In this post we show that the risks the Fed, the ECB and the Bundesbank incur are far smaller than the one the Swiss SNB takes. The Fed has “just” an inflation risk, that could cost 200 billion US$, 1.2% of US GDP. The ECB and Bundesbank have the risk that the euro zone splits up. In this case the Bundesbank will sit on 700 billion € of devalued peripheral assets. In a case of 30% currency devaluation for these assets, they might go for losses of 5% German GDP. The SNB, however, possesses assets of 350 billion € in foreign currency. A 18% franc revaluation to EUR/CHF parity would give them a loss of 60 billion €, 12% of Swiss GDP.

(This post appeared in smaller version on Zerohedge)

Mephistopheles and the Roman Emperor

In a scene from Goethe’s tragedy, Mephistopheles persuades the heavily indebted Roman Emperor to print paper money – notionally backed by gold that had not yet been mined – to solve an economic crisis, with initially happy results until more and more money is printed and rampant inflation ensues.

Most recently, Guggenheim Partners showed in their “Faustian Bargain of Central Banks”, which also appeared in the FT, that the Fed could lose 200 billion US$, when inflation comes back again. Interest rates would increase by 100 basis points and the US central bank would be bankrupt according to US-GAAP.

We explain in this post the differences between money printing as for the Swiss National Bank (SNB), the ECB and the Fed. We show the risks the central banks run when they increase money supply, when they “print”.

This link to the SNB website gives insights into how many francs the Swiss National Bank requested commercial banks to deposit during the last week. It is just a technical accounting process: Minus (or liability) for the SNB, Plus (or assets) for the banks. Therefore it is often called “printing”, like adding a zero to a currency exchange rate. The SNB uses this “electronically printed” money to buy more and more currency reserves and to enforce the CHF cap against the euro. At the same time printing increases the banks’ excess reserves at the central bank.

A simple view of the operation is the following:

