From the May-June Issue of The Misesian.

Few would deny that Human Action is the foundational work of modern Austrian economics and that this is a compelling reason for reading the book. But there is another, equally compelling reason for carefully studying Mises’s great treatise. It is the antidote to the real and immediate threat to human liberty and society represented by the pernicious social philosophy of progressivism. After the collapse of the Soviet Union and other Communist regimes, almost all variants of leftism abandoned Marxism and gathered under the banner of progressivism, especially in Western countries, where they achieved a powerful influence on policy via democratic elections. Indeed, progressivism is far more insidious than Marxism precisely because it rejects class conflict and bloody revolution and fervently embraces democracy as the true path to the perfection of the human race. Progressives view history as an inevitable onward and upward march to a utopian future, an egalitarian socialist state efficiently run by disinterested bureaucrats, intellectuals, and technocrats.

Despite their predilection for socialism, however, contemporary progressives have learned from the collapse of communism that trying to substitute central planning for the market economy leads to poverty, famine, and economic collapse. They, therefore, propose to retain a truncated market economy that is heavily taxed, regulated, and controlled. Capitalists and entrepreneurs will be subject to a blizzard of orders, decrees, and prohibitions and forced to work to support the state apparatus and its cronies and constituencies. In other words, interventionism, not socialism, is the political economy of progressivism. Although he does not discuss progressivism in Human Action, Mises was one of the first to explicitly recognize that all progressives were united in their advocacy of the interventionist economic agenda laid out in The Communist Manifesto. This work was written in 1848, when Karl Marx and Friedrich Engels were exhorting their fellow communists to destroy capitalism by “establish[ing] democracy,” and well before they adopted the view that socialism would inevitably supersede capitalism via a bloody proletarian revolution. As Mises pointed out, “It is impossible to understand the mentality and the policy of the Progressives if one does not take into account that the Communist Manifesto is for them both manual and holy writ, the only reliable source of information about mankind’s future as well as the ultimate code of political conduct.”

Human Action is indispensable for comprehending the operation and consequences of interventionism, the least understood economic system. Although the book presents a systematic exposition of economic method and theory, it is organized as a treatise on comparative economic systems. It analyzes and compares the three conceivable economic systems—capitalism, socialism, and interventionism—from the viewpoint of which best promotes social cooperation under the division of labor among diverse individuals possessing disparate means and ends. In evaluating economic systems with respect to their efficacy in permitting human persons to achieve common material and intellectual flourishing, Mises transcends economics and develops a systematic social philosophy.

Mises begins Human Action with a pioneering exposition of the “praxeological method,” which permits the deduction of an integrated system of economic theory grounded in the self-evident truth that people act, that is, behave purposefully in using their scarce means to achieve their most highly valued ends. By linking the economic method to the undeniable fact that man acts and to a few empirical truths about the real world, Mises establishes that whenever the conditions assumed by a particular economic theory exist in reality, the economist can successfully predict the qualitative outcome of economic policy. Rent controls below market rents will cause a shortage of rental housing; inflation will be quashed by reining in the growth of the money supply; if central banks tamper with the market interest rate via bank credit expansion, they will cause asset bubbles and investment booms followed by a wholesale collapse of asset prices and a recession. The praxeological method thus contrasts sharply with the prevailing positivist method, which vainly seeks to derive “tentatively valid” economic theories by constructing and manipulating static mathematical models disconnected from each other and reality.

Mises begins his treatment of comparative economic systems with part 3, which is devoted to a detailed discussion of economic calculation, its nature and prerequisites. This concept is crucial to evaluating the comparative advantages and disadvantages of any conceivable economic system. In part 4, Mises deals with capitalism, or the market economy. Mises’s placement of the analysis of capitalism before that of socialism and interventionism is not accidental but is necessitated by the fact that private property in producers’ as well as consumers’ goods, unfettered exchange, and a sound, market-based money, are the prerequisites for economic calculation. Using the “construct of the pure market economy” thus enables Mises to employ the praxeological method to deduce the core theorems of economics.

