Brazil’s finance minister coined the term “currency wars” in 2010 to describe how the Federal Reserve’s quantitative easing was pushing up other countries’ currencies. Headline writers and policy makers have resurrected the phrase to describe the Japanese government and central bank’s pursuit of a much more aggressive monetary policy, motivated in part by the strength of the yen.

The clear implication of the term “war” is that these policies are zero-sum games: America and Japan are trying to push down their currencies to boost exports and limit imports, and thereby divert demand from their trading partners to themselves. Currency warriors regularly invoke the 1930s as a cautionary tale. In their retelling, countries that abandoned the gold standard enjoyed a de facto devaluation, luring others into beggar-thy-neighbor devaluations that sucked the world into vortex of protectionism and economic self-destruction.

But as our leader this week argues, this story fundamentally misrepresents what is going on now, and as I will argue below, what went on in the 1930s. To understand why, consider how monetary policy influences the trade balance and the exchange rate.

Typically, a central bank eases by lowering the short-term interest rate. When that rate is stuck at zero, it can buy bonds, i.e. conduct quantitative easing (QE), or verbally commit to keep the short rate low for longer, or it can raise expected inflation. All these conventional and unconventional actions work the same way: by lowering the real (inflation-adjusted) interest rate, they stimulate domestic demand and consumption. America, Britain and Japan are all doing this, although only Japan has explicitly sought to raise expected inflation; America and Britain have done so implicitly. This pushes the exchange rate down in two ways. First, a lower interest rate reduces a currency’s relative expected return, so it has to cheapen until expected future appreciation overcomes the unfavorable interest rate differential. This boosts exports and depresses imports, raising the trade balance. Second, higher inflation reduces a currency’s real value and thus ought to lead to depreciation. But higher inflation also erodes the competitive benefit of the lower exchange rate, offsetting any positive impact on trade.

If this were the end of the story, the currency warriors would have a point. But it isn’t. The whole point of lowering real interest rates is to stimulate consumption and investment which ordinarily leads to higher, not lower, imports. If this is done in conjunction with looser fiscal policy (as is now the case in Japan), the boost to imports is even stronger. Thus, QE’s impact on its trading partners may be positive or negative; it depends on a country’s trade intensity, the substitutability between its and its competitors’ products, and how sensitive domestic demand is to lower rates. The point is that this is not a zero sum game; QE raises a country’s GDP by more than any improvement in the trade balance.

There are other spillovers. Lower interest rates in one country will generally tend to send investors searching for better returns in another, lowering that country’s interest rates and raising its asset prices. By loosening foreign monetary conditions, that boosts growth, though this may not be welcome if those countries are already battling excess demand and inflation.

