Originally by Toyoyuki Sameda, a history of gold from a Japanese perspective, in 1999. We added some of our charts for the German and Swiss perspective.

The 20th Century has various features: it is called a century of war, technological advancement, atomic energy, ideology, economic growth, explosion of population, and so forth. But here it is also a century of gold. This is a history book written from the viewpoint of gold and exchange.

-

Note: Au (from Latin Aurum) Atomic number is 79, Atomic weight is 197.0, and most malleable and ductile of all the metals. It melts at about 1064 deg.C and boils at about 2808 deg.C. Specific gravity of 19.3. Mohs hardness is 2.5 -3. Abundance ratio is 75th in the crust of the earth.

Chapters:

0. Gold Reserve of Japan

1. World War I and Fall of Gold Standard

2. Between World War I and II

3. World War II and Gold Transportation

4. The Bretton Woods System

5. Free Floating Currencies

0. Gold Reserve of Japan:

Sum of gold reserves of Japanese Government & Bank of Japan (1905-36, 1950-70, and 1998) Unit: Au. ton

(similar to Germany, we assume that Japan sold all its gold reserves during the war against China and in WWII)

- The above is the total specie reserve of Japan (Government + Bank of Japan) in terms of tons of gold.

- World gold production increased averagely 3% per year in 60 years (1850 – 1910), scarcely exceeding economic growth of the same period.

- The total reserve of gold could be a barometer of the national strength. Until the World War II gold ratio of the reserve was relatively higher, which was called specie reserve for convertible currency.

- The reserve for foreign currency are usually indicated in prices, which is not a proper tracer in the inflationary trend. US government complies with the exchange into gold by the official rate of $35 per troy once (oz-t.; 31.1035 grams) The exchange market of each country was backed by mostly US dollars which were convertible to gold.

- But since the Nixon shock proclaimed in Aug. 1971, US dollar became inconvertible to gold, virtually shifting to floating exchange system.

- Under the gold standard system, one the trade deficit occurs, it means outflow of gold reserve (gold coins, gold ingot, gold bullion or other convertible exchange).

- In 1911 K. Takahashi, governor of BOJ: “The best way to maintain the specie reserve is to develop domestic industry, but it requires further inflow of the foreign currency.”

- The specie reserve in overseas usually exceeds that of in Japan.This trend becomes conspicuous in the years of inflow of large scale foreign debt.

1. World War I and Fall of Gold Standard:

- 1912: Powder magazine – Balkan peninsulaGermany-Austria-Turkey-Bulgaria (Pan-Germanism) vs. Russia-France-UK-Serbia (Pan-Slavism)

- 1914: Prince & Princess Franz Ferdinand assassinated at Sarajevo

- 1914.7: World War I began in two weeks in Europe:Germany-Austria-Turkey vs. Russia-France-UK

- 1914.8 Japan gate-crashed war, and occupied Qingdao.

- 1914: Collapse of Gold Standard; NY & London stock exchange closed. Trench warfare both west and east front, escalating into all-our war.£

Via BIS, Hjalmar Schacht, The Magic of Money, 1967

1915: Japan presents 21-terriotorial demands to China. - 1915: Wartime export bubble: as World War Iwas protracted, import slumped, while exportwas boosted by:

- supply of materials to the nations in the war.

- increase of export to Asian countries

- increase of export to

- historical record of trade surplus was 117 tons of gold;

- Japanese foreign reserve become 387 tons of gold.The issue is not how to increase the overseas reserve, but how to utilize the overseas reserve.

- 1916: Japanese foreign reserve 535 tons of gold.

- 1917.2: Unlimited attack by German submarines; US

- 1917.11: Russian Revolution

- 1918: Naval blockade against Germany continued aftercease fire.

- Loans to Czarist Russia became default. UK and France aimed to repay US loans by German reparation, trying to return to the Gold Standard soon.

- Severe food shortage in Germany

- German gold reserve: 810 tons “Starvation with gold coins in their mouths.”

- 1919.5: Paris Peace Conference: mainly lead by David Lloyd George of UK, George Clemenceau of France, and Thomas Woodrow Wilson of US, but defeated nations were not allowed to attend.

- 1919.6: US lifted the gold embargo (except Russia), returned to the Gold Standard. But, Japan did not follow to Gold Standard System.

- 1920.1: League of Nations started (without US)

- 1920.12: UK, embargo on Gold & Silver.

- 1920: Japanese domestic reserve 837 tons exceeds that of overseas 796 tons.

2. Between World War I and II:

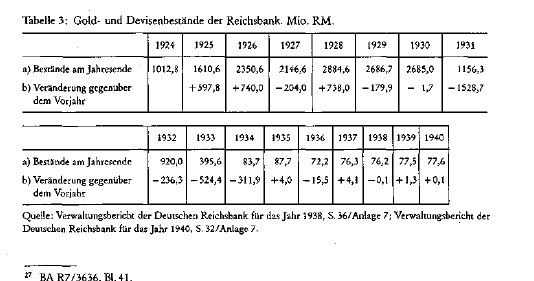

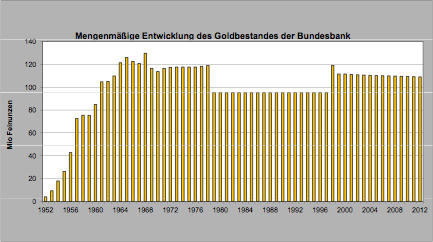

The following chart shows how Germany sold all its reserves between 1931 and 1939.

- 1919.7: Weimar Republic; President Friedrich Erbert. The total amount of reparation was 300B Mark (=107,523 tons) required by UK & France. Initial payment by 1921.4 was 20B Mark (=7,168 tons) But German gold reserve was decreased to 402 tons in 1919. The reparation could by paid not only by gold currency but in kind such as vessel, coal, cattle, and timber.

- 1921.1: Allied Powers’ concluded the total amount of reparation: 138B Mark (=49,460 tons) , with annual payment 2B Mark (=716 tons).

- 1920: Hyper inflation in Germany more than a trillion times. 100T Mark note appeared.

- 1924.4: US Daws Plan: 1B Mark (1924-25), 1.22B Mark (1925-26) and so on as tentative reparation.

- 1924.11: Germany returned to Gold Standard: 1 Reichsmark = 358.31 mg)

- 1929.1: US Young Plan: the remained total 3.58B Mark (=12,831 tons). Also BIS (Bank for International Settlements) was established.

- 1929.10: US NY Stock Exchange clashed (the Great Depression)

- 1930.5: Japan returned to Gold Standard.

- 1930: World Trade decreased over the previous year: -19% (nominal) and -7% (apparent)

-

3. World War II and Transport of Gold:

- 1936: Feb 26 Unsuccessful Coup d’etat in Japan;Japan-Germany Anti-Comintern Pact (1937 Italy joined)

- 1937: Exchange Control Law in Japan;Japan-China War erupted.

- 1937: US Neutrality Act, revised

- BOJ report:Japan must increase the import of not only producer goods but consumer goods to keep expansion of heavy industry. As the export of Japanese light industries was getting less competitive, the export of heavy industry products seemed hopeless; enforcing delivery of gold bullion to maintain the exchange rate. BOJ estimated the possible deliverable gold bullion between 1937 -1941 will be 417 tons. (without breaking down of BOJ’s reserved 260 tons.)

- Japan deteriorated Gold/yen evaluation from 0.75 g/yen to 0.29 g/yen.

- Japan manipulated increase of apparent gold reserve by prior issuance of gold receipt bond.

- 1938: upgraded to Japan-Germany-Italy Military Alliance: Japan assumed Soviet as a possible enemy, while Germany required to include the third nations (UK and France)

- 1939.3.31 Gold Holdings:

- UK 1777; France 2,666; Canada 191; UK-France Dominion 480; United Nations Total: 5,114 tons

- vs. Germany 133 tons (+ Illegal seizure 500 tons?

- Japan shipped Gold to US (1937-41): 608 tons (almost equivalent to 900B)

- BOJ Gold reserve: 91 tons (1952), surprisingly small.

- It sounds strange to deliver gold bullion to US to secure military purchase for the possible war against US.

- 1939.7.26: US denounced US-Japan Commerce & Navigation Treaty

- 1939.8.20: Nohmonhan Incident

- 1939.8.23: German-Soviet Non-Aggression Pact concluded

- 1939.9.1: Germany invaded Poland; World War II erupted in Europe.

- 1939.9.17: Soviet invaded Poland.

- 1940: Germany invaded France; Japan, Germany & Italy Tripartite Pact concluded.

- 1941: US Lend-Lease Act concluded; Japan-Soviet Neutrality Pact concluded; Germany invaded Soviet Union; Japanese assets in US were frozen; Oil embargo on Japan.

- >Top

- 1942-44: Transportation by submarines between Japan & Germany (total 5 times); from Kure Naval Port, Hiroshima to Brest or Lorient Naval Port in occupied France, spending 90 days, submerged most of the day, surfaced in the midnight only. By this transportation, Japan received submarine dumb, radar, bomber pointer, torpedo boat engine in exchange for rubber, tin, tungsten, molybdenum.

- 1942.4.11: Japanese submarine i-30 shipped Kure:On the way back from Singapore, it sunk by a mine

- 1943.6.1: Japanese submarine i-8 shipped Kure:Succeeded return trip.

- 1943.8: German submarine U511 arrived Kure:

- 1943.10.13: Japanese submarine i-34 shipped Kure:Outward trip after Singapore, it sunk by British submarine attack.

- 1943.11.5: Japanese submarine i-29 shipped Kure:On the way back from Singapore, it sunk by US submarine attack.

- 1944.4.23: Japanese submarine i-52 shipped Singapore: Total crew126, delivering engineers to be trained in Germany, with 2 tons of gold bullion. Japanese cryptogram was decoded by US; the submarine was sunk by US carrier’s attack. This information was exposed in 1980 by US.

- 1944.5: German submarine U512: Outward trip, it was sunk in the Atlantic ocean by US destroyer’s attack.

- 1941 -1945: Earmarked Gold:

- French Indochina: 33 tons

- Thai: 44 tons

- China: 53 tons

- “Was it exceptional that a nation which is just being defeated has paid its war expenditure by gold bullion?” (from a history of Yokohama-Shokin Bank), or was Japan relieved from its debt by the enormous inflation?

- 1945.10.1: Army of Occupation surprised the smallness of gold reserve at BOJ. Gold reserve: 91 tons (1952).

4. The Bretton Woods System

-

1944.7: Bretton Woods Conference: United Nations agreed the international monetary systems based on free trade.

- 1945.11-1946.10: Nuremberg Tribunal

- 1945.12: IMF (International Monetary Fund) and IBRD (International Bank for Reconstruction and Development) established. £1=$4.03

- 1946.5-1948.11: International Military Tribunal for Far East (‘Tokyo Tribunal’)

- 1947.5: Japanese constitution enforced.

- 1949.4: Joseph. M. Dodge’s recommendation; $1=360

- 1949.8: NATO established. (Greece and Turkey joined in 1952.2, and W-Germany joined in 1955.5)

- 1949.9: BRD (BundesRepublik Deutschland) established; enforced its constitution (1949.5).

- 1949.10: DDR (Deutsche Demokratische Republik) established; enforced its constitution (1949.10).

- 1950.6 – 1953.7: Korean War; Japan enjoyed special procurement boom amounting $980M (871 tons)

- 1950.7: EPU (European Payment Union) established; later reorganized into EMA (European Monetary Agreement)

- 1951.6: GARIOA-EROA aid to Japan, and Marshall Plan to W-Europe ended.

- 1952.4: Japan recovered independence (San Francisco Peace Treaty)

- Japan confirmed to succeed the prewar foreign liabilities.13 kinds of £debts outstanding balance of£120M, 14 kinds of $ debts outstanding balance of $126M, and one kind of FFr debt outstanding balance of FFr437M.

-

US Gold Reserve (1945 – 1959) US Gold reserve; amounting 21,707 tons in 1949 maximally.

- Period of High-growth economy:

- 1952.5: Japan joined IMF and IBRD; paid-in capital $200M, 75% by yen and 25% by gold (15 tons)

- 1952 – 1965: Introduction of foreign capital, amounting $860M (764 tons)

- 1954: End of removal of reparations. But until then;

- USSR: took from E-Germany $13B (11,552 tons)

- The West Allies: took from W-Germany $517M (459 tons)

- 1956.7: Japanese Economic White Paper said, “No more postwar”

- 1957.3: EEC established by 6 countries.

- 1958.10: France President Charles de Gaulle: Cinquieme Republique after Algerian war and 1/100 denomination in 1960.1.

- 1960.7: Japanese Ikeda Cabinet: “Income-doubling program”

- 1960: US dollar’s purchasing power declined about 40% of 1934.

- 1961.2: W-Europe liberalized overseas travel, while Japan from 1964.4.

- 1963.1: Paris-Bonn Axis (Elysee Treaty)

Gold Reserve of UK/France/W-Germany/Japan (1950-60):

- Miracle economic recovery: West Germany showed 7.9% growth in 1950s, exceeding France in 1952, Japan in 1953, and UK in 1955 in terms of gold reserve. The main reason for this growth due to active export of producers’ goods to other European countries. German industry evacuated to escape from US bombing during the war. The damage ratio was estimated less than 20%.

- 1963 – 69: Euro Dollar market grew from $5M (4,443 tons) in 1963 to $37.5M (33,325 tons) in 1969, mainly derived from excess of dollar, and unregulated from governments.

- 1967.11: Pound crisis; £1=$2.40

- 1968: Japan changed into the constant trade surplus trend from1968, attaining gold reserve 2,326 tons in 1968.

- 1968.5: Paris Peace Conference to settle Vietnam war; agreed in 1973.1.

- 1969: Japan became a supplier of funds into IBRD.

- 1970.8: Oder-Neisse Line became border between Poland and E-Germany.

- 1971.8.15: Nixon shock: suspended conversion between dollar and gold; for fear of decrease of gold reserve less than $10B calculated by official rate of conversion (=8,887 tons)

- tried to maintain Gold Parity: $35/oz-t Au ($1,125/kg Au)

- 1971.12 but US and France agreed new Gold Parity: $38/oz-t Au ($1,222/kg)

- 1971.12 – 1973.3: New rate after G10 Smithsonian Agreement; returned to fixed exchange system with plus and minus 2.25% allowance. <Cf: Right column>

- 1972.5: Return of Okinawa island to Japan; exchange rate 305

- 1973.5: W-Germany and E-Germany joined UN.

- 1973.3: Collapse of Smithsonian System: shifted to Dirty Floating Rate System

| $1 | =BFr 44.8159 | 11.57% down |

| =FFr 5.1157 | 8.57% down | |

| =DM 3.2225 | 13.58% down | |

| =L 581.5 | 7.48% down | |

| = 308 | 16.88% down | |

| =Fl 3.2447 | 11.57% down | |

| =SFr 3.85 | 6.36% down | |

| £1 | =$ 2.6054 | 8.57% down |

| Au parity 1oz.t | =$38 | 7.89% down |

US/Swiss/W-Germany/Japan Gold Reserve & Foreign Currency Reserve (1955 – 1970):

- The bottom figures show that the reserve of 4 major countries. Such reserve includes gold and foreign exchange, but not includes reserve tranche from IMF. However, US reserve was only gold by 1963, but includes foreign exchange after 1964. West Germany exceeded this reserve amount over US in 1970.

US/Swiss/W-Germany/Japan Gold Reserve & Foreign Currency (1955 – 1970):

U.S., Swiss, German and Japanese Gold and Foreign Currency Reserves between 1955 and 1970

5. Free Floating Currencies

- 1973 – : Floating foreign exchange system; surge to Yen appreciation

- 1973.2: US announced new Gold parity: $42.22/oz-t Au

- Gold market: $86/oz-t Au ($27,650/kg)

- 1973.2: First Oil Crisis arose:

- 1973-74: Fourth Middle-East War (Yom Kippur War) erupted.

- Yen exchange rate (1968 – 1997):The year average rates were around 200 by 1985, but showing higher yen & lower dollar since then.

- 1976.6 – 1980.5: IMF reserve 4,665 tons; 1/6 (777 tons) was returned to the investor at the former parity, and another 1/6 was sold in the market.

- 1979.1: Iranian Revolution. Ayatollah R. Khomeini returned.

- 1979.3:EMS (European Monetary System) established; currency basket system (ECU) with 20% pooled gold and dollar reserve from members.

- 1979: Second Oil Crisis

- 1980-1988: Iran-Iraq War

- 1980-1988: Reaganomics and higher dollar & lower yen.

- 1981: Mexico; cumulative external debt problem, devaluating Peso by 41%.

