Abstract

We reckon that the Swiss current account and the Swiss trade surplus will be even bigger in the future, provided that the global economy is not going into recession. This would be one way to remove global trade imbalances with Switzerland, but still the Swiss surplus rises along with global growth.

Prof. Sturm’s, M. Lamla’s article in Vox

The recent Vox article by Prof. Jan-Egbert Sturm and Michael Lamla “Swiss National Bank under attack”1 of the Zurich KOF institute defended the SNB minimum exchange rate against the euro. In this first response we want to examine the following: The researchers maintained that

a “stronger Swiss franc would further increase its trade imbalance with the Eurozone” given “the widespread argument that trade imbalances must be reduced implies that Switzerland should purchase fewer goods from the Eurozone.”

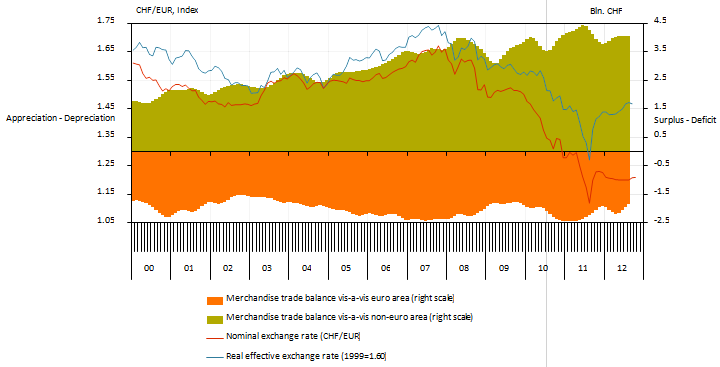

We will show that the researchers have a misleading understanding of the mechanisms and components of Swiss trade. The Swiss trade balance has been negative with the euro zone and positive with the rest of the world for many years.

(click to enlarge)

Looking at the details of their graph, one thing becomes obvious: in the year 2007, when the EUR/CHF was above 1.60 the trade deficit against the euro zone was 2.4 bn. francs, and it reached 2.4 bn. again at the end of 2010, but today the deficit amounts to only 1.7 bn. francs and the EUR/CHF is currently valued at around 1.20. It seems that the researchers’ graph counterproves their own argument. It is obvious that the strong franc helps to reduce the Swiss trade deficit with the euro zone and to reduce “trade imbalances”.

In the following we want to examine the Swiss merchandise trade balance in more detail: we will show which countries and which industries help to achieve the strong surplus.

