We wrote the following overview still in Summer 2013, in the meantime the mainstream economic opinion has changed. The U.S. and also Europe seem to have too many savings and not too much debt any more.

Some simple rules in economics are:

- someone’s debt is another person’s saving

- When inflation and interest rates are high then debt becomes a problem.

- When inflation is low then too much saving is an issue.

The miraculous austerity and disinflation policy of European leaders has converted public and investors’ perception from point 2 into 3 and massively reduced European bond yields.

July 2013:

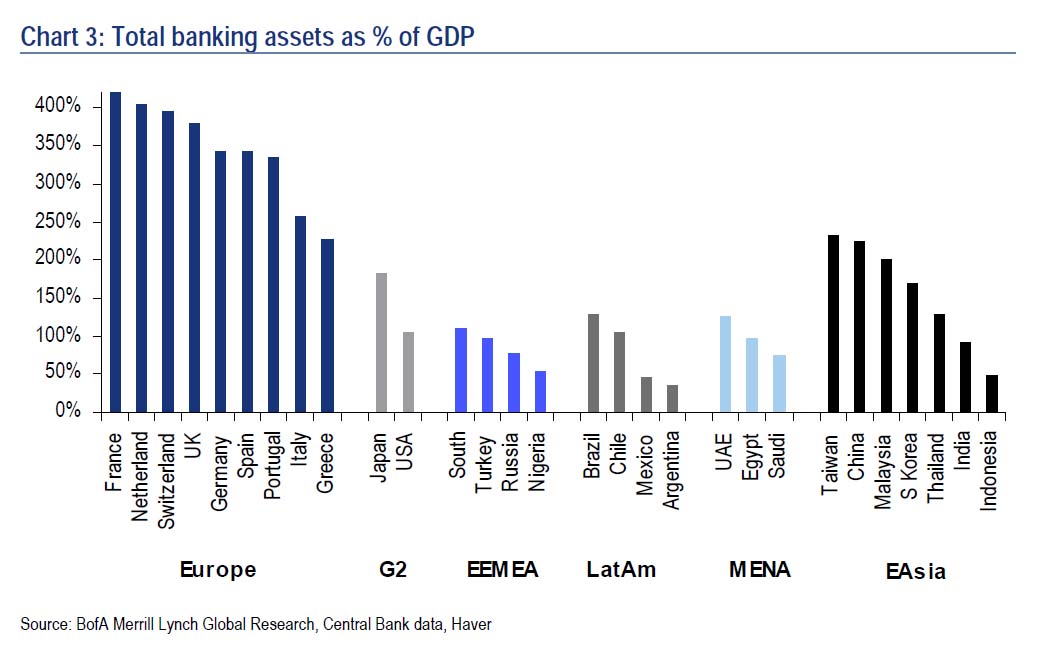

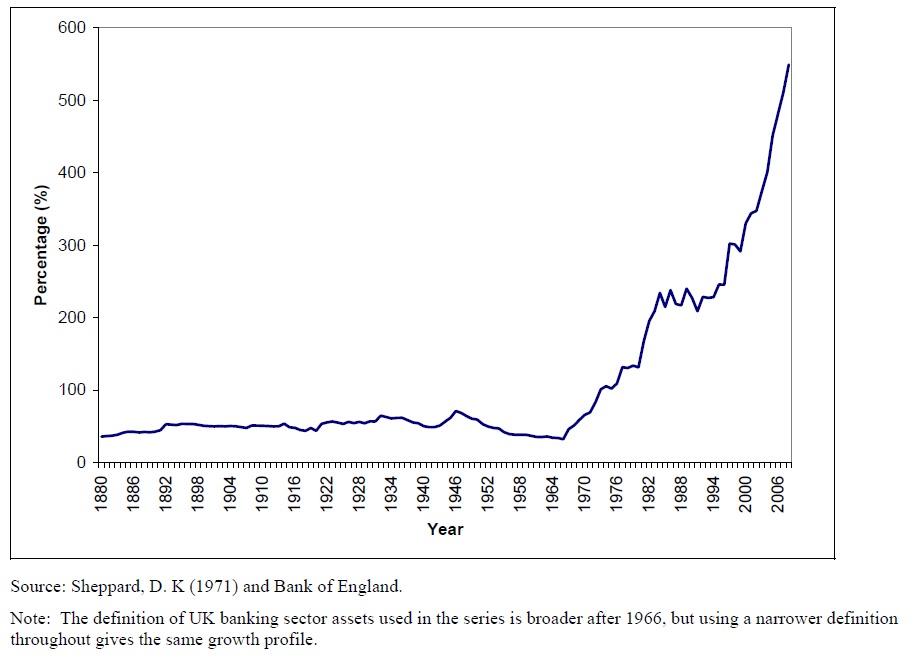

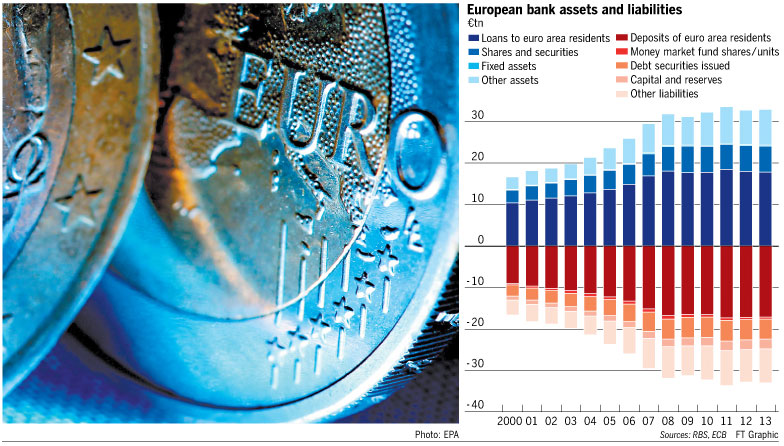

