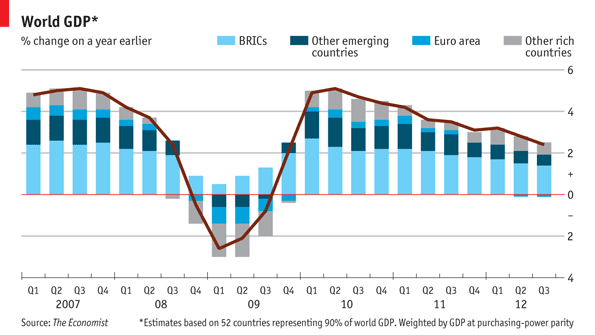

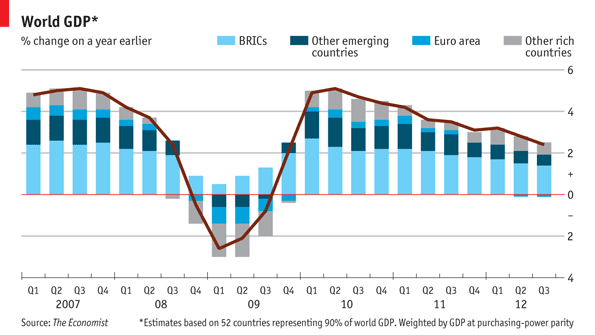

The U.S. economy regularly improves between October and April, in 2012/2013 additionally fueled by "indefinite" quantitative easing, weaker gas prices and higher competitiveness thanks to a stronger Chinese yuan and weaker Asian economies.

You might read the

"the Sell in May, Come Back in October" effect in more details first.

The "Get Stress in May and Relax in October" effect on the other side of the Atlantic

On the other side of the Atlantic a similar procedure repeats every year: Thanks to the good mood in the US economy, US orders to Swiss exporters (+22%) and

German ones rose in 2012 and Swiss consumers kept on spending. The Swiss economy kept on running close to

full employment and the closely related German unemployment beat record lows in 2012 and will be close to those levels in 2013.

Notwithstanding the complaints of the Swiss exporters and tourism industry about the strong franc, the Swiss trade balance is still strongly positive and foreign tourists to Switzerland increased

their spending in 2011, and costs for Swiss firms decreased sharply thanks to cheap imports from the euro zone. Consequently the Swiss GDP rose more strongly than the U.S. GDP despite the fact that US GDP growth must be higher than the Swiss one when the strong US birth/death effect is taken into account.

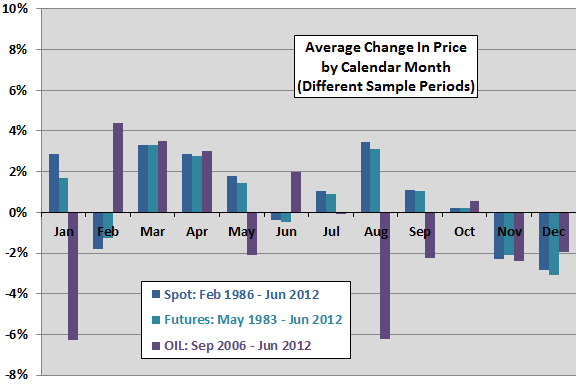

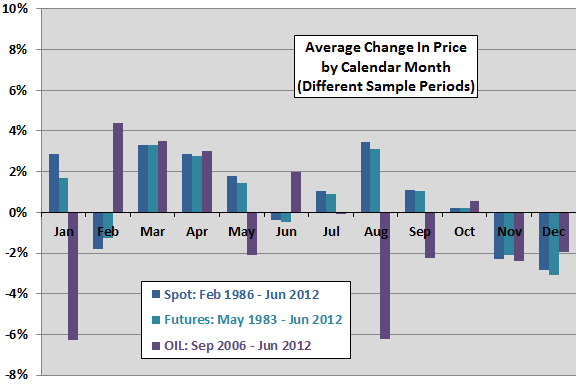

Global growth, oil and gas prices see strong increases in February and March (at least since 2006), which hampers U.S. improvements. Higher prices and the previous U.S. growth increases Swiss inflation in spring.

[caption id="attachment_7236" align="aligncenter" width="576"]

Average Price Change in Crude Oil per Month (

source)[/caption]

As soon as American investors see the bad US data, they look to different directions and realize that there are some other safe-havens, not only the US dollar. And Swiss inflation rises in

The history of the "May to September" effect on the Swiss franc

This is the way history repeats during the weak US months May to September on the other side of the Atlantic:

- Between March and June 2009, the SNB managed to maintain the 1.50 EUR/CHF "line in sand" only thanks to intensive FX intervention.

- Same picture in May 2010: Strong demand for the Swiss franc, even multiplied by the first Greek crisis. The EUR/CHF fell to 1.40. When the SNB had abandoned the FX interventions the Swiss franc even reached parity with the dollar and EUR/CHF 1.30 in September 2010.