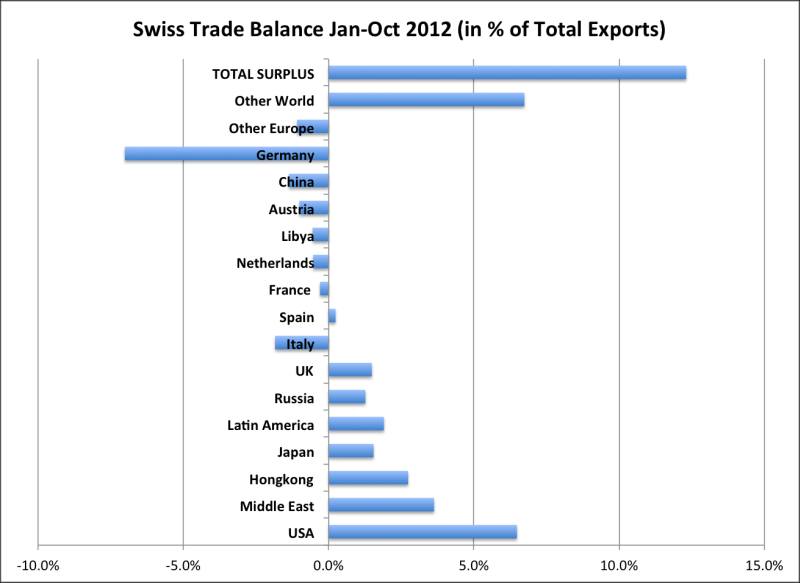

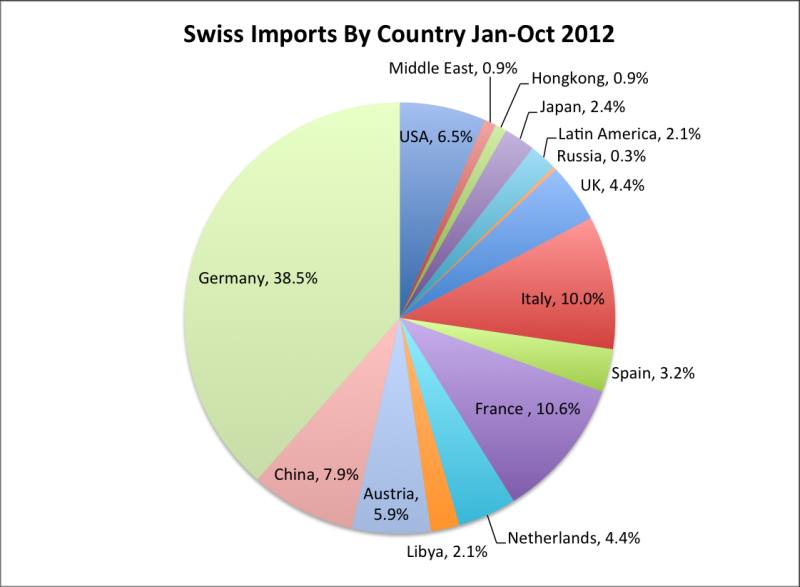

Switzerland benefits most from trade with the United States, the Middle East, Hong Kong, Latin America, Japan and “other world” (mostly emerging markets).

The US boosts the Swiss trade surplus with over 6.5% of total Swiss exports, thanks to nice margins in the pharmaceutical area, the Middle East with another 3.6%, Hong Kong with 2.7% and then Japan, the UK, Russia and Latin America, each with 1.5% to 2% of total Swiss exports. “Other world” contributes another 6.7% of total Swiss exports.

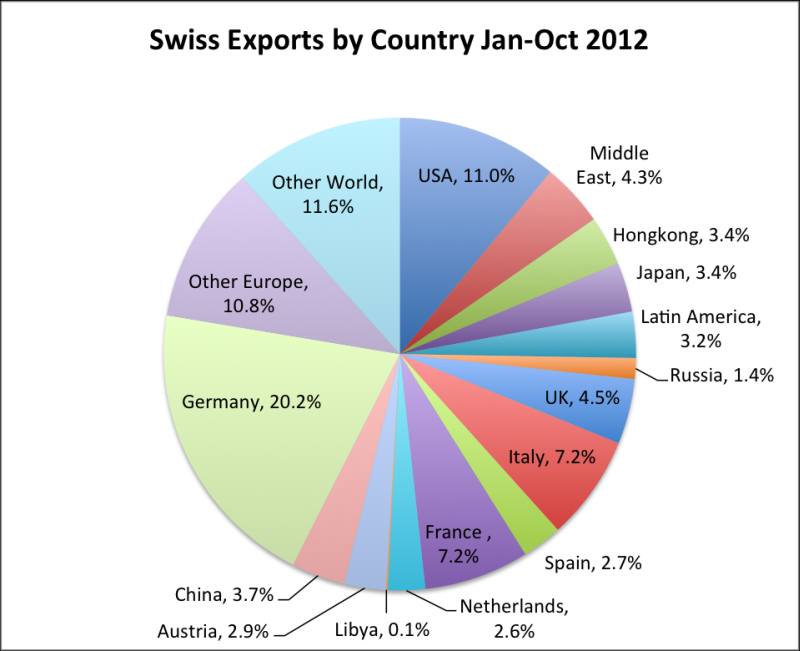

As opposed to the previous graph, the following one shows the exports per country compared to total Swiss exports.

For some it might seem strange, that the Middle East has a trade deficit with Switzerland, when it has big surpluses with Japan or the United States. The reason is that the Swiss deliver pharmaceuticals and luxury products to the Arab countries. The Swiss import 40% of their oil via pipelines through Italy and France, mostly from Libya (30%, as of 2009).

The remaining 60% of petroleum products are imported from refineries in different European states and weigh on the Swiss trade balance with these countries.

The US or Japan, however, refine crude in their own country. Hence, the Middle Eastern crude is received directly by tanker, which results in big US and Japanese deficits with the Middle East.

