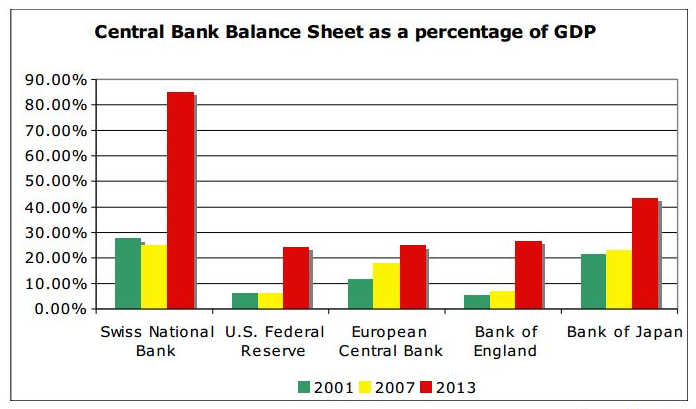

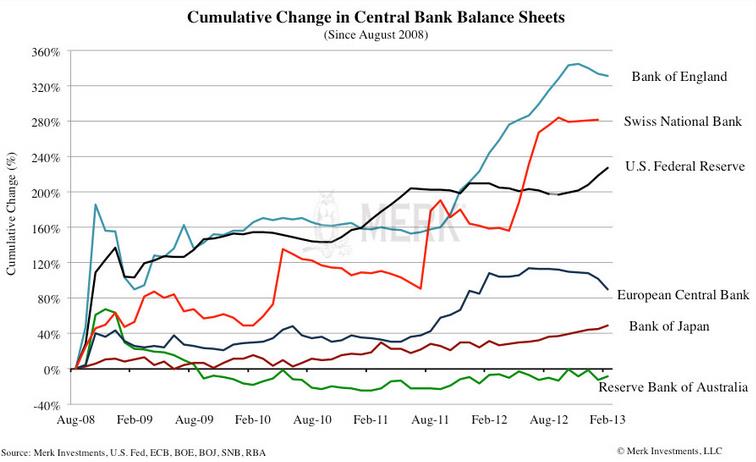

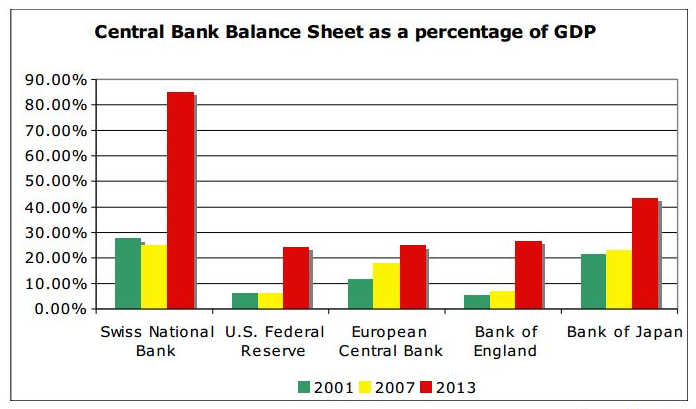

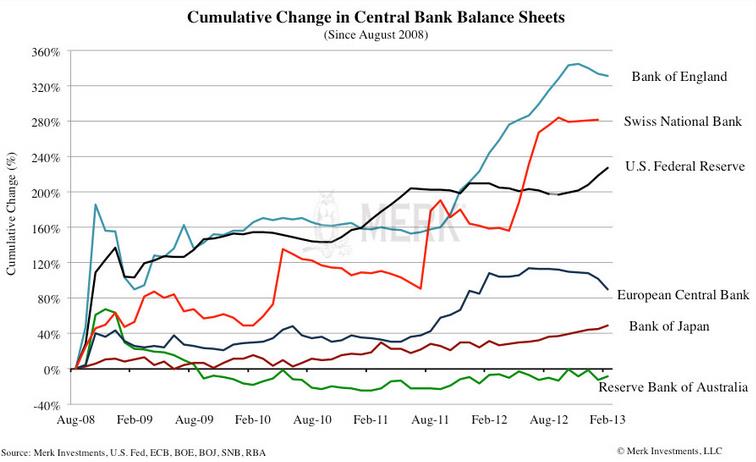

Since 2008 the balance sheet of the Swiss National Bank is 280% higher, this is the equivalent of 60% of Swiss GDP. So did most other central banks, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

The Fed or the Central Bank of Japan mostly own local government bonds, they run an inflation risk but no currency risk.