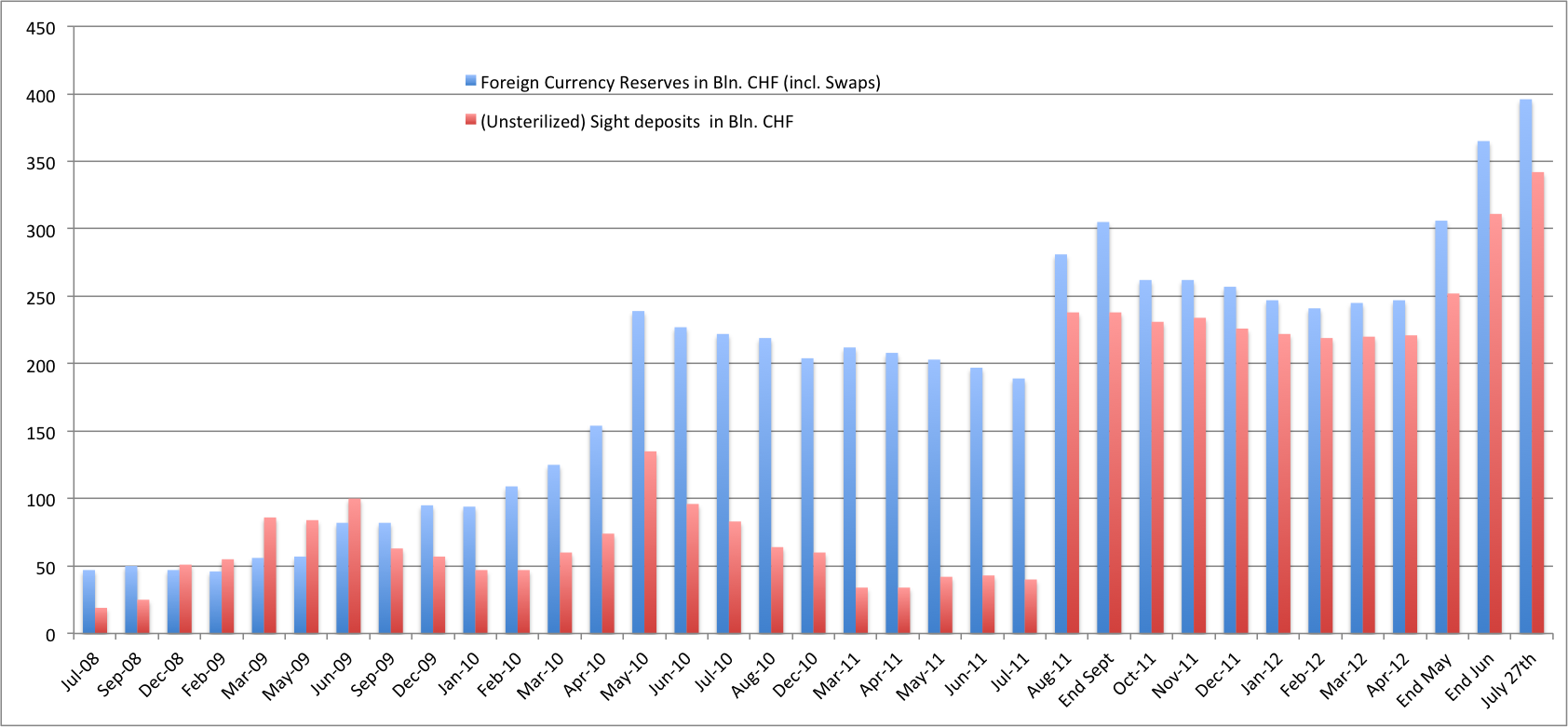

In August/September 2011 the SNB bought back their “SNB bills” and liquidated swaps. Since then each time, when the SNB buys FX reserves, the increase in bank deposits, i.e. SNB debt at banks, moves nearly in-line with the increase of FX reserves. See more explanation about the SNB printing measures and who profits from it here.

The Limits of Money Printing

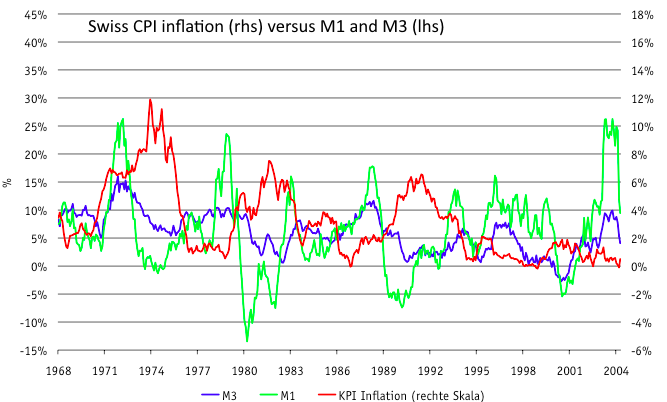

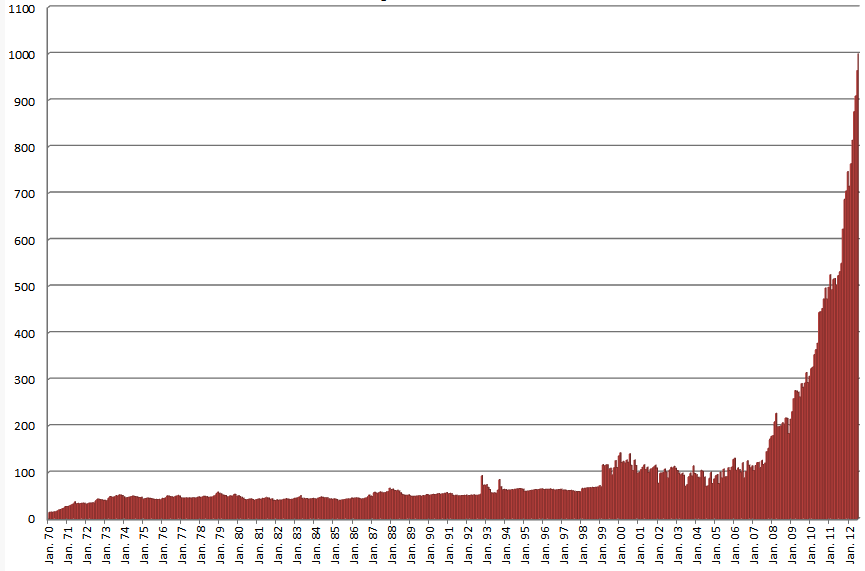

The following graph from the SNB former chairman Hildebrand (2004) shows that a period of inflation had regularly followed the SNB monetary expansion with a delay of about 2-3 years.