The Swiss trade balance with Italy is negative at -1.8% of total Swiss exports. The one with Germany is even more strongly negative with -7.0%, particularly due to imported energy, machinery, intermediate goods and the transit trade (see below).

Swiss imports by country 2012 (author’s graph based on data from Swiss customs 2012)

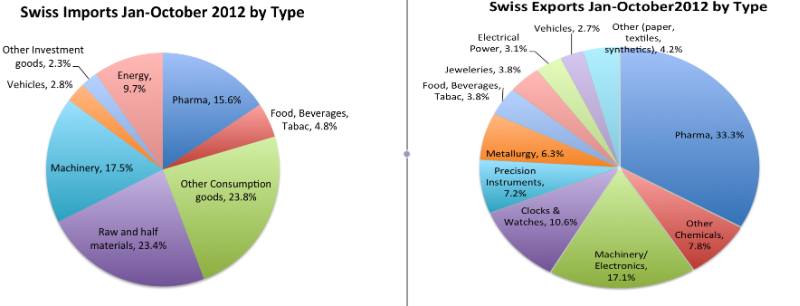

The following two statistics show that a big part of the Swiss trade deficit with the Euro zone is due to imported energy.

Swiss exports and imports by type (author’s graph based on data from Swiss customs 2012),

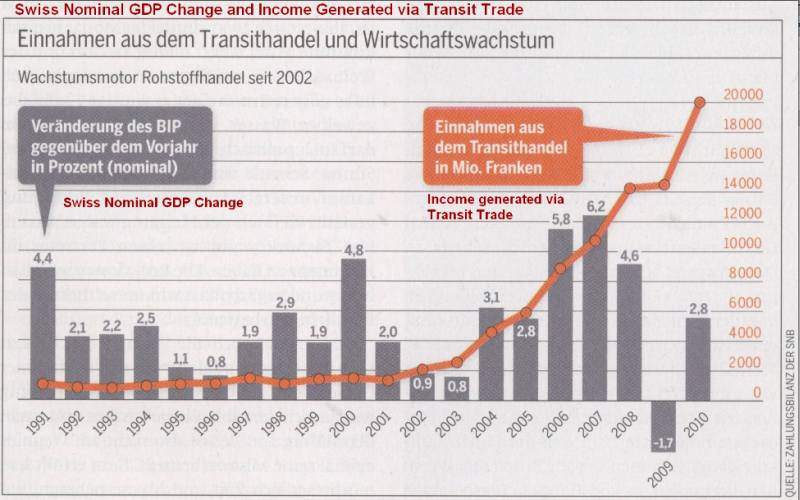

The Swiss global transit trade

A second reason for the Swiss trade deficit with the Europeans is that many companies base their global distribution in Switzerland but the products were imported first from other European countries, like Italy or Germany, the so-called transit trade or merchandising. Glencore, with its basis near the tax paradise Zug, is the leader of the global commodity transit trade. Another example for transit trade is the fashion outlet Foxtown in the Italian-speaking part of Switzerland. They sell Italian-made haute couture to purchasers in Switzerland but also to subsidiaries in the whole world. Foxtown and other similar companies import from the European Union without VAT and sell to global customers invoicing the lower Swiss VAT. The main customer group for the Swiss Foxtown center is Italians that take profit from the lower Swiss VAT and the outlet prices. Often they are able to avoid Italian VAT when returning to Italy.

Thanks to the global transit trade, the Swiss can currently generate income of 20 billion francs – that is typically booked as service and there contained in the Swiss current account. Since most goods do not even touch Swiss soil, they are mostly contained in the current account as services.