In part 5, “Social Cooperation without a Market,” Mises analyzes the “imaginary construction of a socialist society” in which the private ownership, exchange, and market prices of the means of production are all absent. Using the mighty theoretical system he previously deduced from analyzing the pure market economy, Mises demonstrates in five pages that in a perfect socialist society, economic calculation and, therefore, the economizing of the scarce factors of production would be “impossible”—even from the standpoint of the central planner’s own value scale. Under these conditions, social cooperation in production and society itself would quickly disintegrate. The rest of the discussion of socialism involves Mises’s refutation of the counterarguments to his position put forward by socialist and neoclassical economists.

Part 6, “The Hampered Market Economy,” deals with what is often referred to as a “mixed economy” or a “third system” existing somewhere between capitalism and socialism. Mises rejects the possibility of intermixing elements of these two systems: there is either capitalism or socialism, and never the twain shall meet. Either consumers or government planners control the use of scarce resources. Any attempt to divide control of production between both groups inevitably leads to an unstable regime of systemic conflict and crisis because the market economy is a vast and intricate system of interrelated activities. Thus, an isolated government decree or “intervention” aimed at altering a particular market outcome inevitably changes the data of economic calculation (prices, profits, revenues, costs, etc.) throughout the system and provokes a reaction by consumers and entrepreneurs that changes the data yet again. What emerges is a third set of market conditions that is less preferred and may even be positively undesirable from the government’s viewpoint. This invites further interventions. For Mises, interventionism, therefore, is not a third economic system but a market economy in which monetary calculation has been distorted and elements of economic discoordination and chaos have been introduced.

In an unpublished manuscript, Mises called this “the problem of divided supremacy” and argued that interventionism is self-contradictory:

The concept of supremacy logically implies indivisibility. Either A is called upon to decide or B. If both A and B are supposed to be supreme, an insoluble conflict emerges as soon as they do not agree with one another. In the market economy the consumers ultimately determine the course of production; in a socialist system it is . . . the government. Interventionism acquiesces in the spurious expedient of assigning supremacy to both the consumers and the government.