Price Inflation Follows Monetary Expansion

Price Inflation follows Monetary Expansion ebrand SNB Source: snb.chf - Click to enlarge

Broad money supply M1-M3 is rising by around 7% per year. But M0, in particular the deposits of commercial banks at the SNB rose far more quickly. The reason for the masses of deposits is definitely not that Swiss banks are reluctant to lend. In order to stop excessive lending, the SNB had ideas for an anti-cyclical capital buffer in order to stop excessive mortgage loans practices and preserve banks’ capital for a possible downturn. Many people fear the a similar bust of the Swiss real estate bubble like in the 1990s.

Theoretically banks could tell the SNB not to credit their accounts any more, they obtain 0% interest. This would prevent the SNB from further printing. We discuss this including potential negative rate here.

The SNB thinks it will be able to get rid of their excessive sight deposits either:

- when banks want to sell their francs again and and/or

- when the SNB sterilizes the deposits – when it pays back the quickly available sight deposits debt to the banks and converts them into longer-term SNB bills. The deputy member of the SNB board, Dewet Moser, proudly presented in this SNB paper how easy it was to sterilize between May 2010 and July 2011 (see also in the reserves overview above). However he does not speak about the fact that the Swissie strongly appreciated (from EUR/CHF 1.40 to 1.10) during that period and the SNB had to accept huge losses at the end of 2010.

Money Printing in the Euro System

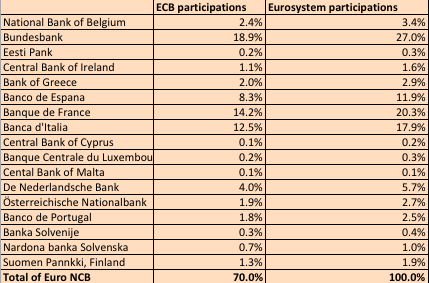

30% of the ECB capital belongs to non-euro states like the UK, Sweden, Denmark, Poland or other non-euro EU member states. This 30% is removed in order to obtain their participation in the euro system. Printing money in the case of “emergency liquidity assistance” (ELA) means that the ECB increases its debt towards the national central banks (“NCBs”) in the ratio of the euro system participations, namely Bundesbank 27%, Banque de France 20%, Banca d’Italia 20% and Banco de Espana 12%.

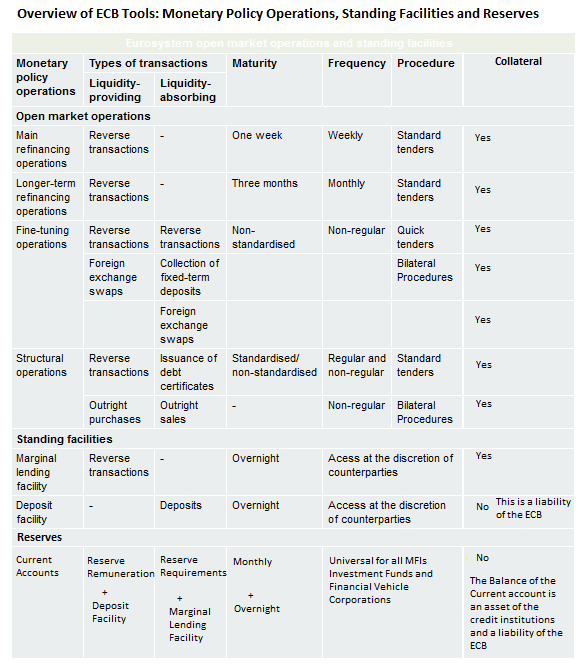

The different “printing money” operations have different names (source Zerohedge, JP Morgan):

ELAs (emergency liquidity assistance) – an ELA is a facility introduced by the individual national central banks (only by ECB approval) designed to allow banks that would otherwise be locked out of normal ECB operations to secure liquidity. Ireland and Greece both have ELAs (although other CBs may have undeclared ELAs open too) and other countries could introduce these facilities. For the ELA, the national central bank is on the hook for any losses (vs. the overall ECB).