Swiss exports are rather price-insensitive, but sensitive to recessions

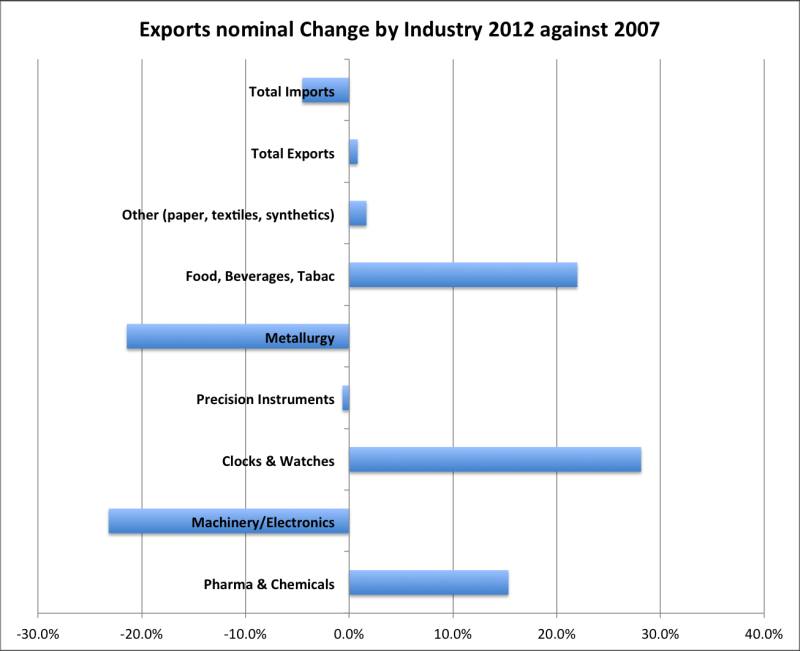

The pharmaceutical and chemical industry, clocks and watches and (despite quotas) food and beverages are the drivers in exports, but machinery, electronics and metallurgy leak.

Exports increased even in terms of the strong Swiss franc, but imports decreased since 2007. A study of the KOF institute2 has proven that the exchange rate changes do not affect the pharmaceutical and chemical industry. Sales of machinery and electronics vary with differing exchange rates only in the countries of Germany and France. Especially for clocks, watches and precision instruments the exchange rate does not matter for most purchasers because of reputation and brand reasons. In economic downturns and recessions, however, sold quantities may go down. This makes the franc similar to commodity currencies. It explains why since 2008 the Swiss franc often takes the same direction as the Australian Dollar against the euro, dollar and yen, especially in rising markets.

Thanks to the continued support from the central bank, Swiss exporters were even able to increase prices despite the weak global economy.

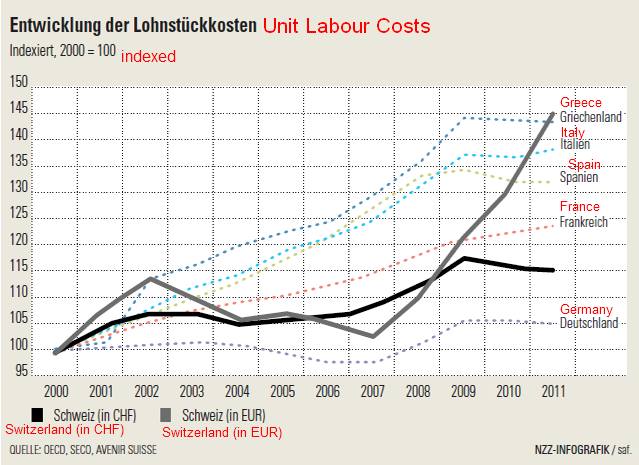

In 2007 the EUR/CHF was valued above 1.60. At the time small and medium enterprises, especially in metallurgy, machinery and electronics, took advantage of the relatively cheap Swiss labor for labor-intensive activities, something which contradicted the Swiss tradition with an always appreciating currency and innovation pressure. In 2007 Swiss real labor costs in the euro were close to the year 2000 index level, but in Greece, Italy and Spain they had increased strongly. Relative to Greece, Swiss labor costs had fallen by 30%.

Manufacturing Costs Switzerland vs. Greece, Italy, Spain, France, Germany

Increasing current account surpluses and foreign incomes

Many considered the Swiss growth during that period too low, especially when compared with the countries that experienced a real estate bubble and strong consumer spending caused by the “artificial wealth”.

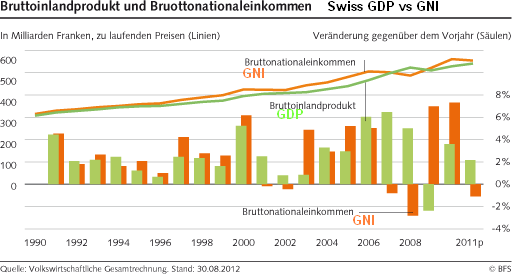

Economists from the Swiss National Bank like Georg Rich ((Rich, Georg: “Deutliche Unterschiede bei Bruttonationaleinkommen und Bruttoinlandsprodukt“, Neue Zürcher Zeitung, 2005)) and Ulrich Kohli3 warned that things were not that as bad as many thought. Foreign incomes and the gross national income (GNI) were strongly rising until 2008.

Development of Swiss GDP vs. GNI

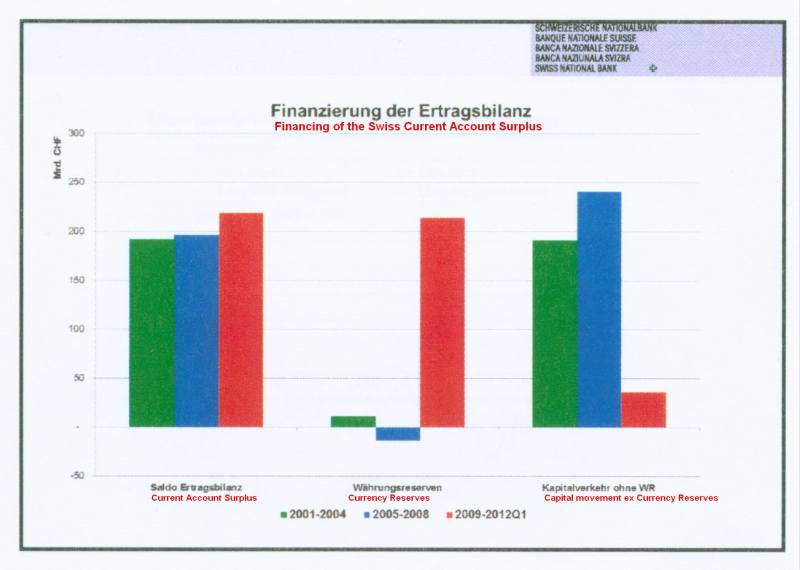

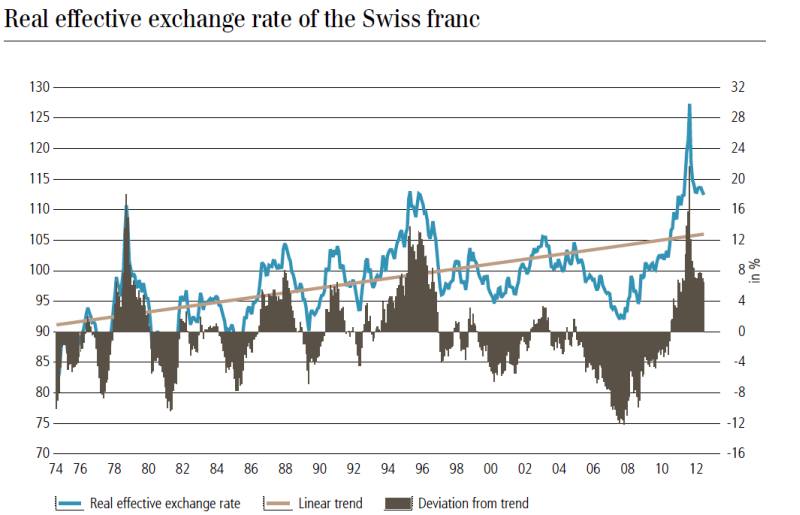

Already between 2001 and 2004 (green columns, in the graph below) the SNB intervened in the currency market to prevent an appreciation of the franc, but interventions were limited. Moreover the current account surplus was not yet that strong.

During this “carry trade era” between 2005 and 2008 (blue columns below) the Swiss current account surplus was entirely financed by capital transfers out of Switzerland to foreign countries. The SNB was able to sell some currency reserves. Swiss money remained parked in foreign assets and currencies. The currency was used as basis for the carry trade and “cheap” Hungarian, Polish and Austrian mortgages.

(click to expand)

Financing of Swiss Current Account Surplus

After 2008 (red columns) a smaller part of the current account surplus still leaves Switzerland, but the rest of the current account surplus of Swiss companies must be counter-financed by the Swiss National Bank in the form of currency reserves.

