Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Written in February 2012

Abstract

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around 1.22 or 1.23 again. Therefore the SNB will need to think about an exit strategy from the current floor. Moreover, it predicted the break-down of commodity currency, because they were clearly overvalue in 2012, but the Swiss franc was not.

- Swiss inflation will soon rise again, especially from Q3 2012 on, one year after the franc had peaked.

- Raising the EUR/CHF floor will risk a stronger inflation, which would contradict the SNB mandate of price stability. Therefore a higher floor risks to be overrun by markets. Potential losses in this fight will lead to price instabilities and directly contradicts the SNB mandate.

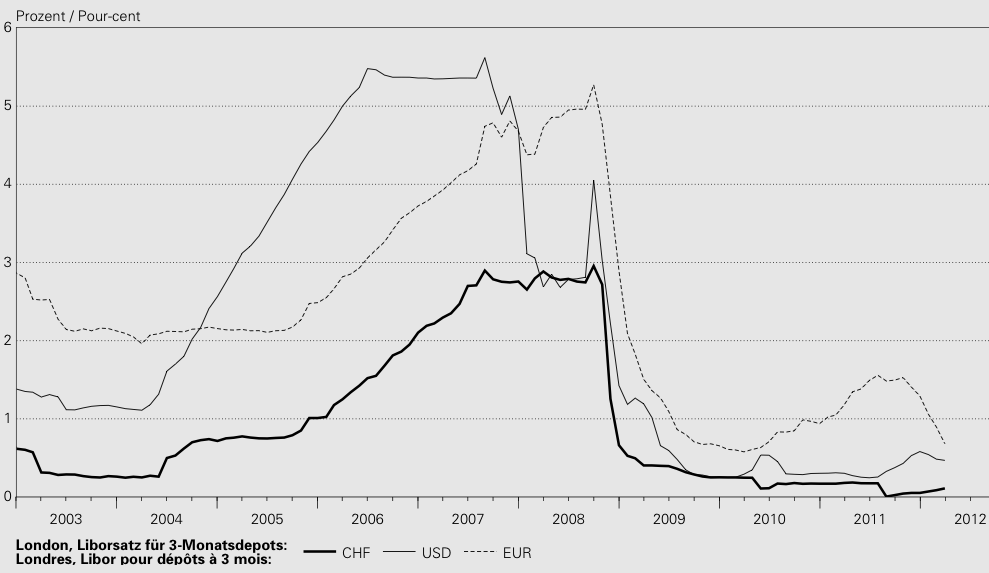

- The interest rate differential between ECB and SNB of 1% is not sufficient to reason a market-driven rise of the EUR/CHF exchange rate.

- PPP based on producer prices suggest that the franc is fairly valued

- The interest rate parity suggests that the franc will rise over time.

- A hike of the floor to 1.25 contradicts the monetarist tradition of the SNB.

- Continuing rise in Swiss real-estate prices and rents thanks to migration of highly educated workers and wealthy people from the EU to Switzerland.

- Economists expect stronger growth in Switzerland than in the eurozone in 2012 and 2013.

- Strong Swiss consumer confidence thanks to continuing low inflation and rising wealth effect

- US recovery and stronger USD supports Swiss exporters and further strengthens the positive Swiss trade balance despite last year’s complains

(1.) The EUR/CHF floor introduced by the SNB

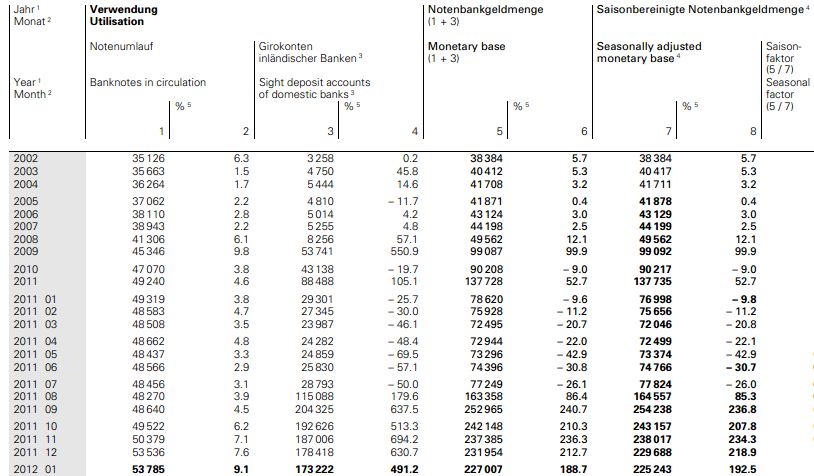

The Swiss National Bank has vowed to keep the 1.20 floor on the EUR/CHF. Looking at the most recent currency reserve levels this seems to be perfectly feasible. The Swiss currency reserves measured by the counter position of sight deposits (active vs. passive side of the balance sheet) have decreased since September 2011 by 35 billion to 169 billion francs (see also the monthly bulletin in the graph below) even if certain analysts suggested that the SNB balance sheet would “explode” and the only chance of an immense loss would be joining the euro.

Ad-interim chairman Jordan claims that a central bank has time. It can wait several years and accumulate foreign currency, take profit of the seignorage effect and go even into negative equity. The SNB profit of 13.5 billion CHF in 2011 as opposed to the loss of 21 billion in 2010 has proven that Jordan was (temporarily) right.

(2.) The Swiss economy

(2.1.) The Swiss economy is very resilient despite strong franc

According to the December 2011 SECO studies, the Swiss economy is not going into recession in 2012, but will experience a growth of 0.5%. The SECO forecast has been updated to 0.8% growth later. UBS speaks of 0.4% growth in 2012 in its February study and has increased it to 0.9% in its March study. Eurostat expects even 1.9% in Switzerland in 2012 against -0.3% to 0.4% in the euro area. All institutes are very optimistic for 2013 and think that the Swiss economy will grow then by 1.6 to 1.9%.

Swiss consumers build the security cushion of this resilience, their expenses rose by 1.1% in 2011 and by 1.6% in 2010, whereas the whole economy expanded by 1.9% in 2011 and 2.7% in 2010 despite the quickly rising franc. Even during the recession years 2008 and 2009 Swiss consumers did not cut their expenses, but increased them by around 1.2% per year. Most recent data show that Swiss retail sales rose by 4.4% in January 2012 YoY whereas the German ones contracted by 1.6%.

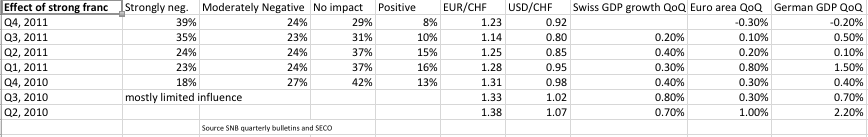

According to the SNB quarterly bulletins Swiss companies accuse the strong franc to hamper their activity.

