Update September 2014:

For a longer time the SNB was able to maintain the floor against the EUR. While Swiss wages are rising by 0.7% per hour, but American and German hourly wages are up by more than 2% y/y. Taking account of falling unemployment, U.S. firms are now ready to pay a total wage increase of 7.5% annualized in Q1 and 5.8% in Q2. Costs for U.S. companies are increasing, but not really for Swiss ones. The question is now if this will translate into inflation, or if the global economic slowing will depress inflation also in the U.S.

In Q1/2014 CHF appreciated more than SNB was able to achieve in seigniorage. In Q2/2014, the bank obtained good results with the rising dollar thanks to Draghi’s euro bashing. The 2013 SNB results were even negative due to the falling gold price.

The following analysis gives a longer term picture.

Will SNB FX Investments Yield Enough Until U.S. Inflation Starts?

(written in April 2013)

We focus on income and yields for foreign exchange positions and gold in order to see if the SNB is able to survive a franc appreciation during an inflationary period in the U.S. and Europe.

We focus on income and yields for foreign exchange positions and gold in order to see if the SNB is able to survive a franc appreciation during an inflationary period in the U.S. and Europe.

These consideration will help us to see if the EUR/CHF floor is sustainable and if the Swiss might even achieve a gain on their investments.

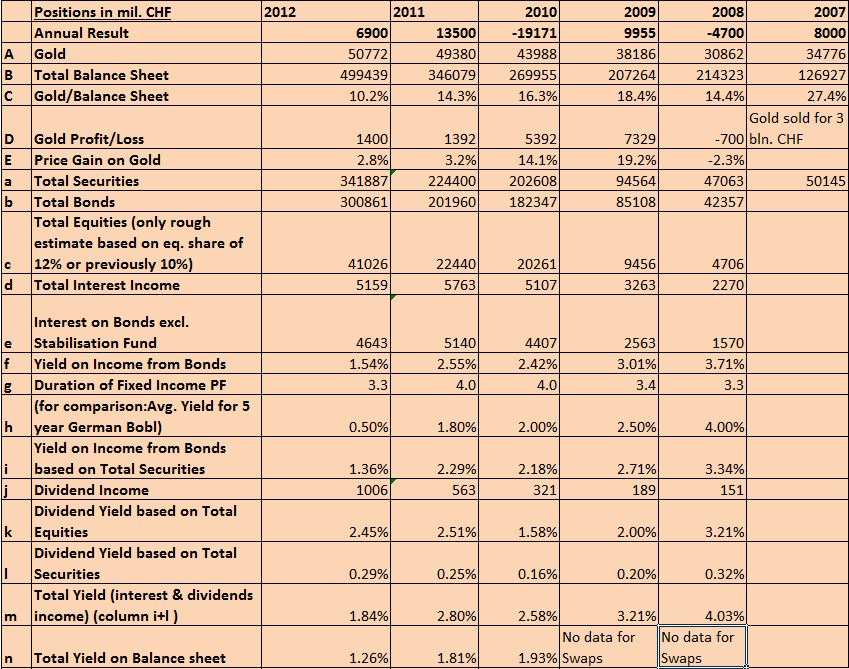

- In 2012 the SNB obtained its last gain on gold, while the central bank left the quantity of bullion unchanged. The gain was 2.9%. The share of gold against Fiat money has fallen from 27% in 2007 to 10%.

- The SNB lost in particular on yen positions, value -12.7% and on dollar positions, -2.7% (we spoke about this when the first ad-hoc news came in January).

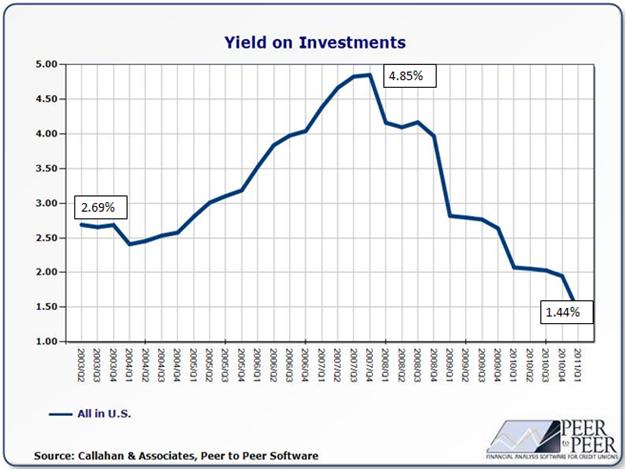

- Despite the low interest environment, the SNB obtained an income of 5.644 bln. CHF on FX positions excluding the stabilisation fund, which is for our longer-term analysis not interesting. The interest yield is about 1.54% on bond positions, which are around 300 bln. CHF.