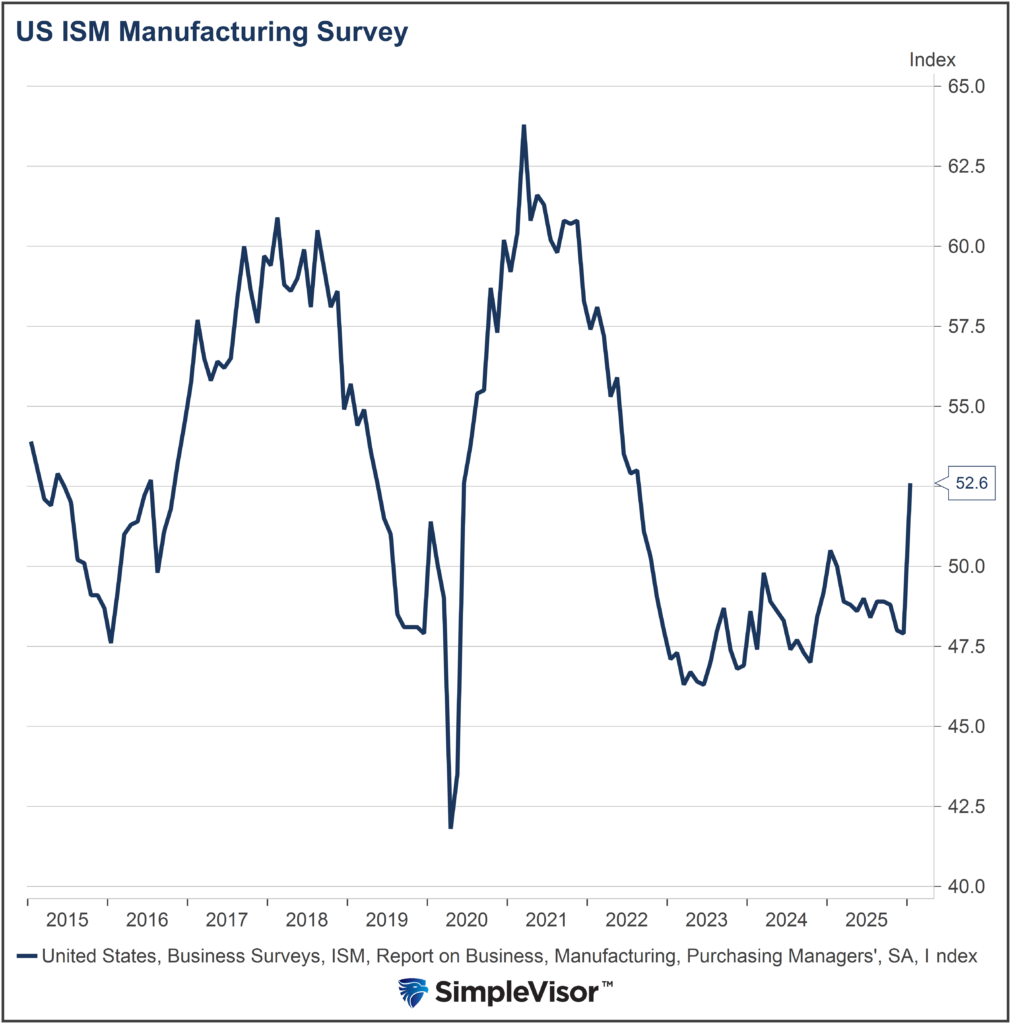

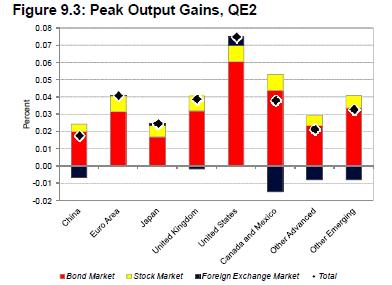

Determining whether QE is good or bad for a country’s trading partners requires working through all these different channels. In 2011, the International Monetary Fund concluded the spillover of the Fed’s first

round of QE onto its trading partners was significantly positive, raising their output by as much as a third of a percentage point, while the spillover of the second round was slightly positive. As the nearby charts show, the IMF concludes the weaker dollar was indeed slightly negative for the rest of the world, but this was more than offset by the positive impact of lower interest rates and higher equity prices.

The 1930s are often cited as a lesson in the evils of competitive devaluation, but they actually show something quite different.

In the 1980s, Barry Eichengreen at the University of California, Berkeley and his co-authors demonstrated that the first countries to abandon the gold standard recovered much more quickly from the Depression than those that stayed on gold longer. Mr Eichengreen has just written a new paper, to be published soon in the Journal of Policy Modeling, elaborating on the international spillovers as countries quit gold, and their implications for today. I strongly recommend it. In it, Mr Eichengreen describes three channels by which leaving the gold standard boosted a country’s output:

First, central banks engaged in what we would now call forward guidance. They committed to keeping interest rates low, expanding supplies of money and credit, and raising the domestic currency price of gold for as long as it took for conditions to normalize … Second, the change in monetary policy had a positive impact on asset prices and therefore on investment. Third …[c]ountries abandoning the gold standard and taking steps to depreciate their currencies were able to expand their exports relative to countries remaining on gold. This channel is controversial because the expansion of exports took place at the expense of other countries, worsening the latter’s economic difficulties…

As Mr Eichengreen notes, determining the net effect of these spillovers on other countries is muddied by these offsetting effects. The direct spillover of depreciation was negative, while the spillover of increased money and credit was positive, as capital outflows “helped to relax conditions in money and credit markets and moderate expected deflation in other countries.” Nonetheless, he concludes that from both calibration exercises and historical literature, the spillover effect was net negative. This might have been averted if everyone adopted the same monetary policy, i.e. quit gold at the same time:

In circumstances where different countries had all experienced the same deflationary shock, the appropriate foreign response was to meet monetary expansion with monetary expansion and currency depreciation with currency depreciation. Two dozen countries, primarily trade and financial partners of the United Kingdom, responded by depreciating their currencies along with sterling. In other countries, considerations of history, politics and ideology delayed or even precluded recourse to this first-best response. Some countries in this position responded with capital controls and trade restrictions designed to switch demand toward local producers. This was less efficient than the first-best response both for them and for their foreign partners.

An international coordinated response, it was argued then and has been argued since, would have been better. But … the sum of the first-best unilateral responses was also the global optimum. Explicit coordination was not needed to achieve it. With few exceptions, countries had arrived at this set of policies (the depreciation of currencies against gold was all but universal) by the end of 1936.

