In a referendum, the Swiss had to decide about:

1) Ecopop, an ecological-political movement that wants to limit (net) immigration to 0.2% of the population.

2) Abolishment of tax advantages for rich foreigners.

3) A gold initiative.

All three initiatives were rejected, the gold initiative by 78%.

George Dorgan summarizes the outcome. He explains what it means for gold, CHF and the SNB. He argues that the next economic cycle will be driven by stronger wage growth in Germany and in the United States. He argues that in some years time the major enemy of the SNB will become inflation that is caused by rising Swiss asset prices and rents and from inflation spill-overs from Germany and the U.S.

The SNB will continue to do FX interventions. But finally it will react according to the proposal raised by Prof. Janssen, a major supporter of the gold initiative: with a managed currency appreciation.

(see also version on Seeking Alpha, published just after the referendum)

Three Swiss referendums on November 30th

The Swiss had to cast their ballots on three popular referendum initiatives:

- An ecological-political movement (“in short form called Ecopop“) that wants to limit net immigration to 0.2% of the population: a number that is far lower than that already approved by the “vote against mass immigration”. Bloomberg speaks of the biggest risk for Swiss business, because this drastic reduction of immigration would cut the output of Switzerland’s big businesses.

The proponents even argue that “too much wealth makes sick” and the Switzerland should limit (GDP and population) growth. Otherwise Switzerland would explode from 9 to 12 million inhabitants, they would prefer the status quo. They explain the initiative in a simple picture:

2. Abolish tax advantages for rich foreigners that are currently taxed on living costs but not based on income or wealth. Some Swiss cantons have tried to attract such wealthy tax-payers, and Michael Schumacher is maybe the most prominent example. The wealthy create more demand for high-quality real estate and are accused of driving prices up. The cantons situated in the mountains (e.g. St. Moritz) are however dependent on their money.

3. The gold initiative.

Members of the Swiss People’s Party want to “Save Swiss Gold” to give more credibility to the SNB’s monetary policy and the Swiss Franc. The initiative would require that the SNB;

- Does not sell any more of it’s gold reserves

- Must not let gold reserves fall below 20%

- Must hold all gold reserves in Switzerland

If the vote is “yes” the SNB has;

- 2 years to repatriate it’s gold reserves

- 5 years to reach the 20% reserve level (via ForexLive)

This would mean that Switzerland would have to buy around 1500 or 1600 tons of gold over 5 years, either with newly printed Swiss francs or with the proceeds of selling euros and dollars. In the latter case the SNB would have to exit the euro peg.

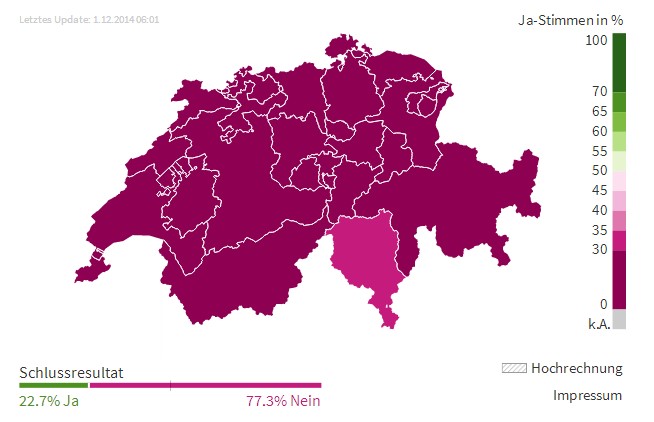

Referendum Results

Ecopop got rejected with 74% of votes, the gold initiative with 77%, the abolishment of tax advantages by 59%. The following shows the Swiss map and the outcome for the gold referendum by canton. None of them are in favor of it. The gold initiative obtained only 22.7% of the votes.

Reimann: “We lost, we have to accept that. People’s verdict must always be respected. But you haven’t heard last of us” #swissgoldreferendum

— Swiss Gold Vote (@swissgoldvote) December 1, 2014

#SNB: “pleased to hear of outcome of the #goldinitiative vote… SNB can now continue pursuing its monetary policy” http://t.co/OOcNZjV0u4 — Swiss Gold Vote (@swissgoldvote) December 1, 2014

Most #Swiss voters rejected #goldinitiative, but in a direct #democracy like #Switzerland the next vote is only 100,000 signatures away #gld

— Swiss Gold Vote (@swissgoldvote) December 1, 2014

Analysis

Both Ecopop and the gold referendum were important for the Swiss franc, the SNB and, to a very limited extent, for the gold price.

1) If both Ecopop and the gold referendum had won, this would have been positive for CHF (FXF) and gold (GLD) in the short term, but negative for CHF in the long-term. The SNB would have been able to sell most reserves possibly above EUR 1.20 in the long-term.

Reason: Ecopop wants to restrict the immigration to Switzerland to 0.2% of the population. This would have increased wages and inflation, but reduced competitiveness of Swiss firms and it would have weakened the Swiss Franc.

It would have been a repetition of history. With the economic crisis in 1975/1976 immigrants had to leave Switzerland. Consequently, the country had strong inflation in the early 1980s. In 1982 former SNB chairman Leutwiler deeply regretted the DEM/CHF floor of 1979.

2) If Ecopop had won and the gold referendum lost, then we would have expected the same long-term picture, but in the short-term the SNB would not have had problems.

3) If only the gold referendum had won, then the SNB would have had immediate and long-term problems with its balance sheet.

4) Finally the effective outcome: Ecopop lost and the gold referendum lost.

Consequences for Switzerland :

- Thanks to the competition of highly qualified immigrants, increases in wages and inflation will remain low. This will enhance the margins of Swiss multi-nationals (EWL) and raise GDP.

According to Swiss statistics, employment levels rose by 0.7% y/y in Q3/2014, while Ecopop wanted to limit immigration (and implicitly employment growth) to 0.2%. The approved referendum against mass immigration (Feb 2014) should result in levels of +0.5% to +1% net immigration and employment growth per year.

The period of excessive immigration and job creation between 2009 and 2012 with 1.5% to 2% more jobs per year, however, is finished. Bear in mind that natural population increases in Switzerland are near zero, while they are higher than zero in the U.S. - Swiss asset and real estate prices will continue to rise for many years (more here).

- Higher real estate prices have not translated yet into price inflation. Rents have gone up by 1% to 1.5% per year since 2008, far less than the yearly 5% increases in home prices. The reason is that regulation couples existing rents to SNB interest rates. Once the central bank hikes rates, then rents will reflect the real estate bubble more.

- The combination of future labor shortages and higher rents might lead to a dangerous price spiral, similar to the early 1980s or late 1990s when the housing market collapsed.

SNB:

- The SNB will further blow up its balance sheet because foreign investors will buy Swiss stocks and real estate to a greater extent than Swiss residents will purchase foreign assets. The SNB will counter this effect with FX intervention.

- FX speculators will help the central bank in the short-term so that interventions will be limited. On Sunday, the central bank appealed to FX traders to buy the EUR/CHF with the usual “committed to buy foreign currency in unlimited quantities” .

Mike Paterson from Forexlive.com confirms “The world and his Mum are long of EURCHF. ” But the magic SNB spells will fail.Serious investors will come in and buy Swiss stocks denominated in CHF, at the latest with US trading. Gains for Euro long speculators will be destroyed again sooner or later. - Any major deterioration in the economic situation in the United States will lead to another heavy assault on the SNB. However, we do not expect this in the next five years.

- One day the SNB will follow the proposal raised by Prof. Janssen, a major supporter of the gold initiative: with a managed currency appreciation or a crawling peg. The fixed peg to the euro will end, but the question remains when this happens. High wage inflation in Germany shows that this point might not be so far away. This spill-over into rising import prices for food is already visible.

- See the long-term picture in our core thesis. With the referendum, nothing changed to it. The managed currency appreciation combined with continuous immigration of qualified personnel is not uncommon. It is a perfect repetition of the Singapore case, a country that let immigrate the best talents from different Asian countries.

Gold:

- We do not agree with arguments that SNB purchases of gold would have had a significant influence on prices. There are far too many other factors that decide about gold prices, but not a single small central bank. SNB’s gold sales during the early 2000 were accompanied by steady gold price increases. In the aftermath of the lost gold referendum, the yellow metal started a great recovery based on far more relevant US economic data (weak Black Friday sales) and speculation about low Fed rates for longer.

- As opposed to CHF, there are no gold-denominated stocks, gold does not have a country. Gold prices typically improve when wages rise more than company profits. Gold is the proxy for wealth distribution to wage earners, which is a major driver of inflation. This distribution happened in the US and Europe in the 1970s. It also took place in Emerging Markets until 2013: wages went up by more 5% per year and helped to boost global GDP, until it considerably slowed with Fed’s tapering.

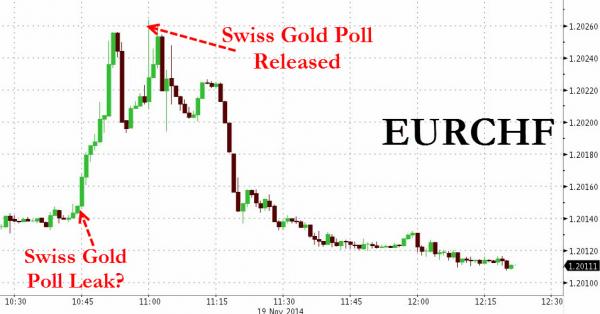

Referendum outcome will not have a big influence on EUR/CHF

We expect a repetition of what happened after the latest poll.

Traders thought that the recent CHF strength was caused by the gold referendum, because mainstream news published such misinformation.

Some traded based on the leak of the poll results. Once the global macro algos from the big US banks and hedge funds started running, EUR/CHF fell again to the level it should be, based on fundamentals and SNB manipulation: namely to levels close to 1.20

In a referendum, the Swiss had to decide about: 1) Ecopop, an ecological-political movement that wants to limit immigration to 0.2% of the population. 2) Abolishment of tax advantages for rich foreigners. 3) A gold initiative. All three initiatives were rejected, the gold initiative by 78%. George Dorgan summarizes the outcome. He explains what it means for gold, CHF and the SNB. He argues that the next economic cycle will be driven by stronger wage growth in Germany and in the United States. He argues that in some years time the major enemy of the SNB will become inflation that is caused by rising Swiss asset prices and rents and from inflation spill-overs from Germany and the U.S. The SNB will finally react according to the proposal raised by Prof. Janssen, a major supporter of the gold initiative: with a managed currency appreciation. - Click to enlarge

It will not be much different this time.

Investment recommendation

We remain more optimistic on Swiss stocks . Curreny manipulation and lower wage inflation will help Swiss companies to achieve better margins than German (EWG) or American stocks.

Background

Four fronts in the Swiss gold referendum (in German)

An overview of the opinion polls.

In favor of a no: SNB chairman Jordan, his speech in PDF format.

Swiss Gold Referendum and SNB’s Opinion: An Exchange of Arguments

The full details, Swiss Franc History: the SNB sells a big part of the Swiss gold reserves at cheap prices.

Latest Referendum in February 2014: Swiss Yes to Referendum Against Mass Immigration is a Yes to Higher Salaries and Higher Inflation

Already in the year 2000, Swiss television SRF anticipated the high gold demand by China and India. Video in German.

See more for

24 comments

Skip to comment form ↓

uuserj

2014-10-17 at 11:46 (UTC 2) Link to this comment

The Acting General Counsel for the International Bank for Reconstruction and Development has offered to distribute physical gold for issuance of gold coin, to all nations.

Source:

https://s3.amazonaws.com/khudes/ltokyoembassiesoutoftokyo.pdf

Background:

https://s3.amazonaws.com/khudes/mboard3.pdf

Karen’s video presentations are getting better from practice and interviewers giving her more time to explain a complex history.

However, Neil Keenan insists that he was entrusted with these accounts by the owners, and that Wolfgang Struck’s Deed of Assignment is invalid.

http://neilkeenan.com/sample-page/

OliverCorneau

2014-10-29 at 09:34 (UTC 2) Link to this comment

http://web.archive.org/web/20141216132833/http://www.mauldineconomics.com/ttmygh/this-little-piggy-bent-the-market

John15cliff

2014-10-31 at 23:47 (UTC 2) Link to this comment

Swiss = chocolate and gold. No gold = no Swiss

joseph deka

2014-11-13 at 12:59 (UTC 2) Link to this comment

The intrinsic value of the fiat currencies (USD,EURO,YEN,UK Pound) is zero. The zero sum game (no to almost no interest) is FREE money for the receivers (mostly banks) and is KILLING savers, pensioners. By creating /printing money they can BUY with that PRINTED money, real assets(companies, direct or via stocks), and worthless mortgage backed loans packages, All giving the banks their toxic loans back and bring the bad loans in Central Banks (for the common people, read taxpayers). How long are the people willing to accept the THEFT of their wealth and killing of savings and pensions by , according to official statistics non existent , INFLATION? People of Switzerland, STAND UP for your RIGHTS and demand a gold backed Swiss Franc and repatriate the Gold to Switzerland!!! I doubt the Gold is still there. The Germans did ask back 680 MT of Gold from London and New York and got….. yes 5 MT of scrap Gold. And Mrs Merkel agreed with OBAMA that the remaining Gold was in “safe” hands in NY.

The Russians and China , India, most Asian countries are BUYING physical Gold hand over first. They are using the Gold price suppressing via the paper gold market COMEX to get their hands on “cheap Gold”. The Gold is being forced out of the ETF GLD Holdings. !!! That’s why the price of Gold can be held down but the owners of GLD certificates will soon find out there is NO GOLD backing in GLD ETF anymore!! It is all to defend the USD as world reserve currency. The US is being assisted by Europe, UK, Japan,Australia and Switzerland. The US is losing the battle. China is signing currency swap lines with the Renmimbi all over the world.The Russians have huge bilateral trade agreements. The USD will collapse and then the Swiss Franc , if still not backed by Gold but aligned with the Euro, will also collapse.

So Vote in favor of the Referendum and get your GOLD back. I do not leave my personal liquid assets with a thief (USA)!

OliverCorneau

2014-11-13 at 22:47 (UTC 2) Link to this comment

Exactly Joseph Deka. The central bankers are robbing the Swiss peoples as central bankers are doing in many countries.

Gold and silver meets all the attributes for a sound medium of trade (money) which is why it has been used as a medium of exchange for centuries while paper currencies have been inflated away to nothing.

Gold maintains its value, it cannot be counterfeited, it is divisible (its density means small amounts can function as large monetary denominations), it is durable, it is easily transportable, it has valued utility in art and jewelry, and its rarity requiring substantial effort and investment to obtain gives it recognized integral value.

Gold’s value made it dangerous to carry around and created a need to secure it, as with any other valuable, but still retain its utility as a medium of exchange without actually needing physical gold.

Jewelers offered a solution. For a fee they would store gold and issue a certificate that would be redeemable for the amount of gold put on deposit. With the gold secure in the jeweler’s safe the certificates themselves became tradable.

With gold assets sitting in their vaults came an opportunity for corruption. It was an opportunity for the jewelers-cum-bankers to utilize the depositor’s gold as security for certificates a banker would print to loan for interest for which there had been no gold deposits. It was possible for bankers to do this because gold certificates would remain out in circulation and not everyone at once would ask to redeem certificates. The crux of the corruption is bankers put the gold on deposit at risk. The contract was for the banker to keep the gold safe. They have violated their contract with the public to provide security of assets.

Gold on deposit, in reserve, was backing not just one certificate but multiple certificates. The temptation to print as many certificates as possible and have as many indebted people paying interest to a bank was enticing to say the least and lead to runs on many banks when it became known there was insufficient gold to redeem certificates.

This is the origin of corrupt reserve banking that has morphed into a global crisis where bank notes are no longer backed by gold freeing bankers from a discipline gold imposes. Globally central banker printing of paper notes is skyrocketing out of control.

Untied States President Richard Nixon reneged on redeeming U.S. Federal Reserve notes for gold in 1971 to stop the drain on U.S. gold reserves. U.S. gold reserves had dropped from over 20 thousand tons to over 8 thousand tons. There was a run on U.S. gold. Confidence in the United States dollar was declining with excessive printing and government deficits. Since 1950 the U.S. dollar has lost 90% of its purchasing value.

Central bank notes are now backed by the strength of an economy behind it. With economies competing on a global scale currency war has broken out to debase a currency for competitive advantage. In short, countries are printing paper notes to leverage whole economies in a race to debase in the same way bankers issued more notes then what they had in gold backing.

The bankers were leveraging the gold and silver to create more debt instruments upon which they made interest. Bank leveraging allowed the bankers to print a large portion of their notes out of thin air without backing. In a run on a bank where people lost confidence in the banks notes, if the first 10 percent let us say redeemed their notes for gold there would be no gold left for the 90% who came later. The 90% would be left holding worthless paper.

There have been many historical examples of this happening. Germany being one of the more famous examples in recent history.

The world is becoming financialized. Central banks are printing piles of paper money far beyond what is required for normal economic operations. As a result backing for all these paper debt instruments is declining. This is what real inflation is. It is the piling on of debt. All these central bank notes (Swiss Franks, USD, Pound, Euro, Yen, etc.) are nothing more than insufficiently secured I.O.U.s. Financial systems are becoming ever more fragile and heading for a crash as real tangible economic assets backing currencies are becoming ever smaller in reserve at a time when the world real resources are being maxed out making it unlikely economies will be able to grow their way out of mounting debt loads.

Debt is not a way to grow an economy. Economies are grown from savings and investment in production and innovation.

Financial leverage is increasing and dominating over substantive economic activities.

In short, central banks are leveraging global economies the same way fractional banking originally started by leveraging gold.

For the Swiss the Swiss National Bank is putting the Swiss economy at risk as they leverage it ever more. This is the real risk for Switzerland that the Swiss National Bank and the Swiss government is not revealing to its citizens. They are not revealing this because they themselves are not aware of the dangers of over leveraging the Swiss economy. They are Keynesian monetarist believing spending is the path to growth and prosperity.

Richard Kast

2014-11-19 at 03:14 (UTC 2) Link to this comment

Nixon removed the gold standard in the US in 72 and worked out a deal with the Saudis to use the US dollar as the petro dollar throughout the world. Time and situations have changed. The Russians and China are trading in their own monies, Russia and Iran are trading in their own monies and the list goes on. The only people abiding by the dollars for petro are the western nations and the Europeans would like to use their own Euro for petro dollars. The dollars throughout the world are falling apart, because the printing presses have to active and the true value of currency around the world is play money at best. The Swedes need to look at the true value backing their currency and they will find it only as play money and the bankers love play money like monopoly. They love to print, they love their debts and they love to control people. Look at the interest rates around the world. Zero return of your investment, while the bankers and the very wealthy are clamoring for more monopoly money to play with. In the meantime, you have been supporting the bankers, the government debt, the wealthy and you have had no return on your investment since 2008. It looks like it was a setup by the bankers, the stock exchanges, the government and the wealthy. The only reason gold has been so low is because the central bankers with the advice of the “Wallstreet” type of investors have asked their governments to hold the price of gold down, which in reality, the price of stocks go up. The price of the currency goes up with the price of gold at the lowest common denominator. However, the world is changing fast, the currencies and especially the dollar will start to see some downside in the very near future, because the game can’t go on forever. Vote yes for the gold standard, and when this happens, your investments backed by gold will see some real upside. If you were so luck to have invested in some gold for the future, it should help you make up for the lost investment income over the last few years.

OliverCorneau

2014-11-26 at 02:35 (UTC 2) Link to this comment

” The real purpose of franc devaluation is to shield

the Swiss banks. from euro devaluation,” Keith Weiner said, http://www.acting-man.com,

21 November. 2014.. . http://www.acting-man.com/?p=34352. The Swiss National Bank has a conflict of

interest and it is the Swiss people who get robbed as their currency devalues

and pays savers little or no interest.

JauntyJackalope

2014-11-28 at 22:53 (UTC 2) Link to this comment

Sorry for you to hear that folks, but todays money are not supposed to be the wealth saver or world saver as you wish… They are defined just only by its function as trade intermediate and accumulating them on your account doesnt make sense for anybody. People in Switzerland “have no money at all” as you understand it, because they use them, invest them expend them make life easier, without care of money. The only money saved in swiss banks are from those who escalte war from east or defend their soaring fabulous fortune they did pillage from their own people on middleeast. Gold has lost its shining since the first world war, when the banking industry developed from its own mistakes that caused the rigidness of rich in post industrial era. Second chop was vietnam war. Youll be suprised that i am more austrian school than anybody, but this time its really different. Money must be pulled out from banks and used, otherwise we are entering the closed door without exit and nobody from you shall expect. If people of Switzerland make the SNB to “cover their money” they will endure the same mistake, what Churchill called his biggest mistake in whole life, when he tied old lady to gold in 30ties, and what caused domino effect fall of whole society, burden unrest and unemployment… war again. Gold is just false expectation, and its hoarding absolutely senseless for 85% of people (except people of india cuz its part of their culture) otherwise its completly useless with cognition of other todays much more persisting and useable scarce ores.

OohLiksi

2014-11-30 at 08:27 (UTC 2) Link to this comment

YES TO GOLD STANDARD

OohLiksi

2014-11-30 at 08:28 (UTC 2) Link to this comment

OliverCorneau YES TO GOLD STANDARD

OohLiksi

2014-11-30 at 08:29 (UTC 2) Link to this comment

YES TO GOLD

ONLY I D I OT STU PID WILL SAY NO TO GOLD STANDARD

mishh

2014-11-30 at 09:24 (UTC 2) Link to this comment

Yes to gold….dollar and euros are printing money with pieces of paper…., which will ultimately make dollars and euros worthless papers…

Swiss Bank currently betrays their country and people.

Paul

2014-11-30 at 22:48 (UTC 2) Link to this comment

That was extremely disappointing and it´s proof that Switzerland is not the country it used to be.

GeorgeDorgan

2014-12-01 at 10:08 (UTC 2) Link to this comment

Paul

That was extremely disappointing and it´s proof that Switzerland is not the country it used to be.

GeorgeDorgan

2014-12-01 at 10:09 (UTC 2) Link to this comment

Mirk commented:

no big problem.

Japan will default in some way (for example like the greece default) and call it “arrangement” with the bond holders (which are in fact the central bank). This solution fits well into the japanese cuture and will be shown as a arrangement cermony in television. The central bank will agree on only paying back lets say 10% of the bonds face value. This gives a good start to cut 2 x zeros from the yen notes(the 10 000 yen note will than be the 100 yen note and be like the not from which they started in 1945). This will somehow reset everything and open the door for the next buble and for additional money printing.

GeorgeDorgan

2014-12-01 at 10:11 (UTC 2) Link to this comment

Paul,

The people cannot

realize future inflationary pressure when it is not yet visible in

prices. This is the task of the central bank. You should not

expect the people to do the job the central bank refuses to do.

kleingut

2014-12-01 at 12:20 (UTC 2) Link to this comment

I can sympathize quite a bit with the motives of the proponents to reign in seemingly reckless Central Bankers. I do not feel sorry for the referendum’s failure because I think it was a misconstruction. The noble motives behind the referendum deserved a better thought-through construct. I am surprised that the proponents did not optimize their construct along the way. Suggestions how to do that were plentiful.

One other aspect keeps coming up in my mind. There seems absolutely no one who sees any future for the CHF other than its strengthening. Everyone seems dead certain that the CHF can only go up. This is so much more surprising when considering the analyses I have read which suggest that 1,30 would currently be the fair value of the CHF based on purchasing power comparisons (also from Swiss banks). Can one really be dead certain that the CHF will not ever again weaken by, say, 10-15%?

GeorgeDorgan

2014-12-03 at 20:24 (UTC 2) Link to this comment

kleingut You probably know that SNB’s friend the bankers are publishing research that wants prove that CHF will weaken, maybe because they want to make money on the clients. More details in

https://snbchf.com/chf/chf-pseudo-mathematics-and-financial-charlatanism/

So I cannot agree with your statement “everybody seems dead certain that CHF can only go up”

The SNB has also educated the public opinion and media that CHF were “overvalued”.

What do you mean with “everybody”?

kleingut

2014-12-04 at 08:45 (UTC 2) Link to this comment

GeorgeDorgan kleingut Well, you are right, it depends on what I read. Frankly I don’t read all that much about Switzerland but I have been following the blog InsideParadeplatz (and lately yours) and when reading IP and the comments, one truly gets the impression that there is only one way for the CHF — UP! Sometimes I wonder whether the CHF could become another ‘black swan’. Let Ebola break out all over Switzerland and people/money will flee the country. Or any other such thing with similar likehood…

GeorgeDorgan

2014-12-04 at 09:09 (UTC 2) Link to this comment

kleingut Exactly you should read not only CNN but also Russia TV, not only the FAZ but also RT Deutsch or not only

As for Swiss monetary policy you possibly read too much the opposition sites Inside Paradeplatz or my blog. I try to be subjective than Inside P., knowing that my readers are intelligent enough. As u see in Twitter they are finance professionals or even some professors.

The most objective view is maybe here.

https://snbchf.com/gold/george-dorgan-auf-finews-die-vier-fronten-bei-der-goldinitiative/

kleingut

2014-12-04 at 12:14 (UTC 2) Link to this comment

GeorgeDorgan kleingut There is one eye-opener which I owe to you — the impact on the exchange rate of CHF being purchased to pay back loans. I returned to Austrian banking in the early 1990 after having spent my first banking career overseas. I could not believe what I saw: every Austrian homebuilder/buyer and many SMEs were financing in CHF (and a bit in Yen). Afterwards, Austrian banks exported that product to Hungary and other Eastern countries. It was so far from everything I had learned about banking before that I could only marvel. Every once in a while I thought that such a high volume of, in a sense, carry-trades could have a down-ward effect on the CHF. I had forgotten about this until I read from you of the impact of such CHF-loans being paid back because all the Austrians/Hungaria borrowers, etc. were/are fleeing the CHF. Obviously, that must have an impact on the exchange rate.

GeorgeDorgan

2014-12-04 at 21:44 (UTC 2) Link to this comment

kleingut The floating currency world works in carry trade cycles. In the financial cycles posts you will find on the blog you see the history. Excessive debt and wage growth in one country is countered by debt and wage growth in another country.

The balance of payments crisis in the US in 2008 was faught with the BoP crisis in the euro zone (so-called “euro crisis”). This one again is faught with excessive spending and debt in Emerging Markets, causing a balance of payment crisis in Russia and elsewhere. Excessive spending and wage increases typically reduce competitiveness and are helpful for the previous losers.

Putin did not combat the debt enough till 2008 and once again till 2012, he wanted to be nice to his people, distributed flats to war widows, wages up 5% each year.

Borrowing in euro and spending in RUB is same story as Austria/Hungary before.

I can understand Chinese that they have capital controls and do not want to rely on debt owned by foreigners. They were a bit more astute than Putin was.

There is only one country that can spend as much as it wants: the 1:N country, the United States. There the elites rip off the less intelligent inhabitants, the Piketty effect.

Currently we are running again into the US irrational exerburance with more US spending/debt,

see also https://snbchf.com/2014/11/gold-price-low-2000/

I see Merkel and Germany as the last protector of sound monetary policy and of the interest of wage earners and savers.

GeorgeDorgan

2014-12-04 at 22:18 (UTC 2) Link to this comment

kleingut The Swiss National Bank is currently accumulating massive currency reserves while the Russian central bank might not have enough.

The Swiss have prepared themselves for their own balance of payments crisis that might come in 20 or 30 years when the well qualified foreigners will have left this strange country again and the ageing effect will have created a lack of labor supply and strong inflation. While in 2000 the SNB argued that they do need all so many currency reserves, in particular not all that gold. In the Swiss BoP crisis (same as 1990s) the SNB will sell many of those reserves again.

JackLoach

2014-12-11 at 23:33 (UTC 2) Link to this comment

Sods —–

Law.