In Q4, 2011 many claimed that the franc had a negative influence on their business, even if the franc had weakened, especially against the dollar. Complains against the strong franc are apparently risen more strongly when the world economy experiences a downturn. In 2010, however, the Swiss GDP rose strongly despite the CHF increase of 10-15% against euro and dollar,even if the SNB regularly warned that the strong franc would have a negative impact on growth.

This implies that only a global recession (in economic terms “a fall of foreign income”) can lead to a negative contribution of the Swiss trade balance to the GDP. A study has proven that the influence of the exchange rate on the exporters is not that strong, because Swiss products, especially machinery and chemicals are not very price-sensitive. Many preliminary goods are imported and therewith the companies can take also advantage of the stronger franc.

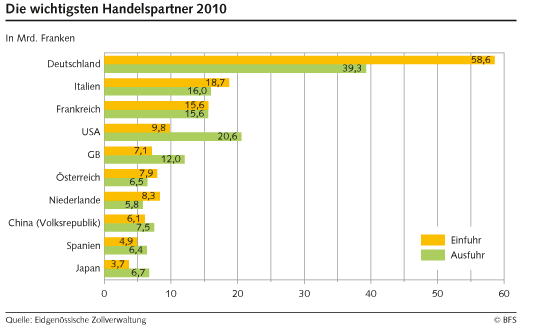

The latest trade balance has shown a 22% rebound on Swiss exports to the United States thanks to the US recovery and the cheaper franc against the dollar, which proves that in global exports of Swiss multi-internationals the USD/CHF exchange rate, that improved from 0.71 in August to currently 0.92, has a stronger influence on exports than the EUR/CHF rate. The bigger importance of the USD exchange rate for the exports, but on the EUR exchange rate on imports is reflected in the Swiss trade balance of 2010 by country.

Importers take huge profits of the in this case more important EUR/CHF rate because they do not give all of their expanded margins back to the consumers. To my mind, importers are not that sufficiently represented in the SNB survey above. Most companies complaining about the strong franc are small and medium sized firms with manufacturing in Switzerland who did not adapt their operating model since the easy times till 2008 when the franc was undervalued and Swiss work was cheap.

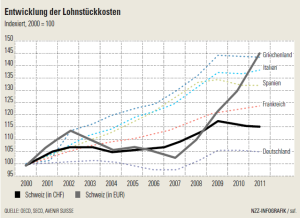

Measured in euro Swiss wages increased between 2008 and today by 35% (2% per year in CHF plus 30% fall of the euro). Avenir Suisse claimed that the Swiss pay rise was only comparable to one in Greece, but also other more successful countries like Australia or Brazil saw their labor costs strongly increase when measured in foreign currencies. With the strong undervaluation of the franc until 2007 it was only logical that wages measured in foreign currency needed to rise.

Cheaper prices did not hinder the Swiss consumers to increase their expenditures, surprisingly for Keynesians. On the contrary, the positive wealth effect prevails on the consumer side: rising home prices, cheaper foreign travels, cheaper purchases in Germany and a lot stronger personal pension fund when measured in euro. This is especially important for the high number of European migrants in Switzerland who often still think in euro and saw their salary measured in euro rise tremendously.

(2.2.) GDP estimates and revisions

The GDP of the US economy is regularly revised downwards. One example is the US GDP Q3, 2011 that was revised downwards from +2.8% via 2.5% to 1.8%, the second example the GDP Q1, 2011, that was revised from +1.8% to +0.4%. To my mind there are people who are interested in showing stronger growth in preliminary readings, whereas in the later readings the real facts (example changes in inventories) cannot be hidden any more.

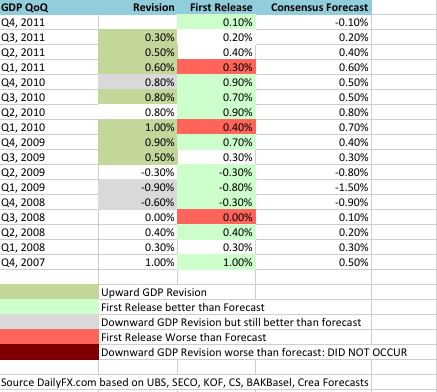

Exactly the opposite has happened to Switzerland: In recent years GDP growth has nearly always beaten the forecasts and often even the preliminary readings. And this still applies to Q4, 2011:

(2.3.) The German-Swiss export model

One other argument that Swiss exports do not take a hit due to the strong franc is the following:

Thanks to low German wages since the year 2000 and increasing labour costs (see next chapter) in the other parts of the Euro-zone German companies are able to generate enormous profits exporting their products and machines to the whole world, especially to the emerging markets. Many German companies have moved (just !) parts of their sales departments and holdings structures to the German-speaking Switzerland in order to influence transfer prices and the biggest part of their profits of international sales there and therefore pay less taxes in this tax-efficient country. Even more than the companies the employees take advantage of low personal income rates.

The opposite model is applied, too (e.g. Swiss companies like ABB and Alstom): Engineering is done in the subsidiaries like Germany or France, whereas top management and international sales staff is still situated in Switzerland, profits and tax advantages are taken in Switzerland. This further enhances the Swiss trade balance and bolsters the Swiss GDP. Swiss multi-national companies apply the same model with their workforce all over the world and taking most profits at home. Moreover, many multi-internationals use the “Double Irish Swiss Sandwich” (original version “Double Irish Dutch Sandwich”), in order to reduce global taxes.

(3.) History and fair value of the Swiss Franc

(3.1.) A short history of the Swiss Franc till 2004

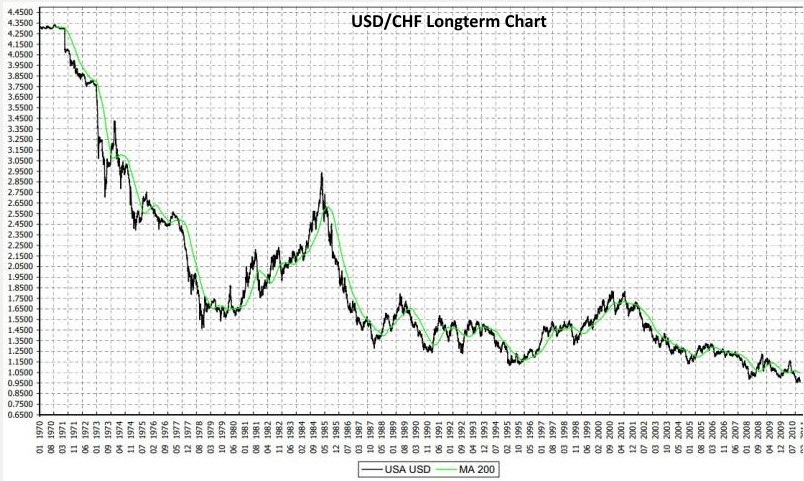

Since the gold standard was abolished countries with negative trade balances and high debt have continuously devalued their currency in order to gain competitiveness and to reduce debt by paying less interest on government bonds than the inflation rates. One example for these countries is the United States, whereas Switzerland represents just the opposite, namely sound finances and a strongly positive trade balance and money supply as target of the monetary policy. This relationship has resulted into a falling USD/CHF exchange rate since 1971.