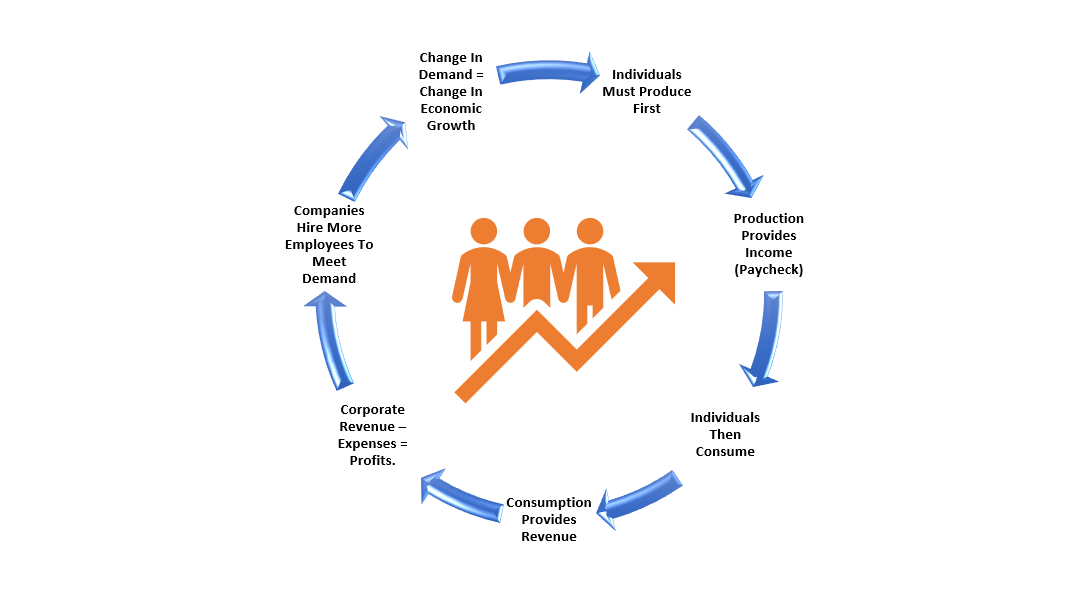

It is under the system of interventionism that economics renders practical service as a predictive science. In the case of pure socialism, all an economist can do is to explain why the system is utterly incapable of allocating resources to their most valuable uses. He can make no predictions about the patterns of operation of socialism because the system is foredoomed to a rapid descent into what Mises called planned chaos. Nor can economics be of much service in predicting the concrete patterns of resource use and pricing that will emerge in an unhampered market economy because these depend, ultimately, on subjective and changeable consumer value scales and, proximately, on entrepreneurs’ anticipations of future market conditions, neither of which can be predicted by the economist with certainty. Put differently, when considering the pure market economy, the economist cannot know the data of the system or their configuration at any moment in the future. For example, he knows with absolute certainty that an increase in the supply of wheat will cause a lowering of its price but does not know if or when this will occur. Entrepreneurs are far more astute than economists in forecasting such occurrences, and even their forecasts are subject to error.

Matters are wholly different with respect to a regime of interventionism, for economists start with the knowledge of the specific economic policy to be imposed. They can thus trace out the consequences using the true and realistic economic theorems yielded by the praxeological method and, therefore, predict the pattern—although not the temporal or quantitative dimensions—of future economic activities that will result, say, from the imposition of a minimum wage or bank credit expansion. In the last book he wrote, The Ultimate Foundation of Economic Science, Mises forcefully makes the claim for the predictive power of economic theory with respect to interventionism:

Economics can predict the effects to be expected from resorting to definite measures of economic policies. It can answer the question of whether a definite policy is able to attain the ends aimed at and, if the answer is in the negative, what its real effects will be. But, of course, this prediction can only be “qualitative.” It cannot be quantitative because there are no constant relations between the factors and effects concerned. The practical value of economics is to be seen in this neatly circumscribed power of predicting the outcome of definite measures. (emphasis added)

In his volume on epistemological problems of economics, Mises boldly places praxeological economics on a par with the natural sciences in its predictive power:

Economics too can make predictions in the sense in which this ability is attributed to the natural sciences. The economist can and does know in advance what effect an increase in the quantity of money will have upon its purchasing power or what consequences price controls must have. Therefore, the inflations of the age of war and revolution, and the controls enacted in connection with them, brought about no results unforeseen by economics.

The theory of interventionism that Mises presents in Human Action predicts with certainty that a market economy hampered by an ever-increasing array of mandates, controls, taxes, and regulations will be an economy afflicted by deepening crises. Crumbling and, simultaneously, overbuilt infrastructure, recurrent financial crises, inflationary redistributions of wealth to mega-billionaire crony capitalists and financiers, trillion-dollar deficits, capital consumption, and erosion of labor productivity and real wages all are crises caused by interventions piled atop interventions. If the progressive Left succeeds in imposing on society its crazed utopian vision of an egalitarian social democracy, humanity will face the gruesome reality of a perpetual crisis economy.

There is, however, a powerful reason for libertarians to take heart from Mises’s analysis. Interventionism is an unstable regime which pitches erratically to and fro between socialism and the pure market economy. Precisely because it contains the inherent contradiction of divided sovereignty, we can predict that an interventionist economy will be battered by endless crises. These crises will undermine the plans and morale of the ruling elites while impoverishing, frustrating, and embittering the productive classes. This will foster an “us against them” mentality and present an opportunity that can be exploited by libertarian thought leaders and opinion molders. These men and women, armed with the lessons of Human Action and imbued with the Misesian spirit of human liberty, will be well disposed to mobilize a militant mass reaction that dislodges the progressive elites from power and propels the economy toward a system of totally voluntary exchange.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter