Legislators manipulate rents. Their regulation only allows for a certain increase in line with the CPI basket, often far less than home-price-inflation.

Statisticians do different manipulations:

Statisticians do different manipulations:

- In many countries owner-occupied rents are not included in the CPI basket – at least in the U.S. it is included.

- Statisticians replace older technology with a newer one and even t-shirts with newer t-shirts claiming that the old t-shirt or an old iPad 1 costs only 80% when compared to one year ago. The 100% price was in 2012 the iPad2, that had the same price as the iPad1 one year earlier. This is the “hedonic quality adjustment”, visible in the low price increase of apparel, recreation (e.g. TV, media) and communication (here gathered together with education that experienced price rises).

- Statisticians may partially or fully replace an expensive good, lets say beef, from the CPI basket with some thing cheaper e.g. pork, claiming that people do not eat beef any more.We admit that most economists think that the statistical adjustments make sense, while the so-called Shadowstats by John Williams essentially remains on the existing basket without replacements and hedonic adjustments.Central bankers and governments liked the statistical modifications. These “flaws” helped to create higher and higher inflation expectations and to push up government bond yields in the 1970s, while today some central bankers would be happy if these statistical modifications did not exist.

But there are drivers that even John Williams would not call manipulators, but we do here:- Totalitarian or close to totalitarian governments in emerging markets like China, Vietnam, Bangladesh or Indonesia prevent that wages rise too quickly. Thanks to cheap wages, a big part of the world’s goods production is done in these countries. Governments fight riots with oppression like recently in Vietnam or in Bangladesh.

- Western companies invest in the emerging markets in order to profit from lower wage levels and from the oppression of totalitarian governments. They neglected the higher paid employees in their country of origin, resulting in weak investments in Europe, in the United States and even in Germany. From 2008 on these perceived competitiveness issues created high unemployment in Southern Europe and initially in the U.S.

- Entrepreneurs manipulate wages, threatening to sack you because there are so many unemployed in your country and outsourcing possibilities to emerging markets.

- Entrepreneurs manipulate supplier prices. They threaten to replace suppliers with cheaper production from overseas.

- Ageing: In many developed countries, the population is stagnating or even falling. This creates holes in the public pension system, so that many people spend less and save more on their own. Supply issues do not occur (yet), thanks to supply from emerging economies.

- Since 2011, European leaders, and even the ECB participated in the case for deflation and said that pay rises in Southern Europe should remain limited and that labour costs must fall so that these countries can compete with Germany. Similarly as the gold standard, the euro is a dis-inflationary currency.

- Higher excess reserves do not necessary create inflation in the same country. The best example is Fed’s QE2. During the so-called “currency war” the additional US base money incited US funds to move to emerging markets. This created heavy investments, rising wages and inflation in these countries.

- Last but not least, the historically most important one: innovation. Apart from gold, this was the main driver that prevented inflation in our history. Innovation helped to feed more and people without increasing long-term price levels until the end of the 19th century. Often wars caused inflation but this movement was quickly reverted. One current example for technology shale gas in the United States, but this is definitely not a technological game changer, which could be 3D printing.

Central banks create asset price inflation, a wealth effect and reduce productivity

The first four ones are often related to “asset price inflation”, while the other drivers are part of the real economy. The idea of central banks is to create a wealth effect. Via the wealth effect central banks try to persuade consumers to spend and banks to lend, i.e. to move to the real economy. We do not negate that the wealth effect could really help the real economy and help to raise salaries; however it is limited to the United States and to currency manipulators like Japan and Switzerland, countries with low unemployment. Moreover, quantitative easing (EQ) targets real estate prices. For smaller companies, start-ups and most individuals in this world this is a cost factor; QE is hence inflationary; it reduces productivity, destroys innovation, and hampers spending of tenants.

Fortunately there are still the factors above and masses of unemployed that help to contain inflation.

Now you ask yourself why did we have so much inflation in the 1970s?

In the 1970s there was no CPI manipulation

Let’s compare these points with the 1970s, a period of high inflation.

- In the 1970s, central banks did not provide cheap interest rates to finance debt. On the contrary in the 1980s rates were extremely high.

- In the 1970s wage inflation drove the behaviour of central bankers, today central bankers drive asset prince inflation, Japanese central bankers drive imported inflation higher. A quote from Jim Rogers: “Today central bankers are like rock-stars, they were nearly unknown in the 1970s”. Yes, today’s central bankers makes us investors rich.

In 1981, however, a certain Paul Volcker killed commodity and home prices, but he initiated a phase of strong U.S. growth.

In 1981, however, a certain Paul Volcker killed commodity and home prices, but he initiated a phase of strong U.S. growth. - Markets did not have the means to strongly influence oil and commodity prices. They were driven by natural supply and demand. There was no margin debt, there were no cheap credits by central banks that helped to bubble up demand.

- Central banks did not allow for low mortgage rates. While salaries were quickly rising, loans were expensive. Home prices were cheap compared to income.

- Many rent regulation laws did not exist yet.

- As for statistical manipulation:

- Owner-occupied rent was not included in the CPI.

- The hedonic adjustment on the CPI was introduced in the 1990s.

- The U.S. Bureau of Labor Statistics (BLS) introduced the replacements,e.g. pork for beef, in the CPI baskets in 1982. Other countries followed.

- There were no economically strong economies with (quasi) totalitarian governments. Instead the world economy was driven by a wave of “excessive democracy” in the form of social reforms and strong power of labour unions. China and Russia were still in their communist phase and Southern American or India weak as for governance.

- Since WWII, American companies strongly invested in Europe, but finally European wages nearly matched American ones. Therefore American salaries had room to move upwards.

- Workers and unions had far more power than today. Full and even over-employment in Germany and other European nations limited the power of employers.

- In the 1970s we had supply side issues, there was no easy way to find cheaper suppliers like today. Transportation and communication to overseas was far more difficult.

- Ageing issues did not exist yet. Employees required higher salaries with the baby boom. Higher population, higher consumption and higher salaries helped to create a wage-price spiral.

- With the final abolishment of the gold window, there was no anchor like gold or the euro today that created internal devaluation.

- Similar as today, excessive monetary expansion in the United States in the 1970s found its way into Japan, Europe and elsewhere. But, as mentioned under (7) and (8), European countries – apart from Germany and Switzerland – did not help much to maintain global price stability.

- Innovation was limited especially in the late 1970s. The improvements of NC machines in the late 1960s helped to reduce inflation in some countries like Germany or Switzerland.

These forces currently create deflation or at least disinflation, lower inflation figures, while the absence of these forces caused inflation.

Inflation is there, just not where you might live!

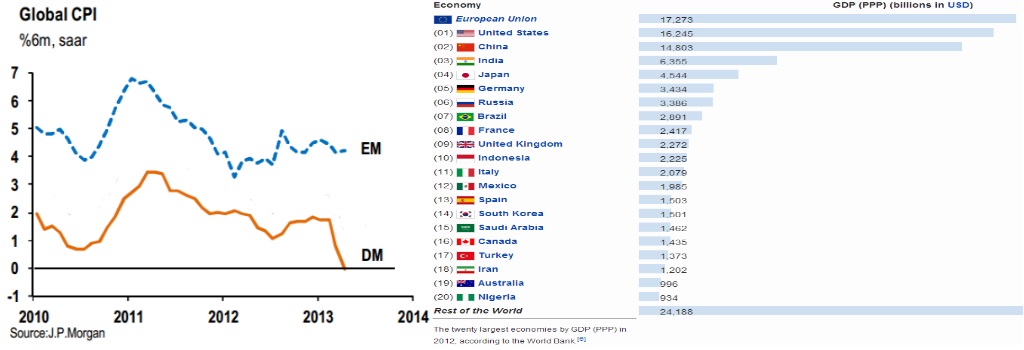

Inflation continues to exist, just not in many developed nations. The following graph from J.P. Morgan shows that inflation is still relatively high in emerging markets, while the fall in energy prices and European austerity had affected the developed nations in 2013. In 2011 the picture was different, 7% inflation in emerging and 3% in developed economies.

Countries like the United States, Japan or most of Europe must improve their competitiveness via a slower rise of wages and inflation. Those weak countries make up only 40% of global GDP, but in the rest of the world inflation remains quite strong.

In 2012 global inflation was around 2.8%, 1.7% in developed and 4% in emerging markets. The 2.8% was higher than the global inflation in the 1950s, during a period when today’s developed economies determined global growth.

Just in 2013 and 2014 we are in a temporary inflation trough in the developed economies, while the figure for emerging markets remains quite high.