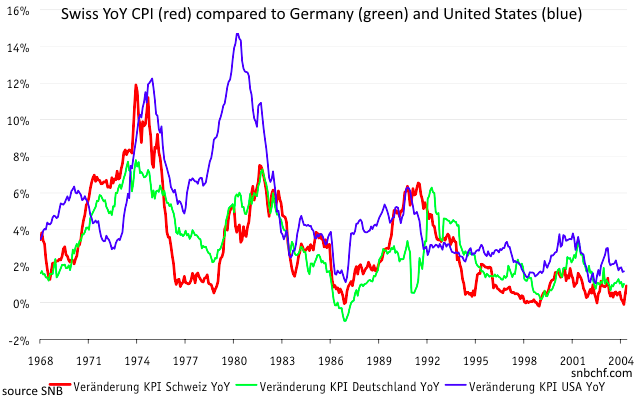

US inflation rates in terms of CPI were mostly higher than the Swiss ones (source Hildebrand 2004).

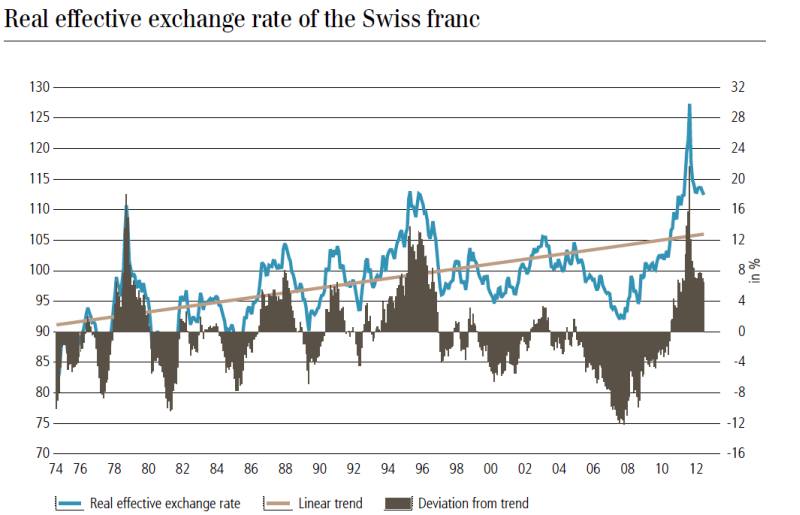

The real effective exchange rate of the Swissie followed, analogously, an ascending path.

- Overshooting 1978: After the recession 1975 the United States and most industrialized economies saw a very expansive monetary policy, where Switzerland maintained money supply targets. The SNB had to buy dollars for 6.6% of the GDP.

- Undervaluation between 1981 and 1986, when the Fed’s Volcker adopted money supply targets and fought US inflation.

- The Plaza agreement 1985 caused the overvalued dollar to fall. Swiss inflation went down and the franc rose again. Swiss real estate prices started to rise strongly.

- Overshooting 1988 caused by the stock market crash in October 1987

- Directly after it an undervalued period because the global economy and also the dollar had quickly recovered. After the first electronic interbank payments were introduced, Swiss banks needed less sight deposits. Since the SNB policy was solely based on money supply it increased interest rates too late. The undervaluation lead to expensive imports. Very high German inflation caused by increased demand and massive investments after the German reunification intensified the problem further and lead to a strong Swiss inflation that peaked at 6.6% in 1991, for Switzerland a very high level. The SNB hiked interest rates excessively till 9% in 1992, which caused the real-estate market to break down.

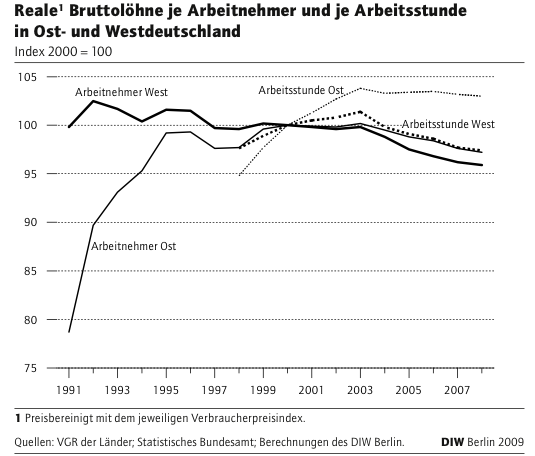

- Overshooting in 1995: In expectation of a VAT increase the SNB did not cut rates quickly, even if the inflation came down again. This resulted in very positive real interest rates, an overvalued franc and a further falling real estate market. The central bank was strongly criticized for its policy.

- Between 1997 and 2004 Switzerland and its main trading partner Germany saw slower growth compared to other European countries. German GNP fell from 254% of the European average in 1990 to 129% in 2002 (Bosch, Weinkopf, page 54). The reason was the complete collapse of the Eastern German industry after the loss of competitiveness due to the introduction of the Western German Mark and the following over-investment into Eastern Germany with artificially high salaries. This lead to a tax-induced housing bubble in Eastern Germany that busted some years later. Many workers left the suffering East. The increased labor force caused German unemployment to rise to 9.4% in 2004, higher than in many European countries, whereas before 1990 Germany had a far lower unemployment. The higher labour supply also put pressure on Western German salaries. Real wages in Western Germany fell by 4% between 1991 and 2008. Due to the costs of the reunification labour costs (“Arbeitsstunde” in the graph below) rose significantly till 2003 and reduced also the Western German competitiveness.

- Because of the dependency on Germany and the de-leveraging after the Swiss real estate crisis, Switzerland experienced slow growth, too. The franc remained close to the linear trend of the long-time real effective exchange rate, in correctly valued territory. In 1999 the Swiss money supply targets were replaced by the maximum target of 2% for the consumer price inflation (CPI).

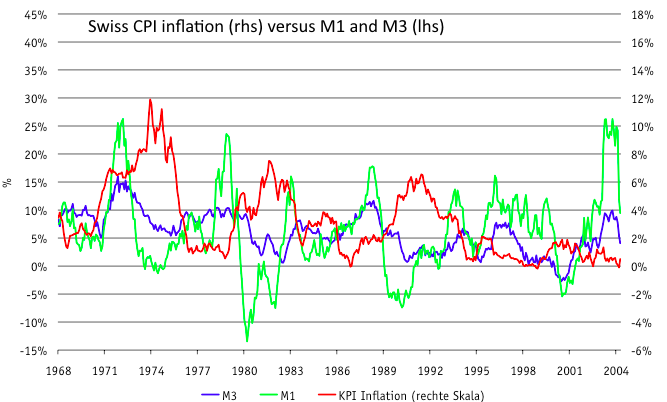

The following graph from Hildebrand (2004) shows that a period of inflation with a delay of about 2-3 years had regularly followed the SNB money expansion in response to the rise of the franc.

(3.2.) Interest rate parity and carry trade

A second reason for the falling dollar against the franc was the interest rate parity that suggests that currencies with low interest (and low inflation) should become stronger over the time. Thanks to the money supply targets Switzerland had mostly lower interest rates than other industrialized countries. Due to the massive expansion of the US monetary base after the financial crisis the fall of the dollar has accentuated.

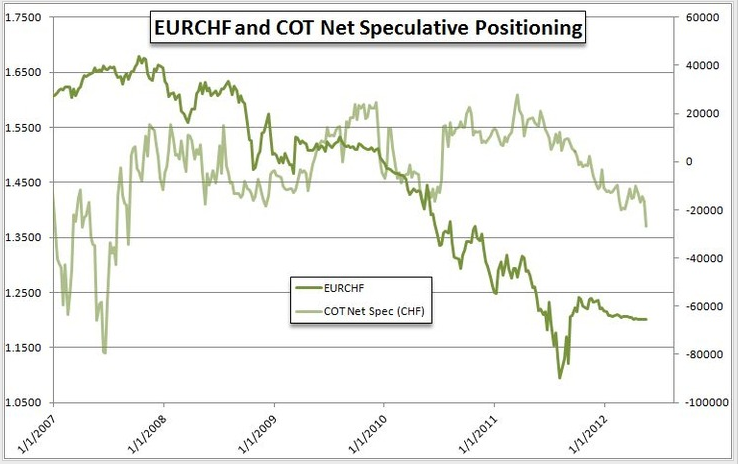

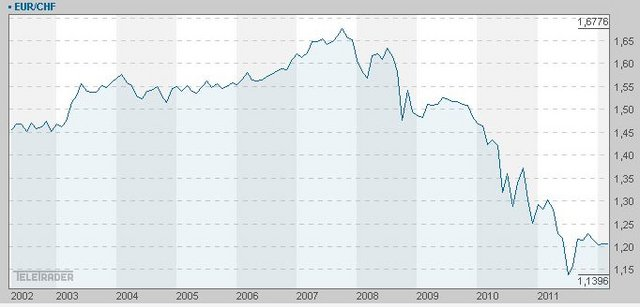

Sometimes the theory of the interest rate parity can be broken: When investors are sure that a country can sustain a strong currency, they prefer to invest into the high nominal interest rate of this country and finance the investment with a credit in a low yielding currency. Since a couple of years this carry trade implies that investors pile money into commodity currencies like AUD, NZD, BRL and NOK which experience high growth and high yields thanks to rising commodity prices, increasing population and rising real-estate prices. The euro was also an investment currency of the “global carry trade” between 2003 and 2008 and rose till 1.60 against the dollar. Thanks to a real estate bubble in several countries and to the rising wealth of emerging markets global growth was strong. Between 2003 and 2007 the financing currencies of the carry trade were the ones with low interest rates like the yen or the franc, visible in the COT Net Speculative Positioning. Till summer 2007 speculators were strongly short the franc in order to invest in high-yielding currencies, one of them was the euro.

After the property bubble busted in several countries in 2008/2009 most economists expect that global growth will be slow for a couple of years. In this scenario investors prefer security and real return instead of nominal returns.

After the financial crisis the carry trade still exists, but in a form that does not contradict the interest rate parity. The financing currencies are mostly the ones of the countries where falling real-estate prices or low growth prevent a hike of interest rates (USD since 2007 and GBP since 2008) and where real returns of bonds are strongly negative. Leveraged by short-term loans in USD or GBP the money is invested into higher yielding assets like stocks, commodities or commodity currencies. Conservative bond investors avoid the dollar or the pound and put their money into currencies with a positive international investment position like the yen or the franc, currencies that guarantee real return thanks to deflation and that should get stronger thanks to the interest rate parity.

(3.3.) Undervalued Swiss Franc between 2004 and 2010 and the reasons

In the time of the global carry trade between 2004 and 2008 the Swiss GDP growth was on average 0.5% stronger than the one in the Eurozone.

The EU-Swiss bilateral agreements helped to increase the number of foreign workers by 23% between 2005 and 2011, whereas the number rose only by 10% between 1992 and 2005. As opposed to former migrations into Switzerland this time foreign employees are mostly highly qualified. Since German wages were relatively low (see previously) German personnel like engineers and computer scientists found it attractive to work in Switzerland and were quickly integrated thanks to the common language. The increasing migration caused rents to go up by more than 2% per year between 2006 and 2009 even during the global financial crisis. Wages increased similarly.

The franc was undervalued against the euro for a longer period between 2004 and 2010 in terms of the long-term real effective exchange rate. Swiss inflation was low and considerably lower than in the euro zone. The reasons were:

- Lower inflation in all industrialized countries than previously thanks to an aging population and cheap imports from developing nations like China

- Slow growth and slow wage increase in both Germany and Switzerland between 1997 and 2004 (see 3.1.)

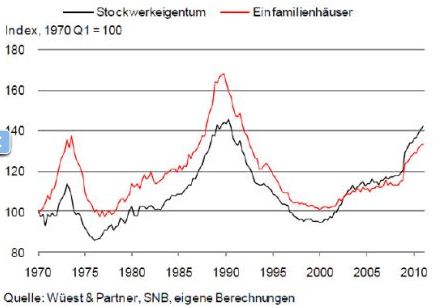

- Moderate increases in Swiss housing prices compared to most other countries thanks to more rigid bank requirements after the bad experience of the Swiss housing bust in the 1990s.

- Lower dependency of Swiss companies on the rising oil prices thanks to increased use of water and atomic energy and resulting lower commodity price inflation than the one of the euro zone.

- Further opening of the Swiss market to foreign companies and imported products (e.g. German low-cost retailers Aldi and Lidl came to Switzerland) reduced prices

The global carry trade favored high-yielding currencies against low yielders like the yen and the franc. The Swiss CPI was consistently under the SNB price stability target of 2%. Therefore the SNB did see any need to raise interest rates till inflation had become a bit stronger in 2006 and the ECB first started to hike rates. Even if the US housing market started to tumble in 2007, Swiss real estate continued its rise. The SNB ignored the risk of a housing bubble, the stronger growth in Switzerland than in the Euro zone : The SNB rates remained steadily at least 1.25% under the ECB rates (source SNB, page 64).

Thanks to the interest rate differential of 1.25% in relatively risk-free environment, the euro rose against the CHF from the fairly valued levels of 1.45/1.50 in 2002 to a top of 1.6776 in 2007. During this carry trade time the EUR/CHF increase completely contradicted the stronger growth in Switzerland and the interest rate parity which suggested that the franc should have appreciated over the time. The SNB saw the franc being used as financing currency of the carry trade and did not battle the fall of its currency. Especially small and medium-sized companies did not see the need to innovate because Swiss labor was not expensive any more. Trade unions were the first to get alarmed about rising health costs as main inflationary signal.

The reasons why the SNB did allow the depreciation of the franc can be seen in the following factors:

- Price stability was maintained, the level of 2% inflation was not reached till 2007. Swiss 2005 CPI, for example, was at 1% whereas the southern members of the euro zone saw inflation rates between 2% and 3.7%.

- The central bank (Hildebrand chapter 5.3.) claimed that the franc was strongly overvalued in 2002/2003 after the bust of the dot-com bubble and 9/11. However this top was not an overshooting like the ones in 1978 or 1988, when we look on the long-term real exchange rate (see above). The later fall of the franc till 2007 was the adjustment to the “fair value” according to the SNB.

- The central bank based itself only on the inflation target and tried to manipulate important monetary principles. So Hildebrand claimed in 2006 that the Neutral Interest Rate had to be lowered.

- Swiss exporters strongly took profit of the undervalued franc and the SNB bashing of its currency. Swiss manufacturing costs were 20% under the ones of Greece, Spain or Italy and even smaller than German ones.

After the financial crisis, however, the scenario completely changed. Instead of nominal return in the carry trade time investors now looked for safety and real return. The Swissie strongly appreciated. Thanks to the inverse carry trade flows the growth difference between Switzerland and the EU increased and Swiss properties continued their rise. Switzerland had a 1.5% stronger growth in 2008 and 2009 than the euro zone, but the SNB continued to claim that the “fair value” of the EUR/CHF were 1.50, the so-called “line in sand” and intervened regularly in the market. In December 2009 the euro declined against the major currencies (including CHF) after the new Greek government admitted that Greek statistics were wrong for many years. The SNB did not fight against the decline, the level 1.50 was apparently just a temporary target to stop a too rapid CHF appreciation and the 1.50 “line in sand” broke.

After the financial crisis, however, the scenario completely changed. Instead of nominal return in the carry trade time investors now looked for safety and real return. The Swissie strongly appreciated. Thanks to the inverse carry trade flows the growth difference between Switzerland and the EU increased and Swiss properties continued their rise. Switzerland had a 1.5% stronger growth in 2008 and 2009 than the euro zone, but the SNB continued to claim that the “fair value” of the EUR/CHF were 1.50, the so-called “line in sand” and intervened regularly in the market. In December 2009 the euro declined against the major currencies (including CHF) after the new Greek government admitted that Greek statistics were wrong for many years. The SNB did not fight against the decline, the level 1.50 was apparently just a temporary target to stop a too rapid CHF appreciation and the 1.50 “line in sand” broke.

The same happened to the level of 1.40 in May 2010. The SNB still claimed that the franc was at fair value and sustained the level by further Forex purchases. Despite falling import prices caused by the rising franc, Swiss yearly average inflation rose to 0.7% in 2010. The SNB had to obey to its main target price stability and left the CHF to the market forces. The fall of the EUR/CHF to the book value of 1.24 in 2010 resulted in losses of 21 billion CHF in the SNB balance sheet. Even more than before the central bank was subject to critical voices from the media and especially from the right-wing party People’s Party (SVP).

(3.4.) Overshooting of Summer 2011 and establishment of a floor

Spring 2011 experienced a reappearance of the carry trade against the yen. As opposed to the time before 2007 the franc was now an investment currency of the carry trade, fired by demands that the SNB should hike rates. The EUR/JPY rose between January and May 2011 from 108 to 122, by 13%. At the same time the CHF/JPY augmented from 85 to 93, by 10%. Still in June 2011 most investors thought that the SNB would hike rates soon based on the inflation expectations of 1% in 2011 and 2012 and 1.7% in 2013.

In summer 2011, when global growth slowed and more and more Euro zone problems appeared, Germany and Switzerland continued to outpace the rest of the euro zone and the US. Thanks to rising inflation and a very risk-adverse investment climate the Swissie continued its rise despite an interest rate differential of 2% in favor of the ECB and reached 107 against the yen and parity with the euro in August 2011. But given the gloomy global economic forecasts one was clear: The franc overshot again.

The SNB decided to intervene and established a floor, a minimum rate of 1.20 of EUR/CHF and claimed to do “unlimited” Forex purchases at this level.

The floor of 1.20 is strong in two aspects:

- It was nearly 20% over the overshoot level of 1.00 EUR/CHF. After the initial deflation fears the exchange rate remained mostly under 1.21. Therefore the 1.20 does not really represent a “floor”, but rather a “peg” between 1.20 and 1.21.

- It only considered the EUR/CHF exchange, whereas the dollar could revaluate against the franc without limits. A strong revaluation of the dollar would make Swiss international companies more competitive, what then quickly happened (see trade balance above).

The current floor of 1.20 seems to be a longer-term target, valid at least valid for two or three years or like Jordan said “it is maintained as long as it is no longer necessary”. Thanks to the floor Swiss companies are able to their business calculations again on a solid basis.

With the retreat of former Hedge Fund manager Hildebrand, who risked and lost his jobs doing insider trading, the remaining SNB council members are mostly academics and rather typical “Swiss”. A typical Swiss has a character attitude that prefers to avoid risk, visible especially in the delivery of by Swiss law secret banking data to the United States.

The Swiss mentality rather seeks compromises with the market (or the US) instead of challenging them. After markets drove the EUR/CHF down to parity, an SNB chairman Jordan instead Hildebrand might have set the floor at 1.10 or 1.15 or would have even avoided a floor. Also the (too) early interventions in 2009 and 2010 might have come rather from Hildebrand, even if Jordan later provided the needed theoretical framework (see also above). On the other side Hildebrand was still a hawk to counter for the Swiss real estate bubble, just 3 months before the floor !

Similar things happened already earlier: Having advocated the expansion of the Swiss monetary base in 2003, already in 2005 he was in favor of rate hikes, earlier than the other members of the SNB council.

In summary, Hildebrand seemed to be a rather interventionist central banker, whereas the history of the SNB and Swiss mentality showed that strong monetary easing was only done in absolutely extreme cases, in the case of overshooting of the franc exchange rate combined with bad perspective for the Swiss economy in comparison to the world economy.

Before Hildebrand, currency interventions when the Swiss economy grew more strongly or fell more slowly than the European neighbors, had been considered as dangerous.