Eurozone banks must shed at least €2.7tn in assets by 2016 for their balance sheets to be “sustainable”, RBS economists have calculated in a research note. The sector’s assets are worth about €33tn currently, or nearly three and a half times the single currency zone’s annual gross domestic product. “If you have a banking crisis and banks are three times the size of their underlying economy, then governments will not be able to support them all,” said Alberto Gallo, head of European credit research at RBS

via Financial Times

Source Financial Times

Why do European banks have more assets than the U.S. ?

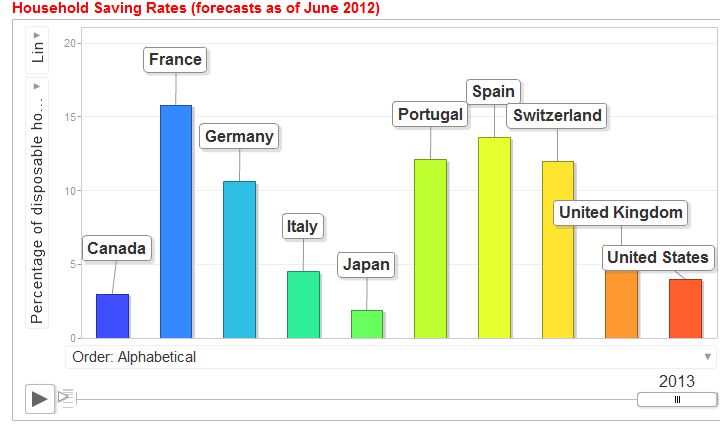

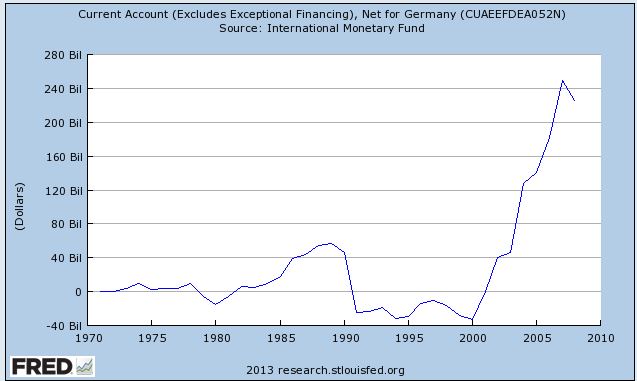

European have trade surpluses, which translate into savings, some more like Germans, some less like France, Italy and Spain.

Answer 2: Because the UK is a huge banking center and contained in the European data.

The data above from BofAML speaks of 350%, the BoE spoke 550% assets of GDP.

Another country with high banking assets is Switzerland.

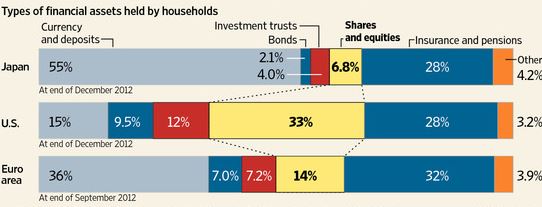

Answer 3: Europeans save differently

The Euro zone invests 68% in deposits and insurances/pensions (that often buy money market funds which again are bank liabilities) while the U.S. has only 43%. The 25% difference, especially the difference in shares and equities, means that US banks have less financing available and therefore less assets than European banks.

This graph shows that the most stable banking system might be Japan. 200% banking assets of GDP, but 83% in conservative deposits, insurances and pensions.

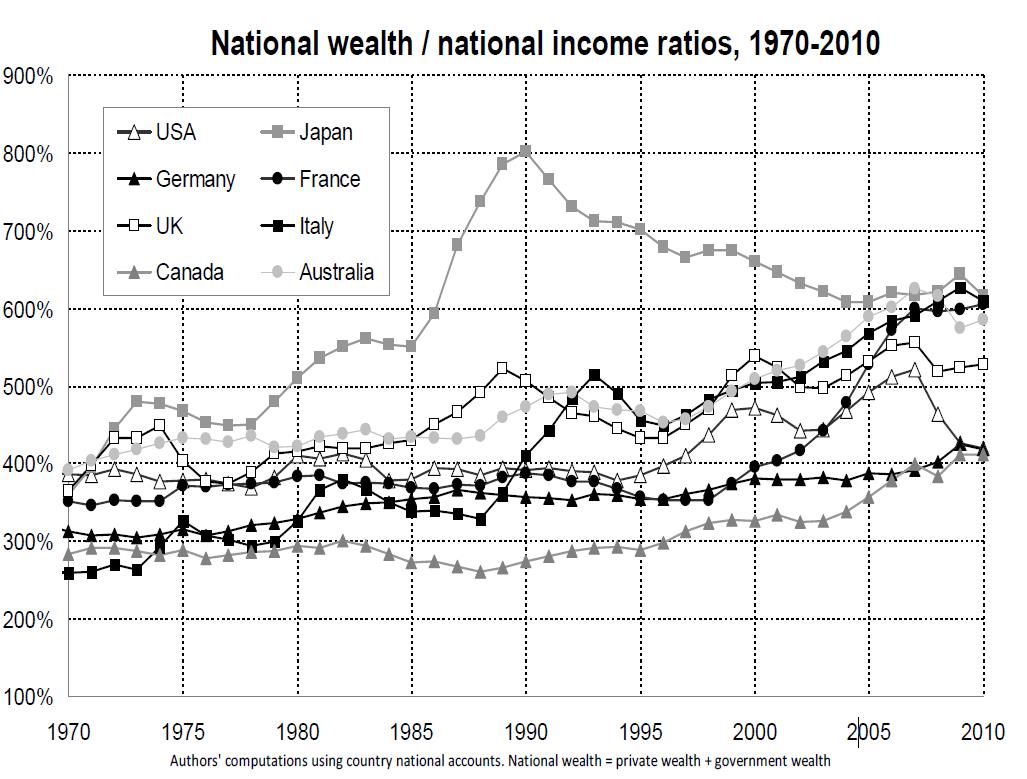

Answer 4: Europeans are relatively richer, the wealth/national income ratio is higher especially for Italy and France.

I am fully aware that wealth depends on valuations of assets and in particular real estate. With falling European real estate prices this wealth statistics could change

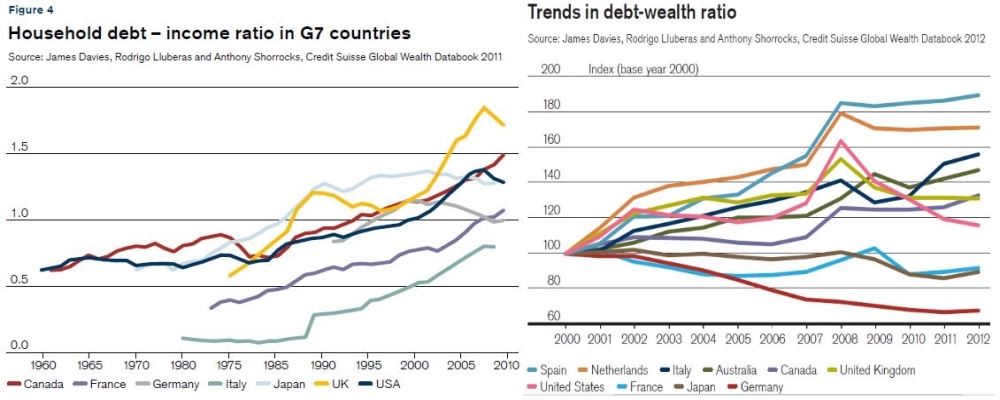

Answer 5: European households have less debt, more assets.

Especially France and Germany have reduced the debt to wealth ratio, as opposed to the UK, Spain, Italy and the U.S.

Are assets of European banks more risky than assets of U.S. banks?

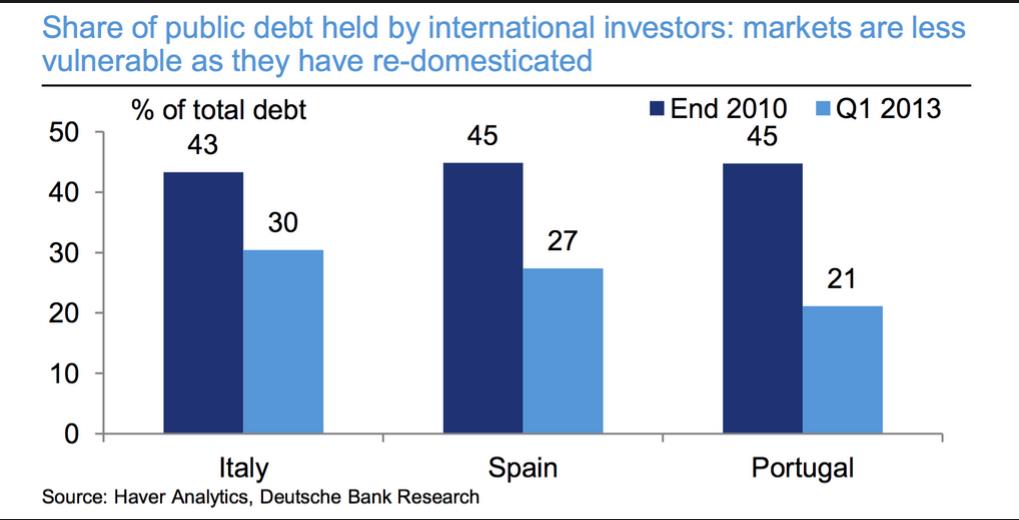

One instrument European banks heavily rely and leverage on, are local government bonds. Those are now more in local hands – often local banks. This re-domestication reduces the risks.

See more for