ECB Liquidity tenders – the ECB currently conducts liquidity operations in 1-week (“MRO” or main refinancing operations) and 3-month intervals (“LTRO” or long-term refinancing operations). Europe’s banks can take eligible collateral to the ECB in unlimited amounts and borrow against it w/appropriate haircuts. Recall the ECB recently conducted two 36-month liquidity operations and in theory could launch tenders for any interval of time (6-month, 12-month, 24-month, etc). However, Europe’s banks may not have a ton of eligible collateral left, making future LTROs less effective than the ones from 2011. Keep in mind too ECB politics are a factor as these operations start to have longer maturities – recall that the ECB eased collateral standards for the second 36m operation but allowed each individual central bank to make the final determination (and some, like the Bundesbank, kept collateral standards unchanged). The next ECB meeting comes up June 6 and there has been some spec of them doing an LTRO less than 36m (something like ~12m).

ECB SMP (Securities Market Program). This was introduced back in May 10 and while it has been dormant now for several weeks (it hasn’t been used since late Mar), in total there have been ~EU215B worth of sovereign bond purchases made via this facility. The SMP is a redirection of liquidity as all purchases are “sterilized” (this is a key difference between the SMP and the Fed’s QE – the Fed’s purchases are “unsterilized” and represent a net injection of liquidity). In theory, there is no limit to the SMP although in reality there are (due to political constraints but also b/c of sterilization limits – recall the ECB once last year failed during one of its sterilization attempts). Back in the summer/fall of 2011, the SMP nearly bought EU10-15B during some weeks (you can see the amounts under “ECBCSMPW Index” on Bloomberg) but it isn’t clear that purchases at those levels can be sustained for long (keep in mind that certain ECB officials, inc. former Bundesbank head Axel Weber, resigned over this program).

By September 6, 2012 the SMP has finished. According to Draghi the size of the SMP was about 3% of euro zone GDP.

The blog “Place du Luxembourg” gives an overview of some more of these ECB operations. These ones were referenced above. The current accounts and deposit facilities (“access at the discretion of the counter parties“) corresponds to the ELAs. The monetary base M0 is increased in this case.

As opposed to the ELAs, the NCBs do not provide liquidity with the “main refinancing operations” (MRO) and the “longer-term refinancing operations”.

In this case commercial banks have the choice to lend money to the ECB directly, to provide “printed money”.

It is clear that currently not only the peripheral states, but German and other Northern banks have money left to lend to the ECB. The lending to the ECB is commonly realized via reverse repurchase agreements (“REPOs”), where the ECB purchases securities (mostly government bonds) from the banks and sells them after one week (MRO) or three months or more (LTRO) plus some interest. If the periphery requires further funds, one can understand that after this week or three months, the ECB will do another market operation with an even higher total quantity of debt to Northern commercial banks. Commercial banks choose reverse repos and get rid of some government bond holdings when the economy expands and government bond prices are expected to rise. At the same time the central banks are able to remove liquidity in the form of deposits, which are too quickly available. The SNB terminated her latest reverse repo operations in May 2012, when the US-driven recovery was over. Since she has relied only on deposits.

If the ECB buys peripheral bonds with this “printed” money, it implies an implicit transfer from the Bundesbank and the commercial banks of the northern states towards the periphery. By nature of the bad ECB assets (aka government bonds of the periphery) this is also sometimes called “qualitative easing”.

The Bundesbank losses could be partially realized, when one day a country leaves the eurozone (either Germany itself or some peripheral countries) and an exchange rate difference among the former euro zone members appears.