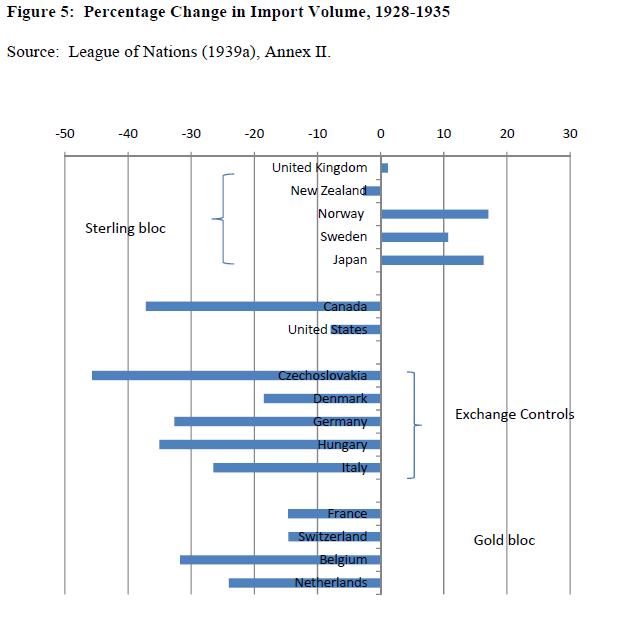

The irony is that to the extent devaluation led to protectionism and falling trade volume, it was more due to countries that did not devalue. In an earlier paper, Mr Eichengreen and Doug Irwin of Dartmouth College note that countries that remained on gold were more likely to erect protectionist measures against imports than countries those that quit. So while imports did collapse, they fell far less for countries that abandoned gold (like Britain, whose imports rose slightly between 1928 and 1935) than for those that stayed with it, like France, whose imports fell 15% (see nearby chart).

What are the lessons for today? The key insight of Mr Eichengreen’s work was that the more countries abandoned gold, the more positive become the spillover effects: “what are now referred to as currency wars were part of the solution, not part of the problem.” The analogy for today is that countries whose currencies are rising because of easier foreign monetary policy should ease monetary policy as well, assuming they, too, suffer from weak demand and low inflation. In fact, America’s QE and the resulting upward pressure on the yen was one of the key reasons Shinzo Abe, Japan’s prime minister, demanded the Bank of Japan take a more determined assault against deflation. The fact that global stock markets have been chasing the Nikkei higher as Mr Abe’s programme is put in place suggests investors believe this is virtuous, not vicious, cycle. This also implies that the euro zone ought to respond with easier monetary policy which would both neutralize upward pressure on the euro and combat recession in the euro zone.

But Mr Eichengreen notes that unlike in the 1930s, today there is a large group of emerging economies who did not suffer a deflationary shock and thus would not benefit from easier monetary policy. Their optimal response, he says, would be to tighten fiscal policy, which would cool demand, putting downward pressure on interest rates and their currencies. But, as in the 1930s, he notes that there are political and institutional barriers to doing so, and instead they are opting for second-best policies such as capital controls, currency intervention, and in some cases, import restrictions.

Those actions have yet to trigger a significant backlash because they are, for the most part, simply trying to slow rising currencies. The countries that have embarked on QE have so far largely steered clear of those measures, with one exception, Switzerland (which I discuss below.) Indeed, Mr Abe’s rhetorical assault on the yen constitutes currency war only insofar as traders think it will be followed by intervention. If Japan stays out of the markets, as the G7’s recent statement suggests, there is no reason to attribute the yen’s decline to anything other than the Bank of Japan’s monetary policy.

There’s an interesting debate over whether even intervention constitutes currency war. Economists traditionally thought such intervention had limited effect. If the central bank intervenes but does not change expectations about interest rates, investors will simply buy up all the currency that the central bank sells until expected returns were once again equal across all markets.

But Joseph Gagnon of the Peterson Institute for International Economics challenges this conventional wisdom. Studies that found intervention does not work were done in the 1980s and 1990s when the sums were far smaller, he says. Central bank intervention is now hundreds of times larger. He explains in an interview:

Japan did $177 billion of intervention in 2011. When countries intervene on that magnitude, I don’t think all the hedge funds and investment banks in the world are enough to neutralize that effect. They’re not willing to gamble more than a few tens of billions. Hedge funds need differential rates of return to induce them to take opposing positions. And the riskier it is, the more they have exposed, and the higher return they need. They expect to make money because government is distorting markets in a way they think is not sustainable, but governments can distort markets longer than you can stay solvent.

This has parallels to the debate over QE. Skeptics like Michael Woodford believe that if the central bank does not change the public’s expectations of interest rates or inflation, no amount of bond buying will alter asset values or stimulate growth. But advocates like Mr Gagnon believe investors have a “preferred habitat;” they hold certain types of bonds or assets because of legal or institutional constraints, even if their returns seem too low relative to their own expectations of interest rates.

Most intervention is sterilized: the central bank is selling currency previously held by the public, so the money supply does not change. Unsterilized intervention, in which the central bank prints the currency it sells, as the Swiss National Bank has done, has different implications. It is, in practice, QE plus sterilized intervention. Imagine an investor sells euros to the SNB and gets newly printed Swiss francs. He invests them in Swiss government bonds, buoying their prices. The result is exactly the same as if the SNB had bought Swiss government bonds with newly printed money, then sold those bonds in order to buy foreign exchange. Based on our analysis here, it is getting one thing right (the QE) and one wrong (the intervention). The SNB justified its action based on the fact that its domestic bond market was too small to acommodate QE in sufficient size. Its trading partners must have agreed, because they didn’t kick up much fuss. Or perhaps Switzerland is too small to matter. Japan should not assume it would get the same, hands-off treatment.

Full story here Are you the author? Previous post See more for Next postTags: