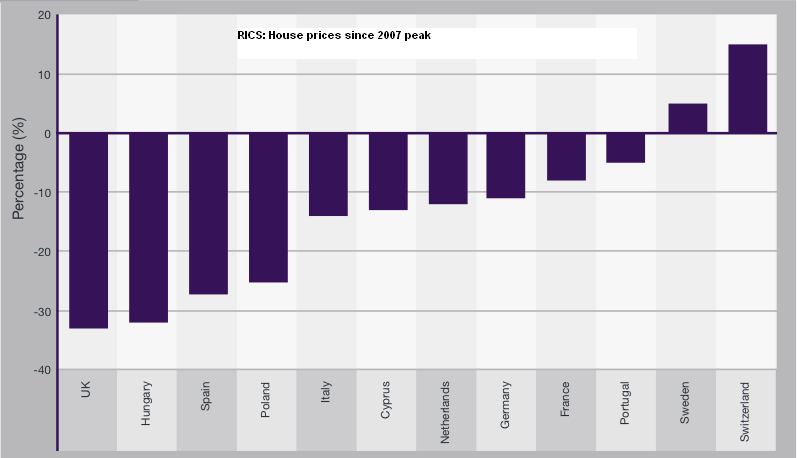

The RICS house price statistics of 2012 shows the following changes since the peaks of 2007:

Spanish house building hit a peak of 665000 units in 2006 and went down to 63000 in 2010 and 55000 in 2011 (RICS page 57). Developers and banks sit on many unsold properties, prices have come down to 2004 levels. Similarly as in the US, and not like in the UK or Switzerland, there is an oversupply in the Spanish housing market.

Spanish house building hit a peak of 665000 units in 2006 and went down to 63000 in 2010 and 55000 in 2011 (RICS page 57). Developers and banks sit on many unsold properties, prices have come down to 2004 levels. Similarly as in the US, and not like in the UK or Switzerland, there is an oversupply in the Spanish housing market.

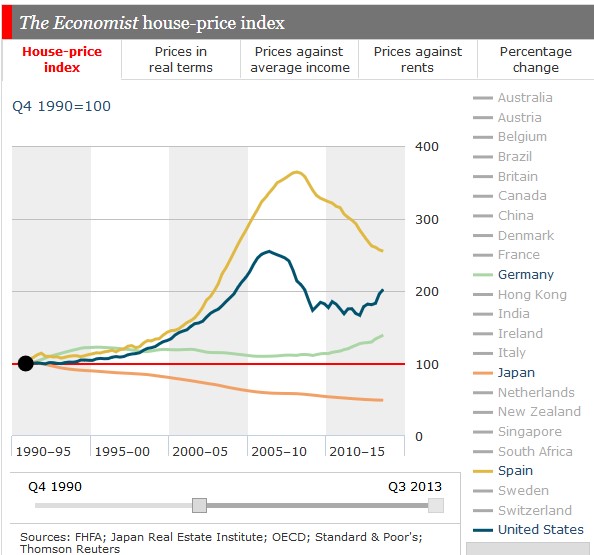

The Economist indicates the high price increases since 1990 and the bust after the financial crisis. Thanks to cheap ECB credit, Spanish prices remain far higher than in the 1990s.

The Economist indicates the high price increases since 1990 and the bust after the financial crisis. Thanks to cheap ECB credit, Spanish prices remain far higher than in the 1990s.

In a paper from 2006 BNP-Paribas gives the reason for the bubble in the following points:

- Different generations do no longer live together.

- A rural exodus has driven house prices in the centers higher.

- migration from other European countries, the migratory balance increased by 800% between 1998 and 2002, whereas it decreased in Germany by 35%

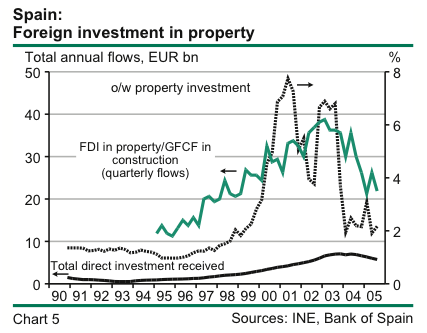

Foreigners (especially britons) bought up to 40% of the houses in the coastal areas. This foreign investment in property helped to push up the spanish balance of payments.

Foreigners (especially britons) bought up to 40% of the houses in the coastal areas. This foreign investment in property helped to push up the spanish balance of payments.

- The housing bubble has led to a virtuous cycle: GDP to which housing directly contributed 10% and income grew strongly. With rising house price people felt the wealth effect, consumer confidence and spending went up.

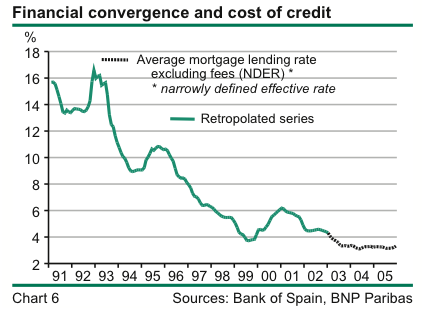

- Lower inflation in Europe since 1995 thanks to cheap imports from the emerging markets and slow growth in Germany had as consequence that the ECB provided cheap money to Spanish banks, whereas during the early 90s the Peseta was weak and especially imported inflation was very high. Given the rising house prices and wages this led to negative real interest rates in Spain and housing became even more interesting.

- Spanish banks managed to securitize many mortgages and sell these products to foreign banks when local deposits were not sufficient any more.