What does “partially” mean? We saw already similar discussions in March 2012, when it had to be decided, if private or public entities take the losses in Greek government bonds, the pari passu. One day, maybe in a couple of years, the ECB or the Bundesbank and the public entities could also need to take losses, a haircut.

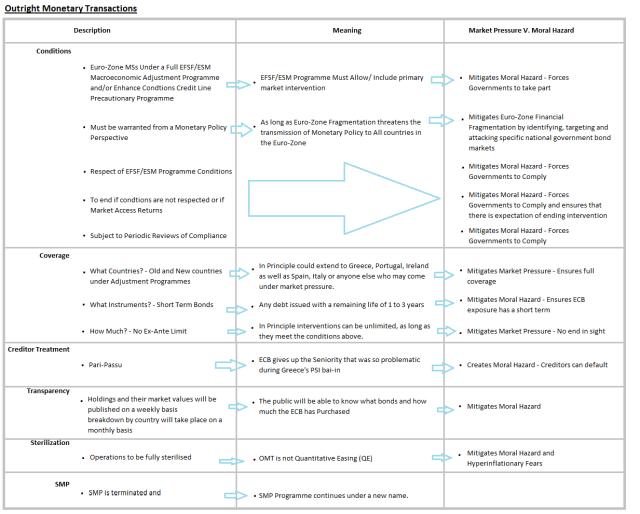

The Outright Monetary Transactions (“OMT”) Program

By September 6, 2012 the ECB introduced the new Outright Monetary Transactions (“OMT”) program. On one hand, it provides unlimited ECB interventions, on the other hand it requires conditionality. Moreover it stipulates that the pari passu is introduced even for public entities like the Bundesbank and ECB, their senior credit status is lost inside this program.

The table below summarizes these features and considers their meanings and implications regarding the effectiveness of putting an end to market pressure and effects on moral hazard.

Potential losses due to money printing are for the Fed: 1.2% of GDP, Bundesbank: 5% of GDP, SNB: 12% of GDP. - Click to enlarge

Legal Considerations about Monetary Financing

Here is a good overview from Place du Luxembourg.

Monetary Financing is a construct rather than a specific issue clearly defined by law. The ECB offers a good overview here. Theoretically, monetary financing includes several dimensions. Legally however, my understanding is that as long as the ECB stays away from the primary market, it should be innocent of any such crimes against price stability, as this is the only act explicitly forbidden by Article 21, Chapter IV of the Protocol on the Statute of the ESCB and of the ECB in accordance with the principles laid out in Article 101 of the Consolidated Treaty on the Functioning of the EU. Nonetheless, the pari passu status of the ECB on these (risky) purchases exposes the central bank to accusations that it is not “preserving the integrity of the central bank’s balance sheet“.

The Potential Tax-payer Bailout of the Bundesbank: Costs 5% of German GDP

The Bundesbank refinances the credit to the ECB (current account and deposit facility), via an increase of its debt at German commercial banks. These again will possess more reserves. Based on these they may give more loans to German firms and housing. This operation will increase inflation over the medium and long-term.

Before 2008 Spanish banks were refinanced mostly directly by German commercial banks. After the crisis this completely changed.

