Post Originally written in May 2013, some updates to winter 2014/2015

In early 2013 it was possible that EUR/CHF appreciated to 1.30.

Our argument was that the rise to 1.30 had to happen quickly before Swiss inflation goes up and SNB exits the cap and hikes rates one day.

UPDATE Winter 2014/2015:

Falling oil and gas prices fueled risk appetite in the United States. WTI prices fell to 55$, US gasoline to 2.70$, nearly one dollar less than one year ago. As usual cheap oil strengthened the dollar; it weakened the oil- and gold -correlated Swiss franc, but even more the risk-on currencies RUB, BRL, AUD, NZD and CAD.

German wages are rising strongly, income for wage earners were up 3.6% YoY according to the Q3 GDP release, German wages are up above 2% for Eurostat., Swiss wages increased only 0.8%. This development is positive for the inflation hedge CHF. Thanks to cheap oil, US manufacturing indices strongly improved. This opposes our analysis below, which is written during a period of higher oil prices. Oil prices lowered inflation in Europe, for us only temporarily until German wages will drive European inflation.

UPDATE July 19, 2013:

Excessive price increases in Crude oil, 108$ during the U.S. driving season instead 92$ in winter. This drove upwards the U.S. producer prices to +2.5% and consumer prices to +1.8% y/y. This seasonal oil movement sustained both CHF and gold.

The Drivers of CHF

In early 2013, Swiss franc continued to weaken. It seemed possible that the EUR/CHF might top close to 1.30. We judged that the franc should slowly improve again after that because it will become a sort of risk-on currency and finally also an inflation hedge.

As basis you should understand that the Swiss franc has four main drivers:

- Safe-haven against the European debt crisis due to strong Swiss ties with Germany. Often the FX algos associate fundamental data for Germany with the Swiss Franc. In times of strong German growth and inflation fears, CHF is also an inflation hedge for German investors.

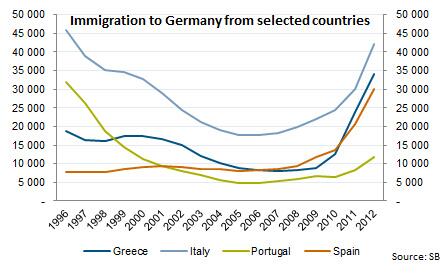

- Stronger long-term growth potential thanks to immigration and a brain-drain from other European countries to Switzerland, and a strong housing market.

- Proxy for the strength of the Chinese and other emerging markets, similar to gold and the Aussie, via foreign profits of Swiss multi-nationals and via the correlation to the German economy and its exporters to China.

- Anti US dollar investment thanks to the wealth of Swiss firms and investors and low inflation. Exactly in this case, CHF becomes a global inflation hedge, similar to gold.

Point 2 and 3 speak for risk-on currency, argument 1 most often is a safe-haven but it is not when Germany sees strong growth. Point 4 becomes important in particular when US wages rise too quickly.

Bear in mind that many Swiss exports are high-quality and luxury, the Swiss economy can only have a “quantity of sales” problem. Best customers of Swiss companies, no matter if banks, watch producers, touristic or pharmaceuticals are wealthy clients often from emerging markets. Price or FX rate does not matter.

The reasons why EUR/CHF might touch 1.30

Originally written in May 2013

- Excessive optimism and risk appetite in the United States thanks to the Fed’s support of the housing market in QE3 via mortgage-backed securities (MBS).

- A side effect of the Fed’s MBS purchases is the “spectacular reduction of the US deficit” thanks to the falling liabilities of Fanny Mae and Freddy Mac and higher corporate tax receipts.

- Simple equivalence:

- Thanks to the Washington Consensus-style implementation of harsh austerity, Fitch upgraded the Greek rating. Other rating upgrades might follow.

- Massive improvements in the euro zone trade balances thanks to US and Asian spending and European austerity.

- This year’s Sell in May effect is only visible in the weaker Aussie dollar, but not in stocks. This is exceptional and a one-off movement: China, other emerging markets and Germany are weaker due to lower exports to the austerity-hit Europe and stronger competition from Japanese firms due to the (one-off) yen depreciation. Weak oil prices and low inflation helped stocks to achieve all-time highs.

- Year on year improvements in the Non-Manufacturing ISM index. Thanks to its services and construction components this index is not hampered by the strong dollar (in June: EUR/USD 1.27)

The reasons why EUR/CHF should slowly weaken from the moment it touches 1.30

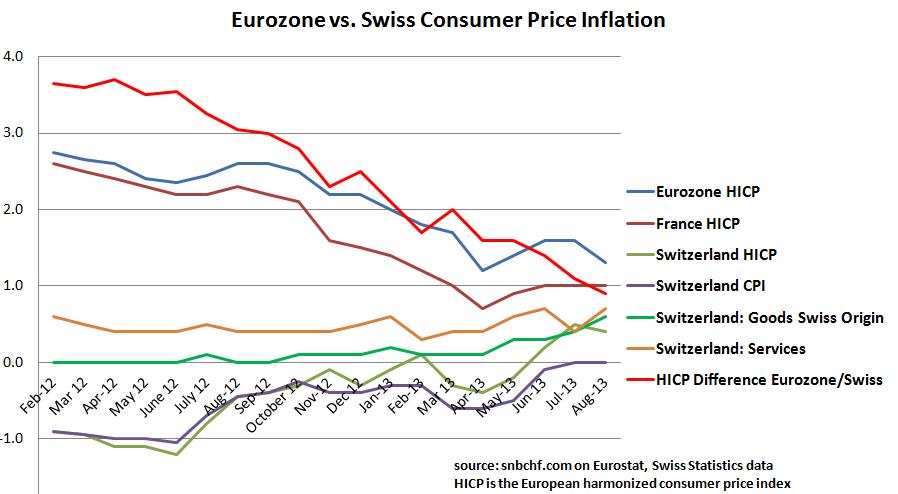

- Inflation differences between the Euro zone and Switzerland will narrow. Due to falling or stagnating wages in the Southern euro zone, the gap has narrowed from 4% to 1.7% in one year, the HICP difference to France or Italy is 1.4%. This movement will continue.

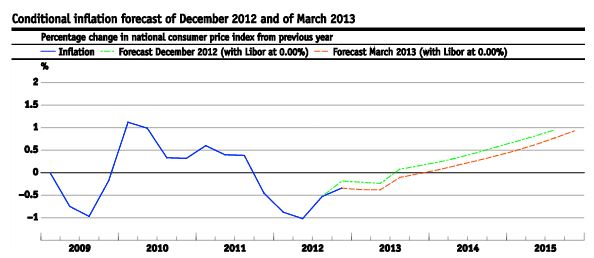

- Once EUR/CHF touches the area of 1.28 to 1.30; the Swiss CPI will incorporate most FX changes two months later through a 27% import share. Then Swiss inflation could be higher than the SNB inflation path, so that the bank might need to exit the floor and potentially hike rates well ahead Fed and ECB. When exactly depends on the speed of the global recovery; we think that it won’t happen in the next five years.

- Current U.S. growth is mostly based on Fed-induced spending and investments, while they are reduced in the Euro zone (including Germany!) – see gross private investment below. New US Jobs followed spending and investments. This is extended by capital movement from East to West, which might reverse, once the fear factor is reduced. Chinese foreign direct investments (FDIs) are already positive after one year of outflows, Chinese gross fixed capital formation is over the 18% target growth.

- At the latest with the 2014 “Sell in May”, the dollar – and probably stocks – should weaken again, and the Swiss franc will be stronger.

We currently see a continued weakening of US industrial production due to the strong dollar, visible in the weak ISM Manufacturing data above. (while thanks to Abe, Japan sees good consumer spending and a export-friendly favorable yen FX rate)

We currently see a continued weakening of US industrial production due to the strong dollar, visible in the weak ISM Manufacturing data above. (while thanks to Abe, Japan sees good consumer spending and a export-friendly favorable yen FX rate)- Historical examples (e.g. Latin America) show that Washington Consensus compromises trigger a strong first/second year performance, because austerity only helps at first. Spreads initially come down and rating agencies

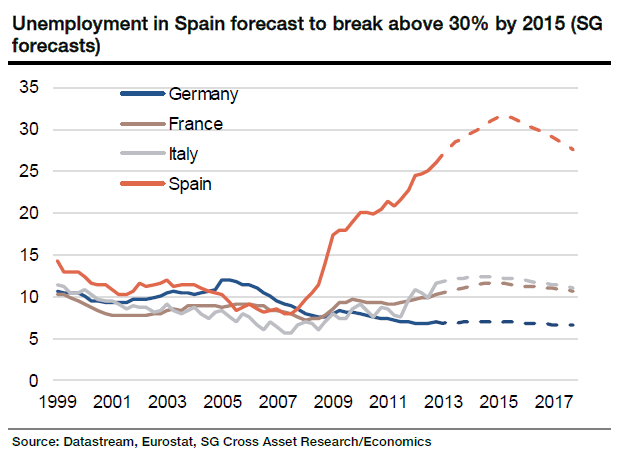

upgrade the concerned countries. This is exactly what happened to Greece. However, due to emigration, low spending and underwater-mortgages, Greek, Spanish and Portuguese growth will be hampered for many more years .

upgrade the concerned countries. This is exactly what happened to Greece. However, due to emigration, low spending and underwater-mortgages, Greek, Spanish and Portuguese growth will be hampered for many more years . - SNB sight deposits are still stable. This is the possibility that the bank is not able to sell nearly any FX reserves. The SNB balance sheet seems to be well alimented by profit repatriations and new Swiss investors’ cash savings.

- The very important Swiss private investors seem to prefer to keep cash or buy Swiss stocks and houses; they do not buy European investments. The Swiss stock market is near all-time highs and according to UBS, Swiss real estate is in a risk zone.