CPI per period Germany Switzerland USA Japan France UK Italy

1949-1996 2.8% 3.1% 4.1% 4.4% 5.9% 6.6% 7.0%

1949-1959 1.1% 1.1% 2.1% 2.9% 6.2% 4.3% 2.7%

1960-1972 2.9% 3.7% 2.8% 5.6% 4.4% 4.5% 3.8%

1973-1979 4.9% 4.7% 8.2% 10.1% 10.2% 14.7% 15.5%

1980-1996 2.8% 3.2% 4.7% 2.0% 5.2% 6.1% 8.6%

source1

When and how does inflation come back?

As seen in the past, high inflation figures in the developed world will come back when costs of manufacturing and services between the emerging and the developed world converge again, when ageing will become an issue and supply-side problems will reappear.

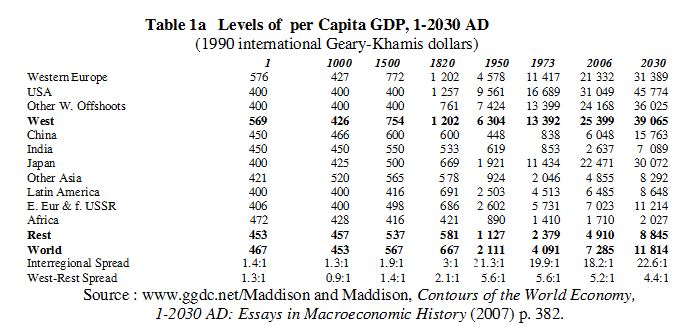

The inflation gap between developed and emerging economies clearly shows that wages and prices are currently converging. The following graph from the Maddison project shows that by the year 2030, incomes in China should rise to around 40% of incomes in the Western hemisphere, compared to 24% in 2006, while the increase for India is from 10% to 18%.

According to Maddison, the gap in capital per GDP between the West and the rest of the world started to increase with the industrial revolution (see below). The period of high Western inflation in the 1970s coincides with the first signs of shrinking in the West-Rest-Spread. Since the Western financial crisis things have accelerated against Maddison’s 2007 paper. Between 2006 and 2010, China and India could increase the GDP per capita by a third and Africa even doubled it. On the other side, the US and Europe have suffered losses since 2006 (source Maddison DB).

The first major Western country where wages are increasing is Germany. German nominal wages are rising by 2-3% per year. In 2013, food prices rose by 5.3% in Germany, while they increased far less but still considerably, by 3.3% in the euro zone.

Inflation as such is not gone. Big wage increases caused inflation in emerging markets to rise, while they needed high central bank interest rates and an economic slowing in 2012/2013.

Examples are:

Argentina’s inflation dilemma

High food prices and sticky inflation in FY13 [in India]

High inflation and strong currency kill the Brazilian economy

Unemployment rates will fall

We will not see hyper-inflation caused by money printing in the next years, this seems to be clear. High unemployment will enforce continuing low pay rises in the U.S. and most Western economies over some years. We judge that once unemployment is reduced, then inflation will come back, even to Western economies.

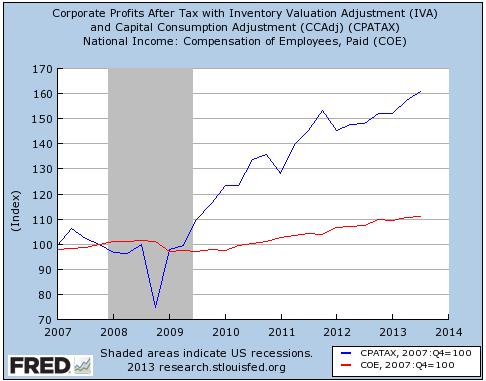

Massive increases of corporate profits compared to wages, point to lower and lower unemployment rates. Companies will not always be able to distribute profits only to share holders but not to employees. Once wages rise, inflation will increase, too.

Same as the gold price, inflation will surely come back (everywhere). It just needs some time to bridge the competitiveness gap between the U.S. and most parts of Europe on one side and the Emerging Markets on the other.

- Geldwertstabilität: Bedrohung und Bewährung, in: Deutsche Bundesbank, Fünfzig Jahre Deutsche Mark – Notenbank und Währung seit 1948, München 1998, 309- 346. [↩]