- 1985.9: Plaza accord aiming lower dollar: exchange intervention target: $1=DM2.5=200

- 1986: Japanese lower central bank rate policy: trigger for bubble economy. World lowest bank rate 2.5% (1987.2), while US 5.5%, Swiss 3.5%, Germany 3%.

- Bubble at World War I occurred at commodities trading, but this time was bubble at stock market and real estate.

- 1989.11-12: Dismantling of the Berlin Wall; End of the Cold War declared.

- 1990.8: Iraq invaded Kuwait. Gulf War (1991.1)

- 1990.10: Reunification of Germany

- 1991.12: Treaty on European Union (Maastricht Treaty);USSR disappeared and 11 CIS (Commonwealth of Independent States) established.

- 1993.8: Japanese Hosokawa Coalition Cabinet

- 1995: Japan full of difficulties:

- 1995.1: Kobe earthquake

- 1995.4: Historically higher yen $1=79; Orderly Reversal declared by G7 (Concerted intervention of buying dollar)

- 1995.4: Collapse of Bubble economy

- 1995.9: Historically lower bank rate 0.5%

- 1995: Asian currencies maintained US dollar pegging system to keep lower yen and higher dollar to increase each export competitiveness.

- 1997.11: Sanyo Securities, Hokkaido Takushoku Bank, Yamaichi Securities broken up.

- 1997: SE-Asian currencies plunged:

- Indonesian Rupia: -58%

- Thai Baht: -45%

- Malaysian dollar・ドル: -35%

- Philippine Peso: -34%

- Singapore Dollar: -17%

- HK Dollar and Chinese Yuan maintained US dollar pegging system, asking US to buy yen and sell US dollar.

- 1998.4: revised Bank of Japan Law revised, enhancing BOJ’s independence.

- 1998.10: Russian Currency crisis, shifted to de facto floating system.

- 1999.1: “Euro” introduced by 11 EU countries except UK, Sweden, Denmark, Greece; ECB (European Central Bank) established;

- Price gap among countries became obvious due to the differences of tax, distribution cost, finance and employment policies.

- Euroland 11 central banks’ reserves: Foreign currency 277B Euro, Gold 100B Euro (26.4%).

- 1999.1: Brazilian Currency crisis, shifted to floating system.

- >Top

- Gold as the last resort: After Nixon shock, theological argument still continues regarding future possibility of returning to fixed rate system and gold standard system.

- 1974.12: US & France agreed to revaluate gold reserve by the market price: But developing countries solidly opposed, because US is gaining huge profit by the revaluation while is persuading demonetarization.

- 1976-80: 1/6 of IMF deposited gold (777 tons) was sold back to the original investors by the former official rate ($42.22), and another 1/6 (777tons) was sold at the market price.

Gold Office Price vs. London Market Price (Ave.) per oz-t.(1968-86):

Gold Office Price vs. London Market Price (Ave.) per oz-t.(1968-86):

- The above chart is the comparison of gold market price at London since dual price system in 1986. London market price is determined by quotations from 5 major traders like N.M. Rothschilds & Sons, Samuel Montague, etc. The drop in 1976 was due to the discharge of gold by IMF. (Cf: $332/oz-t as of 2003.4)

- Gold reserve and its evaluation in major countries (1998.1):

- The left scale is evaluation price (yellow bar) and the right scale is the volume of gold reserve (red line) of

major countries in $/oz-t.

major countries in $/oz-t. - The above chart shows the total gold reserve of EU (even excluding 20% of the deposit to EMF) exceeds the total of US.

- Gold mining cost is said about $260/oz-t.

- There are two opinions about gold: “Demonetarization of gold” and “active user of gold.”

Comment:

- Gold has been a standard of currency backed by the Gold Standard System and the fixed office price of gold in most of 20c.

- But since 1971 by the announcement of Nixon shock, conversion of dollar to gold has been suspended, and money flow rapidly grows exceeding real economy. Where has gone the creditability of currency?

- In 21st century, three credit named Gold, Currency, and probably Ecomoney will sustain our global-local community.

1 comment

1 ping

Ruhail Khan

2015-11-24 at 18:14 (UTC 2) Link to this comment

Hi Mr George Dorgan,

I really appreciate your working by heart.

God bless you

take care

Tariffs and the US stance on WTO – Eunomics

2018-04-17 at 13:53 (UTC 2) Link to this comment

[…] has much to do with the redistribution of wealth occured during the II […]