We explain why according to the European wealth reports “median” Italians are more wealthy than Germans. The main reasons are high savings and accumulation of wealth for the average family until the 1990s, often invested in homes and real estate. Low ECB interest rates finally let the value of the home rise strongly.

Why “Median” Italians are Far Richer than Germans

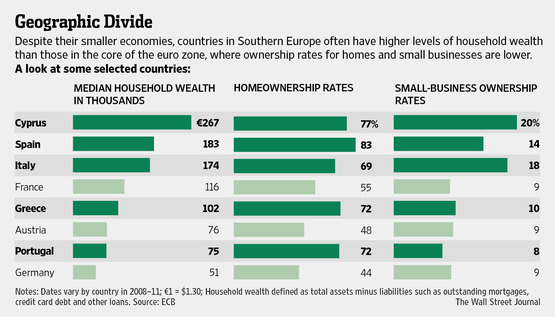

Median WealthAfter rumours and big expectations, on the 21st of March 2013, the Bundesbank presented its first report on German households’ finances and wealth; while, in December one for Italy had been published. According to the German Bundesbank, the European reports showed a median wealth of around 163’400 € in Italy vs. 51’400 € for Germans. As for average wealth, Germans are richer with 195’000 € against 157’000 € for Italy implying that wealth is unequally distributed in Gemany and pretty equally in Italy. Moreover wealth is inequivally distributed between East Germany’s average of 67500€ and the West 230240€. As opposed to Italians with 68.4%, less Germans, namely 44.2% own their home. |

Average, Median Wealth and home ownership rate in Europe |

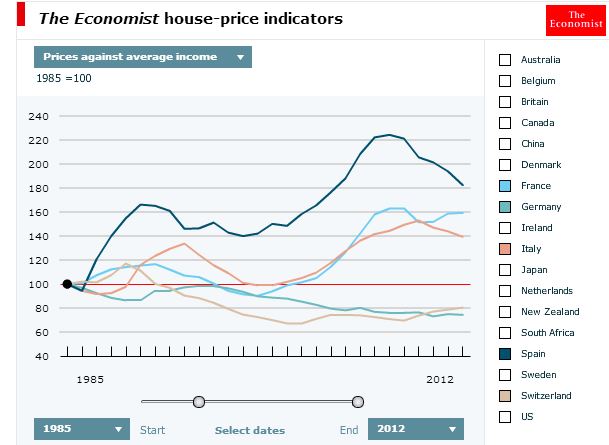

Geographic DivideThe German Central Bank is just one institution within a wider European Project (Eurosystem Household Finance and Consumption Network) that will contribute to the understanding of a family’s finances and the balance sheet of households, thus following the way already paved in the 1960s by the Banca d’Italia. The survey also shows that cheap ECB rates helped many Southern Europeans to acquire property and to prop up prices. This tendency was sustained by many Germans or British nationals who bought houses in sunny places. |

Italy’s wealth in historical perspective

Because Italian data is more comprehensive and a longer panel is available, we look here at the structure of Italian households’ assets and liabilities and their dynamics over the financial crisis of 2008-2011. We also intend to open the discussion of how Italy, the “sick man of Europe”, should once again deal with its political and economic crisis. The last time Italian society and polity faced such a profound financial crisis and deep recession, the strain and burden of adjustment was shared by a large number of taxpayers: e.g. the first large real estate tax called ICI (“Imposta comunale sugli immobili”) was introduced as a temporary and emergency measure in 1992, exactly as a one-off levy on all bank accounts and deposits. Back then, Italy had its own currency and could devalue, diluting the fiscal pain by stimulating nominal aggregate demand (both external, via exports and tourism, and internal via the import-substitution effect).

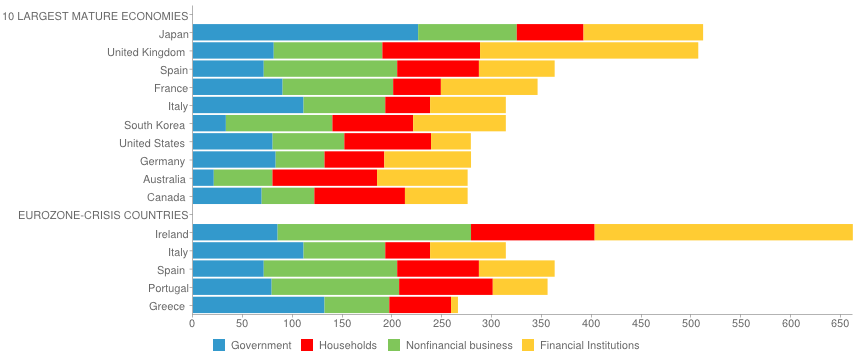

Today, a more comprehensive look at the wealth of nations, including both the public and private sectors, might also be helpful: if the Euro were to be saved, how should the burden of adjustment be divided between member countries? And within the countries, who has to take the largest part of the financial pain? All these questions, despite being at the very core of political and economic developments, are extremely complex and sensitive, thus often neglected in public debates and by the press. Here we present a very humble picture of the financial role of Italy’s households, sketching a few interpretations of how all this came about in the last fifty to sixty years or so.

The data is from two waves of the Bank of Italy’s (BoI) last “Indagine sulla ricchezza delle famiglie italiane” and aggregated for our purposes. Like the European wide project, the BoI collects survey data on a sample of about 8.000 Italian households covering around 300 municipalities. The data is then aggregated to yield an estimate of the assets and liabilities of the entire household sector.

A description of Italy’s household wealthLet us first look at the static picture in 2007, i.e. the situation before the crisis. On the asset side Italian families’ total estimated gross wealth was 9’308bn Euro (giving an average of 157’500 Euro per capita). 3’713bn Euro (39.9%) were represented by financial assets; about 1’000 bn were held in cash and deposits, while around 895bn were shares and quotas of private companies. Some 610bn were invested in pension funds or constituted insurance reserves, and 355bn were invested in unit trusts (both foreign and national). Around 310bn Euro were devoted to finance private companies (mainly Bank bonds) and Italian sovereign bonds amounted to 268bn Euro. About 5’596bn Euro (60.1% of total assets) are attributable to real estate and precious objects, which are made of dwellings and civil buildings for 4’688 bn Euro and 788 bn of land, and industrial buildings and machinery; precious objects (excluding, luxury cars, watches, appliances, etc.) account for roughly 200bn Euro. Having a look also at 2011 shows that the average wealth has not changed (157’080 Euro per capita); the composition of real assets has not changed substantially either. To the contrary, total financial wealth decreased by 4.6%, coming to about 3’542bn Euro and real assets increased by around 7%. It is also worth noting the changing composition of financial assets. Cash, deposits and private debt increased while sovereign bond holdings decreased by a whopping 31.5%; shares and unit trusts, which suffered from substantial price decreases, plummet by 25.9% and 30.3%, respectively. On the liabilities side, Italian families’ total debt was about 799 bn Euro, 43.5% of which was represented by mortgages and slightly less than 30% by other financial liabilities and consumer credit. Somewhat surprising for parsimonious Italians, the latter figure increased by 26.6%, much more than mortgages (+10.1%). Hence, this strong increase in consumer credit (+63bn) is the first sign of consumers’ strains and stresses, and should be read in combination with the constantly decreasing private saving rate. On average financial liabilities increased by 12.6% thus reducing net financial wealth by 9.3% over the period. Net households’ wealth increased slightly by 1.2% from 8’510bn Euro to 8’620bn Euro. |

The Average Wealth of an Italian Household We explain why according to the European wealth reports "median" Italians are more wealthy than Germans. The main reasons are high savings and accumulation of wealth for the average family until the 1990s, often invested in homes and real estate. Low ECB interest rates finally let the value of the home rise strongly. - Click to enlarge Source: Banca d’Italia, La ricchezza delle famiglie italiane, Supplementi al Bollettino Statistico, n. 65, 13 dicembre 2012 * excluding durable goods (e.g. cars, watches, furniture and appliances, ecc.) which are consumption goods; precious objects are estimated

|

Additional figures and international comparisonWe added some additional figures: Household debt to GDP is with 56.9%, compared to public debt and even compared to other nations relatively small. Compared to the high level of households’ assets, the sum of household and public debt is not excessive with 29.4%, despite the high level of public debt. |

Household debt to GDP |

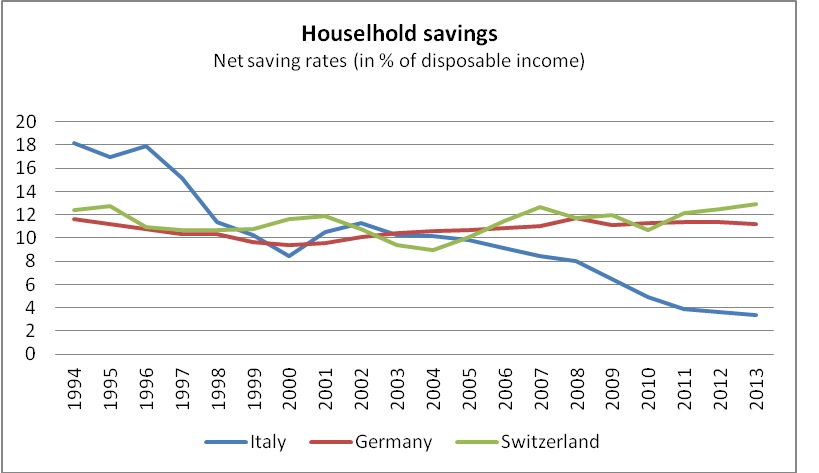

Where does the Italian Wealth Come from?Household wealth is clearly the result of accumulated savings. At least until the mid 1990s Italy had one of the highest saving rates of advanced countries (around 20% of disposable income). Savings in turn, may be allocated to liquid financial resources or invested in real estate and precious objects. The estimates by the BoI show that in 2007, 50% (53% in 2011) of Italian household total assets are attributable to real estate. This seems a relatively high share compared to other countries, especially compared to Germany, that can be explained by looking at Italy’s economic history and its socio-cultural traits.

|

Italian Household Savings Rates Have Fallen from 18% in 1994 to 3% in 2013 |

Why Italians Prefer(ed) Real Estate as InvestmentFirst, Italians own their homes and dislike rents. The reasons are manifold: cultural preferences, extensive legal protection of the tenant at the expenses of the landlord, progressive taxation of rent-income and a relatively high property tax. All in all, from an economic point of view, it does not make sense to buy a flat and rent it; hence, the rental market is small, illiquid and expensive. According to the Bundesbank press release, 82% of Spaniards, 69% of Italians, 58 of French, but only 44% of Germans own a home. Second, Italy’s large shadow economy supported by relatively scant control and soft punishment, allowed business people and the self-employed to recycle money into real estate activities. |

House Price Change in Italy source Global Property Guide |

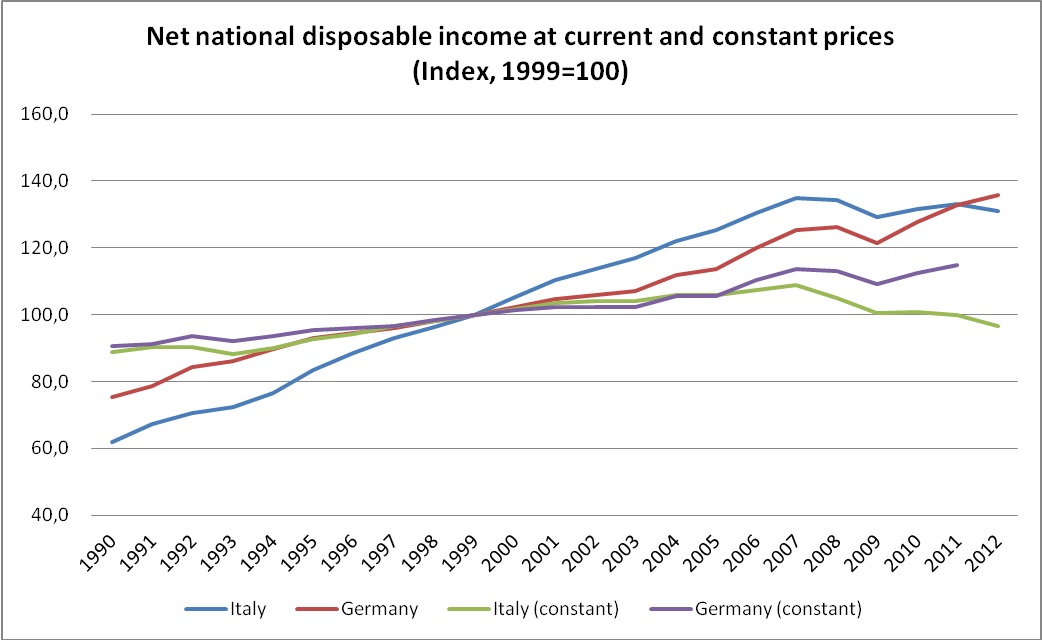

Real estate As Inflation HedgeThird, but probably most importantly, over the last 30 years, Italians “invested in the brick” (“investire nel mattone”), as they use to say, to protect their savings from above-average inflation. The high saving rate, inflation-linked wages (until 1992) and growing nominal income thereafter, made it relatively easy to repay the outstanding nominal debt. Higher interest rates, especially until 1999, made it more attractive for Italians to choose lower maturities and pay back earlier than Germans. This explains why today the 5’000bn Euro real assets are financed by less than 400bn Euro in outstanding mortgages. By comparison, the Bundesbank estimates total aggregate housing debt in Germany (2010) at about 1’000bn Euro, which calculated on a per capita basis, is about twice as much real estate related debt as the average Italian has to service. As a consequence of the first three factors real estate prices have been growing constantly over the last 30 years.

Falling Real Estate Prices since 2008Italy’s house price index fell by 4.64% in 2012, according to Eurostat (-6.94% after inflation). This follows almost four years of house price falls. From 2000 to H1 2008, house prices surged by 85% (53% inflation-adjusted), based on figures from Nomisma. However, house prices started to fall in H2 2008, mainly due to the global financial meltdown. |

|

Sustainability and the long road aheadWhile on aggregate, households balance sheets appear rock solid, but the public sector’s debt burden grows constantly. However, even adding the outstanding public debt (10% of which are household assets) to all households liabilities carries a net positive financial worth in excess of 500 bn €. As we have seen above, the ratio of household and public to total household assets is relatively small with 29%. By contrast, Italian families struggle on the income side, flows are shrinking because of the eroding action of taxes and inflation. This casts doubt on the sustainability of both the public debt because tax revenues are closely linked to, and hinge on, economic growth, and the financial sector, which is profoundly dependent on real estate and sovereign bonds. The risk of price deflation in both real assets and the financial market is a potentially explosive mix for Italian banks and national investors. To keep the country on track, nominal aggregate demand must be relived. To restart growth and increase private sector spending only a few options are at hand; for instance, a combination of accommodative monetary policy and moderate wage increases. The latter may be boosted by substantially shifting the tax burden from income and labour to real estate. Just as Nordea research states: “In crisis countries, there is a lot of wealth that can be taxed as one way to re-balance public sector accounts” (Source Nordea). |

Monti did the wrong reforms

A mix of other reforms liberalizing the protected sectors of the economy should then help to increases productivity and real incomes. Unfortunately, Mario Monti’s technocratic government went in the wrong direction by increasing taxes on both income and real estate, while being unable to liberalize markets, thus crushing the entire economy into a deep recession. Hence, liquid assets were sold and families incurred in new debt to compensate for income stagnation. The next round will mean more pain, more suffering, more families and companies defaulting and dragging the banks with them.