(3.5.) The fair value of the EUR/CHF via different PPP measures

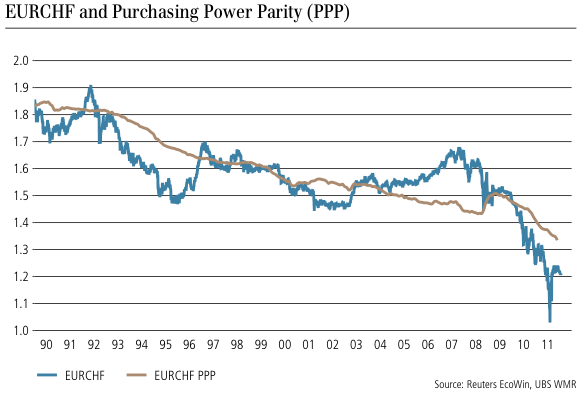

Another reason for the wrong SNB policy was maybe the difference between the PPP measured in consumer prices and the PPP in terms of producer prices. These two measures differ quite strongly, last but not least because Swiss consumers are not very price-sensitive and Swiss importers have recently managed to collect high margins.

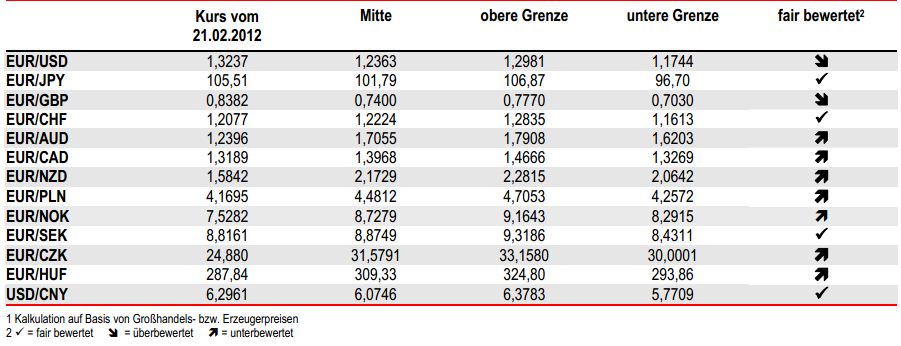

The PPP above provided by UBS is based on consumer prices and stands currently at 1.33, the one provided by HSBC Trinkaus below, based on producer prices, is currently valued at 1.2224. According HSBC the AUD, the NZD and the NOK are strongly overvalued against the euro, but the franc is nearly at fair value.

The Bloomberg producer price-based PPP of CHF/USD stands at 1.00, whereas the USD/EUR is at 0.87, implying a EUR/USD fair value of 1.15 and a EUR/CHF fair value of 1.15. The Bloomberg evaluation is based on producer price inflation since the year 2000 and before that on the average exchange rate between 1982 and 2000. Since the dollar was relatively strong between 1982 and 2000, the real fair value of EUR/USD might be a bit higher. Before 2000 the Swissie mostly followed the trend line of the exchange-weighted currency rate. Therefore it is difficult to doubt the accurateness of the Bloomberg fair value of 1.15 for the EUR/CHF.

This equals to say that the Swiss producers have been and are competitive enough, last but not least thanks to a low tax level, cheap import prices and a continuing immigration of qualified labor (increase of human capital according to the Neo Factor Proportion Theory). The strongly positive trade balance is only one symptom of this competitiveness.

Clearly the 1.15 level contradicts some PPP measurements based on consumer price levels like the Big Mac index (reason Switzerland protects its farmers) or the OECD PPP. The SNB and various Swiss organizations continue to use these values in order to claim that the franc is overvalued. Interestingly the commodity currencies AUD, NZD and NOK are similarly overvalued according to the consumer price based OECD statistics and even more strongly according to the HSBC-Trinkaus producer price-based PPP above. Their central banks do not complain about the overvaluation, but are happy that their stronger currency tames inflation and the risks of an overheating property market.

(4) The SNB’s dilemma between housing bubble and strong franc

(4.1.) A Swiss Housing bubble ?

As opposed to other countries, the Swiss real estate bubble did not pop in 2008/2009, even if prices are up by 40%-50% since the year 2000. On the contrary: the cheap money the SNB has provided to banks, has further fueled it. Previously wealthy people transferred only money to Switzerland. When Switzerland was about to close the black money inflow, these people invested even more in Swiss properties, a way to legalize the money. More and more move to Switzerland in order to avoid the always rising tax rates in the EU, a movement that recently was accentuated when french presidential candidate Hollande announced a 75% tax on the rich.

Even in Q4, 2011, when most European economies contracted, building activity in Switzerland increased by 12.5% YoY, only slightly lower than the Q3 value of 13.5%. UBS warned that Swiss home prices increased in the last quarter by 0.22% and that they are approaching a risk area. Credit Suisse does not consider the rising house prices a bubble but are justified by the rising population.

The argument of the rising population was strangely already used the last time before the Swiss housing bubble busted in the 1990s. At that time the bust was caused by the SNB expansionary monetary policy to counter the strong franc, which further fueled an already overheated real-estate market. The bust was finally triggered by the massive investments and the inflation of the German reunification and the rapid rise of the Deutsche Mark against the Franc due to higher German interest rates. To counter the inflation the SNB did exactly the opposite of its previous policy and increased the Libor rate from 1% to 7% and therewith crashed the housing market (history visible in a history of the franc, in german).

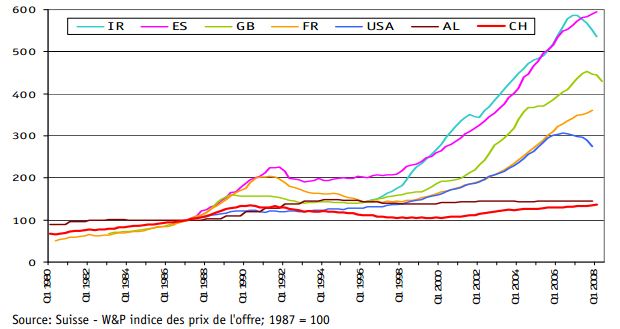

Thanks to the reminders of the last crisis and stricter capital requirements, the house price rise in Switzerland is still lower than the excesses in Ireland or Spain, where prices increased between 1998 and 2007 by 400% (source SNB, AL=Allemagne).

Rents for housing in Switzerland account for nearly 19% of the CPI. Even if existing rents are coupled to an inflation gauge, the ones for new houses and those after tenant changes rise. According to the latest Swiss CPI of January 2012, rents increased by 1.1% on an annual basis, a number well above the negative total inflation value of -0.8% and the inflation gauge for rents. According to the latest February 2012 inflation figures, rents even increased by 0.5% against January.

Still in June 2011 the former head of the SNB Hildebrand stated that the two main risks of the Swiss economy are the strong franc and the “danger of overheating in the real estate sector”.