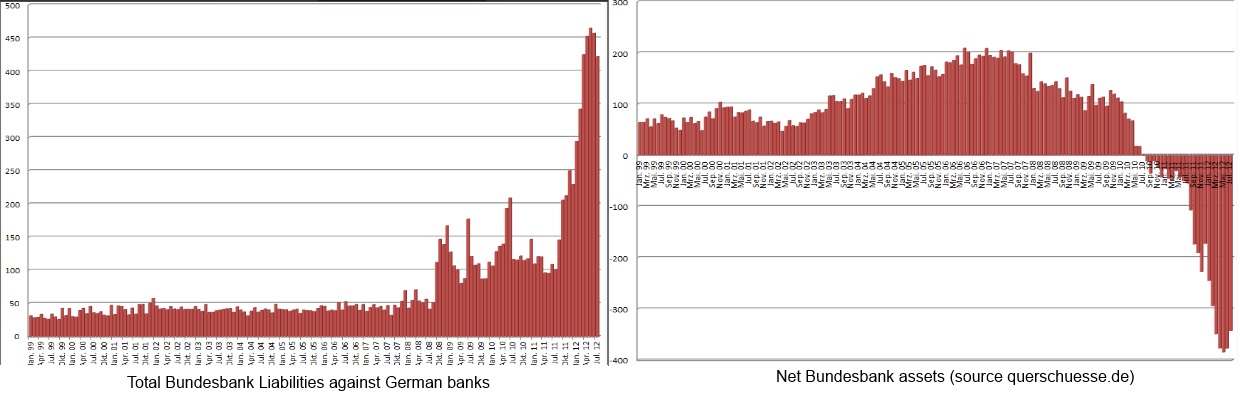

The following graph give an overview of the of German banks’ deposits at the Bundesbank, i.e. the Bundesbank debt with German commercial banks.

source Querschuesse.de

Bundesbank Foreign Assets (source Querschuesse.de)

On one side the Bundesbank has more and more liabilities with German banks. On the other side the graph to the right shows how much foreign Bundesbank foreign assets have risen over the years

A future haircut of 30% on peripheral positions (about 700 billion € of the total 1000 billion foreign assets), would cost German taxpayers, 210 billion €, 5% of German GDP, more than the Bundesbank equity. This haircut would require German tax-payers to bailout the German Bundesbank. See more about why Weidmann has finally realized this problem together with inflationary risks in his critics with the ECB.

In order to avoid the bankruptcy of the Bundesbank, Merkel wants to introduce implicitly a “Euro Gold Standard”, a euro that is dominated by German stability and competitiveness, that, similarly as during the gold standard, forces weak countries into salary reductions and deflation. These weaker countries include the United States in a less stringent form, because the U.S. can still devalue and make U.S. labor cheaper via the currency. See more details.

On this page we show more details on the German Bundesbank and clarify where the Target2 surplus is lying: Under German mattresses….

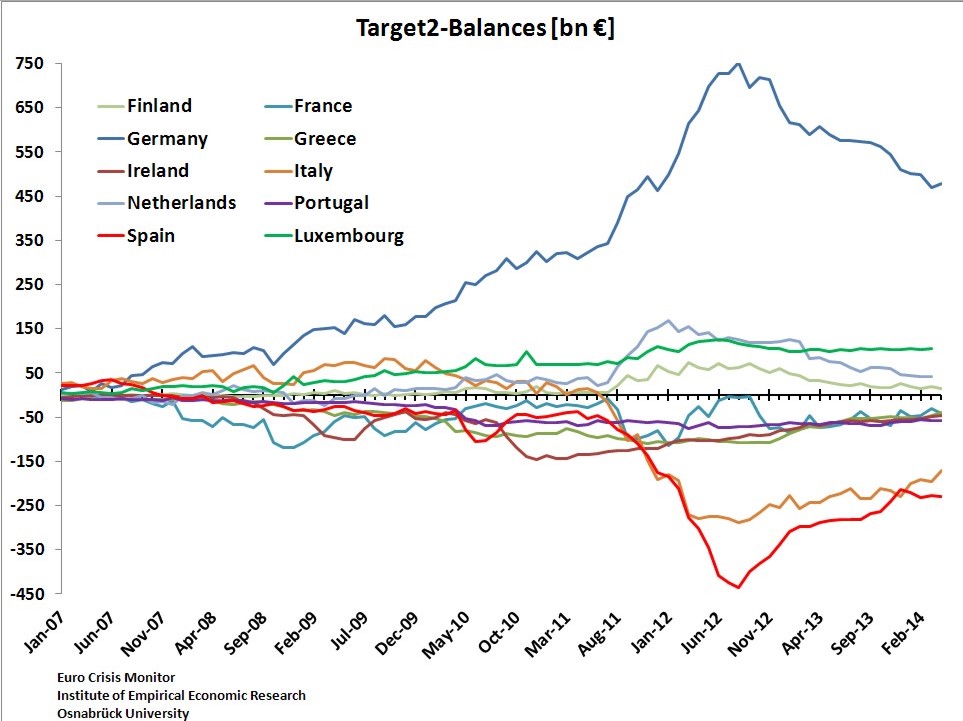

Update: Target 2 Balances by April 2014

Target 2 balances reflect two aspects:

- Current account surpluses (vigorously defended by Hans Werner Sinn)

- Capital flight (vigorously defended by Paul de Grauwe and Karl Whelan, et. al.)