- After the typical US rebound in Q4/2010, the swissie soared again. Like regular it reached a first peak in May 2011 up to a EUR/CHF 1.22 and a USD/CHF of 0.83. Then the increase of the Swiss currency even accelerated to reach EUR/CHF of 1.0076 and USD/CHF 0.71 in August 2011.

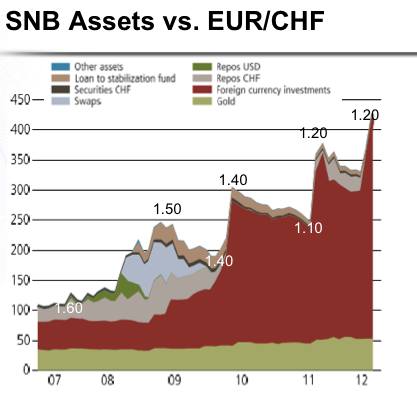

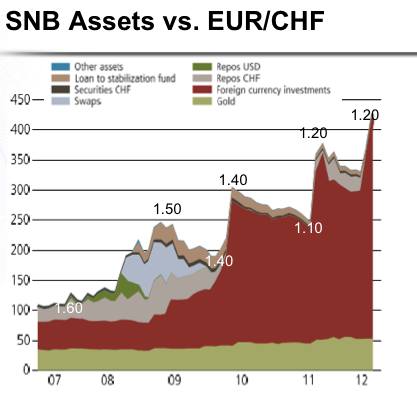

[caption id="attachment_8955" align="aligncenter" width="400"]

SNB Reserves vs. EUR/CHF (G. Dorgan based on

UBS)[/caption]

The SNB knows about this "May to September" effect and timed the

epic introduction of the EUR/CHF floor of 1.20 slightly before the yearly rebound of the US economy and not in the months of July and August 2011, when the franc was hovering between 1.00 and 1.15.

Similarly, the central bank used the positive US months between October 2011 and April 2012 to cut its heavily overloaded balance sheet by around

17% of the currency reserves and sold Euros

deceiving many forex traders that were hoping on a hike of the floor. Unfortunately reserves rose again by 40% after that.

The SNB must sell some reserves

In January 2013, the EUR/CHF appreciated thanks to these seasonal effects and strong risk appetite of FX traders and some hedge funds. The Swiss are hoping that the higher EUR/CHF exchange rate will effectively translate into smaller sight deposits. They hope that this is not a temporary, but a sustainable movement that incites even ordinary investors to go out of the franc, with the consequence that sight deposits fall.

Only then will the SNB be able to get rid of some reserves and reduce the unsterilized money supply. Many people think that the SNB will be able to live forever with the huge amount of reserves, but this is impossible.

For us, the SNB must reduce reserves, for six reasons:

- The big money supply will move Swiss real estate prices upwards and cause Swiss inflation to rise. More about Swiss inflation here.

- Sterilization was easy between 2010 and 2011, investors were keen on the close to zero yielding SNB bills, as Dewet Moser of the SNB proudly explained. But he did not mention that these measures were accompanied by big SNB losses and a depreciation of the EUR/CHF from 1.40 to 1.10.

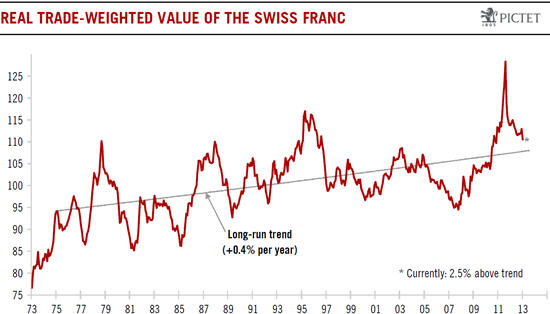

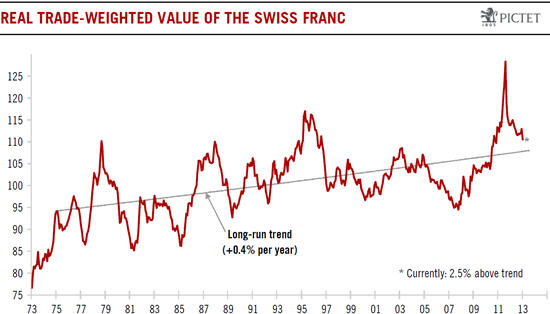

- The Swiss franc is at euro prices of 1.24 even undervalued, see purchasing power parity and real effective exchange rate.

- Given that the Swiss have structural advantages like a high level of human capital especially after the Swiss/EU bilateral agreements, high availability of capital and low taxes, the franc must appreciate over time. This is reflected in the interest rate parity. According Pictet, in the long-term the franc rose 0.4% per year against its trading partners with their higher inflation rates. Immigration to Switzerland will add another 0.2%.