(4.2.) The Swiss consumer price index

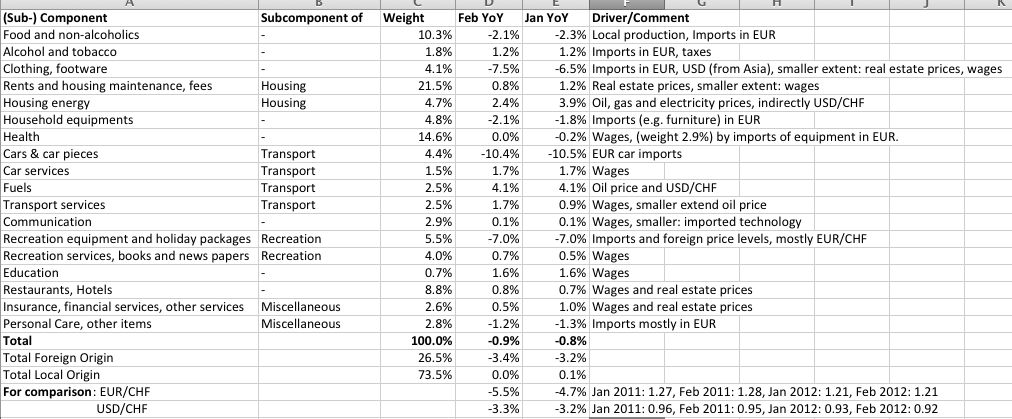

In the following we will examine the composition and the determinants of the Swiss consumer price index, the CPI. In some product groups of the CPI like “Shelter”, “Education”, “Health”, “Leisure”, “Restaurants and hotels” prices mostly depend on local factors, i.e. salaries and real estate prices. All these components make up about 50% of the CPI. Swiss nominal wages increased by 1.3% in 2011 and surprisingly 2% in 2008 and 2009 when the whole world was in recession and despite the rising Swissie.

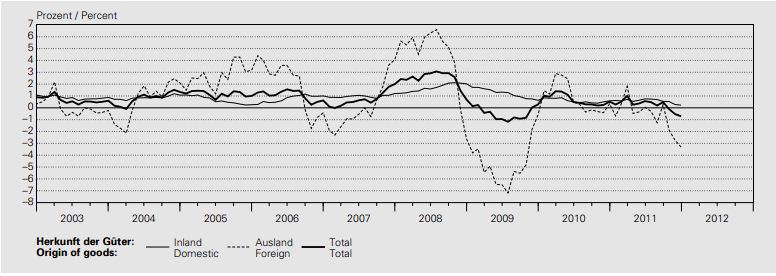

In other product groups of the CPI changes are strongly dependent on the EUR/CHF and USD/CHF exchange rate, because the products are imported and paid in euro or dollar. Imports make up a direct 27% of the CPI, but may have further indirect influences. In the February 2012 CPI reading prices of foreign origin were down 3.4% on the year, whereas prices of products with Swiss origins, 73% of the CPI, were unchanged.

(4.3.) Rise in the EUR/CHF floor may cause inflation if recovery continues

The above graph from the SNB shows that in 2005/2006 and 2007/2008 the rising EUR/CHF and the oil price drove up import prices and subsequently total inflation. Currently we are seeing a rising deflation in import prices similarly as in end 2006 (start of US housing crisis) and in end 2008 (start of great recession) caused by an appreciated franc and a starting recession. Most economists expect the current fall in prices to continue. The crux, however, is that this time we are not heading for a global recession, but for a recovery after the end 2011 trough. The SNB knows that a hike in the floor together with a global recovery would have triggered inflation and consequently did not take this measure.

(4.4.) Components of the Swiss CPI

The following analysis give some details about the components of the Swiss CPI and which factors determine them:

It is obvious that deflation was mostly caused by imports and therefore strongly influenced by the exchange rates EUR/CHF and USD/CHF. Thanks to the floor in EUR/CHF this effect is only temporary, once one year or more since the lows in the EUR/CHF and USD/CHF of August 2011 have passed.

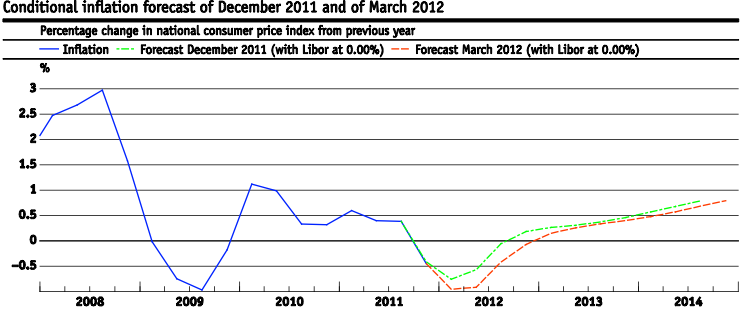

In June 2011 Swiss Statistics and the SNB expected prices to rise 1% in 2012. Recently they sharply downgraded their estimates. The most recent evaluation, speaks of -0.4% on average for 2012. The latest SNB meeting on March 15th was a marketing event, hiding the danger that inflation might come back soon. On the contrary the national bank further downgraded their inflation expectations:

(4.5.) Inflation to come back already in Q3 ?

As we have seen above, changes of many components of the Swiss CPI are driven by the exchange rate of the Swissie against to EUR and USD, a devaluation of the franc or even a standstill can invert the current deflationary scenario into an inflationary one.In February 2011 the EUR/CHF stood at about 1.30 and the USD/CHF at 0.95, 8% and 3% higher than current levels. This explains the fall in prices of imported products by 3.4% YoY in the February CPI.

The fact that one year ago the franc further appreciated will give space for another couple of months of deflation: YoY deflation might increase to 1% between March and April and will then slowly tend against zero. MoM inflation, however, has already risen, the MoM value for the February CPI is +0.3% against +0.2% expected, whereas YoY inflation is -0.9% against -1.0% expected.

The Swiss YoY deflationary scenario might quickly invert into an inflationary one, if the recent rise in business confidence, stock and oil prices is maintained. Internal inflation will mostly follow wage increases (was 1.3%) and increase in rents (was 1.2% in January). We expect inflation of internal origins to go up to 0.5% YoY in the second half of 2012. The main question for internal inflation is if wages will continue to rise in 2012. Exporters and banks are under pressure to lower costs, the SECO even expects unemployment to go up to 3.7% in 2013. This might go in line with lower Swiss wage increases. The probable continuation of salary rises in France and Germany will make Switzerland less attractive for international labour migration, but release some pressure on Swiss exporters.

Inflation from imports, however, will increase more strongly: Provided that the current USD/CHF 0.92 level is maintained, the dollar will have improved in Q3 2012 by 15% from the 0.80 levels in Q3 2011. Together with rising oil prices, the components “Transport” and “Housing energy” might increase up to 15% on an annual basis. This will be a less accentuated for clothing imported from Asia and paid in USD. The YoY increase of the EUR/CHF exchange rate will be rather limited, from the 1.15 levels of Q3 2011 to the floor level of 1.20. Therefore the effects on the CPI components which are driven by the EUR exchange rate, will be a bit lower.