Defaults and/or leaving the euro

Alternatively, to preserve the pecking order of creditors, the Government may partially default on its debt making the adjustment burden last on bondholders only whereas the savings in interest payments may allow to reduce taxes. While Italian households (who hold around 10% of the sovereign debt) may be better off, other sectors of the economy, notably banks, insurance companies and pension funds (who together should account for about 50% of the outstanding public debt) incur large losses and need fresh funds to survive.

The last option at hand is to leave the Euro and devalue. This equals defaulting on sovereign bonds held by foreigners and seeing inflation rising again to relief the real burden of debt and sustain asset prices.

All in all, these aggregate figures allow a first analysis of the political options and the possible stress Italy’s households are facing in the coming decade. However, only by looking at the distribution of wealth and assets, policymakers can shape adequate measures to restore confidence and growth. Economics, in the end, is always a distributional issue.

Author: Umberto Principe (pseud.) is a financial analyst in one of the bigger Italian banks

References and Related:

VoxEU: Giovanni D’Alessio, Romina Gambacorta and Giuseppe Ilardi: Discusses some issues in the survey around household size: Are Germans poorer than other Europeans? The principal Eurozone differences in wealth and income

Credit Suisse, October 2014: Global Wealth Report

Banca d’Italia, 2013: Survey on Income and Wealth

VoxEU: To our reading, Paul De Grauwe and Yuemei Ji emphasize that German companies and the German state are rich, while the household sector is rather poor. Are Germans really poorer than Spaniards, Italians and Greeks?

See more for

2 comments

5 pings

DorganG

2013-04-02 at 21:13 (UTC 2) Link to this comment

I think that Italy might go the Japanese way, deflation/disinflation together with current account surpluses, too many symptoms are similar:

1) Aged society

2) Existing wealth, albeit possibly driven by exaggerated home prices that will slowly deflate

3) In future Italians will achieve a higher saving rates and will de-leverage from remaining debt (I ignore the slight increase of consumer credit)

4) Weaker demand due to aging and de-leveraging, consequently slow or no growth in GDP or in wages.

5) A weaker euro at least for some time (similar as the weak yen until 2007) that will help to achieve consistent trade surpluses

6) Very productive small and medium enterprises that take profit on weak wages. This help to achieve a current account surplus. Albeit the Italian international investment position is slightly negative. Japan’s one strongly positive.

7) Caused by the slow growth an increase of public debt.

The European leaders and the ECB have built the basis that Italy can follow the deflationary path with CA surpluses. The big question is if the current account surpluses will be sustainable. Since foreigners will leave the Italian bond market, only Italians remain. Current account surpluses should finance the public deficit, as result bond yields will fall.

And if the liquidity trap was really a problem for Japan, read here:

https://snbchf.com/2013/02/liquidity-trap-proble/

Deflation/disinflation is certainly something new for Italy….. But it is a buy for Italian stocks

Principe

2013-04-10 at 18:25 (UTC 2) Link to this comment

George,

I agree with your general view and in fact I tend to fear a Japanese decade. Let me just list a few counter arguments to your points, highlighting a couple of potential important dissimilarities between Italy and Japan. I also read your and Noah’s post on Japan, just to be sure I get the point.