Dec.—-

2014.

For almost two

decades we have strived to get justice for the injustice we have

suffered at the hands of a world renowned bank— PICTET & CIE.

BANK.

Two yorkshiremen

both running their own small family businesses trying to resolve the

problem by taking all the correct legal procedures to recover their

monies.

The matter was

raised in Parliament – twice– the FSA investigated the matter

concluding that PICTET had rogues operating in their London Bank —

but the rogues had left —saying no one left to prosecute.??? —–

so there.

We then

approached the Financial Ombudsman Service. (FOS) — our case was

dealt with by seven different people —- then our numerous E-Mails

were ignored — nobody would speak to us ——-so there.

We then asked the

SFO ( Serious Fraud Office.) to investigate our case —- the

criteria of our case ticked all their boxes. — we were instructed

not to send them

any

documents/evidence.—— in fact they wrote to us advising us to go

to the Citizen’s Advice Bureau.(CAB.)

Richard Alderman

the SFO boss —- who responded to our letter was the same man who

would not investigate the “ Madoff” scandal or the “Libor”

fiasco.

The MP’s

committee —- said he was sloppy— and the SFO was run like “

Fred Karno’s Circus” —– it was an office of fraud.—– so

there.

Our M.P.

approached our local Chief Constable to investigate—– he was

called—- Sir Norman Bettison— Chief Constable of West Yorkshire

Police —- a force that made “ Dad’s Army” look like the S.A.S.

They were inept – corrupt —malicious — from top to bottom. We

were criminally dealt with by the Forces Solicitor—- the Head of

the Economic Crime Unit —-and the Chief Constable —– so there.

We were then

advised to pass our complaint against West Yorkshire Police to the

I.P.C.C. – which we did — they advised us to make our complaint

to —- the West Yorkshire Police — we did with reluctance — all

we got was abuse and obfuscation. —– so there.

Sir Norman

Bettison —- The Forces solicitor— and the Head of the Economic

Crime —- have all been removed from their posts and facing criminal

allegations.

—— so there.

We even sought

justice through the Courts — culminating in a visit to the Court of

Appeal-London.— On leaving the Courts of Appeal that day our

barrister a “rising star” informed us — that if that was

British Justice then you can keep it. He quit the law and moved to

Canada —– so there.

A few years later

we learned that one of the judges ( Lord Justice.) in our case at the

Court of Appeal was related to a senior executive of the Pictet Bank

—–so there.

The Ministry of

Justice passed our case to Lord Myners to investigate — we would

rather have had Mickey Mouse or Donald Duck do it. — to this day we

don’t know

—whether he did

anything or not —- probably not — seeing that his wife was on the

Pictet Prix Board.

Pictet & Cie

.Bank — voted private bank of the year 2013.

Ivan Pictet —-

Voted banker of the year 2012. —- the senior partner — lied on

numerous occasions and had documents destroyed — also said genuine

documents were forgeries. —– so there.

Ivan Pictet in

Oct. 2013 —- Given the Legion of Honour — but saying that —-

honours were given to Hitler — Eichmann — Mussolini —Franco

— he’s in fitting company. —-so there.

MONTY

RAPHAEL.Q.C. — Peters & Peters.London. They were the banks

lawyers.

Monty

Raphael.Q.C. along with Ivan Pictet withheld crucial documents

requested by the High Court —- the FSA —- and the police Fraud

Squad. —-so there.

Monty

Raphael.Q.C. became an Honorary Queens Counsellor in March. 2012.

Monty

Raphael.Q.C. became a Master of the Bench in Nov.2012.

An expert in

Fraud —the Doyen of Fraud Lawyers. —– so there.

This says a lot

about Banks — the consensus of opinion is that they are highly paid

“crooks” —- no wonder they voted Ivan Pictet banker of the

year.

It appears that

crimes in the “establishment.” are honoured by their peers.

“HONOURS

AMONG THIEVES.”

Full Story.—-

“google ”

Insert.—– The

Crimes of —– Pictet & Cie Bank.

or

insert

Ivan Pictet/

Monty Raphael Q.C.