Swiss companies have become very cautious and repatriate their global profits into Switzerland. One example are the words of the CEO of the big Swiss exporters, Holcim’s Rolf Soiron, “the optimism of the illumination age, that the future is positive, has vanished, not even in science and technics.”

Wrong central bank policy in 2006 and 2007

Traditionally, the SNB was used to capital in- and outflows, to the volatility of the franc. But the central bank had its main focus on a slightly modified inflation-targeting “Concept 2000”4 and let the Swiss franc fall till levels for EUR/CHF of 1.68 in 2007. Despite a 1% stronger Swiss growth, Swiss Libor rates were 0.75% lower than the ECB rates. The Swissie drifted away from the usually rising trade-weighted exchange rate path.

The result of this bad central bank policy was that especially the exporters in metallurgy, machinery and electronics (united in the Swissmem organization) did not do the necessary innovations. They were the ones that demanded the introduction of the EUR/CHF floor in 2011. We reckon that this floor will cost the Swiss tax payer around 10-15% of GDP, when it will break in one to three years time with the rise of Swiss inflation.

Remark: The SNB regularly presents a graph that misleadingly suggests a long-term stable exchange rate (see here)

During the period after 2009 the central banks accused “speculators” of “attacking” its currency. Between 2006 and 2007, however, the huge capital outflows were well accepted, or as Daniel Gros5, put it:

Capital outflows are considered an equilibrium phenomenon during the upswing of a credit cycle, but capital inflows during the downswing are ‘speculative’ and must thus be neutralised.

Summary

The Swiss merchandise trade surplus is particularly strong with the United States, UK, Japan, Middle East, Latin America, Russia, Hong Kong and other Emerging Markets, especially for relatively price-insensitive pharmaceutical and luxury products that are sold.

Switzerland has trade deficits with its European neighbors because it is engaged in transit trade and because it imports a high part of its energy from its neighbors.

The Swiss National Bank did not support the weak franc in 2006 and 2007, even though they were aware that the Swiss economy was not as weak as the exchange rate suggested. Due to the weak franc, a group of exporters did not undertake the necessary innovations at the time. It was precisely that group of exporters that pressed the central bank to introduce the floor of EUR/CHF 1.20.

We reckon that the Swiss current account surplus will be even bigger in the future, provided that the global economy is not going into recession. A stronger franc would help to reduce the trade surplus with the group of countries that see a trade deficit with Switzerland and to reduce the trade deficit with its European neighbors. This is the only way to remove these global imbalances.

Investors have become very sensitive to trade imbalances; any improvement in the Swiss trade will put further pressure on the SNB. Swiss investors and companies are very reluctant to invest in the euro zone. Moreover, German investors will continue to seek shelter from the low interest rate and financial repressions of the ECB. Therefore we think that both EUR/CHF and USD/CHF will and must depreciate over the long-term. Only a return to high rate differentials between ECB and SNB (a new “carry trade“), would prevent this scenario. More details of our reasoning can be found here.

We have a horizon of three to four years time for when the SNB will remove the floor due to inflationary pressures between 1 and 1.5% CPI increase. Most probably they will move to a crawling peg (details here). When exactly, depends on the state of the global economy.

- Jan-Egbert Sturm and Michael Lamla, in VoxEU: “Swiss National Bank under attack”, online link, November 2012 [↩]

- M. Lamla, A. Lassmann, in KOF Analysen: “Spezialanalyse: Der Einfluss der Wechselkursentwicklung auf die schweizerischen Warenexporte: eine disaggregierte Analyse”, Online Link, Summer 2011, SA1, page 42 [↩]

- Kohli, Ulrich: “Switzerland’s growth deficit: real problem – but only half as bad as it looks”, Online Link, Schweizerische Nationalbank, 2005 [↩]

- Baltensberger, E.; Hildebrandt Ph., Jordan T. in Swiss National Bank Studies: “The Swiss National Bank’s monetary policy concept, an example of a principles-based policy framework”, Online Link, 2007 [↩]

- Daniel Gros, in VoxEU: “An overlooked currency war in Europe“, October 2012 [↩]