These currency revaluation effects will push price increases for products of foreign origins in Q3, 2012 to 4 – 7% YoY, levels not seen since the May 2008 CPI, when prices for foreign products rose by 6%.

In Q4, 2012 these high levels might continue when the oil price increase against the low Q4, 2011 levels will accentuate, even if currency revaluation effects should limit the YoY price increase (based on USD/CHF in Q4, 2012 = 0.90 vs. USD/CHF in Q4, 2011 = 0.95).

(4.6.) Increase of the floor in 2012 ?

The following simple calculation indicates that a rise of the EUR/CHF floor could trigger even higher inflation: 27% of the CPI come from foreign origins would result into an imported inflation of 4% = 1.25/1.20, raising the Swiss inflation by 1%. An increase to 1.30 would even enhance the imported inflation by 8%=1.30/1.20 and the total inflation to a value of 2%. A EUR/CHF of 1.40 would raise the imported inflation to 16% and the total inflation to 4.5%. Certainly these values will be lower in reality because importers will not be able to increase prices that quickly and will need to renounce to some of their profits or will switch to local production.

It becomes clear that a rise of the floor in an inflationary environment would strongly contradict the main SNB mandate of price stability. In the SNB monthly bulletin of Q3, 2010 Hildebrand clearly states: “In concluding my remarks today, I would like to reaffirm that maintaining price stability is the SNB’s utmost priority. We equate price stability with having average annual inflation below 2% while avoiding deflation. ”

Moreover, the Swiss central bankers strongly rely on monetarist ideas and tradition, and this implies that the money supply shock of summer 2011 should not be repeated so soon, and they must return to steady predictable growth of money supply. A further increase of the money supply to reach the floor of 1.25 would be a complete contradiction of the SNB tradition.

(4.7.) Break of the EUR/CHF floor in Q3 2012 ?

When markets will see these for Switzerland high inflation levels together with a continuing Euro debt crisis, they might trigger the break of the EUR/CHF floor in the third quarter of 2012. The SNB might be cautious in responding with unlimited Forex purchases because the main goal of the central bank is price stability.

We personally suppose, that in Q3/2012 the SNB will not hesitate to buy currency without limits, because their own measure the average CPI for 2012 will be lower. She will expect YoY inflation to come down again in Q4/2012 and will claim that the high YoY inflation in Q3/2012 was due to the “temporary” strong franc in Q3/2011.

(5.) Mid-term Outlook

(5.1.) Morgan Stanley predicts break of the floor in Q3 but for other reasons

One big player who expects the floor to break is Morgan Stanley: They expect a 1.10 EUR/CHF floor break in Q3 together with a global economic downturn and continuing Swiss deflation. Opposed to my opinion they see the EUR/USD tank to 1.20 in Q3 along with other risk currencies. Currency analyses of Morgan Stanley have to be taken with extreme care, they usually follow the most recent trends. As example they currently expect a EUR/JPY rate of 86 in Q3/2012. In their forecast of end April 2011, just 7 months ago, they went for a target of 126-130. As the Swissie is concerned, this is exactly the recession and deflation scenario Jordan speaks off. We do not doubt that the SNB is able to buy unlimited foreign reserves in a such deflationary scenario and will be able to maintain the peg at 1.20.

At roughly the same time (February 3) JP Morgan published a different view for this year. They expected the euro to appreciate against the dollar till 1.38, but that the oil prices would rise only slowly. They saw Brent at the price of 120 $ at the end of the year.

(5.2.) Outlook for 2012 and 2013

We agree a bit more with JP Morgan and think that the global economy will slowly recover in 2012, with considerable down-side risks caused by the euro zone crisis. In our view, the year will ultimately end in a global upturn based on the initial good performance of the US.

Today’s world economy is that global so that it is not possible that one part of the world (e.g. US) lives an economic upturn and the other part of the world (e.g. Europe or China) does not. This global imbalance phenomenon was possible only in 1999/2000 after the Asia crisis and led to a great bubble in stocks. The US growth at that time was unstoppable till Asia recovered and the oil price rebounded. Markets already anticipate that global growth follows on the US upturn, even if the PMIs in Europe and China still show contraction. Oil prices will rise this year along with the recovery, the Iran issues and last but not least driven by investor demands of yield. Like always, rising oil prices will hurt the US the most and will invert the initially good US performance into a rather mediocre growth starting from the moment when gas prices will have reached high levels.Till that time growth in China and Germany should have picked up again. Due to the Chinese monetary tightening and falling real estate prices, China will have more difficulties than countries with dovish central banks. This China problem remains the second down-side risk.

(5.3.) Will the EUR/CHF never rise over 1.22 again ?

Sooner or later rising inflation (oil price increases and the sharp rises in German and French wages) will remind the ECB of its mandate “price stability” and this will lead to conflicts inside the ECB later in 2012 or in 2013. Inflation implies a stronger euro, but together with a continuing PIIGS crisis this results into an even more stronger Swissie (identified by many as being the Germany without default risks having a strongly positive trade balance, a safe haven par excellence).

To my mind, the SNB will be able to hold the floor for another two years till 2014 when this inflation together with insufficient growth in the US and in the PIIGS will trigger another flight into the Swissie and gold (see Morgan Stanley’s rather realistic longer-term outlook or Jim Rogers). Till that time the Swiss economy will have recovered from the too quick appreciation of the Franc in 2010/2011 (see the comment of Economiesuisse).

The Swissie (and similarly gold) will start to depreciate on a longer-term basis only when nominal and real returns in the US start to rise. US house prices will not increase that soon, US wages rise too slowly due to high unemployment and oil prices hamper US growth. All this indicates that the Fed will not hike rates before 2015.

The current interest rate differential between euro zone and Switzerland of roughly 1% is insufficient to make the euro more attractive than the Swiss safe-haven. In Summer 2011 even a difference of 1.5% was not enough to stop the fall of the euro against the franc to parity.

In summary we suggest that the euro cannot rise against the franc to more than levels of around 1.22 except in two scenarios:

1) A global recession that limits Swiss exports and forces the SNB to intervene.

2) A shift back to the global carry trade, i.e. interest rate increases worldwide including the US and the subsequent fall of the safe-haven currencies. This would enable big Swiss investors like pension funds to put their money again out of the franc and less attraction of the Swissie for foreign investors.

After the recent US recovery and rising oil prices, it seems that the first scenario will not happen that soon.

In order to make the second scenario work the growth in the euro zone will need to be stronger than the one in Switzerland. Given the current problems in the PIIGS countries, the contraction of house prices in the US and in the PIIGS and the aging population in most developed countries as opposed to continued migration into Switzerland, this second scenario seems to be one we will need to wait many years or even decades for. Till then the EUR/CHF might have fallen to parity or even less, because the interest rate parity and lower inflation favors the lower yielding currency and renders their companies more competitive over the time.

See more for