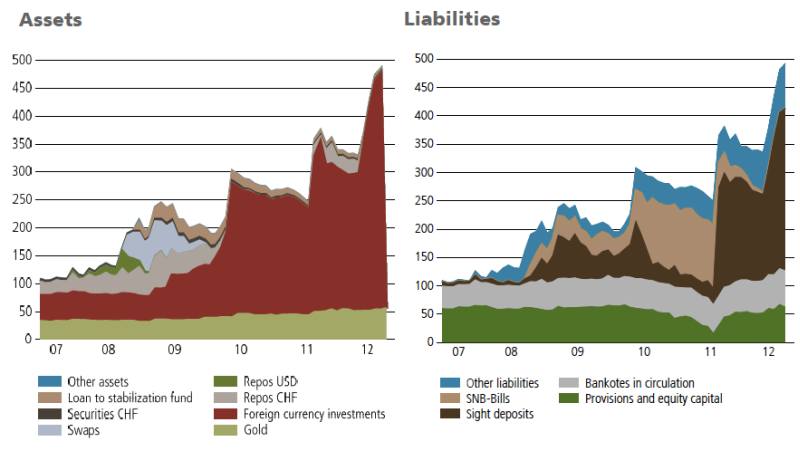

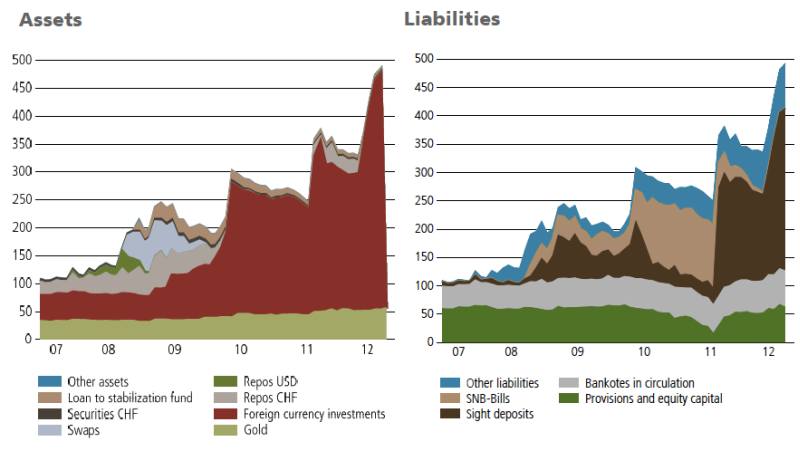

The following graph from UBS shows how the SNB has increased both assets and liabilities, its balance sheet expansion.

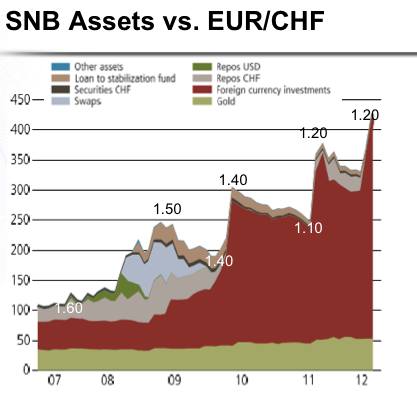

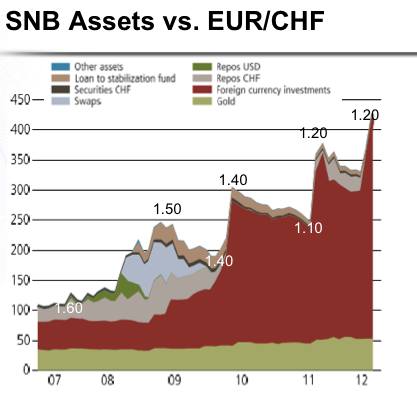

| We like to compare the increases with the fall of the EUR/CHF exchange rate.

The graph shows that a decrease of reserves was only possible when EUR/CHF appreciated. Maintaining the EUR/CHF relatively stable was only possible when reserves strongly rose.

- Between March and June 2009, the SNB managed to maintain the 1.50 EUR/CHF “line in sand” only thanks to intensive FX intervention.

- Same picture in May 2010: Strong demand for the Swiss Franc, even multiplied by the first Greek crisis. The EUR/CHF fell to 1.40. When the SNB had abandoned the FX interventions the Swiss Franc reached parity with the dollar and EUR/CHF 1.30 in September 2010.

- After the typical US rebound in Q4/2010, the Swissie soared again. Like regularly it reached a first peak in the May 2011 up to a EUR/CHF 1.22 and a USD/CHF of 0.83. Then the increase of the Swiss currency even accelerated to reach EUR/CHF of 1.0076 and USD/CHF 0.71 in August 2011.

|

Since 2008 the balance sheet of the Swiss National Bank is 280% higher, this is the equivalent of 60% of Swiss GDP. So did most other central banks, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency. - Click to enlarge |

The following tables show the SNB balance sheet in comparison to the one of the Bank of Japan, another central bank that strongly intervenes in markets.

SNB vs. BoJ Balance Sheet (source SNB and BoJ)

As said, the huge difference is that the Swiss buy foreign assets and foreign currency whereas the Japanese possess only 5% foreign assets, see more details.

George Dorgan (penname) predicted the end of the EUR/CHF peg at the CFA Society and at many occasions on SeekingAlpha.com and on this blog. Several Swiss and international financial advisors support the site. These firms aim to deliver independent advice from the often misleading mainstream of banks and asset managers.

George is FinTech entrepreneur, financial author and alternative economist. He speak seven languages fluently.

See more for 1.) SNB, George Dorgan's opinion