The first and most important difference is the monetary system. Italy has no direct control on monetary policy and QE is not likely under the current institutional setup. The key point in missing the monetary lever is that easy money is not flowing there where needed. This has at least two consequences on future growth prospects: first, new credit which stimulates aggregate demand (private/public investments) will be scant (real lending rates are far too high, something which neither Germany had in the past decade) and hampering growth; second, assuming that the average cost of public debt is around 4%, the country would need to grow at least 4% nominally to stop the increasing debt dynamics (just impossible to achieve under structurally low real growth/demand and flat prices). The bottom line is that if Italy were to follow Japan, the adjustment would be much more painful in terms of income growth, unemployment and social consequences, as there is absolutely no chance to monetize debt under the Euro.

Second. Although I’m not an expert in predicting exchange rates, we have seen the Euro depreciating each time the “Confidence Fairy” went away, hence in my view there is only a binary outcome: either the euro crumbles (boosting Italian exports and lifting all the other nominal variables across Europe) or we get deflation. A somewhat lower Euro is unlikely as Germany is already running ultra-high trade surpluses, which even stronger household import demand wouldn’t be able to offset. In Noah’s post he assumes that the Yen did not devalue substantially against the dollar; but the Yen decreased (appreciated) from around 130JPY to 100 JPY in between 2002 and 2004, and depreciated around 20% thereafter. So you are right in your remark (point 5), and this is confirmed by REERs. In real terms the depreciation was quite substantial, at least up until the financial crisis, and helped to increase the CA surplus. Probably the nominal depreciation was due to carry trade, rather than QE. But on the real side things have changed a lot mainly because trade patterns have changed substantially. Japan has always been the frontrunner in global production chains and this together with an aging society, I think, is to a great deal responsible for the low inflation environment.

Does something similar can happen in Italy? Not sure. Because while it is true that Italy’s society is aging rapidly and lower immigration flows will further exacerbate this problem, the country cannot be considered a platform for re-exports and processing-trade (Japan did it with China and South Korea, Germany does with the US and Eastern Europe); Italy has structurally higher inflation and incredibly high taxes. Right the opposite case as Germany which might actually explain why Germany’s elite does not want to go back to the DM. Due to the previous two points, I think real income will not rise and above average inflation will persist. There will be some deleveraging in the private sector, while saving rates will probably stay low or even become negative to offset the low income growth.

UP

Ps. I have found a few charts but I’m not able to show them here

European Wealth Reports: Why “Median” Italians are Far Richer … | Wealth Building Tips

2013-04-10 at 07:52 (UTC 2) Link to this comment

[…] See the original post: European Wealth Reports: Why “Median” Italians are Far Richer … […]

Patrimoniale? No grazie. Anzi, c’è già! « Hic Rhodus

2014-06-27 at 06:36 (UTC 2) Link to this comment

[…] e italiani. Un’analisi più dettagliata di quanto noi italiani siamo ricchi si trova in un articolo di un economista indipendente che arriva alla conclusione che quindi potremmo uscire […]

L’EU cadrà con la rivalutazione dell’euro (e del petrolio): per sopravvivere Berlino dovrà svalutare la moneta unica ossia mantenere i periferici in crisi costante, con collasso a termine dell’Unione | Scenarieconomici.it

2017-08-04 at 11:07 (UTC 2) Link to this comment

[…] ** https://snbchf.com/italy-euro-exit/european-wealth-italy-germany/ […]

L’EU cadrà con la rivalutazione dell’euro (e del petrolio): per sopravvivere Berlino dovrà svalutare la moneta unica ossia mantenere i periferici in crisi costante, con collasso a termine dell’Unione – Eurocrazia

2017-08-04 at 15:43 (UTC 2) Link to this comment

[…] ** https://snbchf.com/italy-euro-exit/european-wealth-italy-germany/ […]

€, symbol italských problémů – Kechlibar.net

2018-05-23 at 17:54 (UTC 2) Link to this comment

[…] politiky (u Švýcarů by okamžitě skončili). Společnost se přizpůsobila, Italové mj. rádi nakupovali nemovitosti coby trvalou hodnotu nezasaženou inflací. Většina italských rodin dodnes bydlí ve svém, […]