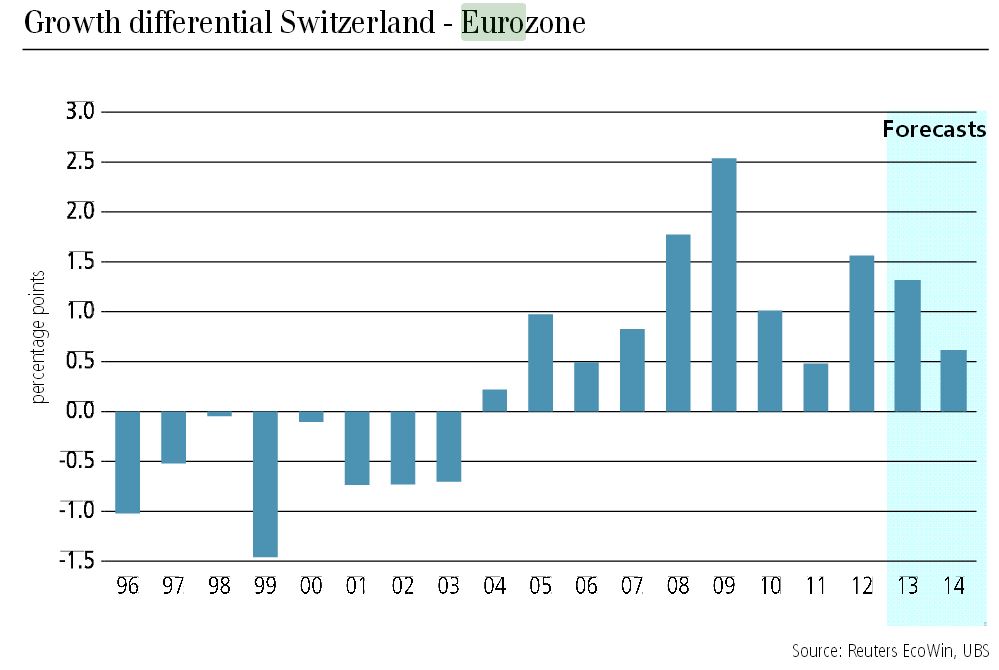

At the latest from May 2014 on, the EUR/CHF should not rise over 1.30 again, because inflation rates might be similar in the euro zone and in Switzerland, just that Swiss GDP growth and in particular Swiss construction activity will be higher over many years.

Already in 2004 the Swiss economy was stronger than the euro zone, but the currency continued to weaken until 2007

It is crucial that EUR/CHF hits 1.30 as soon as possible. With time, the inflation difference will further shrink. Any back-drop in risk-aversion, a potential Sell in May effect still in 2013, will lower this upper bound.

SNB acts as hedge fund and not as central bank

The SNB might sell some of her reserves till the end of 2013. In a couple of years, however, the bank might be forced to sell euros around 1.20 or even lower due to inflation pressures. In the meantime the bank must earn income to prevent future losses. Therefore it acts like a hedge funds and invests cyclically and not like a central bank that acts rather counter-cyclically. An example are the strong equity purchases in 2012/2013 and the reduction of the bond share already in 2012.

Investment recommendation (May 2013)

Day traders:

In the upcoming month, any fundamental data event related to US manufacturing should be rather negative for the US dollar, any event related to housing or sentiment rather positive for the dollar.

Pay attention to Fed kakophonia that range from reducing QE3 (hawk Plosser) to even lower and exceptionally low rates for 5-10 years (the usually hawkish, but now rather dovish Kocherlakota). The Fed should see that stronger growth happens where the “hot money” is flowing to.

Until recently the target has been the United States. If, however, the US does not exhibit better growth figures, then these funds will move away to Germany or the emerging markets that have more sustainable growth thanks to current account surpluses, rising incomes and thanks a low wages still a competitive advantage against the U.S.

See more for

3 comments

Joe

2013-05-22 at 20:56 (UTC 2) Link to this comment

CHF will go up like a rocket. 1.6 to 1.7 is possible in the next few months.

DorganG

2013-05-23 at 06:05 (UTC 2) Link to this comment

No, FX is not that easy. With 27% import share, 1.60 or 1.70 implies Swiss inflation will

rise to 10% this and 15% next year, SNB will hike rates and CHF will be a

investment currency of the carry trade.

I picked the 1.30 level because it will equalize Swiss rising internal

inflation and Eurozone falling internal inflation over the next year.

Over the longer term this also implies that central bank rates will be

nearly equal, which again means that EUR/CHF will slowly fall.

trader

2013-06-04 at 00:11 (UTC 2) Link to this comment

Is there any chance that SNB would follow BOJ and just depreciate

currency big time, ignoring inflation – if only to shake confidence of

inflows and to restart outflows?

Otherwise it seems they will be

cornered and then game is lost. If CHF appreciated to near or at parity again

it could blow whole economy because… as you should know everyone was

fleeing back then to buy for so much cheaper behind borders – and in

switzerland borders are *very close* from all directions. I would like

to hear your opinion on that Mr. Dorgan(and thanks for excellent

articles btw.).best regards