The gap between rising real estate prices in Switzerland and falling prices in the periphery and in France, will boost consumer confidence and lead to stronger Swiss spending and GDP growth; for us another 0.4% over the next years, a total of 1%. We call this 1% the "required yield".

The gap between rising real estate prices in Switzerland and falling prices in the periphery and in France, will boost consumer confidence and lead to stronger Swiss spending and GDP growth; for us another 0.4% over the next years, a total of 1%. We call this 1% the "required yield".

- We computed a annualized yield of 1.8% for SNB investments for Q3/2012 based on coupon and dividend payments. As we all know, government bond yields have arrived at the "zero border". This 0.49% is far under the required yield of 1% and pushes central banks, the same as insurers, into risky investments. The SNB increased equity holdings to 12% despite the slowing global growth and rising wages in many developed economies, that might pave the way for future inflation and reduce company margins.

Higher reserves can push the obtained yield even further down, because higher yielding older investments (e.g. U.S. treasuries bought in 2007) are replaced with lower yielding ones (e.g. treasuries bought in 2012).

Higher reserves can push the obtained yield even further down, because higher yielding older investments (e.g. U.S. treasuries bought in 2007) are replaced with lower yielding ones (e.g. treasuries bought in 2012).

- Last but not least, it is worth mentioning, that Swiss investors see no better place than Switzerland, given that global and Swiss growth perspectives do not divert that much - as opposed to the period between the year 2000 and 2007. And Swiss real estate seems to be a far safer place than the U.S., the euro zone or the emerging markets. So why exporting the francs? It is better to repatriate the profits.

The difference between required and obtained yield will be covered by the Swiss cantons, translating into future Swiss tax increases, because a central bank cannot go bankrupt. One day, the SNB will obey its principle of price stability, fight inflation with a stronger franc, give up the floor and accept huge losses.

If, however, the SNB buys francs and sells euros, the exchange rate will come soon back to levels close to 1.20, at the latest in May.

George Dorgan (penname) predicted the end of the EUR/CHF peg at the CFA Society and at many occasions on SeekingAlpha.com and on this blog. Several Swiss and international financial advisors support the site. These firms aim to deliver independent advice from the often misleading mainstream of banks and asset managers.

George is FinTech entrepreneur, financial author and alternative economist. He speak seven languages fluently.

See more for 1) SNB and CHF

Average Price Change in Crude Oil per Month (source)[/caption]

As soon as American investors see the bad US data, they look to different directions and realize that there are some other safe-havens, not only the US dollar. And Swiss inflation rises in

Average Price Change in Crude Oil per Month (source)[/caption]

As soon as American investors see the bad US data, they look to different directions and realize that there are some other safe-havens, not only the US dollar. And Swiss inflation rises in

SNB Reserves vs. EUR/CHF (G. Dorgan based on UBS)[/caption]

The SNB knows about this "May to September" effect and timed the epic introduction of the EUR/CHF floor of 1.20 slightly before the yearly rebound of the US economy and not in the months of July and August 2011, when the franc was hovering between 1.00 and 1.15.

Similarly, the central bank used the positive US months between October 2011 and April 2012 to cut its heavily overloaded balance sheet by around 17% of the currency reserves and sold Euros deceiving many forex traders that were hoping on a hike of the floor. Unfortunately reserves rose again by 40% after that.

SNB Reserves vs. EUR/CHF (G. Dorgan based on UBS)[/caption]

The SNB knows about this "May to September" effect and timed the epic introduction of the EUR/CHF floor of 1.20 slightly before the yearly rebound of the US economy and not in the months of July and August 2011, when the franc was hovering between 1.00 and 1.15.

Similarly, the central bank used the positive US months between October 2011 and April 2012 to cut its heavily overloaded balance sheet by around 17% of the currency reserves and sold Euros deceiving many forex traders that were hoping on a hike of the floor. Unfortunately reserves rose again by 40% after that.

The gap between rising real estate prices in Switzerland and falling prices in the periphery and in France, will boost consumer confidence and lead to stronger Swiss spending and GDP growth; for us another 0.4% over the next years, a total of 1%. We call this 1% the "required yield".

The gap between rising real estate prices in Switzerland and falling prices in the periphery and in France, will boost consumer confidence and lead to stronger Swiss spending and GDP growth; for us another 0.4% over the next years, a total of 1%. We call this 1% the "required yield". Higher reserves can push the obtained yield even further down, because higher yielding older investments (e.g. U.S. treasuries bought in 2007) are replaced with lower yielding ones (e.g. treasuries bought in 2012).

Higher reserves can push the obtained yield even further down, because higher yielding older investments (e.g. U.S. treasuries bought in 2007) are replaced with lower yielding ones (e.g. treasuries bought in 2012).