Submitted by Mark Chandler, from marctomarkets.com

Instead of Greece, the political spotlight in Europe is on Spain. There are two conflicting impulses. On one hand, Spain is reportedly engaged in negotiations to design a structural reform package that could be adopted prior to formally asking for assistance that would in fact meet the Troika’s conditionality. These structural reforms, which may not include new taxes or spending cuts, could be announced toward the end of next week.

On the other hand, with the decline in yields and recent bond auctions that clearly demonstrate that Spain has not be frozen out of the capital markets, and the sense of urgency has slackened. Germany’s finance minister reportedly sees no need for Spain to request aid. Some press reports also suggest the pressure that Italy was applying to Spain to seek relief, to help stabilize Italian yields, has also lessened. We do not anticipate a formal request by Spain until mid-October at the earliest.

At the end of next week, the three month review of Spain’s financial system is expected to be completed with the outcome being a clearer understanding of the banking system’s recapitalization needs. Spanish officials insist that the 100 bln euro backstop already granted will prove more than sufficient. There is some desire to use the “excess” for other purposes, but this will prove contentious.

In the US, President Obama has enjoyed a significant post-convention bounce. If the poll numbers in the swing states is maintained over the next week or so, it would imply more than a post-convention bounce is at work. While we have suggested that Obama’s re-election was the most likely scenario, we recognize that in terms of the fiscal cliff, that the presidential race is only half the story.

The key issue is whether Obama’s “coattails” will be sufficient for the Democrats to capture the House of Representatives. If this did happen, it would increase the chances of a compromise to resolve the fiscal impasse. The latest polls and projections suggest this is unlikely and that the Republicans will maintain a small majority. This in turn worries businesses and investors that the country is still moving headfirst toward the fiscal cliff.

In this ugly contest, we suspect that Europe remains uglier. The FOMC decision on QE+ was not spurred because the US was in danger of slipping into recession, but because growth was not fast enough (to reduce the unemployment rate quick enough). The euro area (and Japanese) economies appear set to contract in the current quarter. The US remains one of the few high income countries in which its growth rate is above, albeit slightly, bond yields.

We continue to suspect the position adjustment that weighed on the dollar in Q3 is over or nearly so. Many fund managers began the quarter underweight Europe and were forced to chase the market or under-perform benchmarks. As we note below, there has also been an adjustment by speculative participants.

Last week, we noted that the technical condition of the dollar against most of the major currencies was still poor. The exception was the Canadian dollar, and to a less extent the Australian dollar. The price action over the past week has seen the improvement of the dollar’s technical outlook broaden to include the British pound and the Mexican peso.

Given the current correlations, a recovery in the US dollar against those “risk-on” currencies, would likely occur in a weakening equity environment. The S&P 500 appear to be carving out a near-term top. The close before the weekend was poor (on the session low). A break of the 1450 level would support this “topping” view and could spur a move toward 1400. Of note, the S&P 500 has recently typically fallen at the start of the week. In eight of the past 10 Mondays (though used Tuesday Sept 4 due to the Labor Day holiday on Monday Sept 3), the S&P 500 has fallen.

Euro:

The net short speculative euro position was reduced in the week ending September 18, continuing the trend that began in early June. At 73.5k contracts, down 22.k on the week. It is the smallest net short position since last November and has been cut in half in the past eight weeks.

This has been primarily a function of short covering. Another 14.5k contracts were reduced to a still substantial 122.3k. This is the smallest since April. However, bottom pickers and now momentum traders have also been accumulating a long position. The gross longest increased by 5.6k contracts and at 48.8k, is the largest since June.

The euro spent most of last week paring back gains. It was the worst performing major currency, slipping 1.1% against the dollar. However, on the pullback, a key area technically that we identified last week ($1.2900-20) held and off that the euro recovered about 50% on Friday what it had lost on the week until then.

While the technical tone has weakened, we still do not see a strong sell signal for short-term participants. Medium term participants may reduce euro exposure or short dollar hedges into euro strength. A move now back above $1.3080 would could see another cent advance.

Yen:

Sterling:

Swiss franc:

Canadian dollar:

Australian dollar:

Mexican peso:

Global Stock Markets (by George Dorgan):

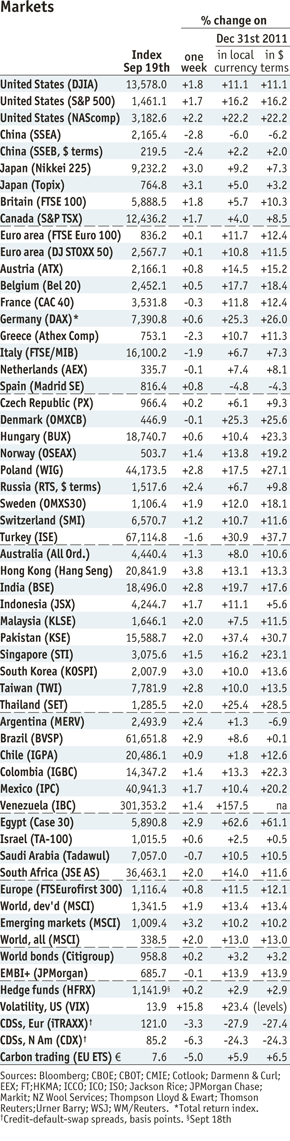

In the last week the DAX has overtaken Denmark’s OMX as best performing index in US$ terms. The NASDAQ, the Dow Jones and the S&P 500 could claw back some lost terrain against these extremely expanding European indices.

Chinese resumed their downward trend, but Japanese, Canadian and British stocks saws further gains thanks to QE3.

In the euro area Greek and Italian stocks had to give up some of the 7% gains seen in the last week, but the Spanish IBEX continued its recovery.

Northern and Eastern Europe markets saw gains again.

The Swiss SMI has finally achieved 10.7% return in both CHF and 11.6% in USD terms.

Gains for Australian stocks were limited to 1.3% last week, after the strong currency rise prevented higher profits. In the Emerging Markets, Russia and Brazil strongly improved again last week, “QE-unlimited” raised hope on a stop of the capital outflows. Both Mexico and Colombia continue this year’s success story despite of the issues of Argentina and Brazil.

More related posts directly from Marc’s website:, , , , , , , , , , , , , , , ,

Tags: Bank of Japan,Bank-Recapitalization,Canadian Dollar,Commitments of Traders,COT,Currency Positioning,FX Positioning,Japanese yen,Marc Chandler,MXP,Net Position,Peso,Speculative Positions