Since 2012, the Target2 balances, have become tighter. Even if the periphery still shows negative current accounts, at least the capital flight part has become better: some money returned to the periphery.

The Swiss Faustian Bargain: Swiss Money Printing a lot more Risky than the Fed’s QE3

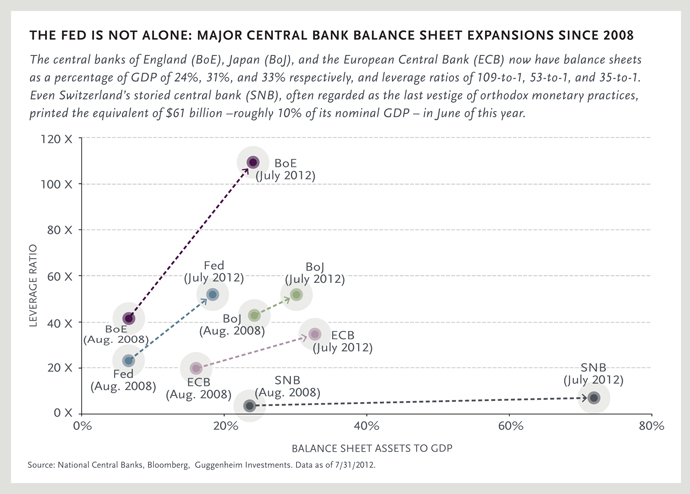

Guggenheim Partners showed in their “Faustian Bargain”, which also appeared in the FT, that the Fed would loose 200 billion US$, when inflation comes back again. Interest rates could increase by 100 basis points and the US central bank would be bankrupt according to US-GAAP. For them this is the Fed’s Faustian Bargain with the Mephistopheles “inflation”. For us the SNB’s money printing is a lot more risky than the Fed’s Quantitative Easing. The graph shows where the Swiss problem lies:

Money Printing of Major Central Banks (Source Guggenheim Partners) - Click to enlarge

The SNB’s ratio of printed money to GDP is a lot higher than the one of the Fed. In case of inflation the Fed’s losses of 200 billion USD amount “only” to 1.2% percent of the US GDP. It would imply, as Guggenheim Partners state, a bankruptcy in terms of US-GAAP. But still the Fed will be refinanced by the generous US tax payers.

The risks for the SNB, however, are eight to ten times higher: based on current FX reserves, it will cost at least 10% of the Swiss GDP, if Swiss inflation picks up and the Euro crisis will be not resolved till then.

As opposed to the ECB, the SNB only buys high-quality assets, mostly German and French government bonds. However , for the SNB the assets are in foreign currencies, for the big part they are denominated in euros. FX rates move a lot more quickly than American government bond yields do. This is a risk the Fed does not have, and neither the Bundesbank, as long as the euro zone does not split up.

Further Fed quantitative easing drives the demand for gold and the correlated Swiss francs upwards. Sooner or later this will pump more American money into the Swiss economy and will raise Swiss inflation. At the extreme, an unlimited Quantitative Easing will bankrupt the SNB or force the tax-payer to bail out/recapitalize the SNB with an injection of 80 billion francs, 12% of Swiss GDP.

The same applies for the ECB printing and the OMT: over the long-term this will drive money out of the euro zone and even out of Germany into Switzerland, because Swiss assets are more interesting and less risky and less-inflation-prone than the ones in the periphery. Moreover, a 12% higher Swiss debt is still far lower than Germany’s debt/GDP ratio.

None the less, these two are the Mephistopheles for the SNB: Bernanke and Draghi, the ones who promised an easy life based on printed money.

See more for