- This yield is astonishingly far higher than current yields of the major SNB holdings (e.g. 5 year German BOBL or US treasuries, the current duration is 3.3 years). Other assets (e.g. Italian, Spanish or Portuguese bonds) valued around 15 bln. CHF. They might have contributed to over 1 billion CHF with their higher yields. Moreover, the Swiss hold 6% in corporate bonds and some older and/or longer government bond issuances that should yield more.

- Cash positions at other (central) banks with 85 bln. CHF, 17% of the SNB balance sheet, do not earn interest. The unusually high portion of cash let suspect that the central bank wants to buy equities and/or bonds at cheaper prices.

- The dividend income on the 40 bln. CHF equity investments (12% of the SNB positions) was around 1 bln. CHF, a dividend yield of 2.45%.

- Adding up interest income and dividend income one obtains a total yield of 1.84%, which is around 1% less than in 2011. Since the SNB needs to replace redeemed bonds with bonds with higher yields, it can be expected that income on the SNB portfolio falls further.

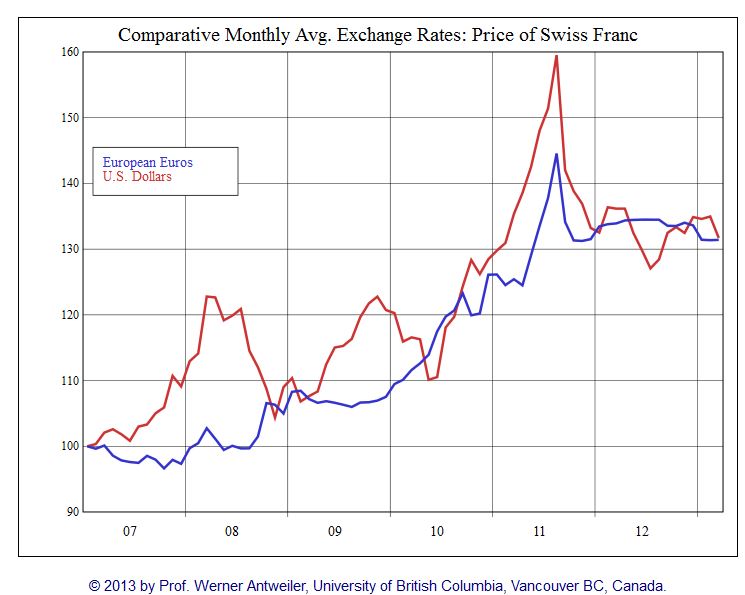

Only with a huge balance sheet expansion, the SNB managed to handle the 32% appreciation of the franc from 2007 against both the dollar and the euro. In 2007 the franc was undervalued against the euro with a EUR/CHF rate of 1.68. While the EUR/CHF fell to 1.50 in 2009, the SNB suffered already first losses due its early interventions against a still undervalued franc. Due to strong growth and some inflation signs, the SNB accepted the euro to fall to 1.24 by end 2010. Since 2010, the currency rose strongly against both euro and dollar, because it was stopped at 1.20 by the central bank. Most recently the EUR/CHF appreciated to its 2010 level of 1.24 again.

Our analysis shows that yields on investment are falling more and more, the not invested cash additionally reduces SNB profitability. If inflation rises again, then both SNB bond and stock positions could fall in price.

We suspect that future (limited) global growth will be driven by the United States, China and Germany (and with it also Switzerland), but a lot less than previously by other emerging markets (reasons forthcoming, one example here). Therefore we are pessimistic also for the gold price.

Apart from weak yields, this will lead to losses in all three types of SNB positions and answer the question why the central bank holds so much cash.

If however, there is a strong improvement for the American economy that triggers a rate hike in 2014 or 2015, then the Swiss franc could depreciate against euro and dollar. As it did after 1982 thanks to the Volcker moment.

The Fed’s policy with unlimited QE3, let us doubt very strongly that the U.S.will recover strongly as it did after 1982.

Given the current risk-on environment, the floor seems to be sustainable, but it will be in a future inflationary scenario?

See more for

1 ping

Jordan’s “Does the SNB need equity?”, an assault on the Swiss constitution? - Central-Banks

2017-05-05 at 16:31 (UTC 2) Link to this comment

[…] debt.Effectively Meyer seems to be right: The euro lost 6% per year on average since 2008, but SNB’s yield on investment is under 1.5%. This implies that debt (or FX losses) rise far more quickly than foreign assets can […]